Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

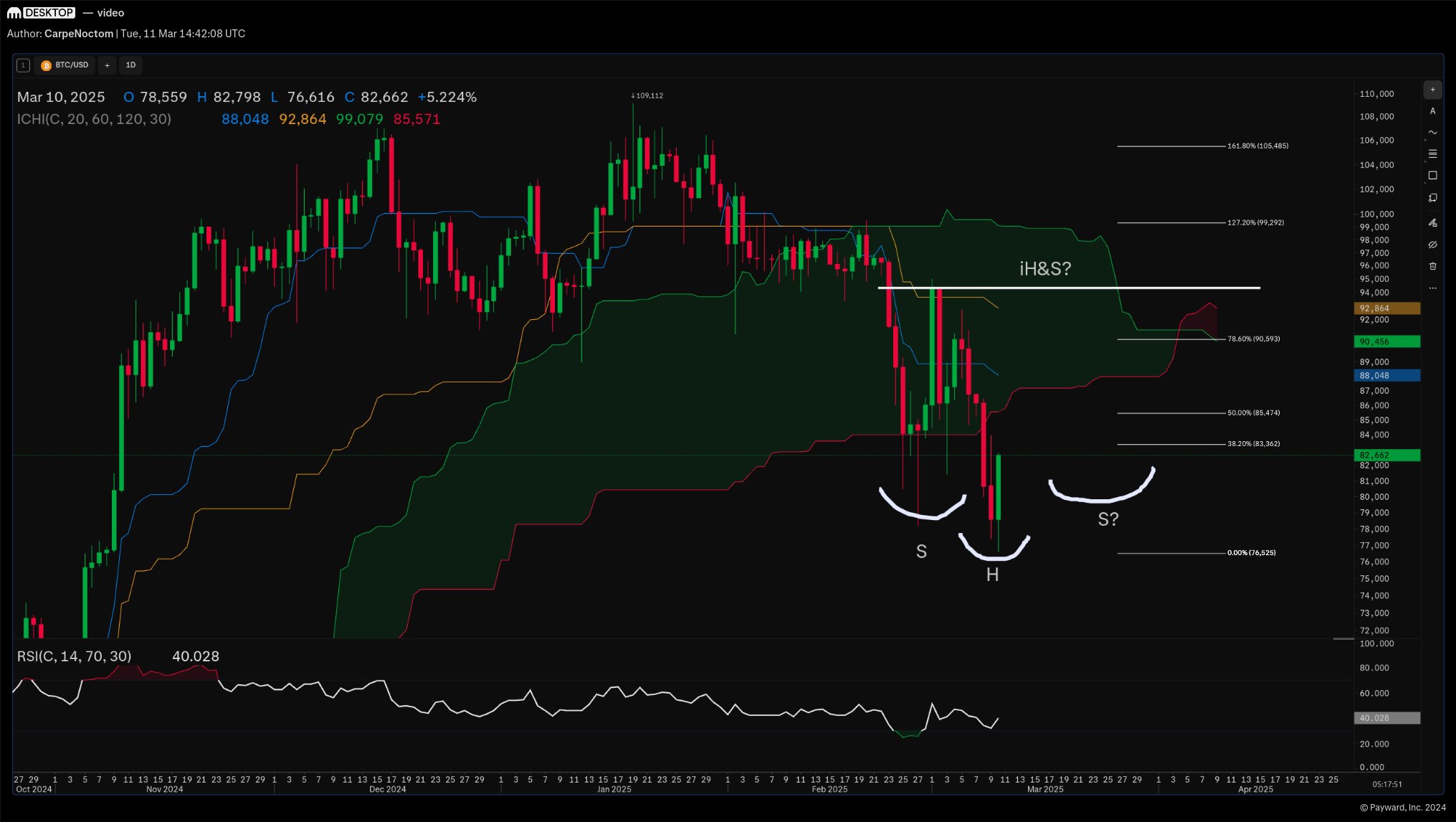

Bitcoin (BTC) stays on a critical point and keeps above his annual rotary level. In his last market analysis, seasoned crypto trader Josh Olszewicz outlined important technical factors that could determine Bitcoin’s next step in his last video Analysis, the emphasis on the importance of RSI abnormalities, volume trends and candlestick formations.

With BTC who has experienced heavy downward pressure in recent weeks, Olszewicz investigated whether the market has reached an exhaustion point for sellers or that will probably remain downwards.

Is the Bitcoin below?

A crucial observation in the analysis of Olszewicz is the presence of bullish divergence on both RSI and volume, a pattern that historically indicates a potential trend domination. He noted: “BTC is currently stuck on the annual Pivot, it is holding on the OG Pitchfork here and we have applied a bullish divergence to both RSI and volume. We have a lower low price, higher layer in RSI at a lower volume. “

Related lecture

This setup reflects similar circumstances observed in August and September, where Bitcoin saw relatively equal lows in price, but RSI was considerably higher lows. Although this does not guarantee a imminent reversal, Olszewicz pointed out that it increases the chance of a potential upward movement, especially if further confirmations occur.

From a candlestick perspective, the price action of Bitcoin shows early signs of potential stabilization. Olszewicz emphasized the meaning of Dragonfly Doji formations, in particular in combination with bullish flooding candles, which often indicate the depletion of the seller and trend remarks.

“What I would like to see in many of these graphs is what we already see every day – a green dragonfly candlestick. It is a small body with a long wick that demonstrates a clear rejection of lower prices. If confirmed, this can be an early soil signal. “

However, he warned that although these patterns can be an indication of a shift in market sentiment, they are not watertight and require extra confirmation of the price structure and momentum indicators. In addition, Olszewicz added Via X: “BTC IHS Brewing? Far too early to definitively call this, but we have the early attributes of a bottom of several weeks. Would join a potential Kumo outbreak in Q2 and measure for an ATH test. Something to check in March, a new LL would probably destroy this possibility. “

Olszewicz advised traders to stay disciplined and to prevent over-delivery positions in volatile circumstances. He emphasized the importance of maintaining a consistent strategy for trade scope and avoiding emotional decision -making. ‘You don’t have to bring it all back to one box. You don’t have to take revenge. Trust drops in times of chaos, and that is when most people make mistakes. “

Related lecture

He also warned of blind dollar costs average in assets, simply because they seem to be heavily discounted: “Only because there is something that falls 80% does not mean that it is an automatic purchase. It might look great today, but that doesn’t mean it doesn’t stay lower. That is why risk management is the key. “

Although the wider macro -economic landscape remains uncertain – with continuous tariff problems and mixed signals of traditional markets – the technical positioning of Bitcoin suggests that a potential auxiliary prally could arise in the coming months.

Olszewicz suggested that March and April could be crucial periods for Bitcoin, where a clearer trend could develop. He repeated, however, that traders would have to concentrate on setups with a high probability instead of speculative plays. “If BTC can stabilize here and recover the most important levels, reinforces the case for a stronger recovery in Q2. But it’s too early to make that call. At the moment the best strategy can be just to wait for setups with great confidence. “

At the time of the press, BTC traded at $ 81,599.

Featured image made with dall.e, graph of tradingview.com