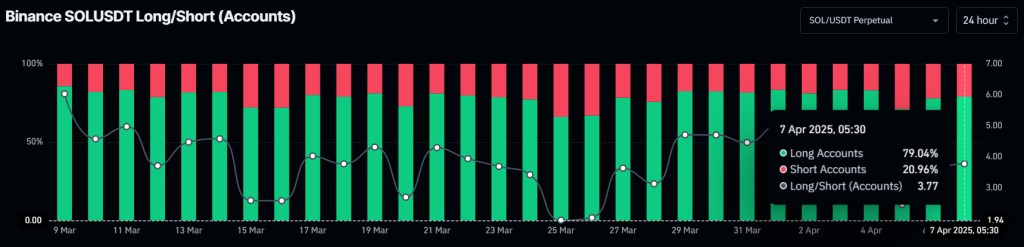

Solana (SOL), the world’s sixth largest cryptocurrency per market capitalization, attracted enormous attention from Binance traders. Recently, data from the on-chain analysis company Coinglass revealed that 79% of top traders go on Sol for a long time, despite the Bearish market sentiment.

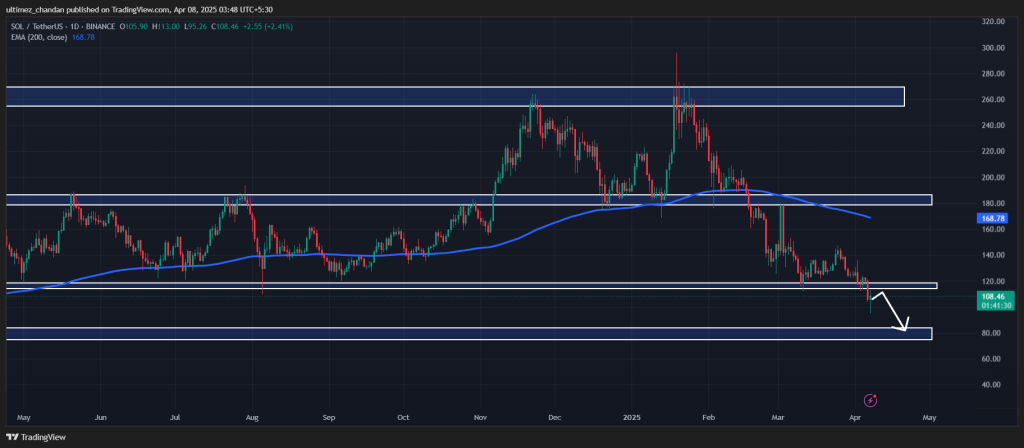

Solana (SOL) Price promotion and upcoming levels

According to the technical analysis of experts, Sol Bearish appears despite the continuous price recovery. On April 6, 2025, Sol broke off from the long -term key support level of $ 115 and also closed a daily candle below that level, a level that it had held since March 2024.

This breakdown has pushed Sol into an extremely bearish phase. However, the current price recovery seems to be a retest of the demolition level.

Based on the recent price action and the historical momentum, if SOL remains below the level of $ 115, there is a strong possibility that it could fall by 30% and reach the $ 77 level in the near future.

These Bearish front views are strongly supported by momentum indicators such as the Relative Strength Index (RSI) and the 200-day exponential advancing average (EMA) in the daily period.

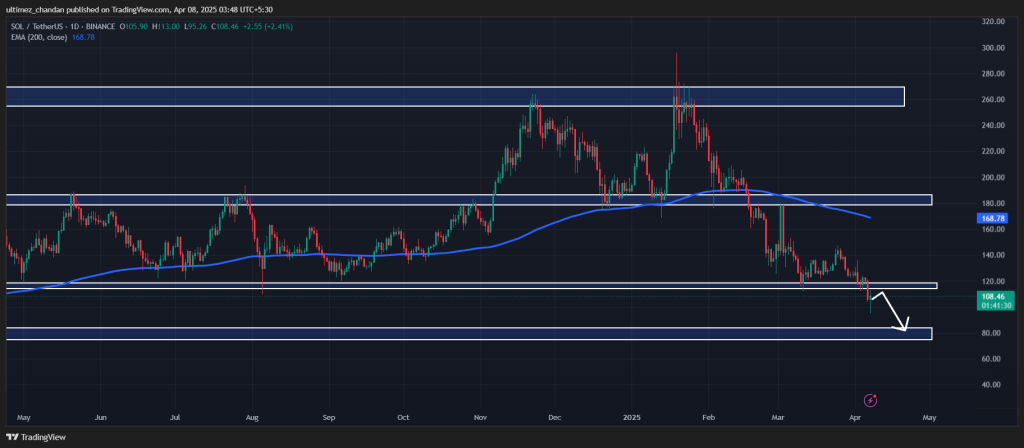

Current price momentum

From writing, Sol traded nearly $ 107 and had registered a price fall of more than 1% for the past 24 hours. In the meantime, it actively showed a strong recovery, with a low of $ 95.6 during the Asian market session. In the midst of this considerable price fluctuation and market volatility, the trade volume of SOL was raised by 185% in the same period.

$ 140 million in Sol outflow

While investigating the statistics on chains, it seems that whales, investors and long-term holders have seized the opportunity to collect Sol at the current price level, according to the on-chain analysis company Coinglass.

Data from Spot -entry/outflow shows that exchanges have seen an outflow of around $ 140 million in SOL in the last 24 hours. This substantial outflow suggests potential accumulation and can lead to purchasing pressure.

However, due to the prevailing Bearish sentiment, a strong upward meeting can be difficult to reach.