- The volume indicators for the daily time frame showed that the sales pressure was not overwhelming.

- Cardano did not guarantee the lows and traders must also be in place for the price movements of BTC.

Cardano [ADA] Faced with rejection in the field of $ 0.75- $ 0.76 in the hours prior to the time time. Bitcoin [BTC] Saw a decrease of 2.38% in seven hours and dragged ADA by 4.68%. An earlier report noted that the response of the price to the $ 0.8 resistance zone would tell.

The Bulls were rejected before they tested that resistance, as BTC witnessed weekend volatility, who also rocked the Altcoin market. Yet the higher period of time remained in place.

As long as the range was in the game, ADA investors had a buying option with a clear, close invalidity.

Time for Cardano bulls to bid on the dip

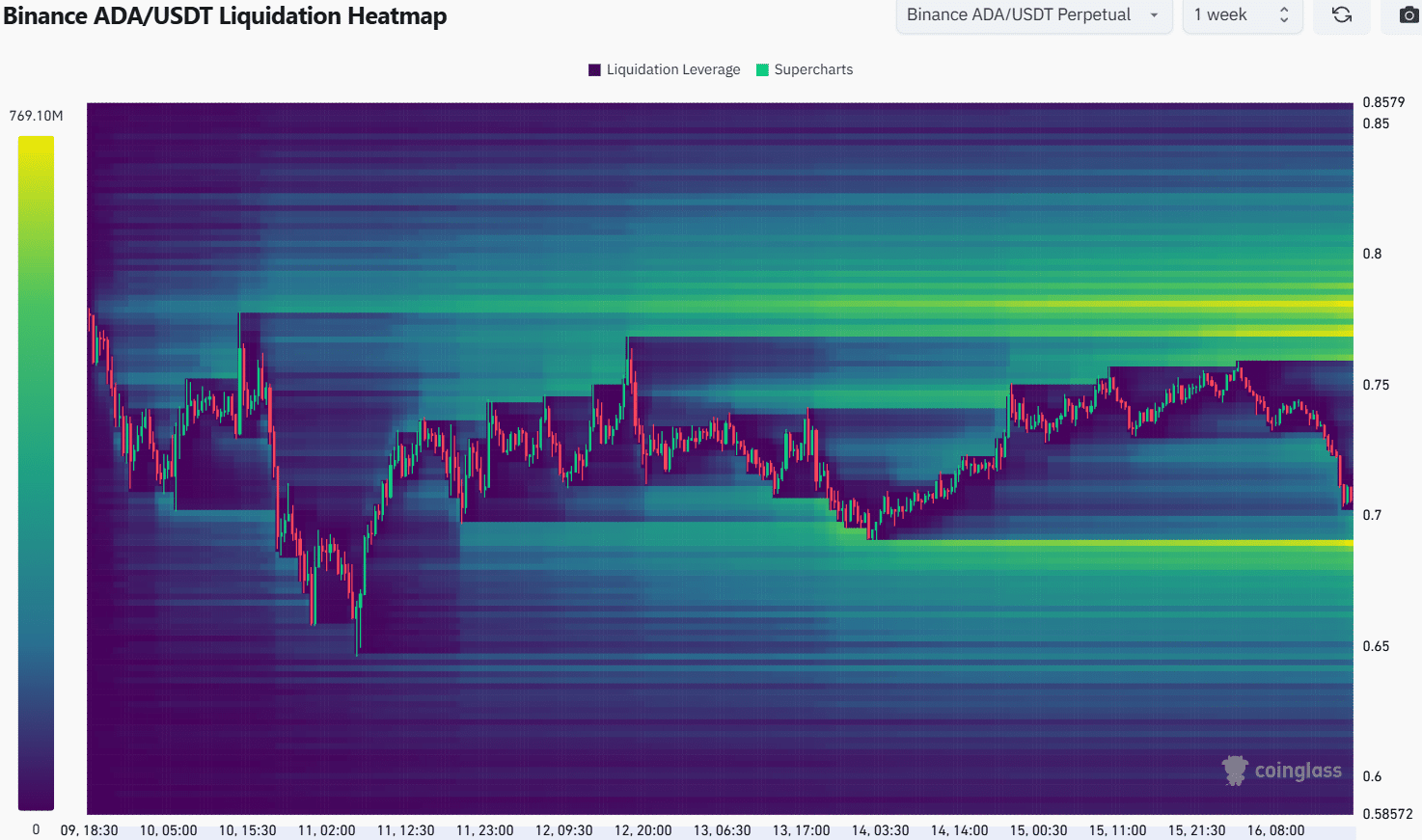

Source: Ada/USDT on TradingView

The market sentiment was shot – the Anxiety and greed index was 30, which indicates fear. It stated anxious sentiment in March.

Recent online activity and price promotion suggests that Ada may have difficulty maintaining support at the level of $ 0.6. For swing traders, however, the risk-to-balance ratio still seems favorable.

The range low, marked at $ 0.682, positions the recent DIP of ADA at $ 0.58 as an area where the liquidity was probably collected. This may lower the prices.

Nevertheless, last week’s low point offers $ 0.647 a chance for long entries, with stop -losses recommended at 3% -5% below this level. This opportunity stems from the confluence of support in the low range and the lack of a significant bearish pressure in technical indicators.

At the time of writing, the A/D line withdrew the profits from the beginning of March, but did not crash at the local lows. Similarly, the CMF was within the neutral territory and the capital outlets were considerable according to the indicator.

The great oscillator also showed a weak bearish Momentum. All these factors marked the region of $ 0.65- $ 0.68 as a likely candidate for a price bounce.

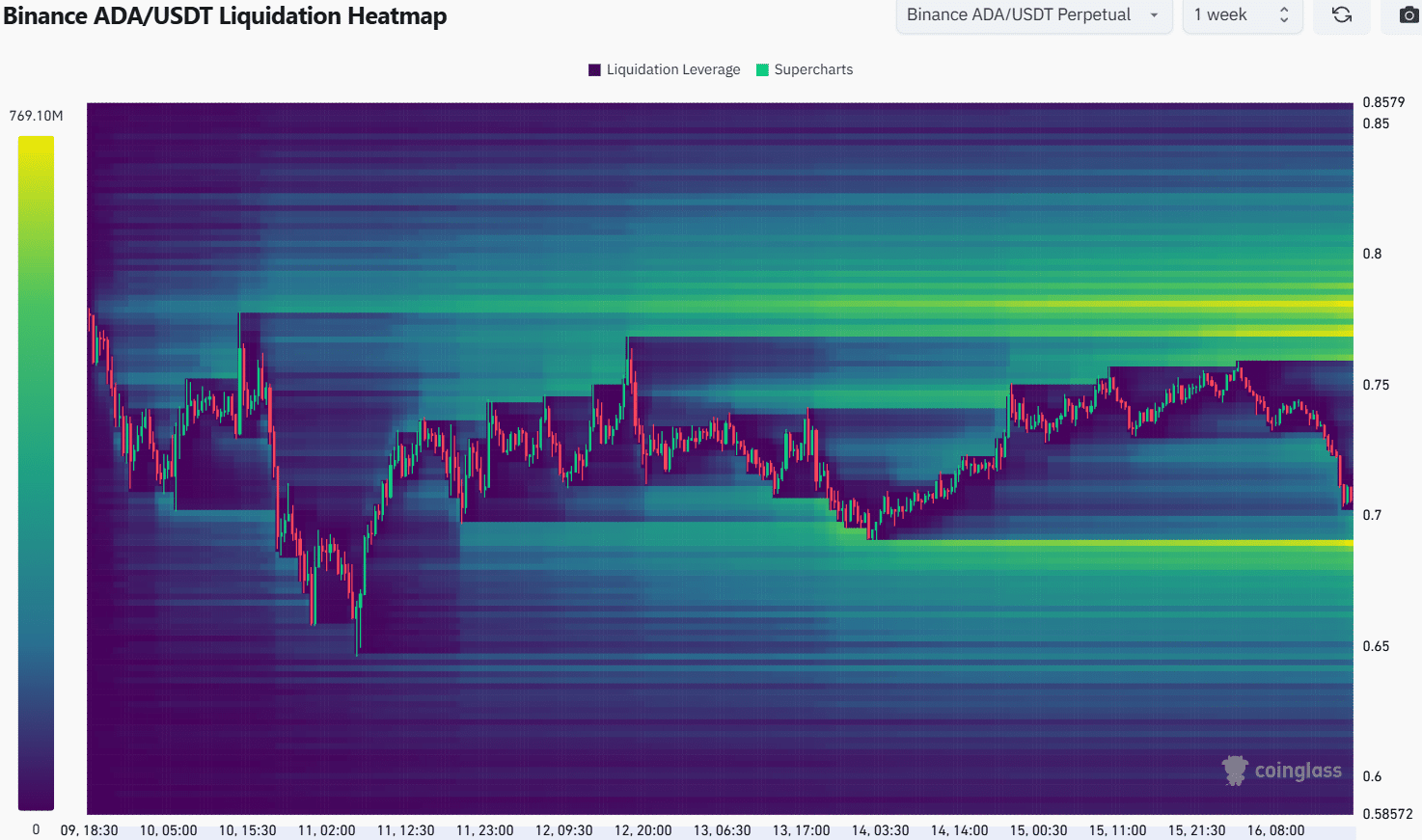

Source: Coinglass

The 1-week liquidation heat showed that the lows of $ 0.68- $ 0.69 were a liquidity pocket near the price. It would probably lower the prices before a price bounced.

However, it was no guarantee that Cardano would bounce here -it would be highly dependent on BTC trends in the next 24-48 hours.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer