- Strategy eyes $ 500 million increase in stock sales for BTC acquisition.

- The update of the company aroused mixed views from the crypto community.

On March 18, Michael Saylor, founder of Strategy (formerly Micro Strategy), announced one plan To sell $ 500 million in new ‘perpetual preferred stock’ (STRF) Bitcoin [BTC] buys.

Recently the company had issued a different preferred supply ‘STRK’ for similar BTC objectives.

This was part of that of the company goal To pick up $ 21 billion through share issue and another $ 21 billion due to debts (convertible notes) for BTC purchases.

Mixed views on the plans of the strategy

Clarify the difference between the new category of the strategy of stock issue, Bitwise’s head Alpha, Jeff Park, said”

“You can buy Strk today for a yield of 9.4% with upward convertibility or STRF for a return of 10% with virtually no interest function.”

Simply put, Strk can be exchanged for MSTR, but STRF does not have such a function and entails more risk.

However, some members of the crypto community regarded the ‘high leverage’ of Strategy as a risk factor for the entire BTC market. One pseudonymous market analyst, Wazz Crypto, stated”

“This ID*OT is currently making Bitcoin uninvestable. Can it even be more digital gold if it is bound by the solvency of a single company?”

Another user, Simon Dixon, called it a ‘at the next level risk’ that a save may require if it goes down.

“The announcement of strategy of a perpetual dividend of 10% paid in dollars, according to the lack of sufficient dollar income and working with a Bitcoin-based balance is at risk of the next level.”

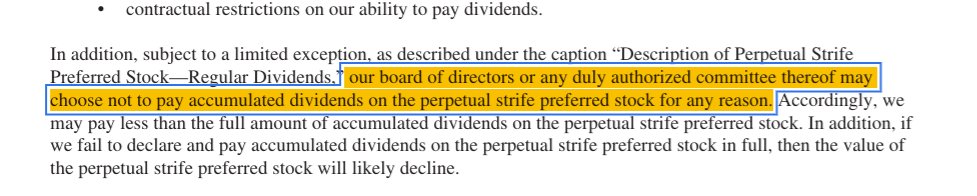

BitMex research clarifying That the company can prevent the dividends of MSTR and STRF holders from paying.

“It seems that $ mstr can prevent these dividends from 10% to 18%” to be paid “for whatever reason.” The likely result here is that class A $ mstr shareholders never get a dividend payment. “

Source: X

For his part, BTC critic Peter Schiff mentioned the new issue of shares ‘ridiculous’ and added”

“The only thing that fully reflects (BTC) is the support of the Trump administration. As soon as that goes, it’s all over for Bitcoin and $ mstr.”

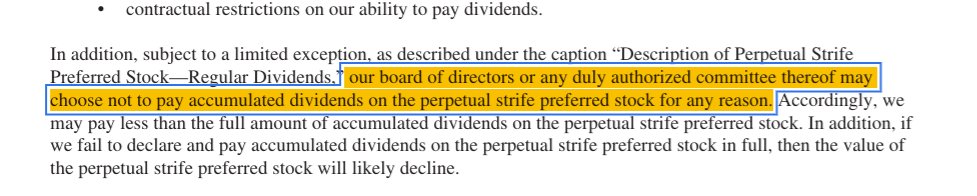

In comparison with the last quarter, the BTC purchase pace of the company was delayed in 2025. On March 16 it bought 130 BTC, which increased its stock to 499,226 coins – a check of 2.3% of the total BTC offer.

Source: Cryptuquant

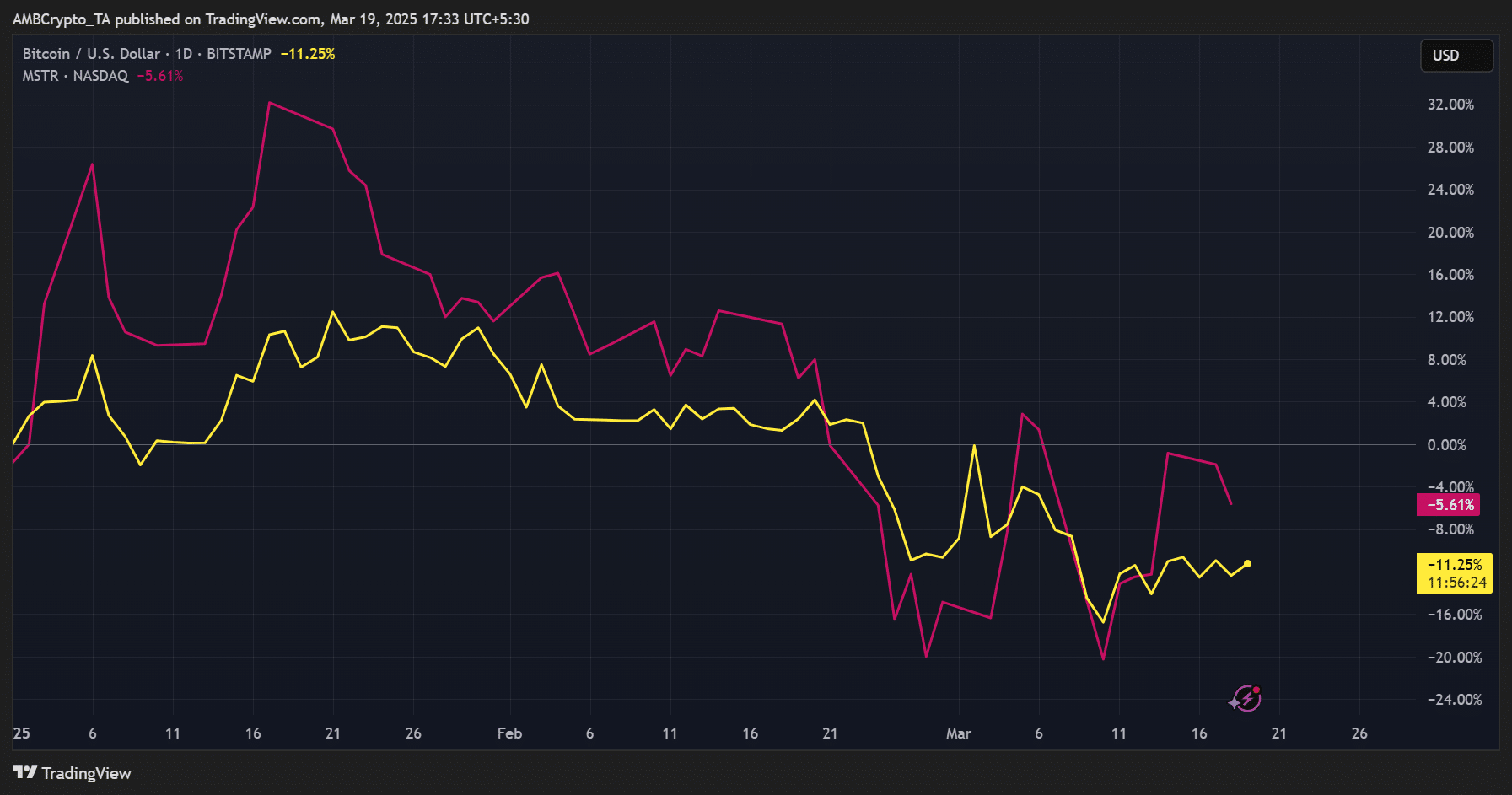

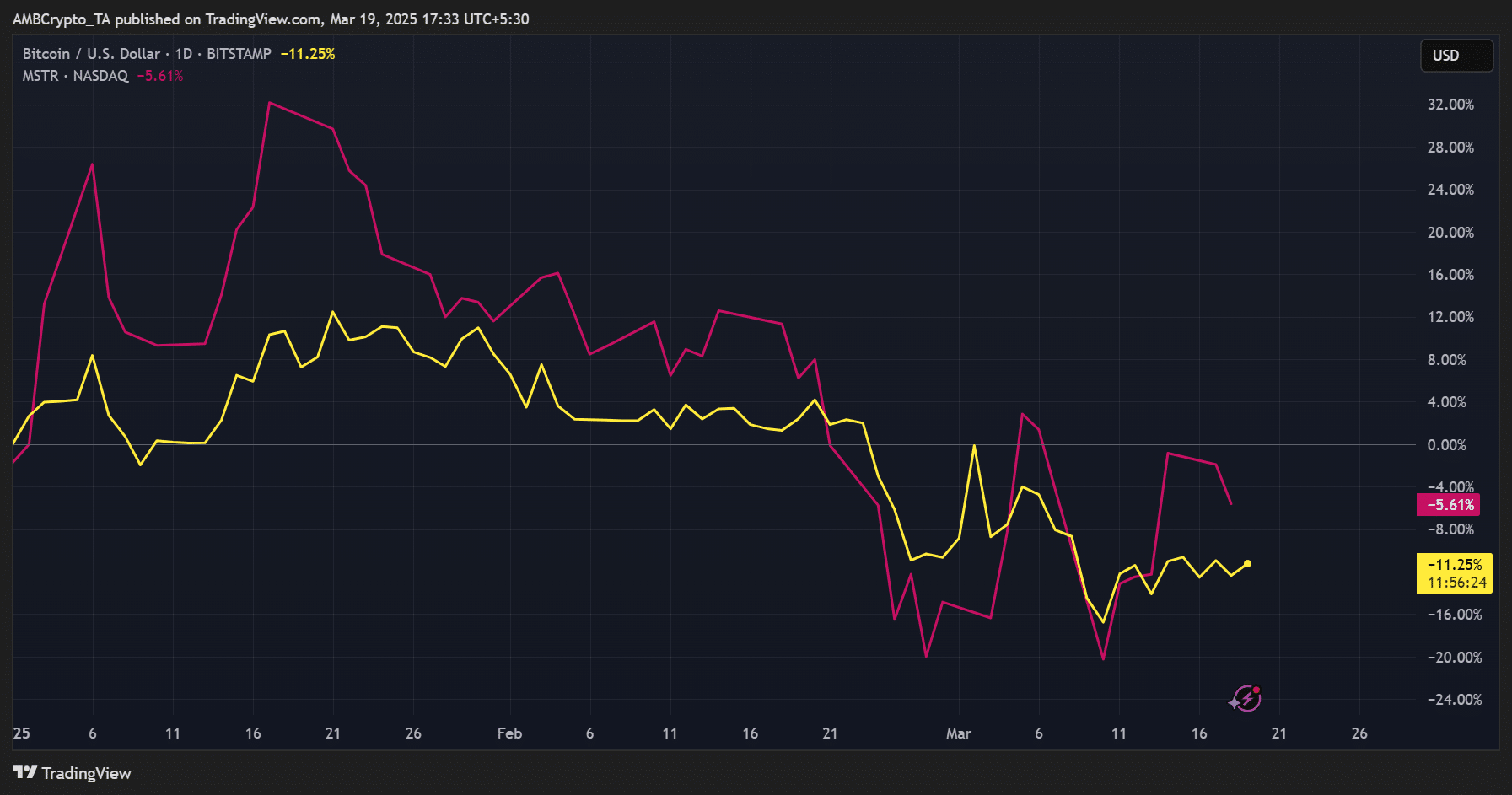

From this letter, MSTR was appreciated at $ 282, with 48% a decrease compared to its recent highlights of $ 543, after recent BTC losses. In the past two weeks it fluctuated between $ 230 and $ 300 because BTC remained below $ 90k in the same period.

On a year-to-date (YTD) performance, MSTREN kept the risk-off sentiment better and only fell 5% compared to the fall in BTC from 11%.

Source: MSTR vs BTC, TradingView

Last week MSTR made a profit of 26%, because BTC has re -tested $ 85k, which suggests that the share could post a strong recovery if the cryptocurrency reversed its losses.