- FTX Unstaked and has released another $ 22.9 million Sol to different addresses.

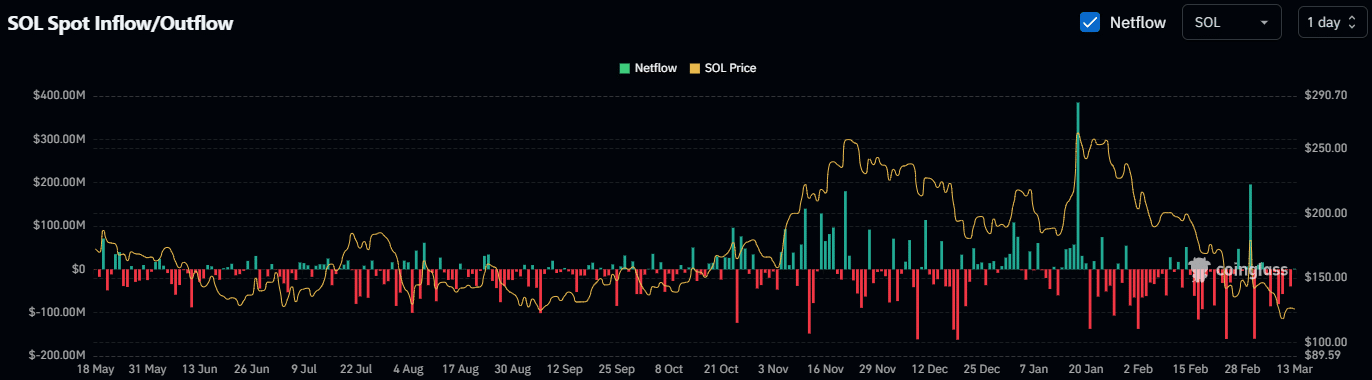

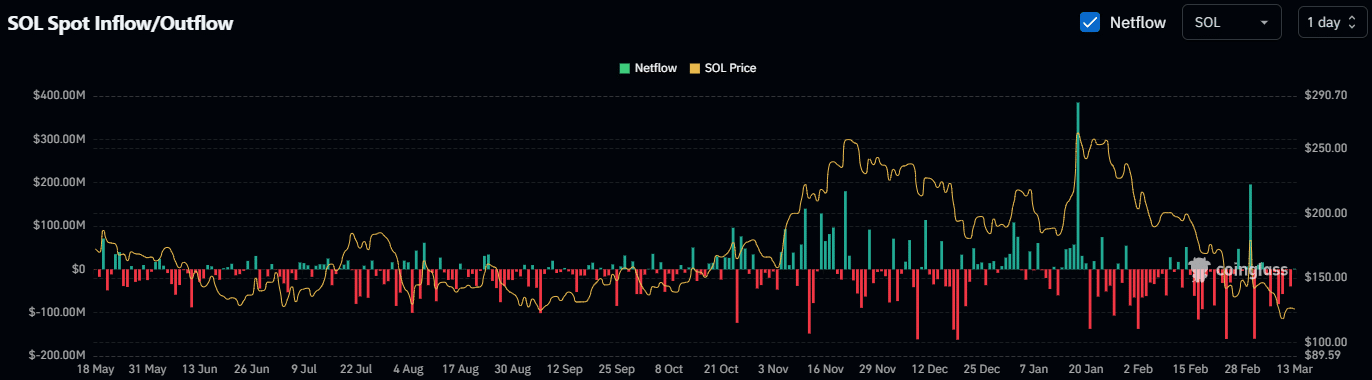

- So far, Sol has seen around $ 400 million in March of flowing by CoingLass data.

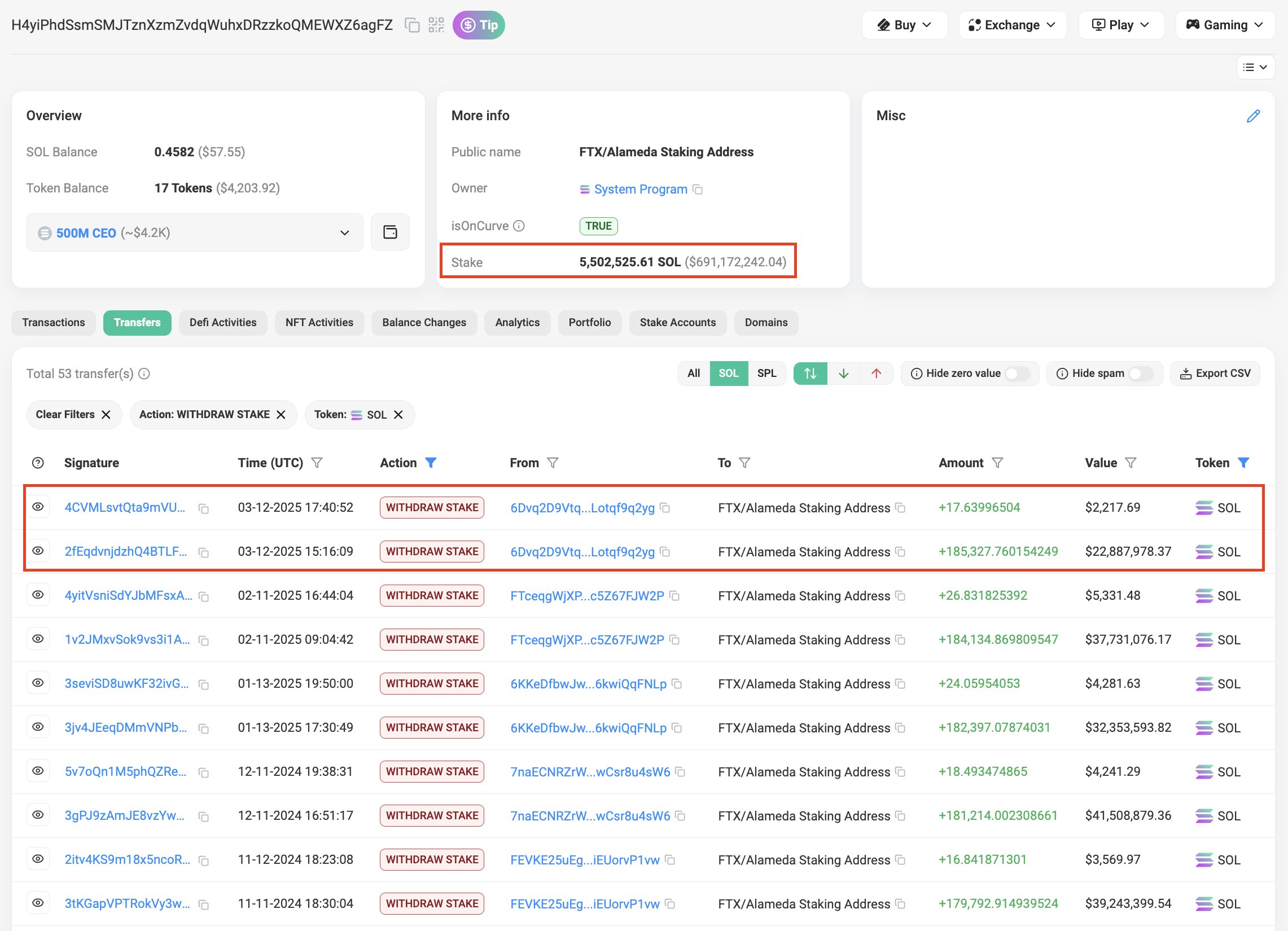

FTX/Alameda has discharged another 185,345 Solana [SOL] ($ 22.9 million) Tranche, increasing the sale of fears.

According to Blockchain Analytics platform PrickThe exchanged exchange moved the SOL to 38 portfolios for distribution, which is part of the monthly unloading.

Source: Place on chain

The bankrupt exchange still had 5.5 million SOL (worth $ 696 million). Since November 2023, the company has unloaded around $ 1 billion from SOL, added the place to the chain.

On March 4, ftx did not stand and unloaded More than 3m SOL ($ 432 million), probably part of the planned 11.2 m SOL discharge.

Although SOL in the unlocking at the end of February and fell to $ 125, the CME Solana Futures announcement has raised the Altcoin to $ 180 at that time.

Sol on the edge

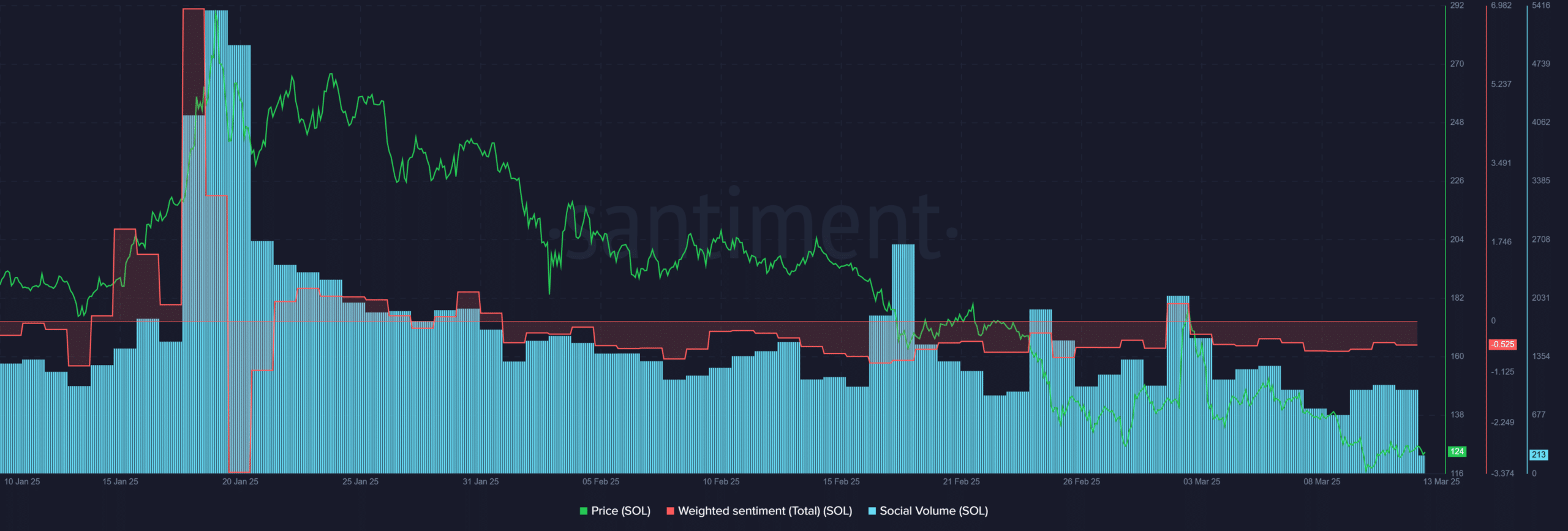

Since the liquidity of Trump Memecoin in mid -January, Altcoin’s market feeling has not been strongly positive.

After the CME Futures update, Sol’s sentiment became short positive, but remained negative afterwards. Social volume, which follows online market interest, was also filled in in Q1 2025.

Source: Santiment

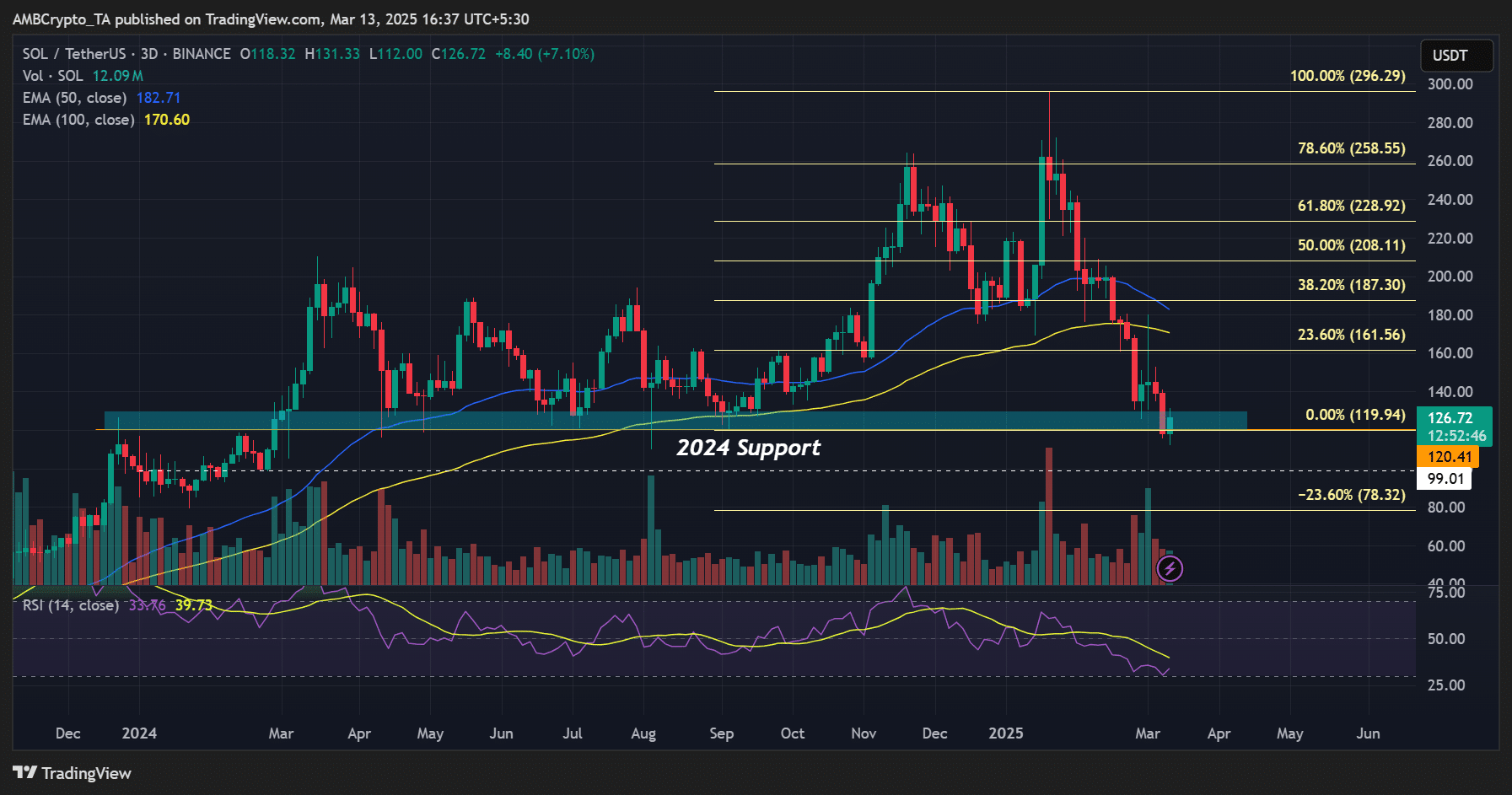

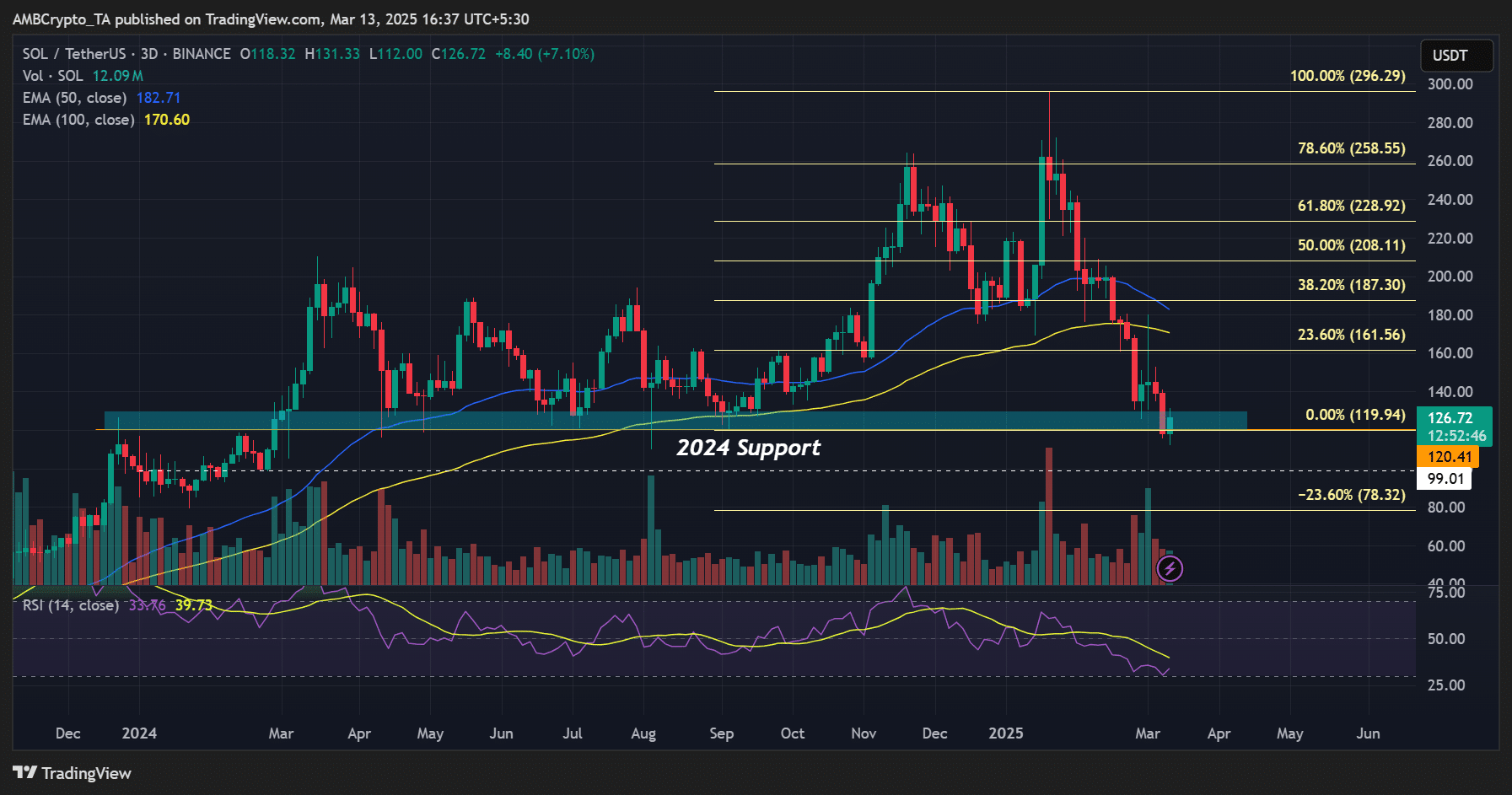

At the time of writing, Sol was appreciated at $ 127, with 57% a decrease in a record high of $ 295. In combination with the negative sentiment, it can be less attractive for short-term traders, especially with macro-uncertainty.

However, the Altcoin can be undervalued for long -term investors and a great purchase at the current level.

In fact a lookonchain report noted That a recently made wallet has created $ 25 million Sol from Binance, much more than the non -stake amount of the FTX.

However, the overall trend among investors was a risk-off approach. This week, SOL has left almost $ 100 million per Coinglass data.

In the $ 319 million unlocking period from SOL markets, which reinforced a bearish sentiment was strengthened in the $ 319 million last week.

Source: Coinglass

Although the outflows have been subsidized, SOL would need a huge demand to reverse losses of 57%.

From a price diagram perspective, the current levels would be a purchase if the support level of $ 120 and crucial 2024 is strongly defended.

Source: SOL/USDT, TradingView

However, the second and relatively safer mention for a SOL-Long position would be if the price resident the progressive averages, especially for short-term traders.

On the other hand, a crack under $ 120 support Sol would drag to $ 100.