- AAVE broke out as daily price action remained strong

- Fundamentals supported the price move and suggested the altcoin could rise further

AAVE recently broke out of an 800-day accumulation range on the weekly chart, indicating a potentially bullish trend. This breakout seemed to be supported by the stochastic RSI, which showed strong buyer interest.

Despite a potential bearish close to this week’s AAVE/USDT candle, sentiment remained positive on the charts at the time of writing. Even as other major cryptos with top market caps saw their own declines.

In fact, last week’s candle closed above critical levels within this range. And for the AAVE to continue its bullish momentum, this week’s candle must close above the same range. Regardless of whether it closes red or green.

Source: TradingView

The most important factor to watch is whether AAVE can maintain its position above the range. If so, this could mean a strong upward move in the near future.

The successful retest of AAVE holds up

AAVE’s price action successfully retested the previous range high on the daily chart of AAVE/USDT. This gave even more confidence to AAVE’s power in the charts.

If AAVE’s price action continues to rise without retesting the same range high, it would mean that a more significant upward move could be imminent.

Source: TradingView

This scenario would provide a highly profitable, low-risk trading opportunity. Particularly as AAVE has shown resilience to the challenges of the broader market.

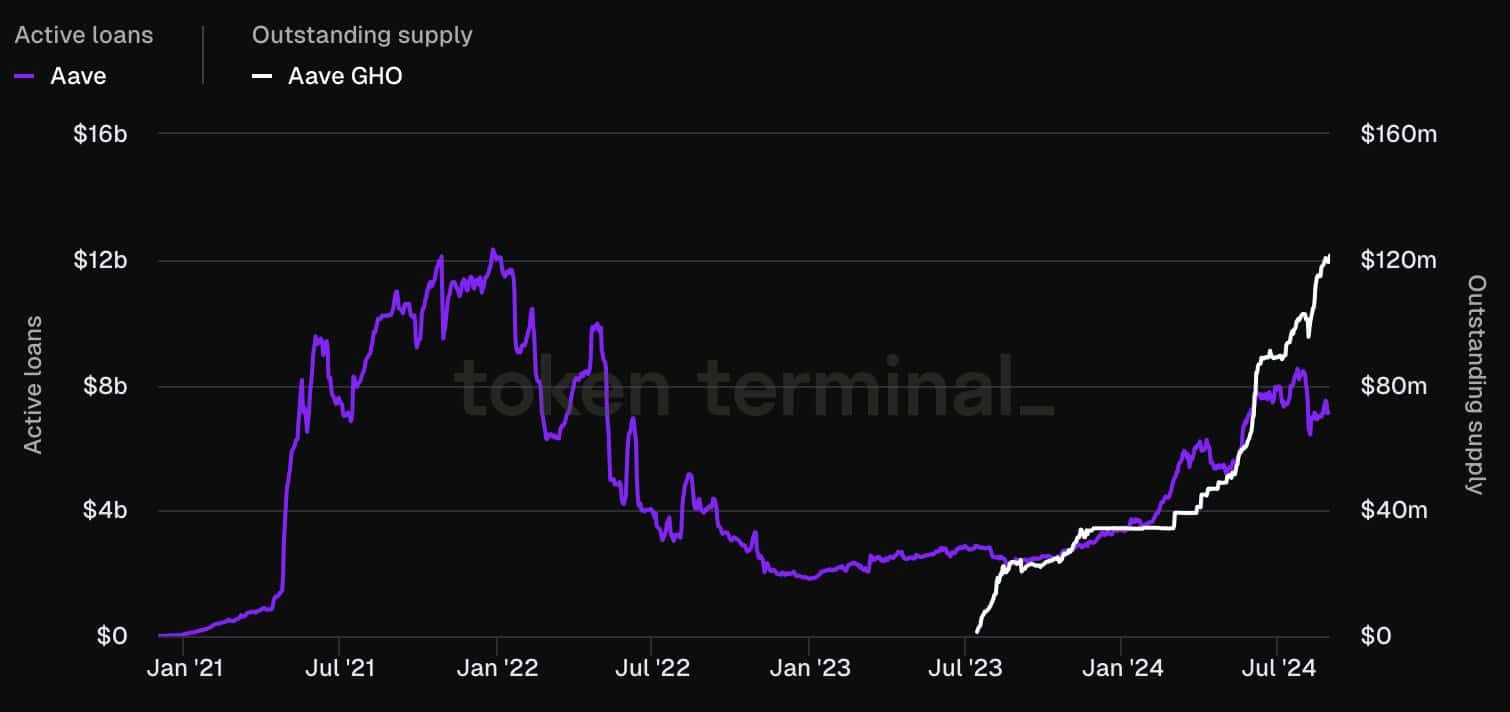

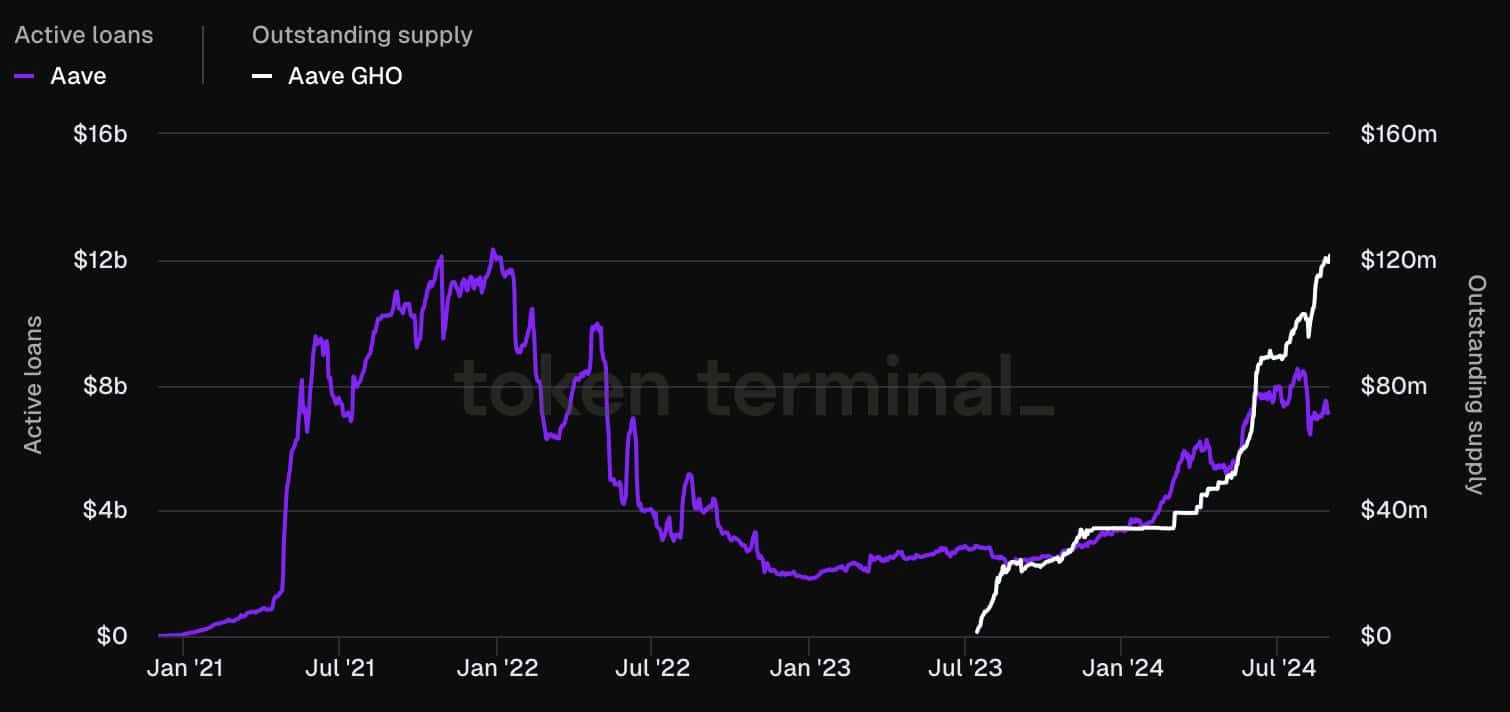

Aave products are booming…

In addition to technical indicators, Aave’s fundamentals also seemed to point to potential growth. The platform’s products, especially its lending and stablecoin businesses, have seen significant growth over the past year.

This expansion supports the idea that AAVE could be primed for a price increase in the coming weeks or months.

Source: Token terminal

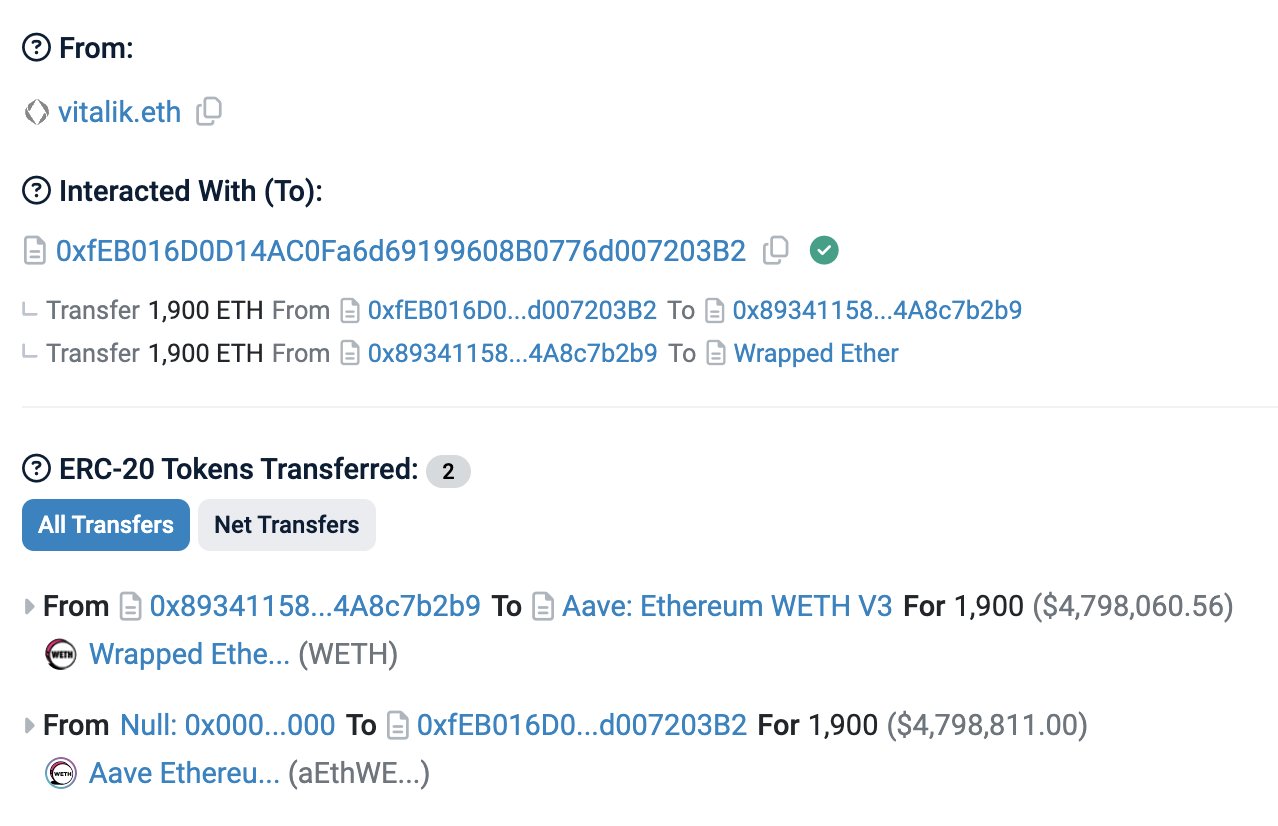

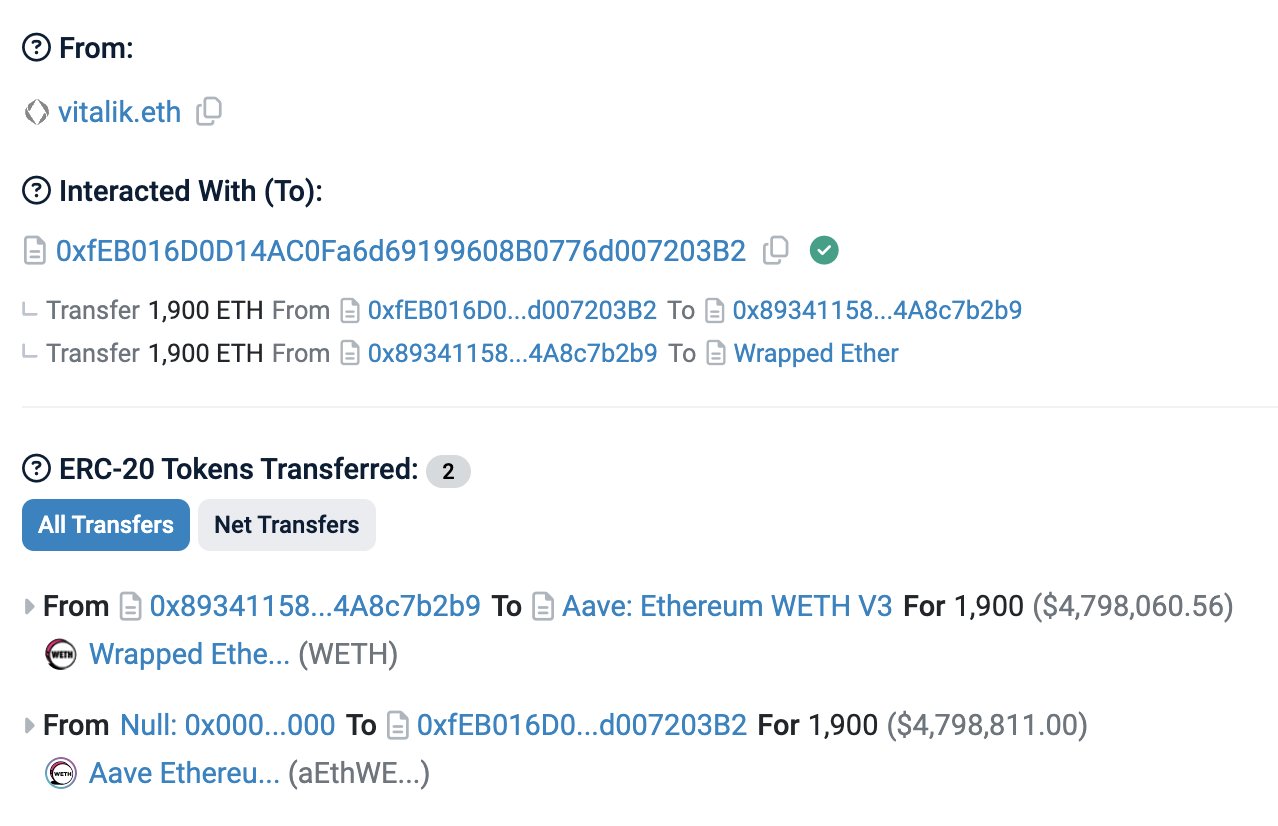

Aave as a liquidity management tool

One of Aave’s key strengths lies in its ability to manage liquidity effectively. The platform allows users to deposit assets into liquidity pools, from which others can borrow. This ensures a balanced flow of assets within the ecosystem.

This liquidity management tool is even recognized by Ethereum co-founder Vitalik Buterin, who uses Aave. This could potentially be a crucial tool for the Ethereum Foundation.

Source: Stani Kulechov/X

Aave’s vision is to be the backbone of all credit markets, providing liquidity at various forms of tokenized and native value. These growing utilities and infrastructure could further increase the price of AAVE in the near future.