- Toncoin’s Price Inslump left 96% of holders in the red, which expresses concern about investor sentiment and market stability

- Chain statistics revealed falling activity and profitability

The Cryptocurrency market has recently seen a considerable part of turbulence, and Toncoin [TON] Holders feel his weight.

According to data from IntotheblockAbout 96% of the Ton holders are currently loss, which emphasizes the severity of the decline. While the price continues to float near its recent lows, the market sentiment remains grim, where traders wonder whether a recovery on the horizon is or not.

96% of the ton holders are under water

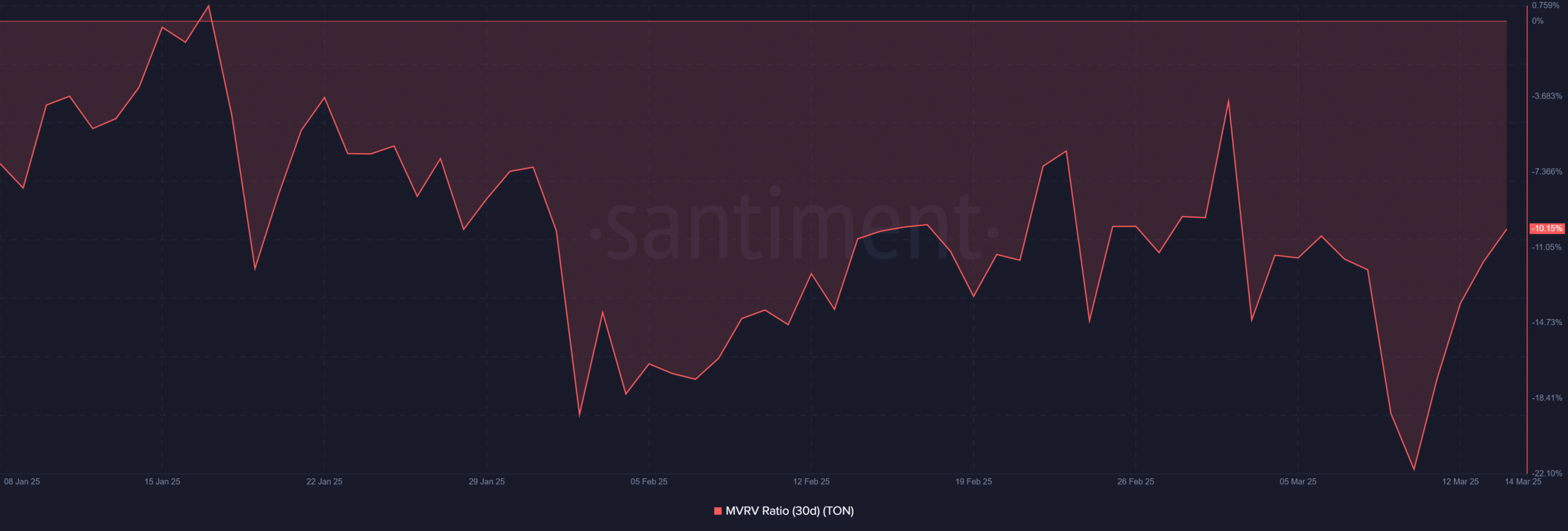

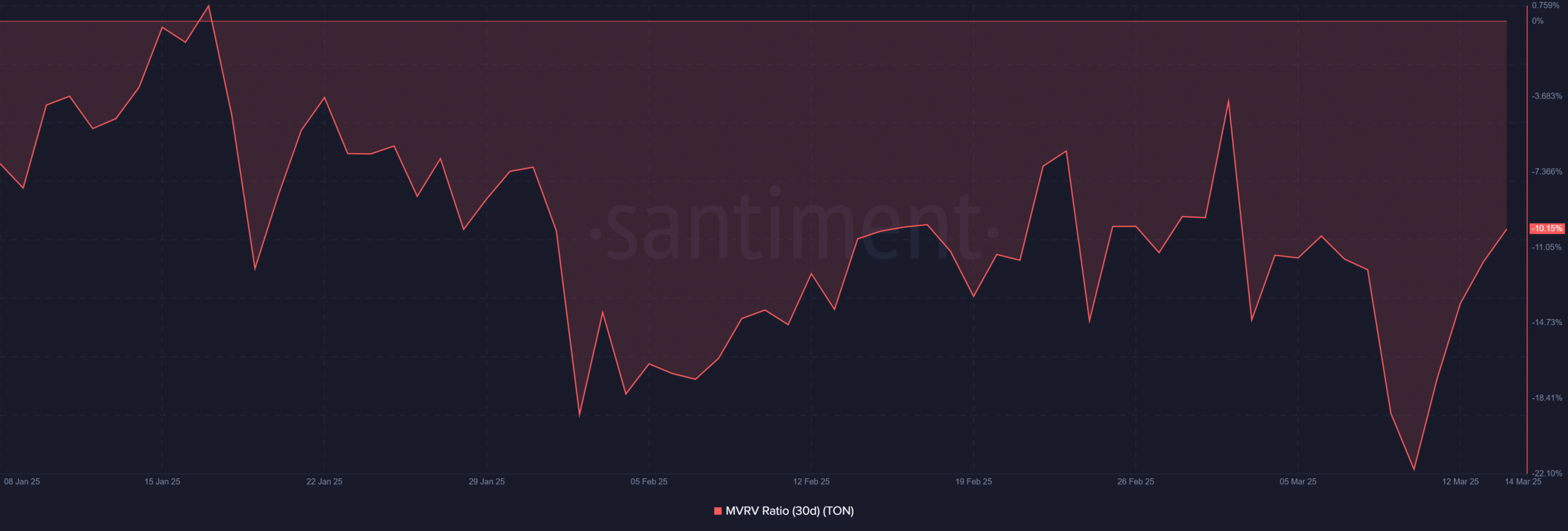

A deep dive in Data on chains revealed that almost all Toncoin investors are now in a losing position. In fact, at the time of writing, the MVRV [Market Value to Realized Value] Ratio, which does not follow -realized profits and losses, indicated that Ton has been in a negative area for a longer period of time.

The MVRV 30 -day relationship had a lecture of -10.15%, which confirms that most holders may keep assets with losses.

Source: Santiment

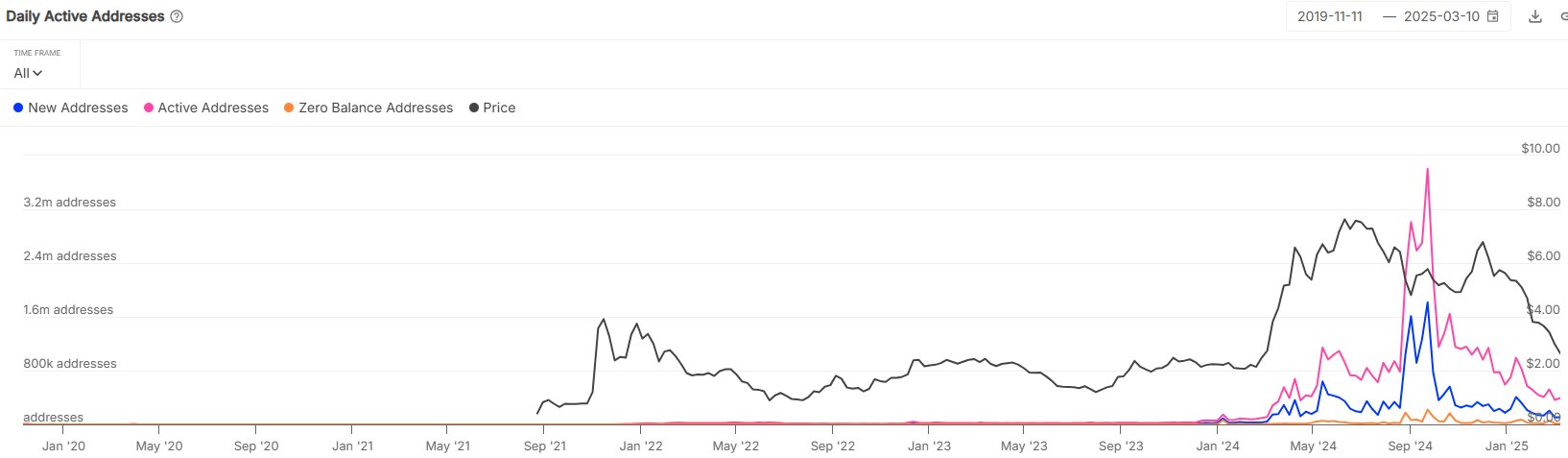

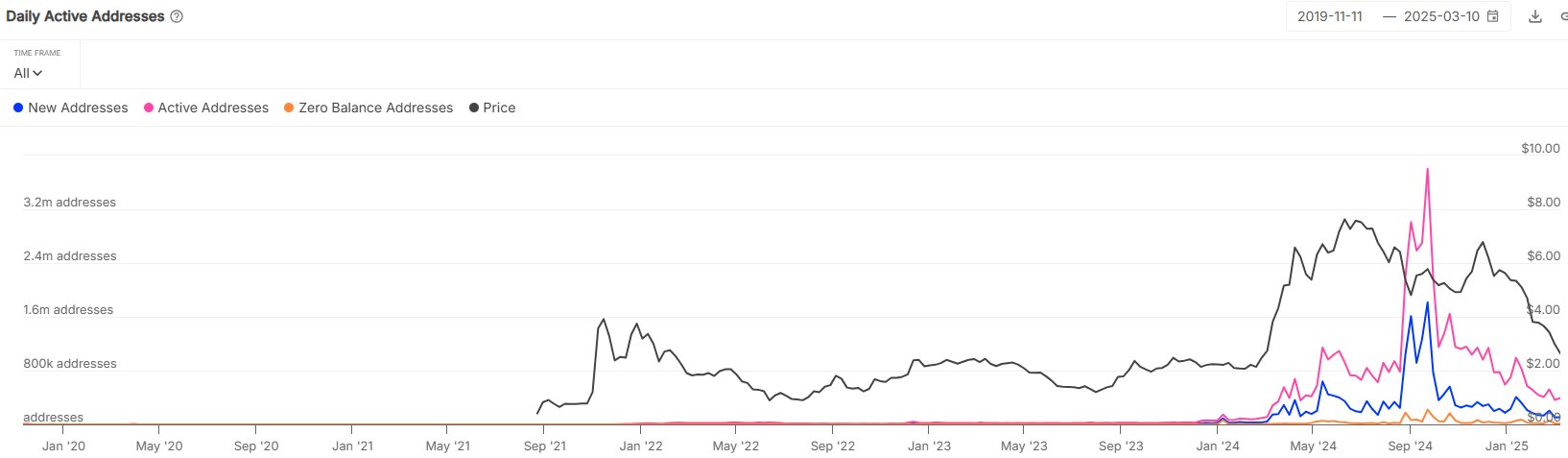

This decline was further proven by the daily active address graph, where a sharp decrease in user activity seemed to be aligned with the price decline.

With new addresses that blink weak growth, investors’ confidence can also decrease.

Source: Intotheblock

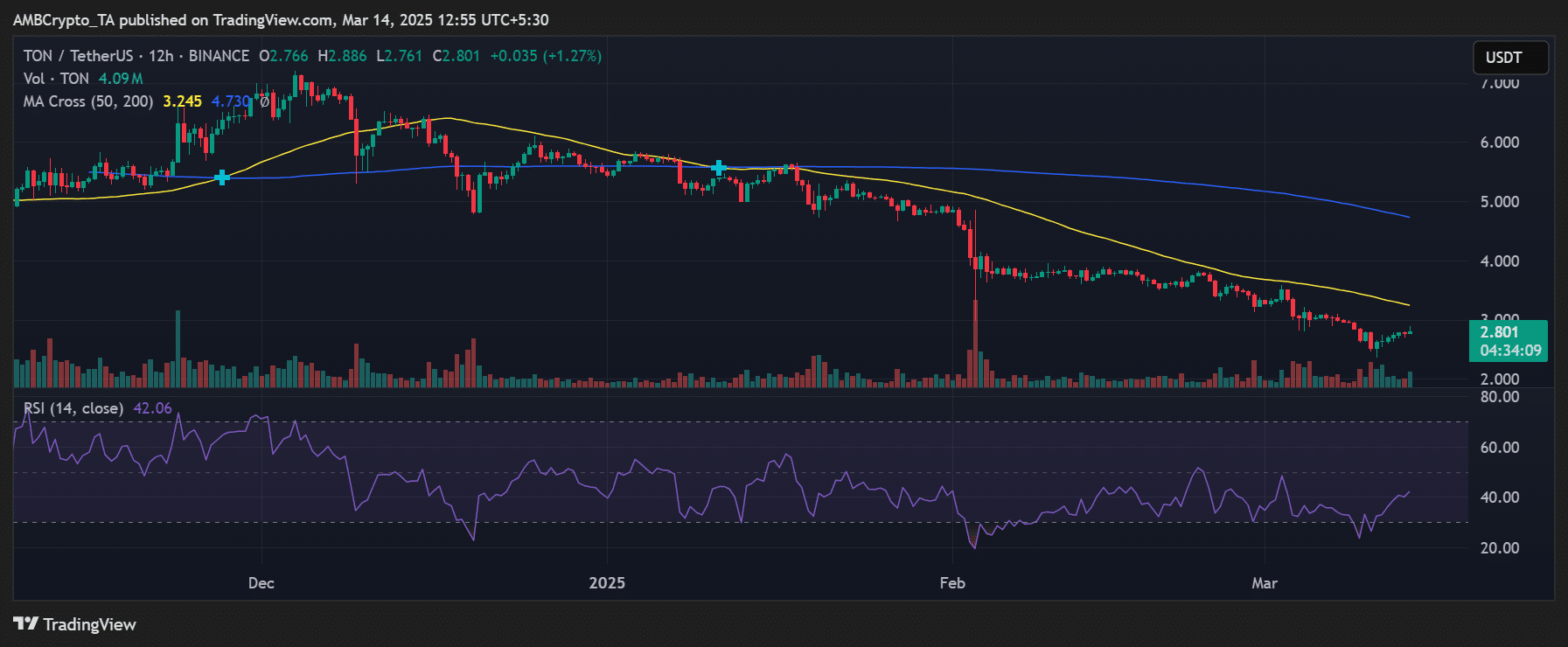

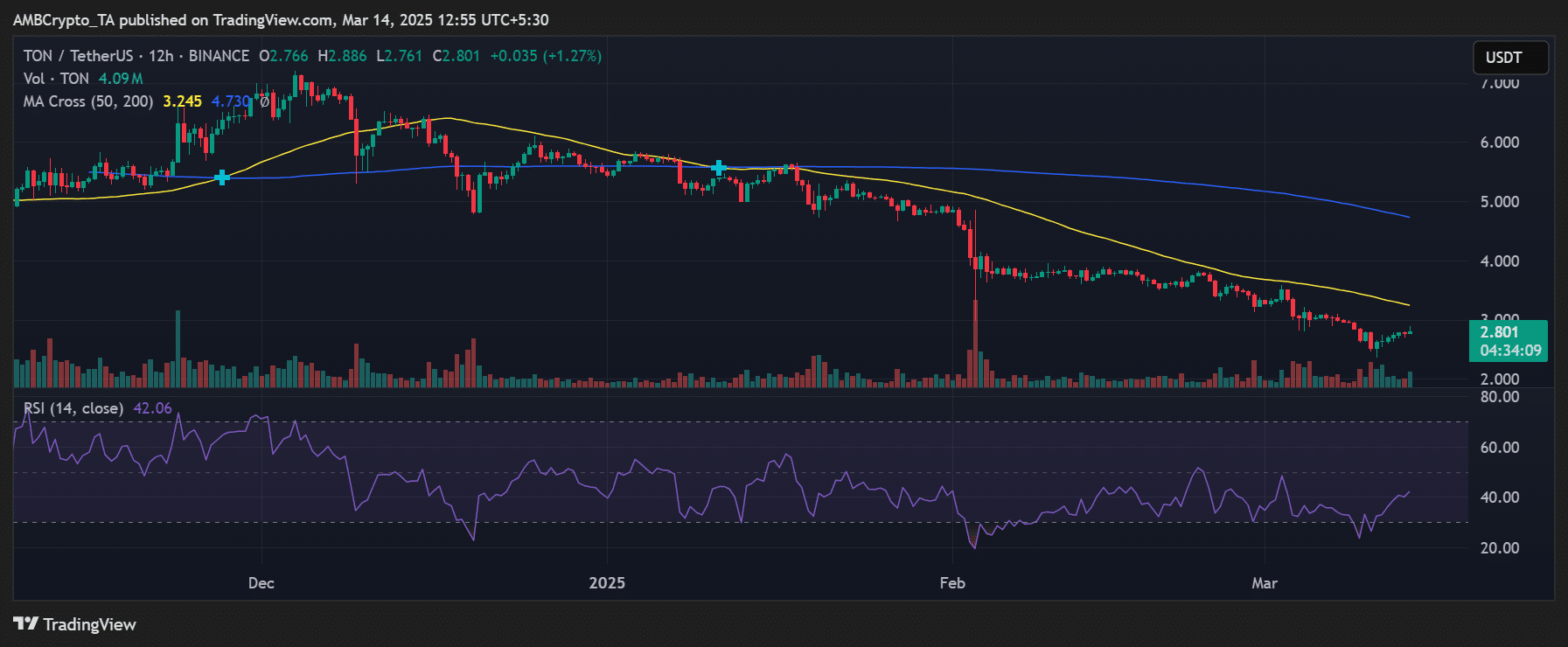

Price performance and important resistance levels

The price of Toncoin is a long -term downward trend and struggled to reclaim his previous highlights.

At the time of the press it was traded at $ 2.80, because it was confronted with consistent rejection at the resistance level of $ 3.24 consistant with the 50-day advancing average. A failure to break above this level could see the price of Ton further, testing the $ 2.50 support zone.

Source: TradingView

Despite the bearish front views, technical indicators hinted that a potential relief bounced into the charts.

The RSI [Relative Strength Index] Was on 42.06, which shows that Ton can approach over -sold circumstances. When buyers withdraw, a short-term rebound can push the price to the range of $ 3.00 $ 3.25 before another possible decrease.

What is the next step for Toncoin?

Toncoin’s recovery will depend on a shift in market sentiment and renewed demand. The lack of bullish momentum, combined with low MVRV measurements, suggested that accumulation is still underway. If Toncoin recovers important support levels and witnesses an increase in active addresses, this can free up the way for a more expensive recovery.

For now, investors must remain careful because Ton continues to act in a weak structure. With almost all holders under water, the sales pressure could be maintained, unless a strong catalyst must demand the demand for the market.