- ADA -Price forecast looks Bullish after he has recovered all the profit it achieved after the announcement of the strategic reserve.

- The obstacles overhead were considerable and the sentiment on the market meant that buyers were reluctant to come in.

Cardano [ADA] Saw a price win of 17.8% in the last 36 hours.

Speculation that Gemini could mention Cardano at their fair, combined with the US Crypto Strategic Reserve News from earlier this month, the investor sentiment could have changed in the past two days.

Although the co-founder of Gemini did not think Cardano was a suitable asset to the strategic reserve, he did not play the list of mention.

Combined with a retest of the strong support of 3 months, can Ada be set for a bullish reversal?

Cardano’s fast profits can be stopped at …

Source: Ada/USDT on TradingView

Cardano’s rigging In the last 48 hours, it was probably due to the retest of the range of 3 months at $ 0.68. However, the volatility after the announcement of the strategic reserve meant that the buyers were at a disadvantage.

The price could not defend the $ 0.8 level. It had been a bearish order block, but acted as a bullish breaker block for a short time. The descent under $ 0.8 has put the bulls on the rear foot and fights uphill.

The great Oscillator showed that the momentum has been shifted visibly.

The structure on the daily graph was bearish, but the reach -based character in recent months meant that it was better to pay attention to the levels than the structure.

The reach of 75% at $ 0.8 coincided from February with the Bearish order block and marked it as the nearest and strongest resistance zone.

The CMF was at -0.01 and showed no significant capital flows in or out of the market.

Ada -Price forecast

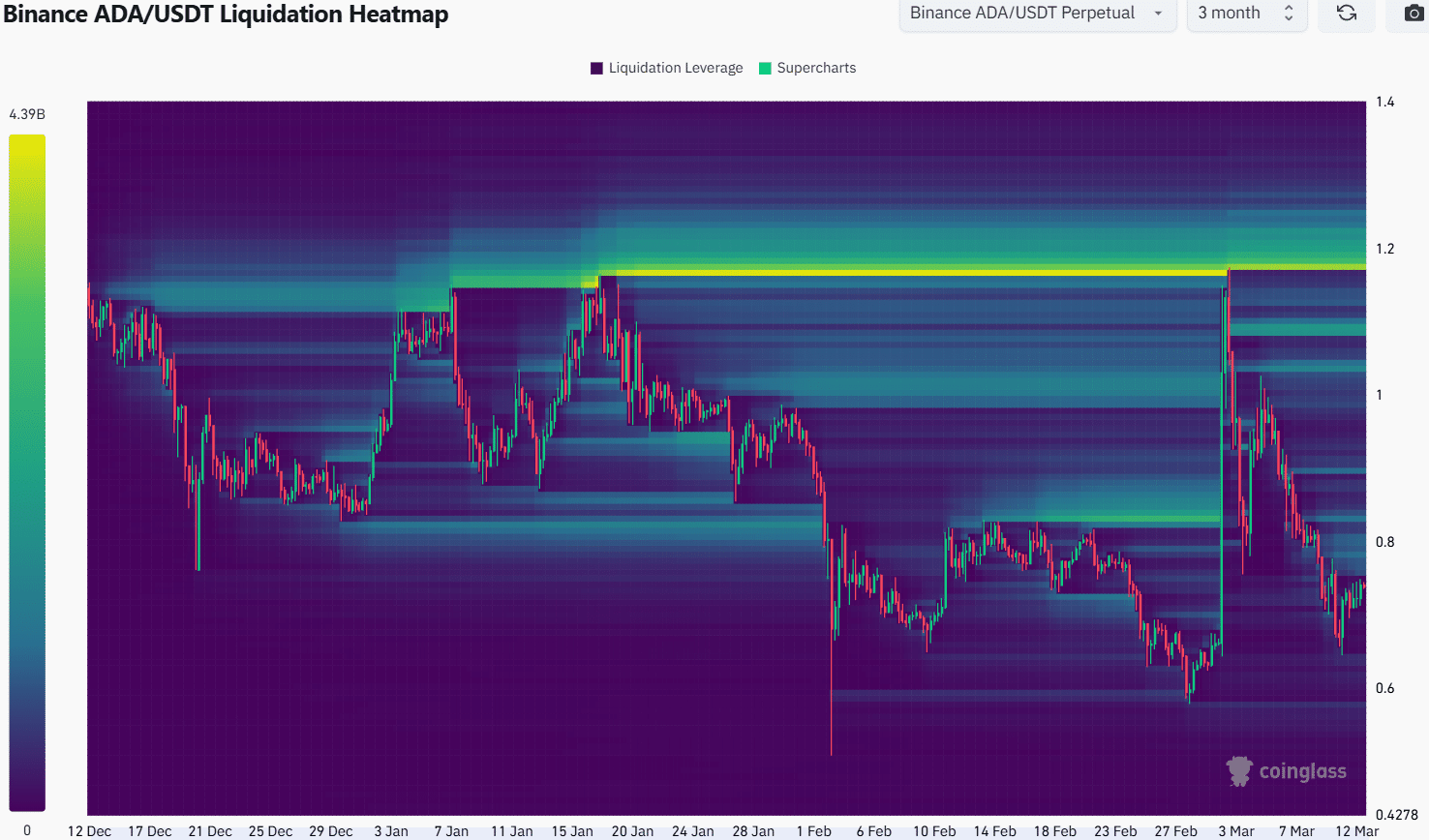

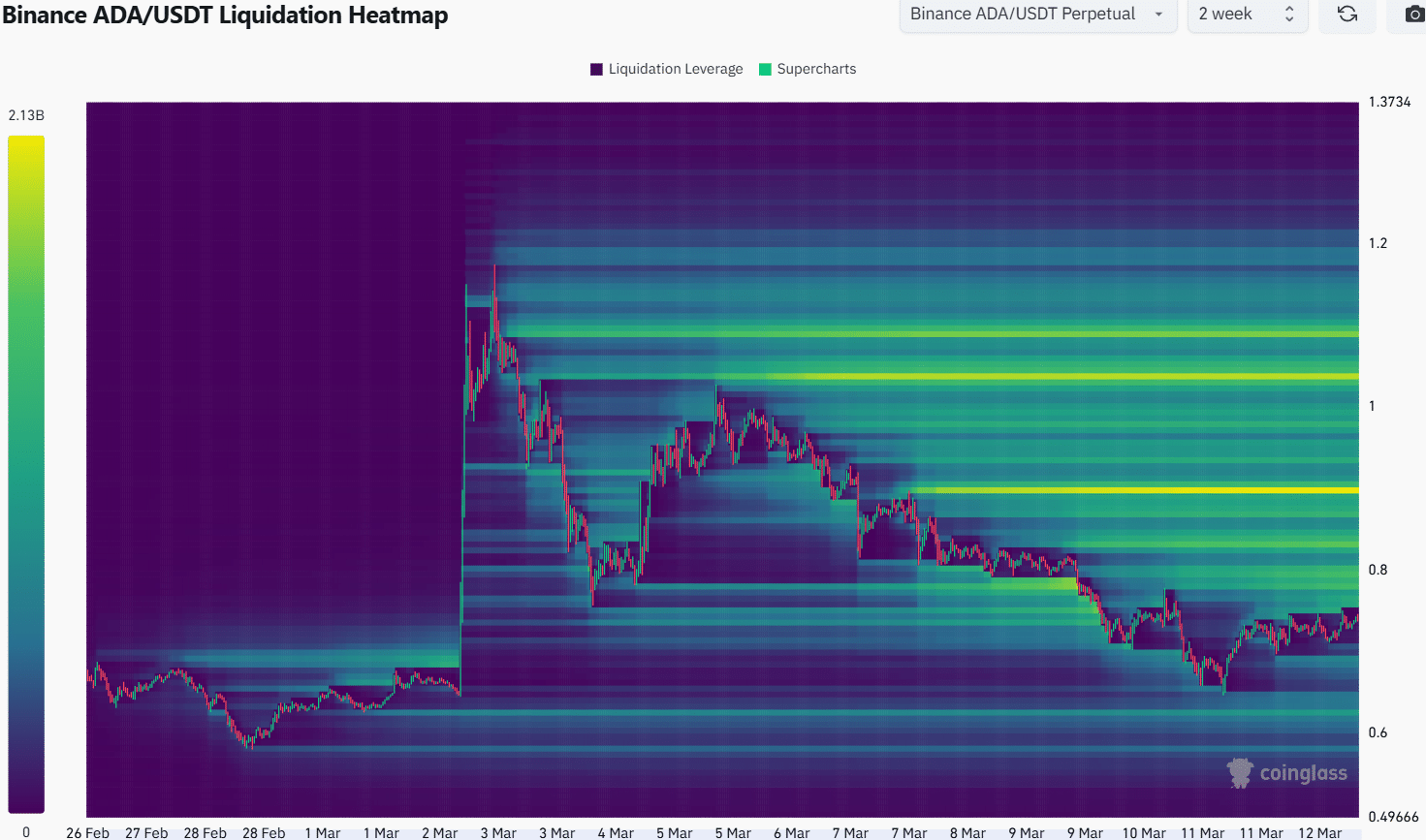

The 3 -month liquidation heat showed that the most important liquidity cluster to pay attention to $ 1.17 was. The levels of $ 0.634, $ 0.8 and $ 0.83 were also lower periods for the timetable to view.

The heat of 2 weeks showed that this was indeed the case. The way North was filled with liquidation levels, which means that ADA prices will be attracted to the north, possibly as high as $ 1.

However, this upward attraction was contrasted with a lack of purchasing pressure on the spot market and a market -wide Bearish bias.

In particular, the $ 0.9 was a promising bearish zone. It looked good in line with the middle range level at $ 0.907.

That is why traders can wait for Cardano from $ 0.8 to understand if they should try to conquer a jump to $ 0.9. Similarly, a movement above $ 0.9 $ 1.03 and $ 1.09 could revise.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer