- Crypto inflow of $ 644 million has broken the one-week outflow, which indicates renewed investor confidence

- Bitcoin has retained his supremacy on the market

The Cryptomarkt saw a large turning point last week, with $ 644 million in inflow – ending for five weeks. This shift is a sign of the growing trust of investors, especially as the institutional demand rises.

Bitcoin [BTC] Led the recovery and attracted $ 724 million and the $ 5.4 billion outflow from previous weeks. On the contrary, Ethereum [ETH] Confronted with $ 86 million, while Solana [SOL] won $ 6.4 million, which shows that investors remain selective.

Crypto -Inflow shows that Bitcoin’s support is released

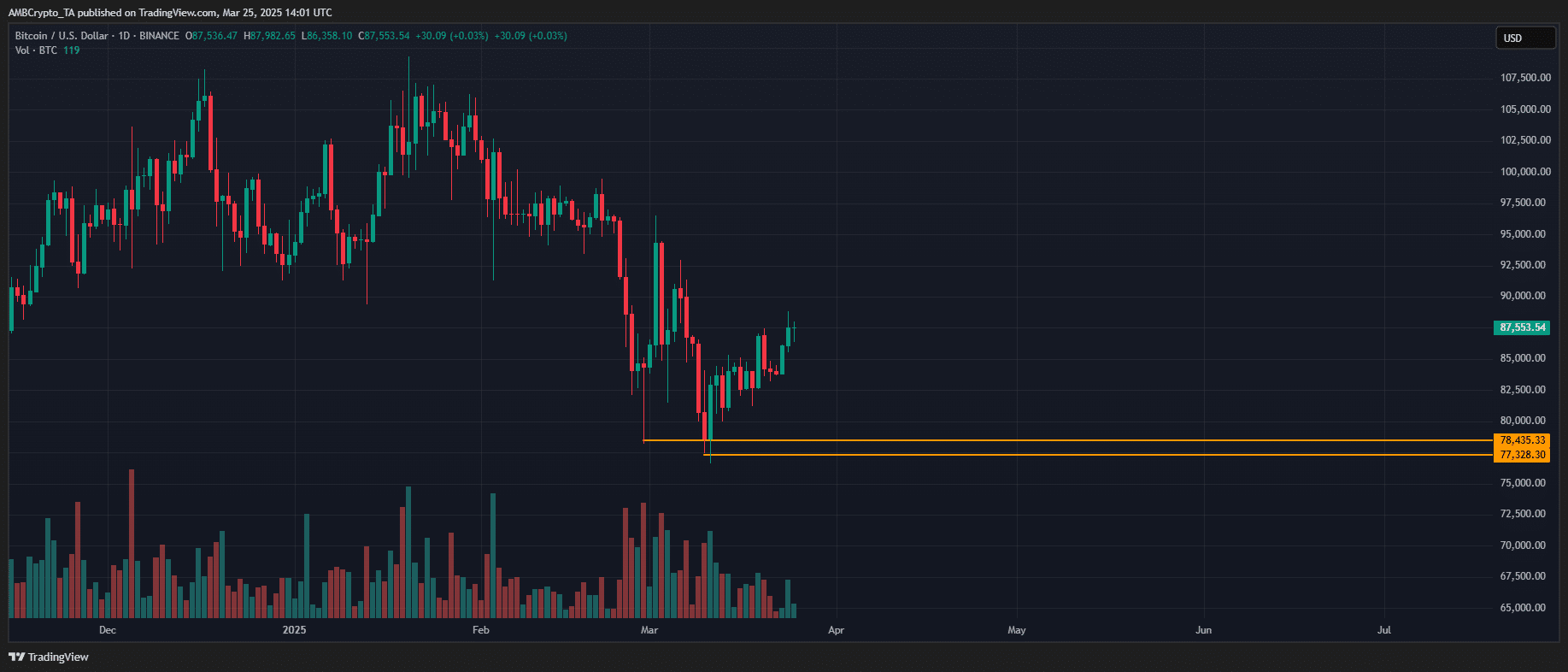

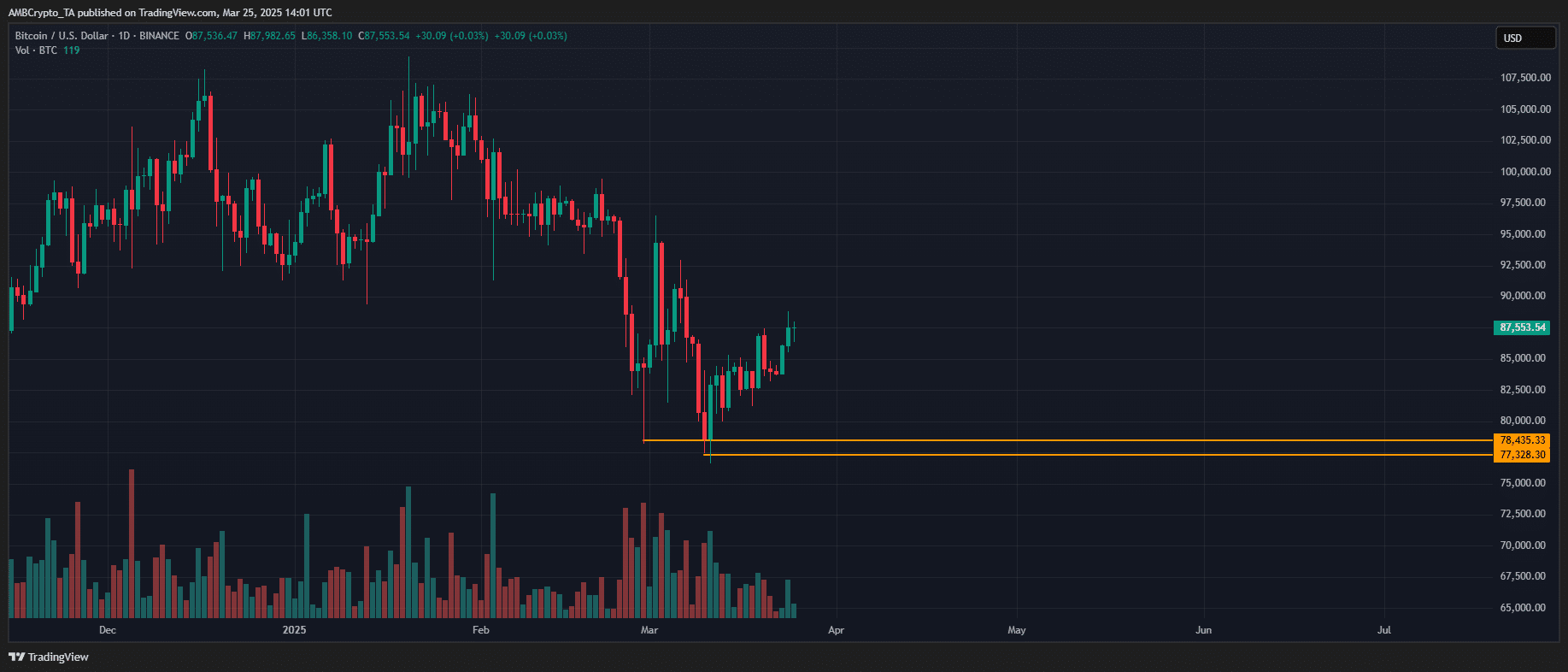

Despite successive market shocks, the dominance of Bitcoin remains solid and retains above 60% – the same level observed prior to the elections. Interestingly, this stability follows a substantial retracement of its highest peak of $ 109k to its enormous fall to $ 78k.

The price promotion is an indication of a strong conviction. Despite short -term fluctuations, a bullish continuation of a new highest scenario remains. Especially with upward momentum that is likely to build over the long -term horizon.

The $ 724 million in crypto intake further confirmed the ongoing demand for BTC, which strengthens the dominance of the market.

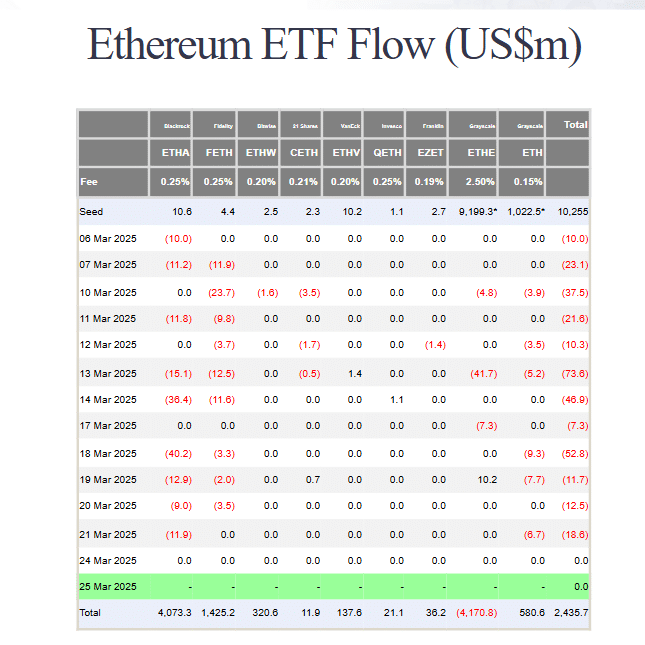

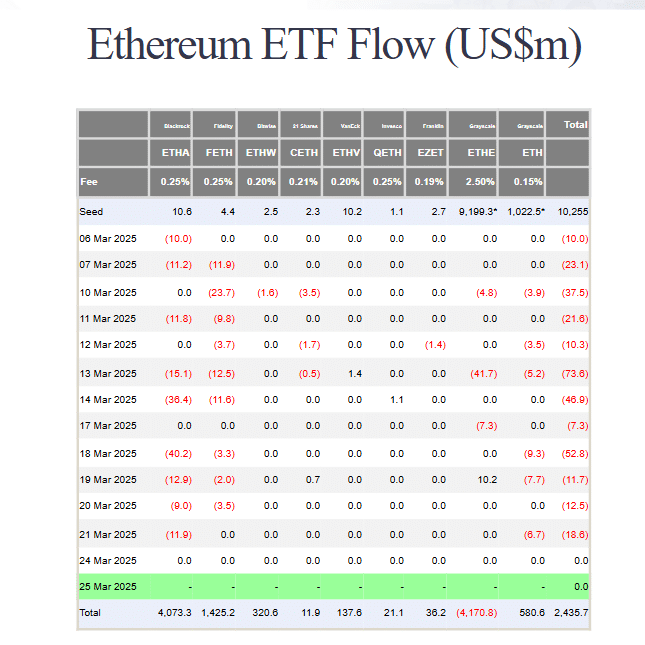

However, the difference in crypto entry also revealed underperformance in Altcoins, in particular Ethereum. In fact, the crypto has seen consecutive out of ETFs over the past two weeks.

Source: Fats Side Investors

This trend has only strengthened the dominant position of Bitcoin, because it continues to catch the lion’s share of the institutional capital.

In the midst of speculation of a Bearish Q2 driven by the shifting of tax and monetary policy, the crypto inflow of $ 644 million in digital assets can act as a critical catalyst for a market reverse.

The inflow into Bitcoin signal robust institutional trust. This, in combination with reduced sales pressure, could feed upward boost, possibly limit a wider market in the market and cause a rebound in the coming quarters.

Bitcoin’s position in a Bearish Q2 – Naming Market Tegenwind

With the Q2 that unfolds under bearish circumstances, the mutual rates of President Trump, effectively on April 2, can worsen existing macro -economic pressure.

Historically, such macro opposite has led to considerable price corrections in Bitcoin. The active has even lost the critical support zone of $ 80K on two different occasions.

Source: TradingView (BTC/USDT)

On the contrary, on-chain statistics and crypto inflow suggested that although volatility can intensify, Bitcoin’s market structure and long-term demand could offer structural support.

Nevertheless in $ 5.4 billion sluice From BTC ETFs in recent weeks guarantees attention. Although the dominance of Bitcoin remains undisputed, the true test of the resilience is approaching quickly.

If Institutional and Retail Inflowing recent patterns continues to reflect, Bitcoin may be able to withstand the turbulent market conditions.

However, if the crypto reverses, FOMO could disappear, causing the Bitcoin risk meeting. In such a scenario, a potential withdrawal to the $ 80k support zone would remain a viable target, with a greater risk of a deeper correction.