Delta, a new layer 1 platform that challenges the status quo for building high-throughput decentralized applications, has raised $11 million in funding.

The platform positions itself as a “network of networks” that aims to break the traditional trade-off between blockchain sovereignty and interoperability, a nagging problem that many developers face today.

Delta’s funding round was led by Figment Capital and Maven 11, with contributions from Variant, DBA and other investors. (Blockworks co-founder Michael Ippolito is also an angel investor.)

The functional goals of Delta’s architecture are similar to those of the major rollup clusters – OP Superchain, the AggLayer or ZKsync Elastic Chain frameworks – all of which face interoperability issues arising from Ethereum’s rollup-centric roadmap.

Dapp developers often have to choose between two approaches: building within the confines of a single framework or creating an independent app chain that needs to retrofit interoperability solutions.

The new approach aims to combine the best of both worlds by giving developers local control over their environment while maintaining global connectivity through the base layer, said Ole Spjeldnaes, CEO of Repyh Labs, which is building Delta.

“Originally we thought this is what Ethereum would look like – you wouldn’t need these local clusters,” Spjeldnaes told Blockworks.

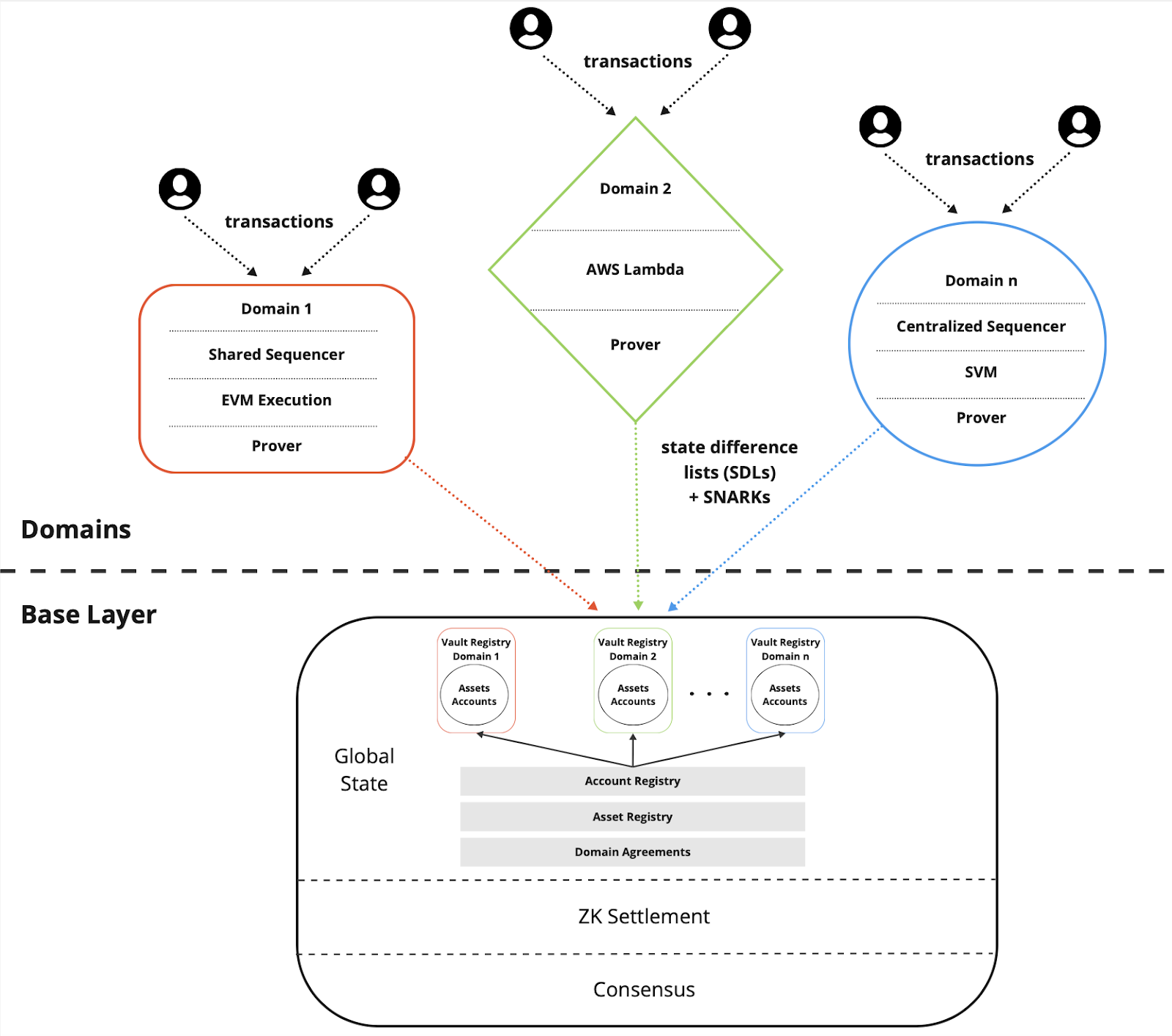

Delta’s architecture separates transaction execution and ordering from data availability and settlement, offering theoretical advantages over both app chains and rollups, which typically require complex bridging solutions. In Delta, execution takes place within individual ‘domains’, which are similar to app-specific rollups or execution shards.

The main difference with, for example, a ZKsync Elastic Chain is that these domains retain full power over their blockspace and can use any existing virtual machine or develop custom programs. However, Delta eschews Ethereum, and all its domains settle on a new decentralized base layer, guaranteeing shared global status and interoperability.

“Delta is a more bottom-up approach to primarily achieving stronger properties than what something like the ZK Elastic Chain can provide, because it is a single state machine,” said Spjeldnaes. “If Ethereum had not had to think about being backwards compatible and had foresight, this is what it would have ended up looking like.”

Unlike Ethereum rollups, all assets within Delta’s network remain at the base layer, notes Myles O’Neil, Repyh’s chief product officer.

“There’s no real equivalent for this in merger terminology,” O’Neil told Blockworks.

This has consequences for the issuance of assets and liquidity. For example, a stablecoin is issued once on the base layer and is automatically available for use in all domains.

Another notable feature of Delta is its use of zero-knowledge proof-based settlement integrated directly into the base layer, allowing domains to collaborate without any external coordination or intermediate bridges.

Source: Repyh Labs

“There is a minimum number of things that need to be proven by all domains,” Spjeldnaes explained, but as long as they follow this set of so-called ‘global laws’ from Delta, they retain the flexibility to sequence whichever implementation they choose. . or the authorization model they want.

Domains generate a State Diff List (SDL), a compressed standardized format for state changes based on their own transaction order, and submit it to the base layer, along with evidence that the SDL does not violate any global law (or that the domains own the list). “local laws”). The state model avoids conflicts between the state subsets of each domain.

“We’ll let the domains have their say on how much more they want to prove,” O’Neil said. “So if they want to be completely reliable, just like a ZK rollup, they can choose to prove their entire execution path.”

All domains will have to use a shared prover, which should be “the most efficient for everyone,” Spjeldnaes said. “The goal is really to maximize strong interoperability without infringing on the sovereignty of each domain,” he added.

Delta’s proof-of-stake validator set uses a leaderless and orderless consensus mechanism known as Byzantine Reliable Broadcast (BRB), which Spjeldnaes compares to Sui’s Narwhal-Bullshark consensus algorithm.

“I think Sui is very elegant,” said Spjeldnaes. “They can simply place orders for those transactions that require orders [but] that adds a lot of overhead – which you can see from the benchmarks – you have Narwhal and then on top of that you have to add Narwhal consensus, and that’s really the bottleneck.

BRB avoids this overhead, and Spjeldnaes noted that the computational requirements for validators will be very low because their main job is verifying proofs. By eliminating the need for global transaction ordering, the network scales linearly as more machines are added, Spjeldnaes said.

“We also see this as a protocol that could scale quite well in terms of the number of validators, but we haven’t tested this yet so we can’t really make a strong claim about it.”

Delta’s biggest problem will be how to ramp up usage and bring resources to yet another layer 1 network. With the mainnet launch still over a year away, O’Neil said they will be going after both crypto natives and non-crypto developers from the fintech and Web2 world.

By addressing the shortcomings of current leading ecosystems such as Ethereum and Solana, the team hopes to demonstrate the benefits of a new paradigm.

“What a system would look like if you built everything from scratch,” O’Neil said.