- The Bitcoin battery trend score rises above 0.1, indicating a potential shift in renewed purchase interest.

- A convincing reversal still requires sustainable demand.

Bitcoin’s [BTC] Accumulation trend score is for the first time since 11 March checked above 0.1 – a modest but remarkable shift in a different bearish landscape.

Although the distribution remains firmly under control, this increase in a flicker of buying interest that can indicate the early stages of renewed question.

The most important question now is whether this marks the beginning of a market reverse, or only a temporary break in the prevailing downward trend.

Accumulation activity re -awakens after prolonged silence

After a heavy wave of accumulation during the Late Q4 rally weather mirroring in deep purple nodes on the graph-it, the sentiment definitely risk-off when Bitcoin entered a distribution-dominant phase at the beginning of 2025.

This transition is clear in the increasing frequency of yellow and orange markers, which points to widespread sales or hesitation to buy.

Source: Glassnode

March 2025, however, reveals a subtle but remarkable shift: accumulation scores are starting to climb, with colors that go back to purple.

Although still modest, this change suggests renewed interest rates in the longer term or entities that gradually rebuild positions.

It can represent early positioning for a potential trend removal or just a short-lived deviation in a continuous bearish cycle.

Market sentiment and potential reversal

Bitcoin’s constant downward trend is defined by extended distribution, where the ATS stays below 0.5 – which indicates dominant sales pressure.

The recent climb above 0.1, although minor, indicates the revival of accumulation – a pattern that is often seen during the early stages of recovery after major corrections.

Historically, such transitions have followed the soil bottoms, where accumulation slowly builds up as trust.

Currently, strategic movements by institutional players and expectations of regulatory clarity could stimulate this subtle shift.

However, to have the trend claim, accumulation must be maintained by continuous institutional demand and supporting policy signals. All abrupt setbacks or sharp volatility peaks can disrupt this budding recovery.

Bitcoin: weak momentum, limited purchasing pressure

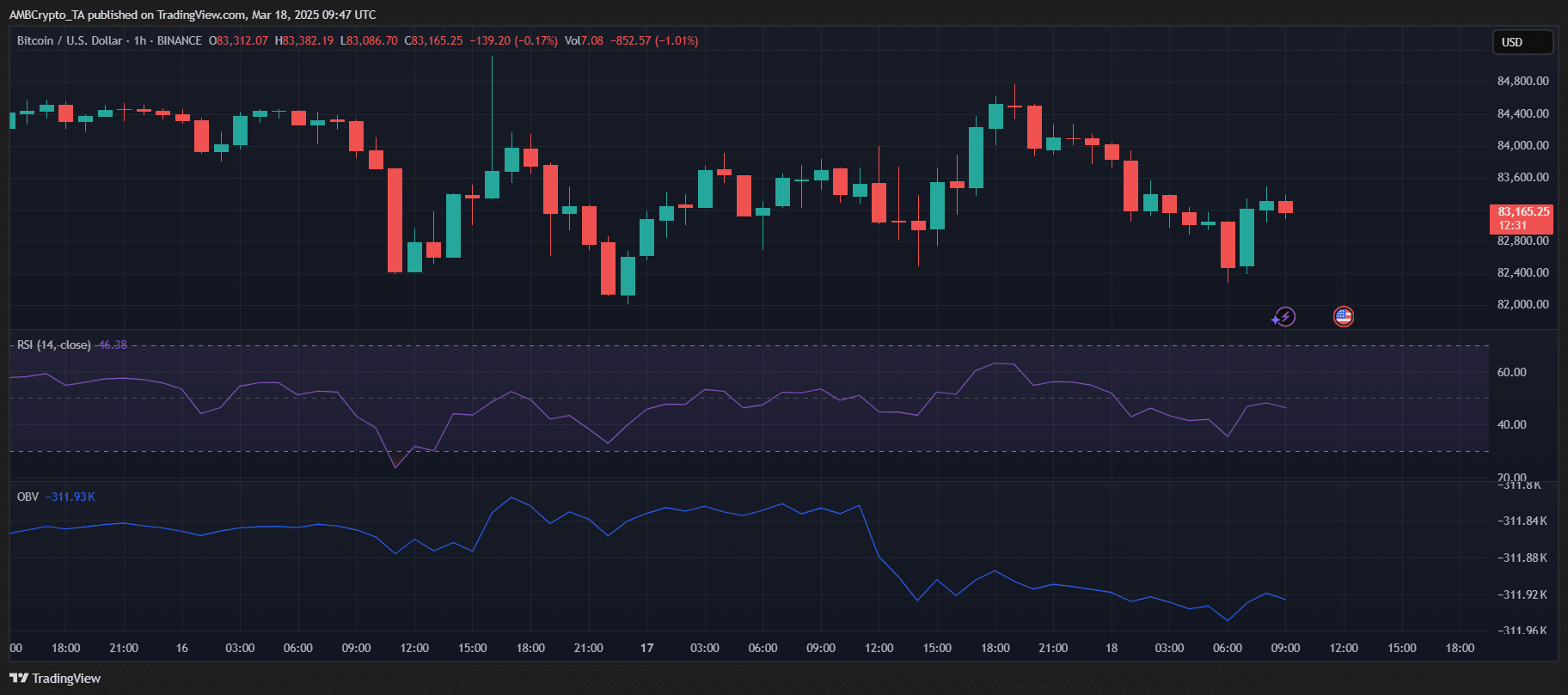

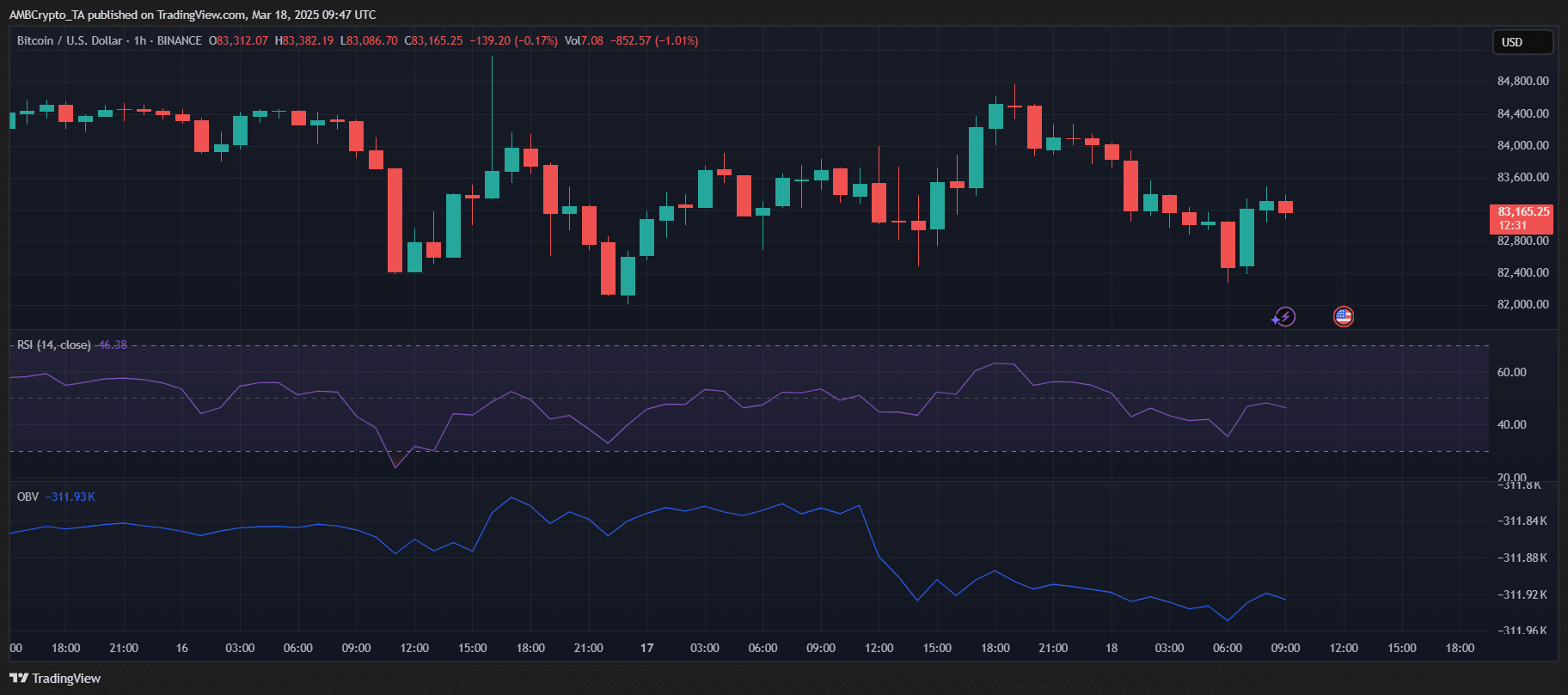

Bitcoin was at $ 83,165 at the time of the press, more than 1% in the last 24 hours. The hourly table revealed a struggle to reclaim upwards, with a pattern of lower highlights that persist despite short rebounds.

The RSI was 46 and reflected weak bullish pressure and no clear signs of the sold -off Activum.

Source: TradingView

In the meantime, the OBV remained firmly negative at -311.93K, which emphasized a lack of persistent purchase activity. All in all, these indicators pointed to a careful sentiment in the short term.

To get a convincing reversal shape, BTC should break above $ 84,000, accompanied by the rising volume and a RSI push beyond the neutral 50 mark.