- Pepe has a bearish structure and prospects on the higher timetables.

- Another 5% higher displacement is expected, but the demand was too weak to indicate further profit.

Pepe [PEPE] Saw flows of fairs and some proof of accumulation in recent weeks. At the same time, holders had no loss and the consistent sales pressure forced this year’s downward trend.

This long -lasting ariting has not yet been terminated.

In the short term there was some hope for small profit. A move to the high -two -week highs of two weeks was expected, but that was not an outbreak. Here are the levels that traders have to watch out.

Pepe Rebound of Mid-Range Support

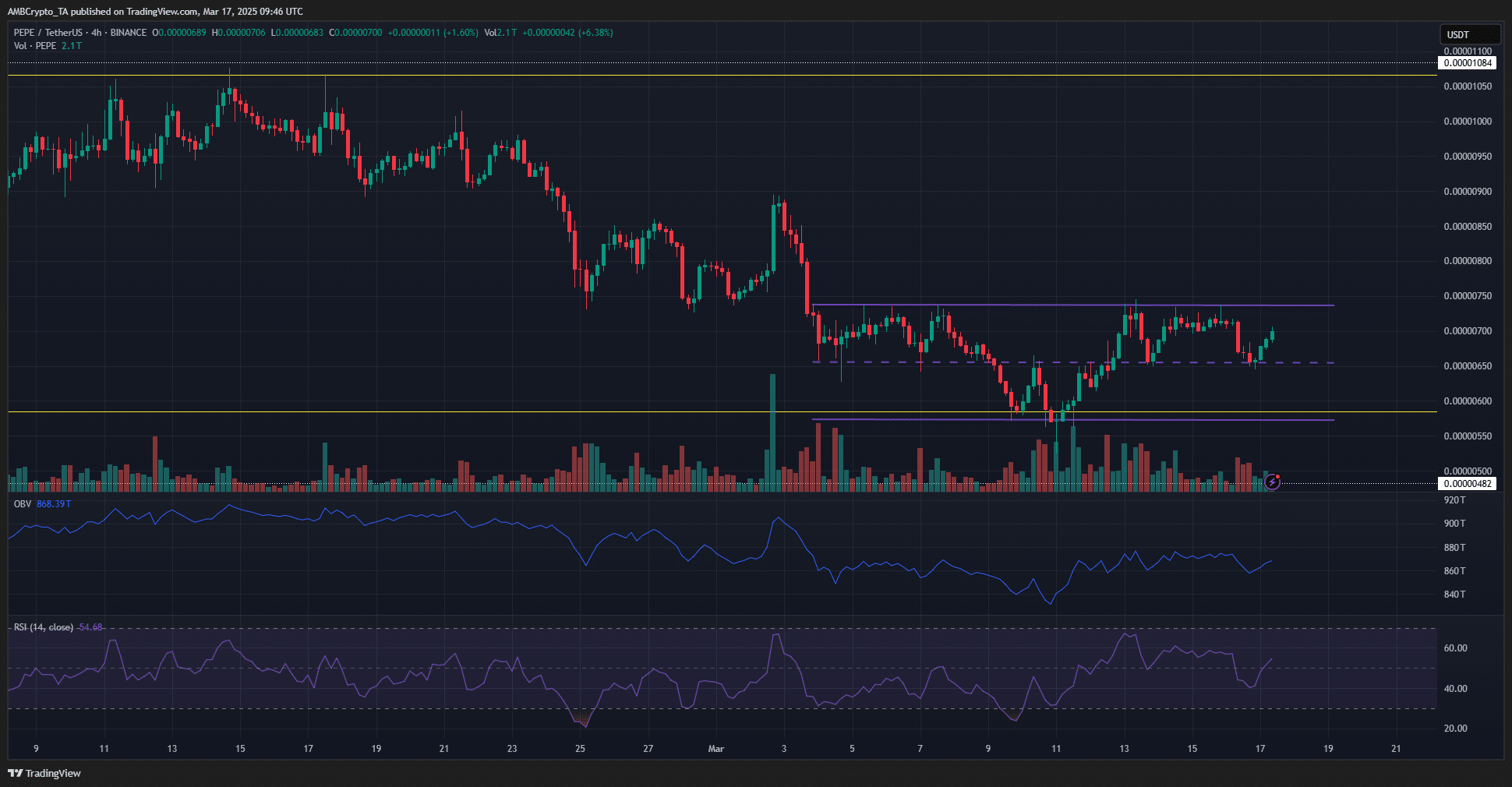

Source: Pepe/USDT on TradingView

The higher timetables were strong bearish, but the lower schedules showed consolidation for the memecoin. Pepe has now traded for two weeks between the levels of $ 0.00000572 and $ 0.0000736.

The range (purple) was valid because not only the extremes were respected, but also the medium -range level at $ 0.00000655.

The repeated tests of this level as support and the strong response of Pepe increased the credibility of the reach.

At the time of the press, the RSI climbed back above neutral 50 after a dip at the weekend. This showed Bullish Momentum in the short term that Pepe could bring to the reach height.

An outbreak was not on the cards, but traders still have to manage the risk in case one takes place.

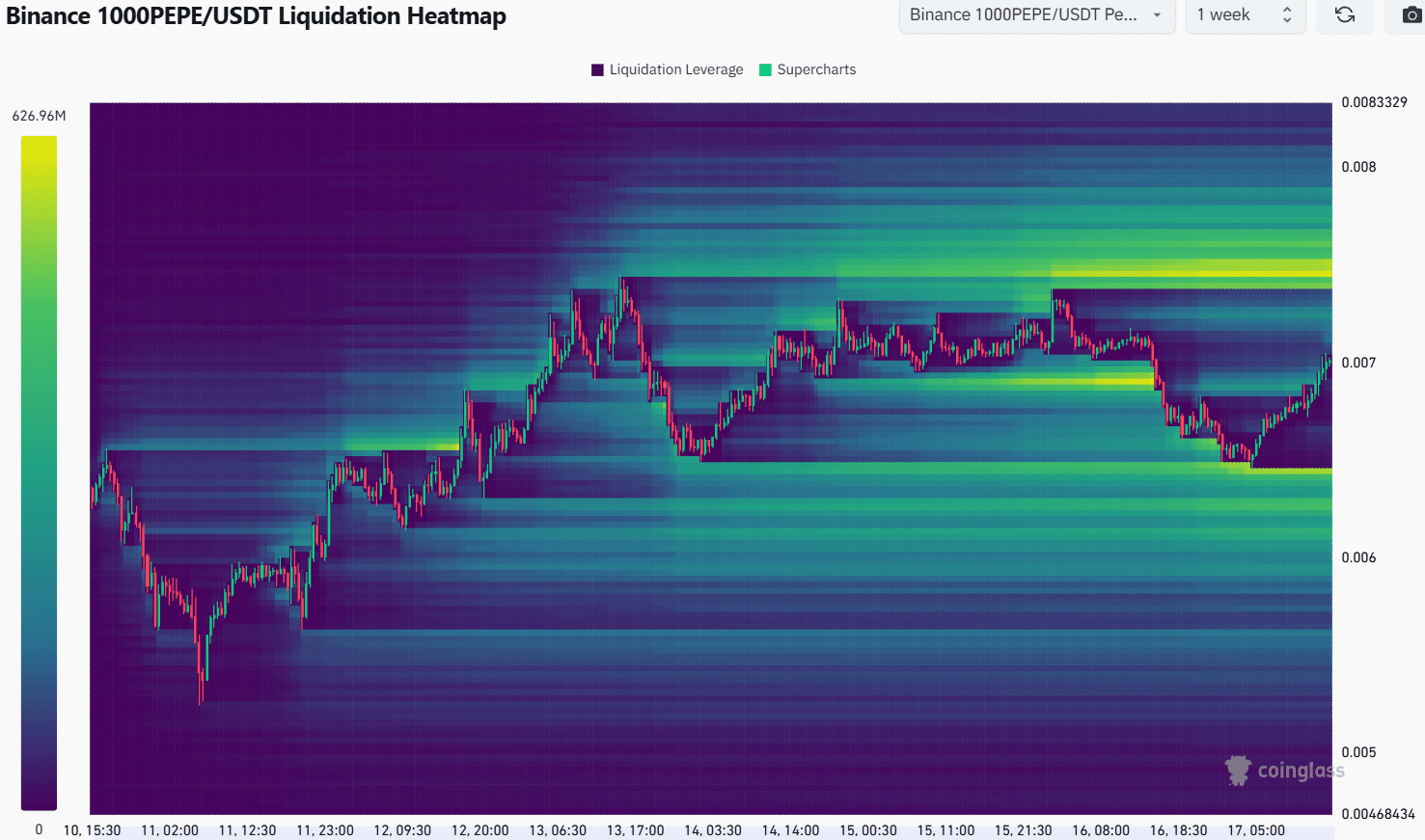

The 1 -month liquidation heat showed a cluster of liquidity at $ 0.0000075, just above the range height.

This back -up of the idea that Pepe prices would rise another 5% in the coming hours or days to wipe the liquidity pocket. Furthermore, the $ 0.000009 was the next magnetic zone to view.

Because the volume indicator does not show that a breakout was probably, we can adhere to the idea that the range would continue to exist. The heat of 1 weeks showed a liquidity pocket for $ 0.00000745- $ 0.0000075.

The local layer around $ 0.00000645 was a bearish target in the short term. This level was just below the medium-range level, which means that a retest of the mid-range region of swing traders could offer a buying option.

Bitcoin [BTC] Volatility can ruin the formation of the Pepe range and cause abnormalities above reach during the New York session for traditional markets.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer