- Bitcoin comes closer to a showdown with high efforts. A huge short of $ 332 million at 40x leverage is at stake.

- Is a Squeeze income powered by liquidation?

While the market is taking a breathing break, a trader placed a very lever 40x short on Bitcoin [BTC]. The trader has a full account of $ 8.3 million risk to open a position of $ 332 million.

Currently, the short Is on a non -realized loss of $ 1.3 million, with a liquidation price set at $ 85.290. With Bitcoin trade near $ 83,245, the position hangs in a delicate balance.

If Bitcoin pushes higher, a short squeeze can feed an outbreak. But if Bears defend resistance, a sharp withdrawal could follow. However, the battle will not be easy.

The cross of this range brings 699.2k BTC into focus, while the profit pressure is building. An important stakeholder pool that BTC bought on a peak of $ 86,391 can be ready to cash in.

Source: Intotheblock

For bulls to take control, this sell-side liquidity must be absorbed by a strong question. Unlike the decrease in Bitcoin to $ 78k – where 46k BTC flowed, signaling strong Mockery – The price level of $ 84k did not see such an inflow of capital.

This evokes concern about the strength capitulation zoneWhich means that many holders remain under water in the short term.

If BTC touches $ 85k $ 86k, taking a profit could intensify, so that some holders can lead to them even capitulating and breaking instead of HODL, increasing the sales pressure and risking a long squeeze.

With the supply that the demand probably weighs heavier, this trader has positioned the shorts around a critical resistance zone. If bears hold their soil, a withdrawal to $ 81k seems to be more and more likely.

Volatility in Bitcoin -Dermatenmarkt

Despite the weak question, open interest (OI) rose in just two days by $ 2 billion, which indicates aggressive positioning in Bitcoin derivatives.

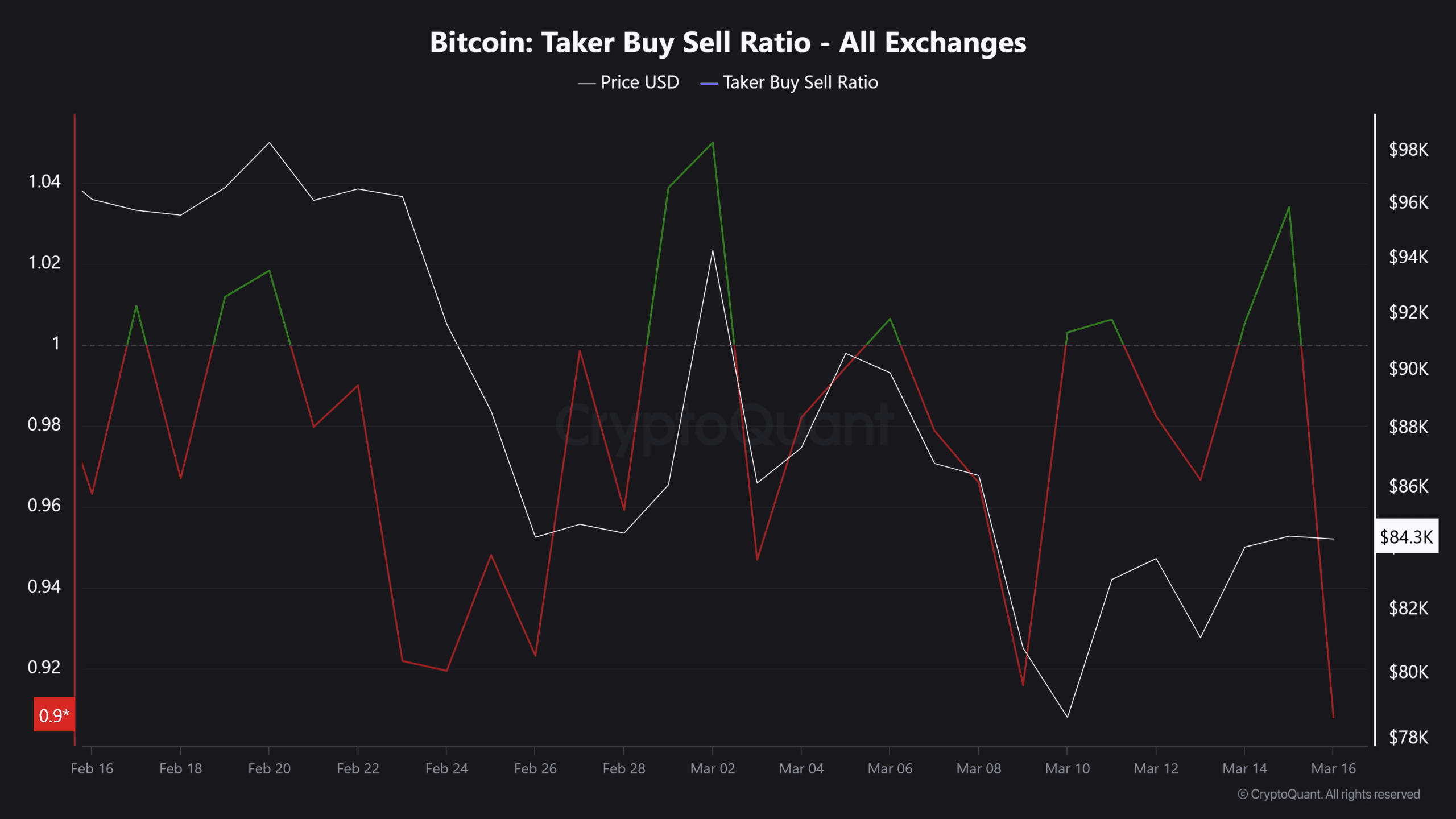

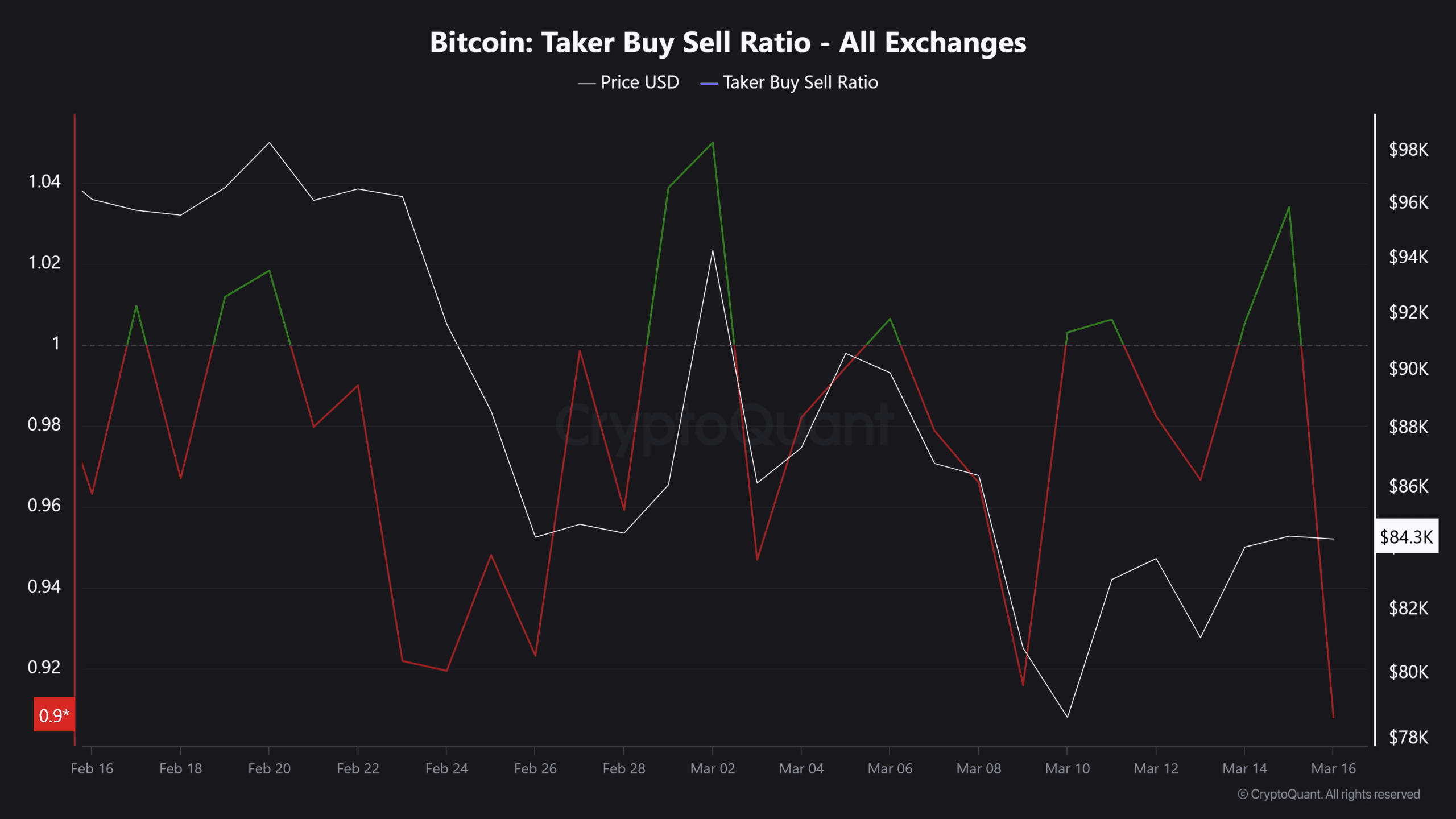

With the Taker Buy/Sell Ratio still less than 1, the liquidity on the sales side continues to dominate in eternal markets.

Source: Cryptuquant

This suggests that traders are a potential reversal, with a lot of positioning for taking a profit. If the momentum weakens, a wave of OI Liquidations Or closures can strengthen volatility in the coming days.

To activate a short squeeze at the short position of $ 332 million and to break the $ 85k – $ 86k resistance, a strong place and the futures question, is needed.

With Taker Buy/Sell Ratio still under 1, however, the dominance of the sales side signals bearish control.

If the market conditions shift, a short squeeze bitcoin could propel higher. Otherwise a pullback to $ 80k – $ 81k remains a strong option.