This is a segment from the Empire newsletter. To read the full editions, subscribe.

If you think the Ethereum L2 space is crowded, you might not be thinking big enough.

Granted, there are now more than 100 different satellite blockchains orbiting the Ethereum mainnet, per L2Beat.

Kraken is preparing to launch another one, Ink, which it plans to stake on Optimism’s Superchain. It will be Superchain’s 24th fully participating network.

L2s generally process transactions off-chain – where it is much cheaper – and periodically transmute them to Ethereum for proper settlement.

The low cost and speed allow developers to build apps that would otherwise be cumbersome when running directly on Ethereum. Exchanging tokens on Ethereum currently costs $5.48 in gas fees, compared to just $0.18 for OP mainnet.

The Superchain is a meta-network intended to make the Ethereum ecosystem more cohesive. Optimism Labs offers a standardized tech stack that developers can use to customize their blockchains, either as general-purpose networks or as something more app-specific.

Superchain networks – operating alongside Optimism’s own layer 2 – agree to share the fees they generate, either 2.5% of onchain revenue or 15% of onchain profits, whichever is higher.

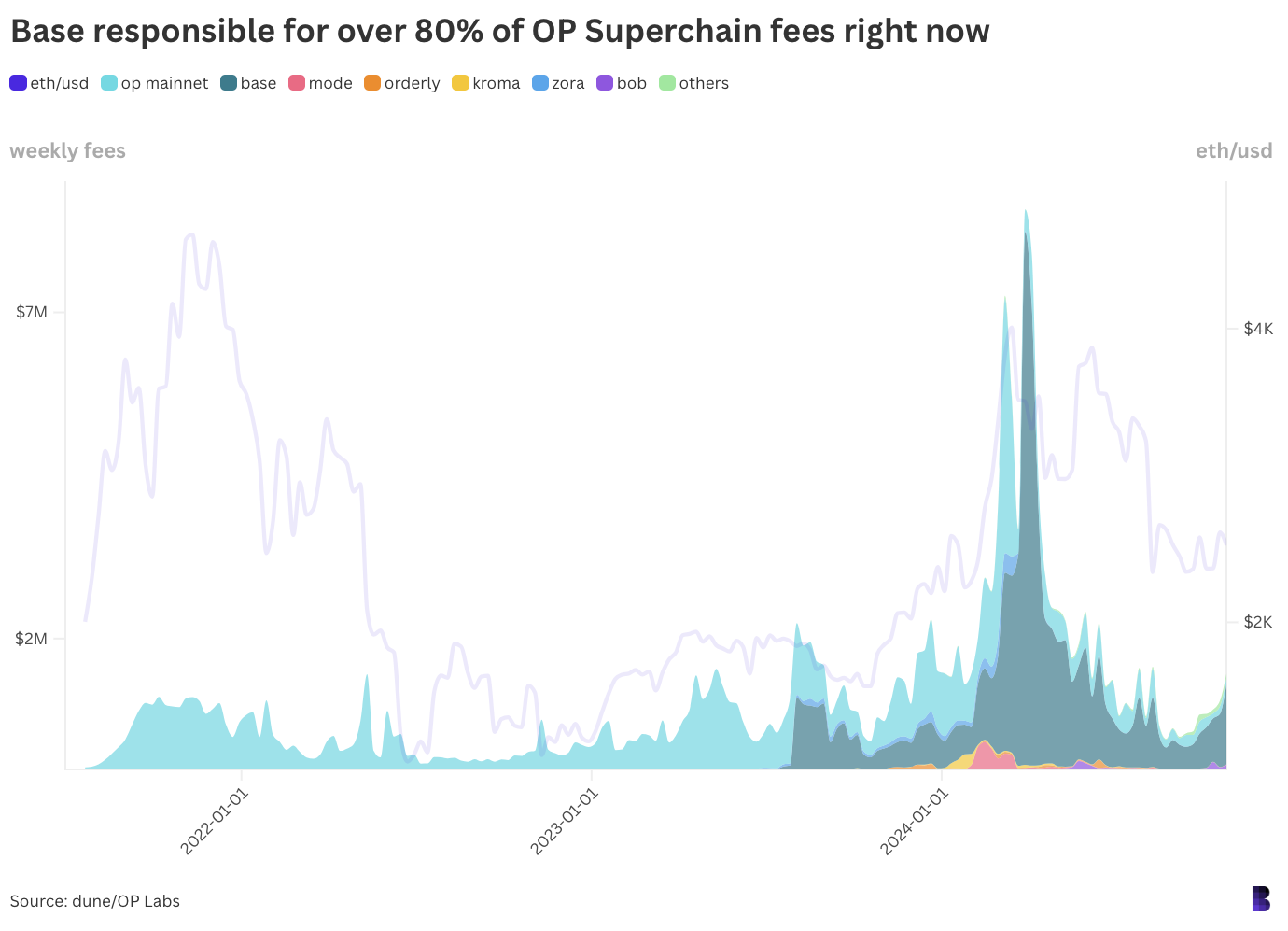

Weekly Superchain spending recently rose to August levels

So if Kraken does indeed make a big splash with Ink, it would work to the advantage of the two dozen others on Superchain.

Users of those networks have spent a total of $180 million in ETH, valued daily, since OP Mainnet launched in July 2021.

And while Ethereum’s blobs significantly reduced L2 fees in March, nearly 38% of Superchain’s lifetime total came from after Dencun.

Base is largely to thank for this. Coinbase’s tier 2 – which Kraken’s Ink will eventually compete with – currently generates more than 80% of all OP Superchain fees, or between $620,000 and $1.23 million per week in October, with transaction numbers and profitability at record highs.

Uniswap, memecoin launchers and trading bots like Banana Gun currently contribute the largest share of base gas spending, according to data from Blockworks Research.

Whether Kraken really intends to loosen Base’s grip on the memecoin corner of the Ethereum space is questionable, even if it would come with bragging rights. Uniswap Labs is gearing up to launch its own Superchain network, Unichain, next month, which could throw an even bigger spanner in the works.

It says something about where we are going: a blockchain for every company, app, game and community. Build the block space and they will come.