- The Ethereum Foundation is selling a large sum of ETH, leading to bearish speculation.

- Address activity suggests there is some accumulation despite the FUD.

The amount of FUD in the crypto market increased in recent days as investor confidence evaporated. This was the case, especially for ETH after the big sale of the Ethereum Foundation.

Is your wallet green? Check out the Ethereum Profit Calculator

Recent prevailing sentiment, especially regarding ETH, suggested that it recently hit a local high. As such, downside expectations are significantly higher this week. The Ethereum Foundation has traditionally removed a significant amount of ETH from its addresses near the peaks of a bullish trend. The Ethereum Foundation recently sold 15,000 ETH.

Ethereum Foundation’s large-scale sales record in recent years: Recently, the Ethereum Foundation sold 15,000 ETH. In 2021, EF sold at a peak of 20,000 ETH. But in 2020, 100,600 ETH was sold at a price of 657. pic.twitter.com/BCiSlutQ5F

— Wu Blockchain (@WuBlockchain) May 7, 2023

While the foundation has contributed to selling pressure in the past, it hasn’t always been at the top of a bull trend. There have been some instances where buying pressure has prevailed despite the large outflow of Ethereum Foundation addresses. In fact, several indicators confirmed that there was significant demand in the market.

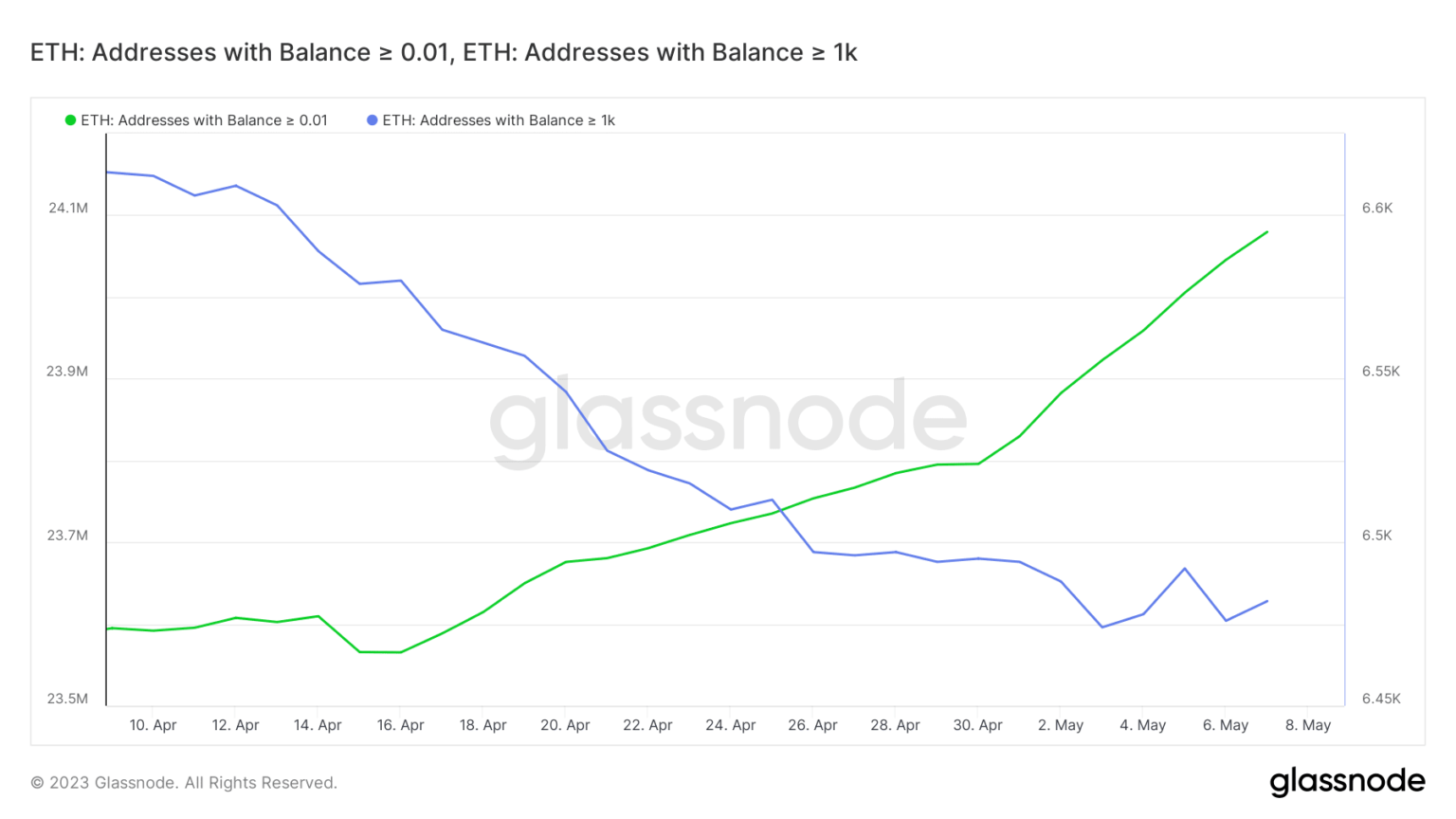

Addresses with 0.01 ETH or more just hit a new ATH, confirming that traders in the retail segment were buying. While this may lead to speculation that they provide exit liquidity, a look at whale activity revealed that addresses with 1,000 or more ETH have also begun to accumulate over the past two days.

The same whales previously contributed to the selling pressure over the past four weeks.

Source: Glassnode

Are mid- to long-term holders selling?

Recent data suggested that long-term holders bowed to the FUD and the pressure to take profits. According to the latest Glassnode alerts, ETH’s realized limit has just hit a new five-month high. This meant that most investors who sold their ETH sold for a profit.

📈 #Ethereum $ETH Realized limit just hit a 5-month high of $173,915,307,687.21

View statistics:https://t.co/JEcbTHEjsD pic.twitter.com/baI1mZPc6M

— glassnode alerts (@glassnodealerts) May 8, 2023

The same findings can be taken as a sign that most of the recent buyers did not add to the prevailing selling pressure. In other words, there was still significant demand for ETH at its current price level. This may also explain why the downside is limited for now.

Realistic or not, here is the market cap of Ethereum in terms of BTC

ETH bears have encountered support just above the $1800 price range. An increase in selling pressure could weaken the same support and lead to lower prices. There was a spike in active deposits in the past 48 hours at the time of writing, underlining the higher selling pressure.

Source: Sentiment

The network’s growth has also slowed significantly since May 5. This is likely due to lower organic activity amid sluggish market conditions. The recent memecoin hype has contributed to a significant amount of activity recently.