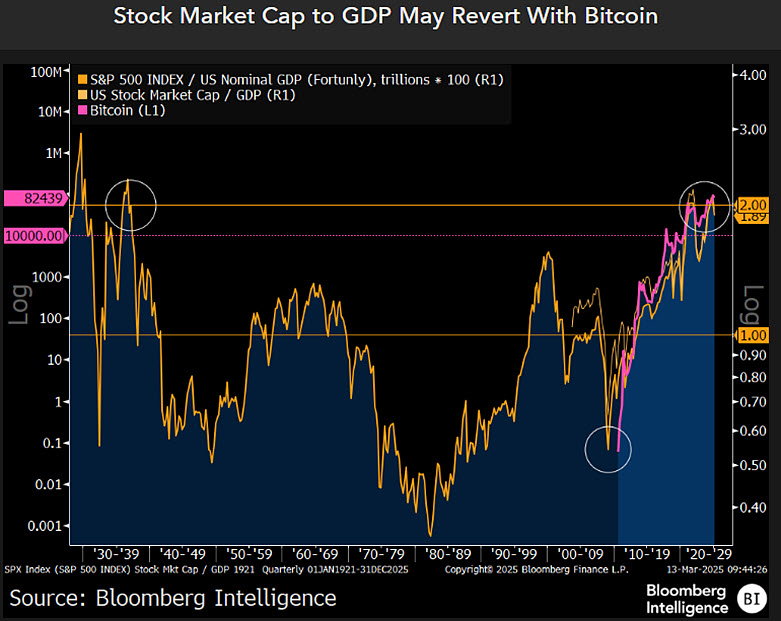

Senior Bloomberg analyst Mike McGlone warns investors that Bitcoin (BTC) could almost 90% crater of the current price due to the conditions of the gold and stock markets.

In a new thread on the social media platform X, McGlone tells His 66,900 followers that the best crypto assets from Market Cap can fall to just $ 10,000, because traders bury a lot for it.

“$ 100,000 Bitcoin can lose a zero, in favor of Gold-Bitcoin was born around when the stock market was Bottom in 2009 and was a leader of one of the greatest risk-asset rallies in history, which can suggest what is important.”

According to McGlone, there is currently nothing Stop The downward process of BTC, because gold has surpassed the Digital Activum flagship so far in 2025.

“Bitcoin back to $ 10,000? Peak lever risks, rising gold. Gold is approximately the same amount in 2025 to March 13 – about 15% – that Bitcoin is falling. But with Bitcoin for around $ 80,000, what does those processes stop? About a decrease of 6% in the S&P 500 can suggest what is important.

The largest exhibition -related fund (ETF) launch in history, the shift of President Donald Trump to very volatile and speculative cryptos, and re -election could prove peak bubble that was related about 25 years ago. “

Bitcoin acts for $ 84,899 at the time of writing, a fractional increase in the day. A fall in the level of McGlone would represent approximately a decrease of 88% for the crypto king.

The analyst continues remark That investors shift their appetite from BTC to gold is clear when viewing ETF data.

“Bitcoin/Gold Cross may have reached a peak, with implications – after four years of outsource, Gold ETFs certainly changed on the inflow in 2025, which can indicate a shift in risky appetite.”

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Featured image: Shutterstock/Jorm S