After consolidating for a week, Ethereum (ETH), the world’s second largest cryptocurrency per market capitalization, is ready for an enormously upward momentum. On March 18, 2025, the general cryptocurrency market again witnesses a price increase. In the midst of this, ETH has reached the upper limit of its consolidation and is about to get out of an outbreak.

Ethereum (ETH) Technical analysis and upcoming level

According to the technical analysis of experts, ETH is in a tight reach between $ 1,840 and $ 1,955 for the past week. As the prices about the cryptomarkt rise, however, it actively reaches the upper limit of this range and it is now a few points after the outbreak.

Based on recent price action and historic momentum, if ETH infringes and closes above the $ 1,960 level, there is a strong possibility that it could rise by 11% in the coming days to reach $ 2,200.

In the midst of the recent fall in price, ETH has fallen considerably and acts under the 200 exponential advancing average (EMA) on the daily period, indicating that it is actively in a downward trend.

Bullish on-chain statistics

Despite the fact that ETH is in a downward trend, intraday traders seem to be bullish because they bet strongly on the long side, according to the unchain analysis company Coinglass.

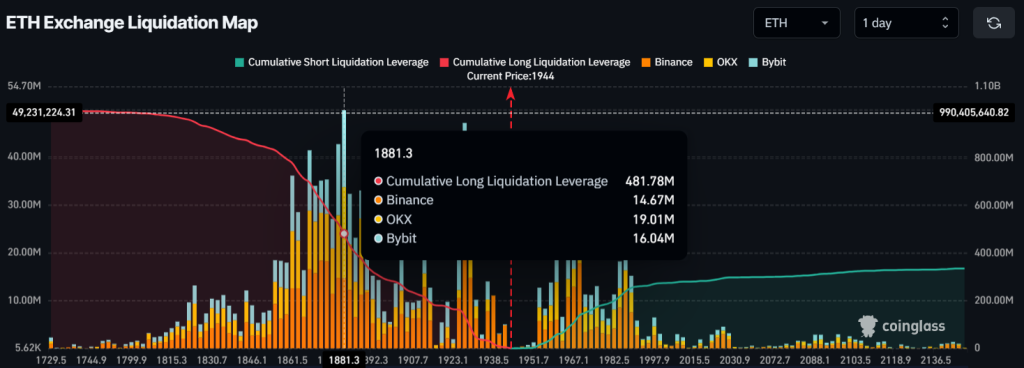

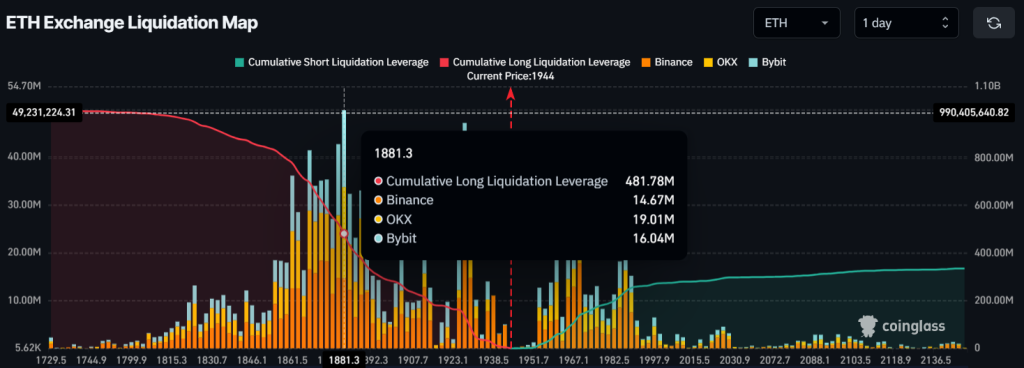

$ 480 million in long positions

Data shows that traders are currently being used too much for $ 1,880 at the bottom, where they have built $ 480 million in long positions. In the meantime, $ 1,970 is another survival level, in which traders have built up $ 140 million in ETH short positions, which clearly indicates a bullish prospect among traders.

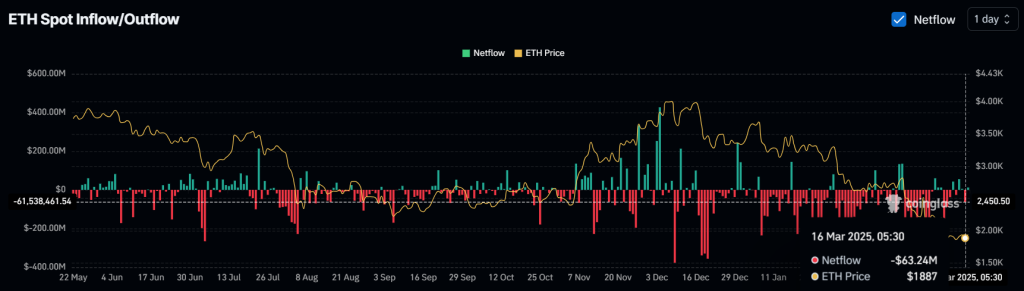

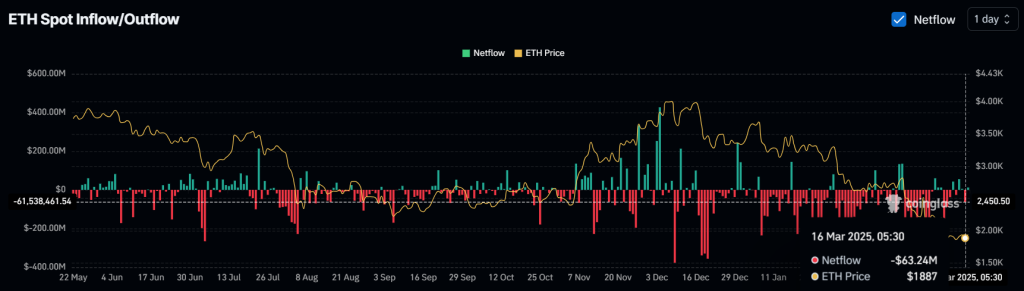

$ 50 million in ETH outflow

In addition to the bullish prospects of traders, investors and holders also seem to be bullish in the long term, because they seem to collect it actively and use the recent price decrease, according to the on-chain analysis company Coinglass.

Data from Spot Inflow/Outflow shows that exchanges have experienced ETH outflows for nearly $ 50 million in the past 48 hours, which indicates potential accumulation and presenting an ideal example of a ‘buy the dip’ chance.

Current price momentum

ETH is currently being traded near $ 1,950 and has registered an upward boost of 5% for the past 24 hours. During the same time frame, however, it was a witness to considerable participation of traders and investors because of his bullish prospects, resulting in a jump of 30% in the trade volume.