- Bitcoin’s gains in October are largely due to the supply crunch caused by the halving.

- According to AMBCrypto, the supply shock has yet to disappear.

Bitcoin [BTC] consolidated within the $66K-$67K range over the past seven days and is currently trading at $67,160 with a slight gain of 0.57% from the day before. This consolidation mirrors BTC’s July pattern, where resistance at $68,000 led to a rapid decline below $55,000. So it is crucial to stay within this range to avoid a similar downturn.

Interestingly, October’s gains are largely due to a post-halving supply crunch, which has created new scarcity in the market. As BTC concludes its most bullish month, conditions could be ripe for a supply shock as demand adjusts.

The impact of Bitcoin’s halving has yet to materialize

Historically, the post-halving period has acted as a major catalyst for bullish rallies, especially from an economic perspective. As the supply of BTC shrinks, miners are often hit the hardest, leading to their widespread capitulation.

Simply put, as block rewards decline, miners may find it challenging to cover their operating costs, prompting many to leave the market.

This shakeout leaves only the most efficient miners in the ecosystem, potentially creating a more robust environment for price increases as supply decreases.

Source:

As the chart above shows, miners’ reserves have been steadily declining since the April halving, reflecting this dynamic.

While one might assume this would create selling pressure, the scarcity of BTC among miners – especially as block rewards hit lower lows – is not significantly impacting the market.

If demand remains high, much of the selling pressure is absorbed, creating ideal conditions for a supply crunch.

This environment kept October bullish, with BTC testing near $70,000. However, an outbreak has yet to occur, indicating that the expected supply shock has not occurred.

This scenario maintains optimism for a potential parabolic rally as we approach the end of the fourth quarter.

Efficient miners are still in the game

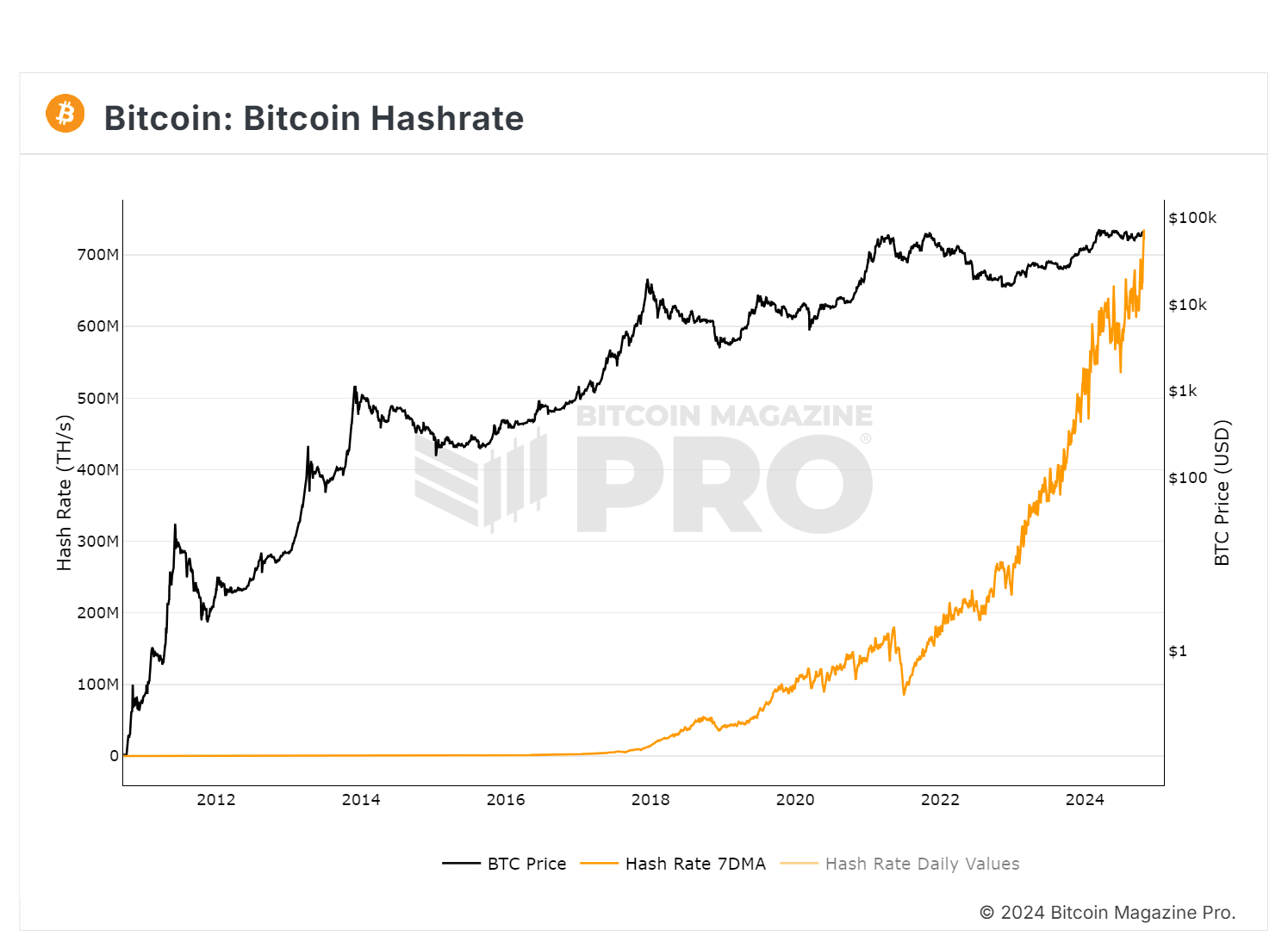

The effects of the halving are clear: Bitcoin mining problems have reached an all-time high, meaning more computing power is now needed to process transactions. This situation forces less efficient miners.

Source: Bitcoin Magazine Pro

As a result, the hash rate has also increased, indicating a more secure and robust network. This trend highlights the consolidation of mining operations, where only those with the best technology and the lowest costs can survive.

In short, a mass capitulation could still be in the offing, potentially leading to a significant price increase as available supply diminishes, despite continued demand.

Institutional interest is growing

Currently, all exchanges are seeing a significant increase in BTC reservesindicating selling pressure coming mainly from the mining community for the reasons stated above.

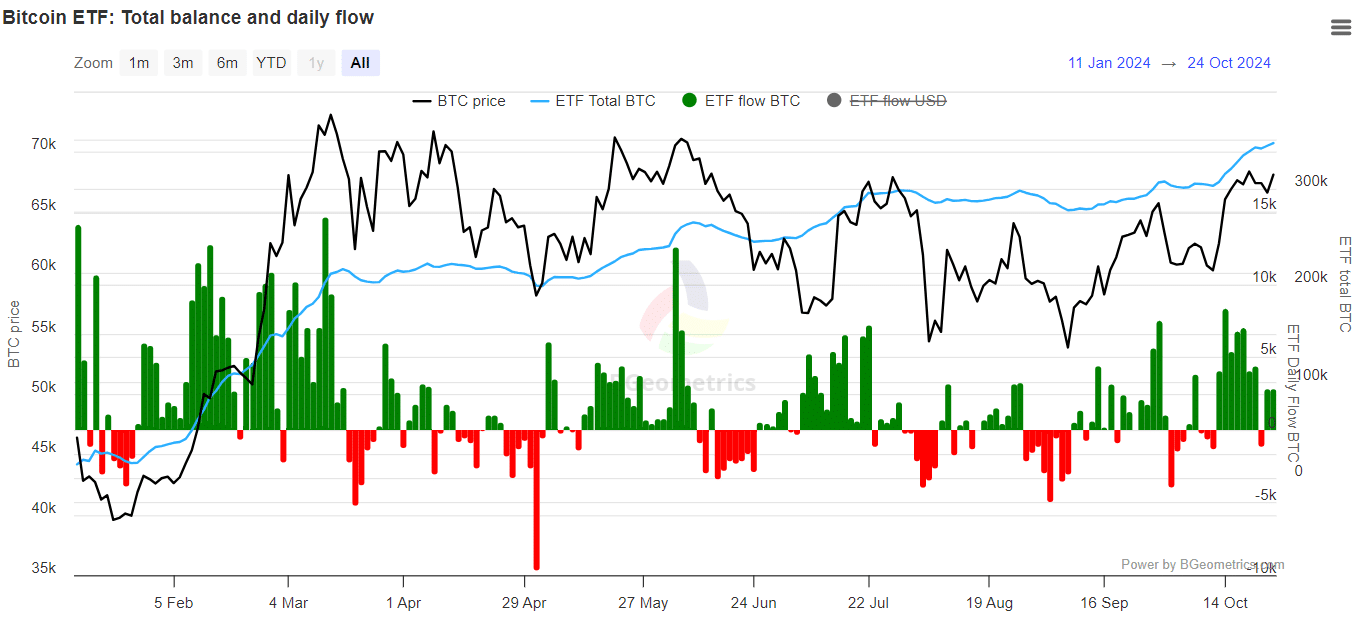

As noted earlier, a supply shock can occur if demand remains high despite these pressures; otherwise a repeat of the July cycle could occur. Interestingly, there has been a notable increase in ETF inflows in October, indicating growing retail interest.

Source: BGeometrics

Furthermore, BlackRock’s Bitcoin possessions have surpassed 400,000 BTC and reached 403,725 BTC, worth $26.98 billion. In the past two weeks alone, BlackRock has purchased 34,085 BTC, worth $2.3 billion.

This indicates that institutional demand is on the rise, reinforcing AMBCrypto’s initial hypothesis of a brewing supply shock.

Read Bitcoin’s [BTC] Price forecast 2024–2025

While the current consolidation is crucial to prevent BTC from faltering, a consistent balance between supply and demand will ultimately determine whether BTC can reach a new ATH before the end of this quarter.

In any case, the capitulation of the miners highlights the effects of the post-halving environment; their departure now requires a more sustained purchasing effort at current prices. Although a slight retracement may occur, a full-blown relapse seems unlikely.