- There has been a significant decrease in BTC outflows after touching a new withdrawal point

- Liquidity inflow in Coinbase correlated with the purchase action of investors on the spot market

Bitcoin, the world’s largest cryptocurrency, continues to act at levels well below its all-time highlights. In fact, losses can be seen across the board, with the Cyrpto with a value of just over $ 81,000, at the time of press, after a decrease of 24 hours of almost 2%.

Now that Bitcoin trade close to his critical support levels at the graph, spot traders have gradually started collecting the asset. That is why it is worth analyzing other factors to determine whether BTC will see a price pump in the coming days or not.

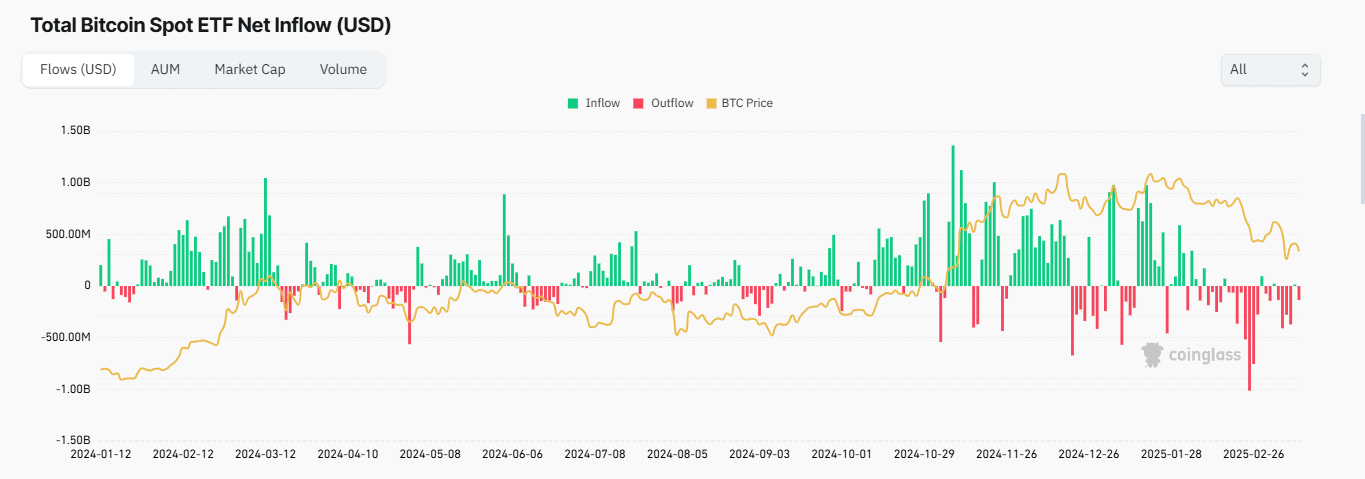

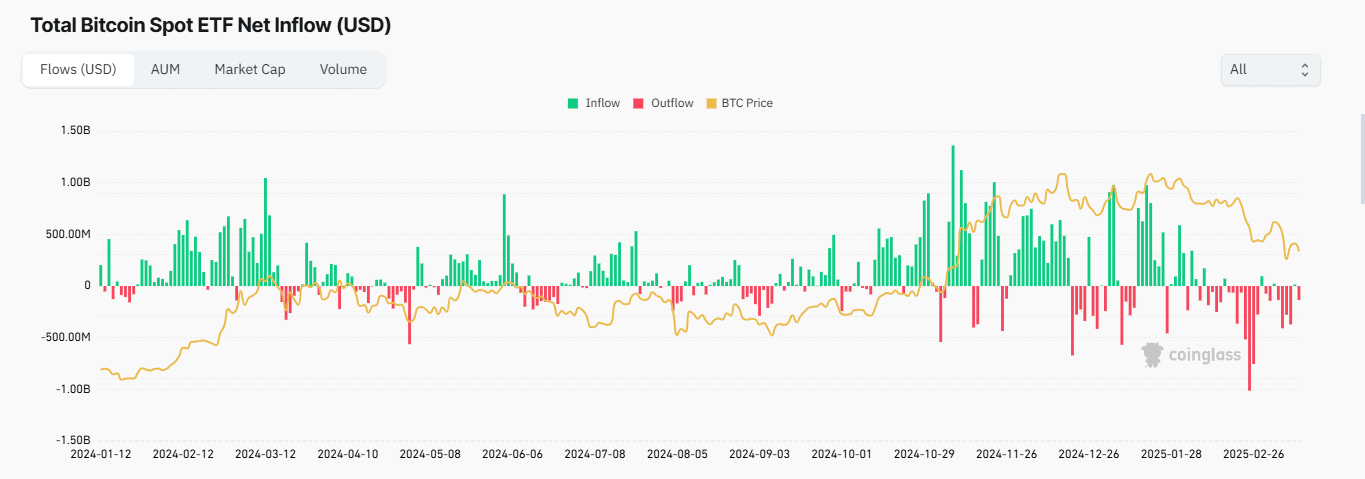

Spot ETF outlines delay

Recent data has shown a significant decrease in BTC outlets of Exchange-Traded Funds (ETFs) in the past month.

At the time of writing, Bitcoin reached a peak with $ 1.01 billion on 25 February-with a total Bitcoin turnover of $ 2,039 billion between 25-27 February 25th the sale of investors who was rejected.

In the last 24 hours alone, $ 135.20 million was withdrawn from the market, with assets that are managed at $ 97.62 billion – a considerably high amount.

Source: Coinglass

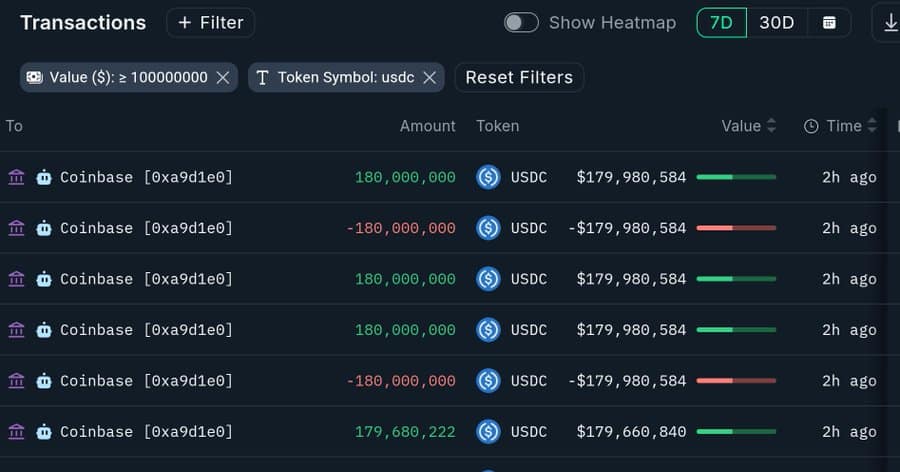

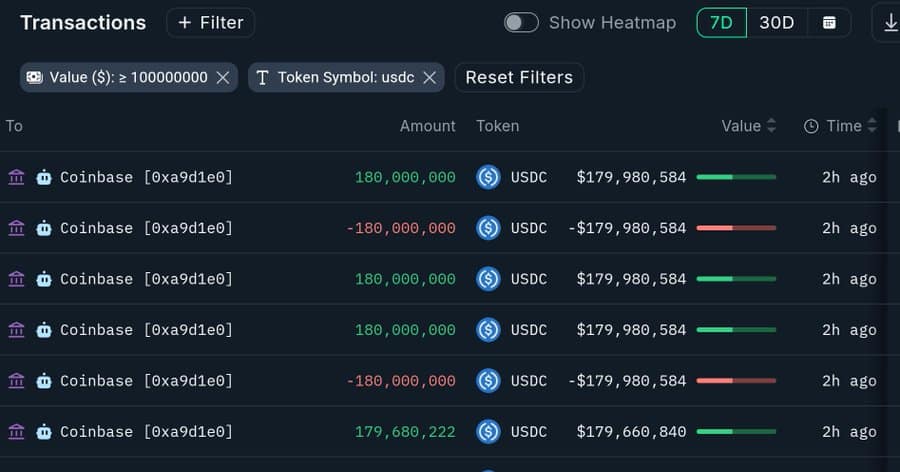

Although the sale in BTC Spot ETFs has been delayed, there have been enormous liquidity inflow in Coinbase.

In the last seven days alone, the inflow has covered 719 million USDC. Such a large inflow into a cryptocurrency exchange, while the price stagnates is a sign of continuous accumulation. This would also suggest that participants buy a rally pending.

Source: Nansen

A glance at Bitcoin’s Exchange Netflows on Coinglass confirmed this purchase activity. Especially since spot traders have bought BTC for about $ 57 million in the past two days, with the Netflows stock exchange negative.

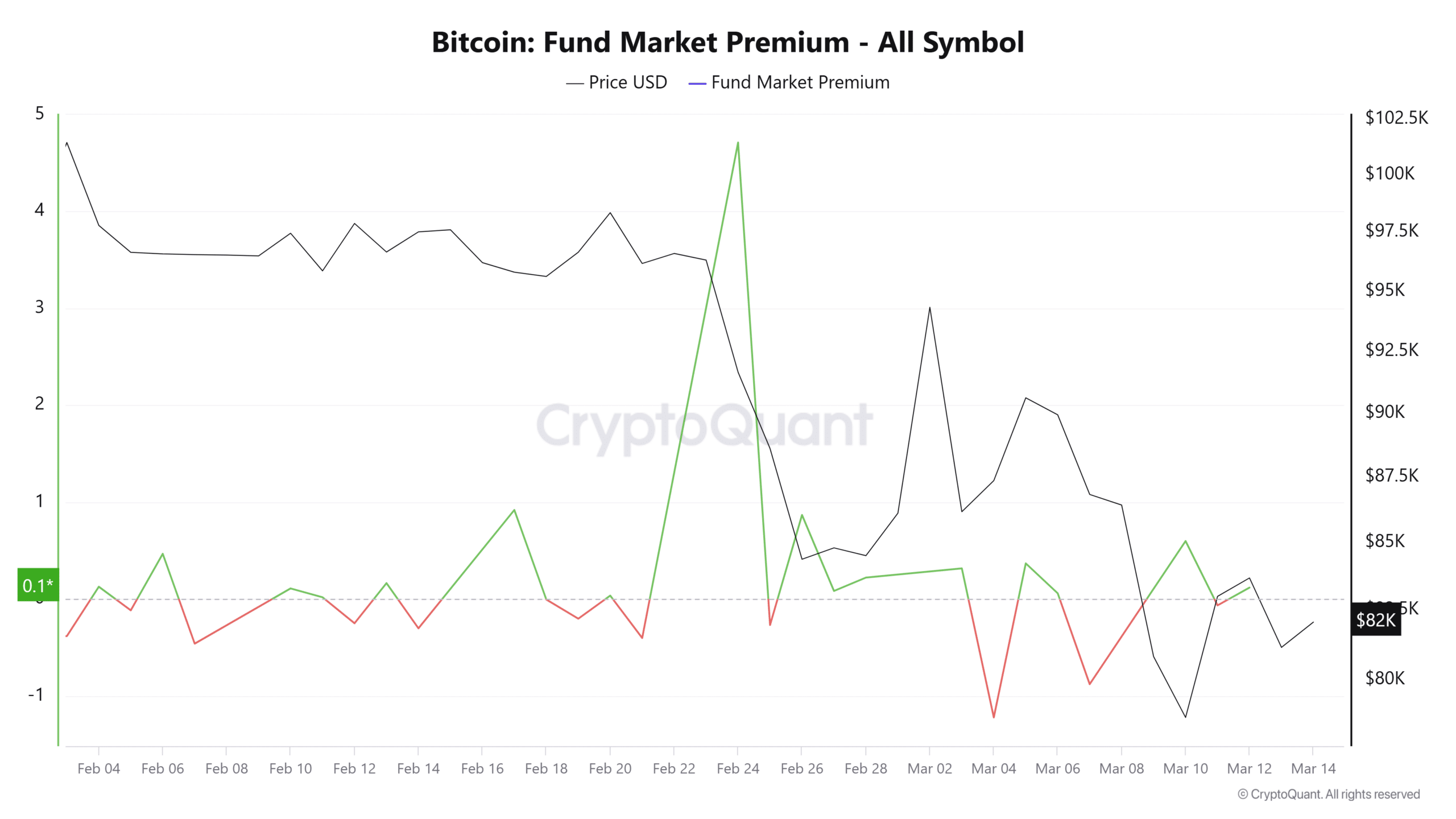

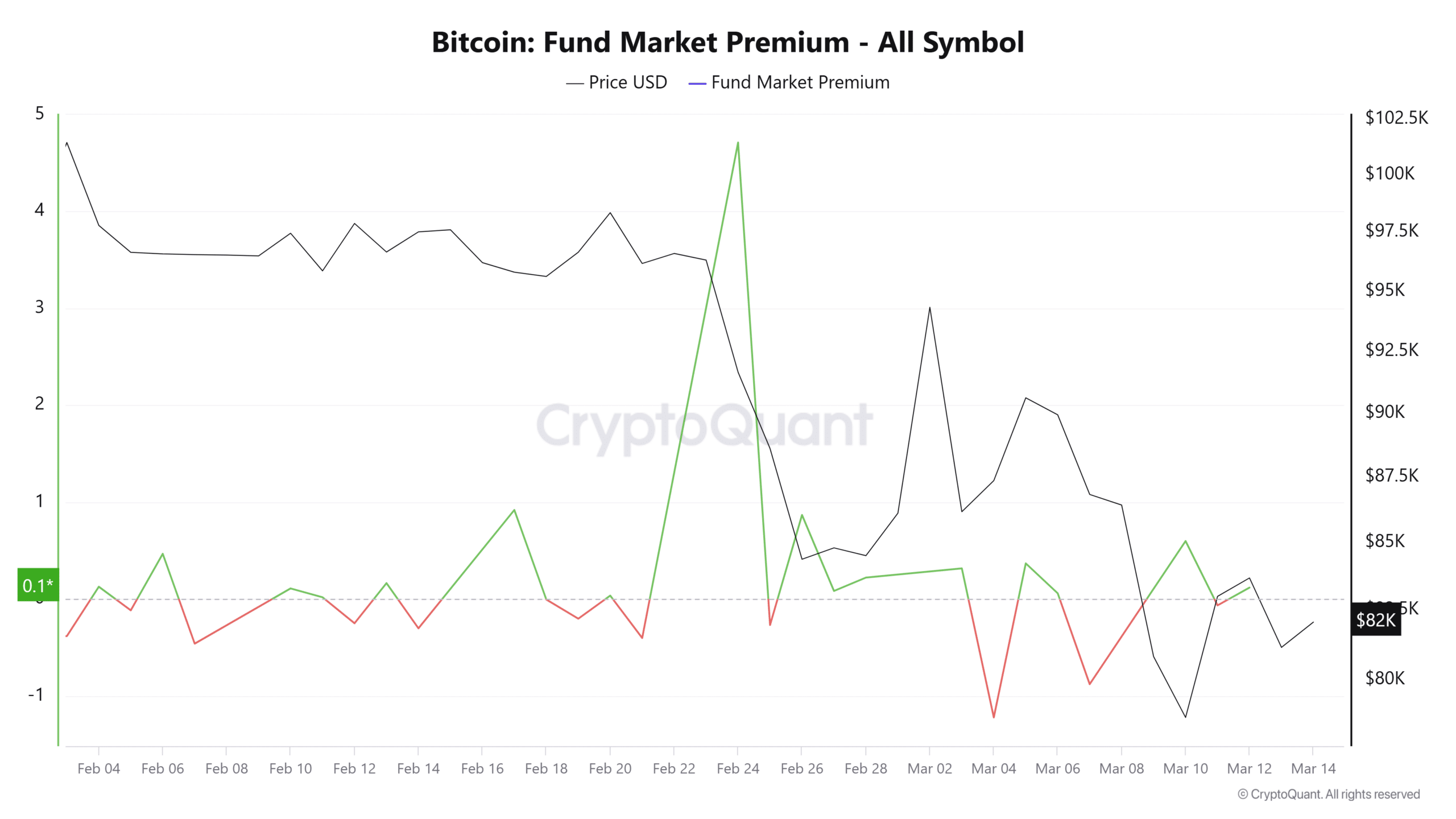

Negative Netflows mean that traders buy an active one. Institutional investors seemed to share a similar sentiment because the market premium of the funds became positive. It had a lecture of 1.03, at the time of press.

Source: Cryptuquant

Here it is worth pointing out that the fund market premium measures the institutional demand and the supply for BTC.

A lecture above 1 indicates buying, while a negative lecture confirms the sale.

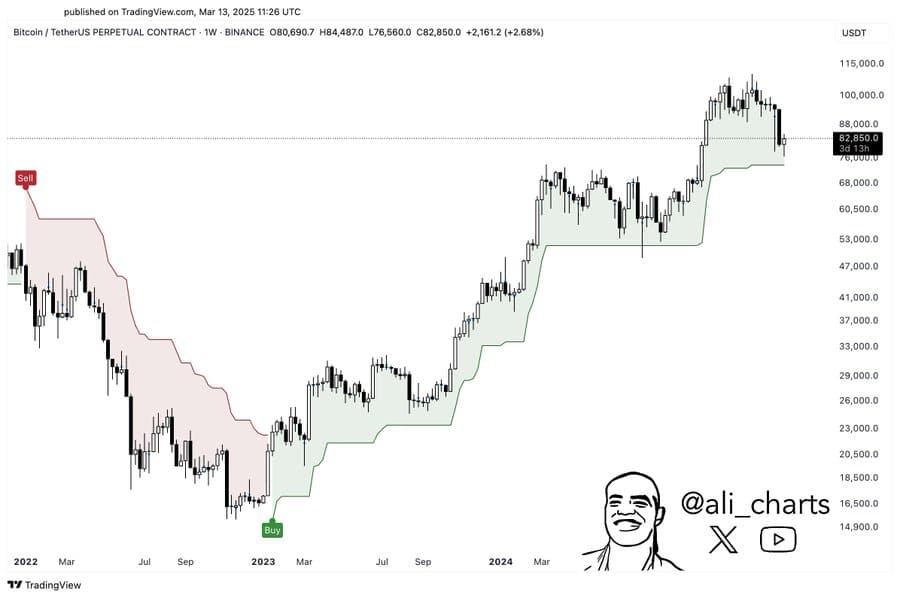

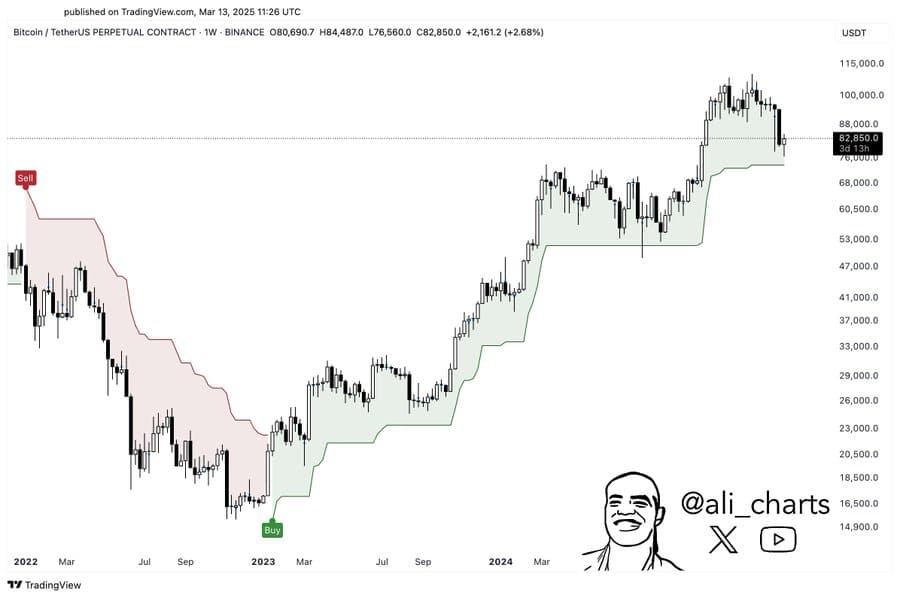

Weekly support remains a key factor

Although Bitcoin has regained the power in the market, by pointing a possible rally, the market sentiment could shift. If this happens, the following remarkable support level would be $ 74,000.

Source: TradingView

This level of support has been laid down since January 2023 and is a basis for markettrallies. If the price responds positively and trends higher of this level, this can indicate an important Bitcoin rally. However, a violation of this support may indicate a high bearish sentiment, which leads to further price decreases.

For now, the market remains well positioned for a revival, provided that bullish sentiment continues to dominate.

![Bitcoin [BTC] Accumulation rises as ETF Cool outlines – is there a breakout?](https://bitcoinplatform.com/wp-content/uploads/2025/03/Abdul_Bitcoin-1000x600.webp)