- The maps of Mana, Sand and AXS revealed remarkable supply clusters

- Cost -based analysis emphasized important battery zones that could define the next trend for large metaverse tokens

The Metaverse was once the next major innovation in digital ecosystems, with projects such as Decentraland [MANA]The sandbox [SAND]and Axie Infinity [AXS] lead.

However, hype around the metaverse has cooled considerably in recent years. In fact, the prices of large Metaverse tokens have also had serious decline, with investor interest in consistent.

Now, with signs of renewed engagement and price activity, is the most important question – are metaillese tokens organizing a comeback?

Cost -based analysis – Signs of accumulation or distribution for metaverse tokens?

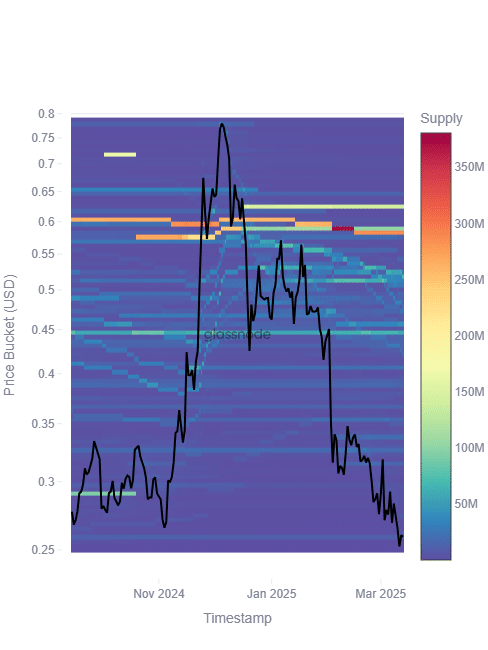

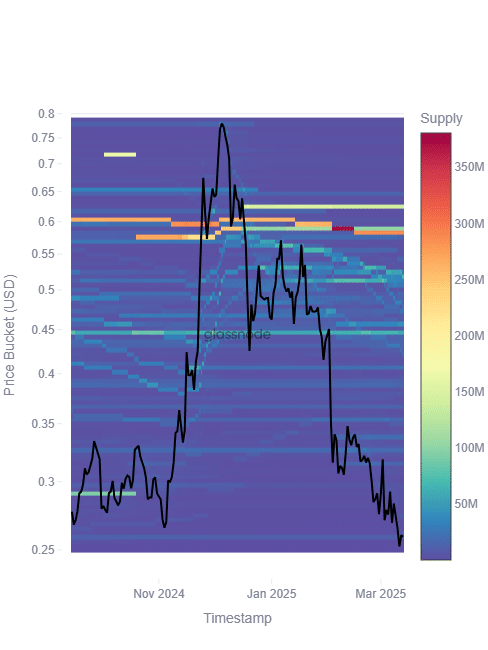

Research into the Cost -basis distribution Metriek for Mana, Zand and AXs revealed some crucial insights into investor behavior. The charts saw significant supply clusters at higher price levels, with a clear downtrend of the price since the early 2025. A large point of care is the continuing overhead offer, which suggests that many holders bought at higher price levels and can still be loss.

- MANA – The price fell steadily in the charts and fell from around $ 8.50 at the end of 2024 to around $ 3 in March 2025. The cost -based rates clusters indicated that a large part of the supply is concentrated between $ 6.50 and $ 8.00, which may work as a resistance zone.

Source: Glassnode

- Sand: A similar pattern can be observed, with a price fall from $ 0.90 to around $ 0.25 in the same period. The largest accumulation zone was around $ 0.60 mark, which indicates a potential challenge for bullish attempts to reclaim lost land.

Source: Glassnode

- AXS: Rather one of the most popular Play-to-Earn tokens, AXS has mirrored the downward trend. The range was heavily clustering from $ 0.55 to $ 0.70, while the price fluctuated around $ 0.30 in the charts.

Source: Glassnode

Investor sentiment – still careful?

These graphs also suggested that metaillese tokens should not break out of their long -term decline. Despite small signs of purchase activity at lower price levels, the delivery pressure has remained high.

This may mean that any price increases can be confronted in the short term with a strong sales pressure of holders who even want to break.

Moreover, did not indicate chain activities, not a major influx of new users. A real Metaverse revival would require both institutional importance and a broader acceptance of metaille-related platforms that are still missing.

Can metaille tokens restore?

For Metaverse tokens to regain the momentum, different conditions must be met,

- Higher trading volumes and a greater demand for metaverse platforms – the current price promotion remains speculative without a substantial user involvement.

- Reduction of overhead supply-an outbreak above the most important resistance levels can indicate that long-term holders are reducing sales pressure.

- Reed Investor Interest in Web3 and Metaverse Development – If large companies announce renewed investments in space, tokens such as Mana, Zand and AXs can benefit from this.

As it looks now, try to stabilize metaillese tokens. However, their recovery is far from guaranteed. While the graphs have suggested accumulation at lower levels, there is still a meaningful outbreak.

That is why investors must remain careful and follow the most important resistance zones before they expect a fully -fledged revival of Metaverse.