- According to VanEck, BTC’s high network hashrate was partly boosted by cheap power in Texas.

- However, the sell-off by BTC miners has intensified and could depress prices in the near term.

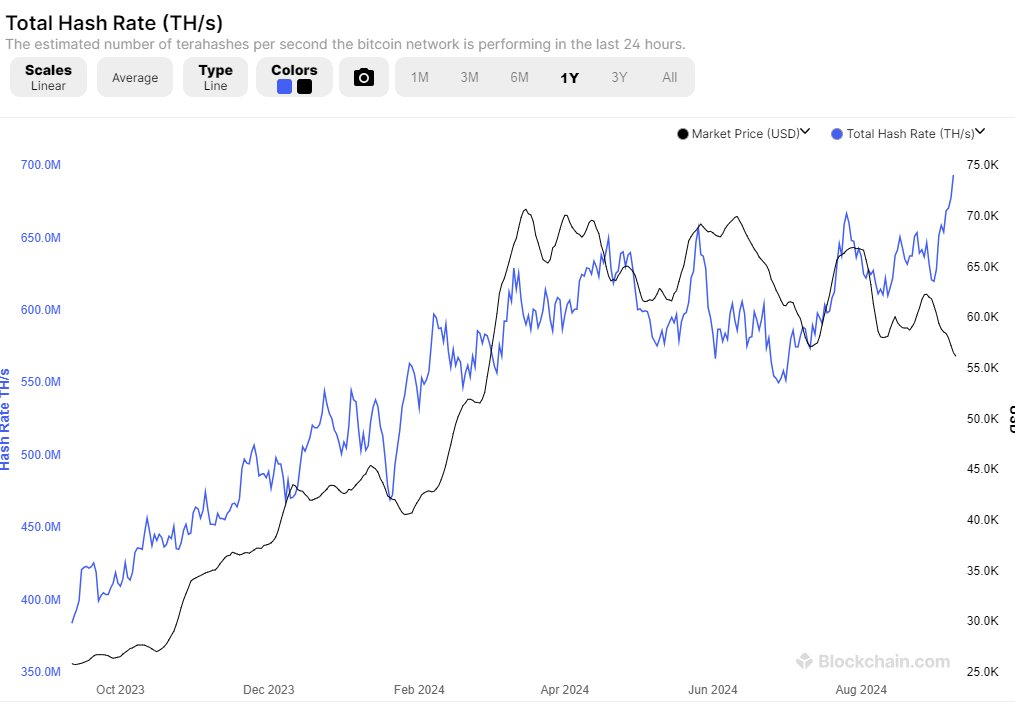

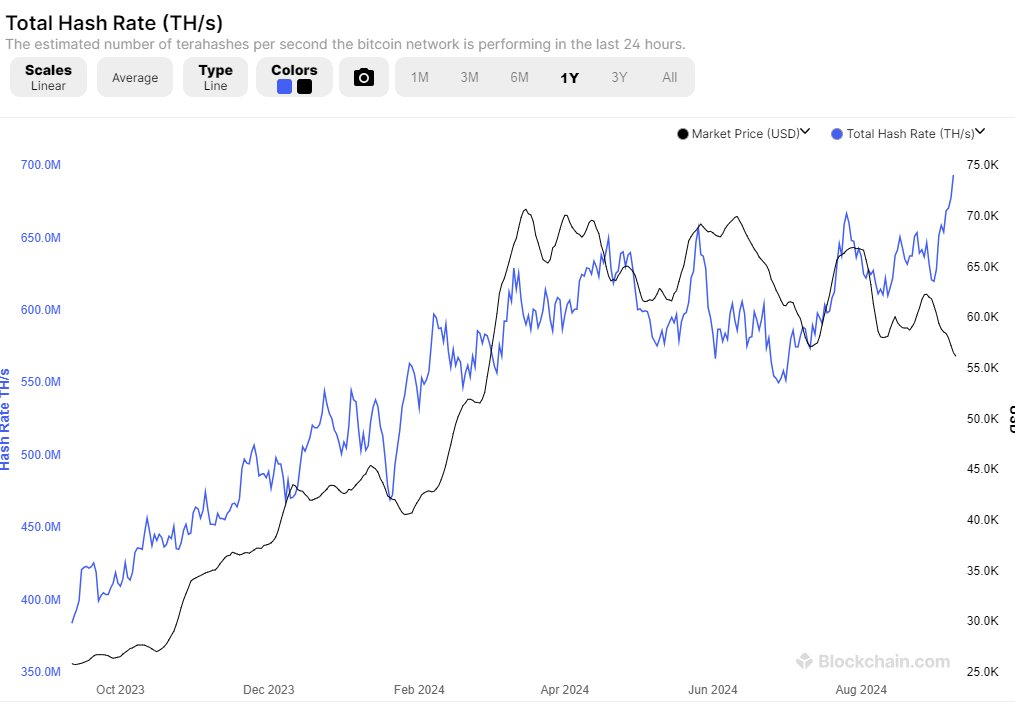

Bitcoin [BTC] The network’s hashrate has seen a remarkable recovery, from a low of 550 TH/s in June to a record high in September.

The metric tracks the computing power required to mine a single BTC and, by extension, network security.

Source: Blockchain.com

The recovery suggested that miners put more energy into the summer following the mass capitulation of miners that kicked off the post-BTC halving in April.

Although the metric positively correlates with the BTC price, it has recently shown a divergence.

BTC price tracks network hashrate

According to Mathew Siggel, head of Digital Assets Research at VanEck, the network’s hashrate spike was partly caused by cheaper electricity in Texas during the summer. He said,

“The recent hash rate increase appears to be driven by higher rig utilization following seasonal summer dips in activity due to high electricity prices during peak months. But future energy prices in Texas (~10% of global hash rate) are now at their lowest in four years.”

Source: Bloomberg

Siggel added that if mining costs remain low, the miner sell-off could ease and reduce pressure on BTC prices.

However, Glassnode found that despite miners’ improved conviction, BTC traders persisted not convinced about the BTC price in the short term.

Meanwhile, the selling pressure from miners appears far from over. For the past three days, miners have been doing that discharged 30,000 BTC, worth approximately $1.7 billion, on the market.

Source: Santiment

At the time of writing, the total September sell-off was 40,000 BTC, meaning most of the dump (30,000 BTC) occurred earlier in the week when BTC attempted a price recovery.

This continues miners sale could derail a strong price recovery for BTC.

At the time of writing, BTC was valued at $56.6K, down 4% from the monthly high of $59.8K.