- MakerDAO saw a surge of interest in wstETH on its vaults.

- The MKR price continued to rise along with the velocity.

The dominance of the LSD (Liquid Staking Derivatives) industry has made many protocols such as MakerDAO[MKR] have failed to compete with the likes of Lido. However, according to recent data, it seemed that MakerDAO could benefit from the growth of LSDs in the future.

Realistic or not, here is MakerDAO’s market cap in terms of BTC

Is MakerDAO anti-fragile?

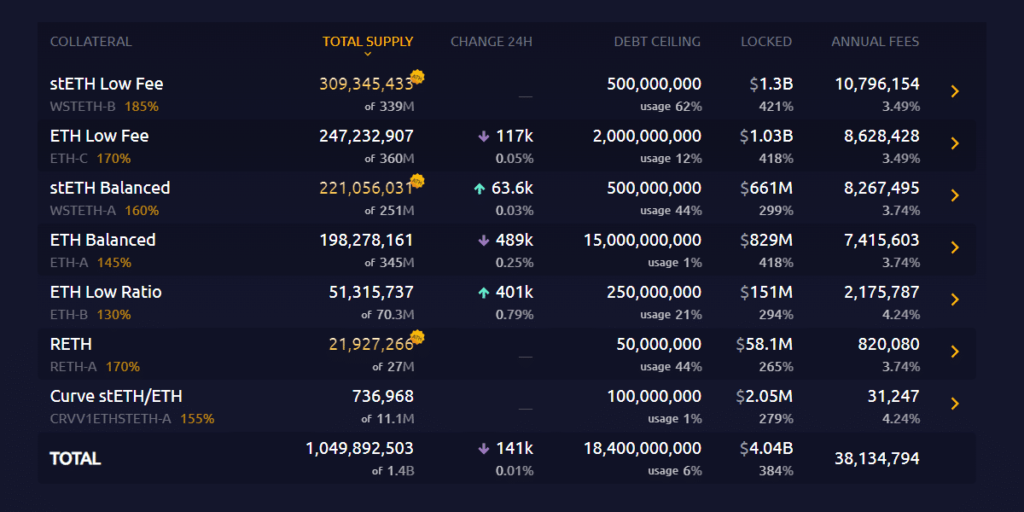

Based on new data, LSDs are at new highs in the MakerDAO protocol. The WSTETH-B vault holds an impressive 309 million DAI, while the WSTETH-A vault collected 221 million DAI.

In addition, the RETH-A vault registered a significant amount, with 21 million DAI. These numbers reflected the growing popularity and adoption of Liquid Staking Derivatives within the Maker Protocol.

Source: MakerDAO

This trend has positive implications for MakerDAO as it demonstrates the protocol’s ability to cater to users seeking staking reward exposure while using their staked assets as collateral for DAI generation. It also indicates that competing in the DeFi sector is not a zero-sum game and that one protocol can benefit from the progress of the other.

The prominence of LSD-based assets has reached a remarkable stage, where wstETH has surpassed ETH as the primary crypto collateral for generating the highest amount of DAI debt on the MakerDAO protocol. At the time of writing, the cumulative DAI debt generated by wstETH stands at 530 million. It surpassed the 497 million DAI debt generated by ETH. This shift in dominance underlines the growing popularity and acceptance of wstETH as the preferred choice for collateral and DAI generation within the MakerDAO ecosystem.

WSTETH has surpassed ETH as the crypto collateral with the highest DAI debt:

• 530 million DAI generated from WSTETH

• 497 million DAI generated from ETH pic.twitter.com/dxxahkEPuK— Maker (@MakerDAO) July 6, 2023

This shift was driven by the vault type WSTETH-B, which reached a new all-time high of 309 million DAI in total debt.

Source: MakerDAO

Is your wallet green? Check out the MakerDAO Profit Calculator

How’s MKR doing?

When we got to the token, the price of MKR was seen to have increased significantly over the past week. At the time of writing, MKR was trading at $924.74. The speed of the token had increased during this period, which also indicates that the activity around the token had surged. However, along with the price, MKR’s MVRV ratio also grew. A growing MVRV ratio highlighted that the incentive for MKR holders to sell their holdings could be very high at the time of writing.

Source: Sentiment