- The falling whale activity and coin days destroyed (CDD) were both encouraging signs.

- There is a chance of a deeper correction, but the worst of the sale may be over.

Bitcoin [BTC] The prices fell to $ 76.6k on 11 March before he saw a bouncy. At the time of the pressure, the price was $ 82.8k, a bouncy case of 8.2% in just over 24 hours. The downward trend went strong, and whether this was the last dip was unclear.

Trying to catch falling knives is a meaningless exercise, and it is better to pick them up after they have hit the floor. However, the investors can help to understand how far the price of the floor is, and statistics can shed some light on this.

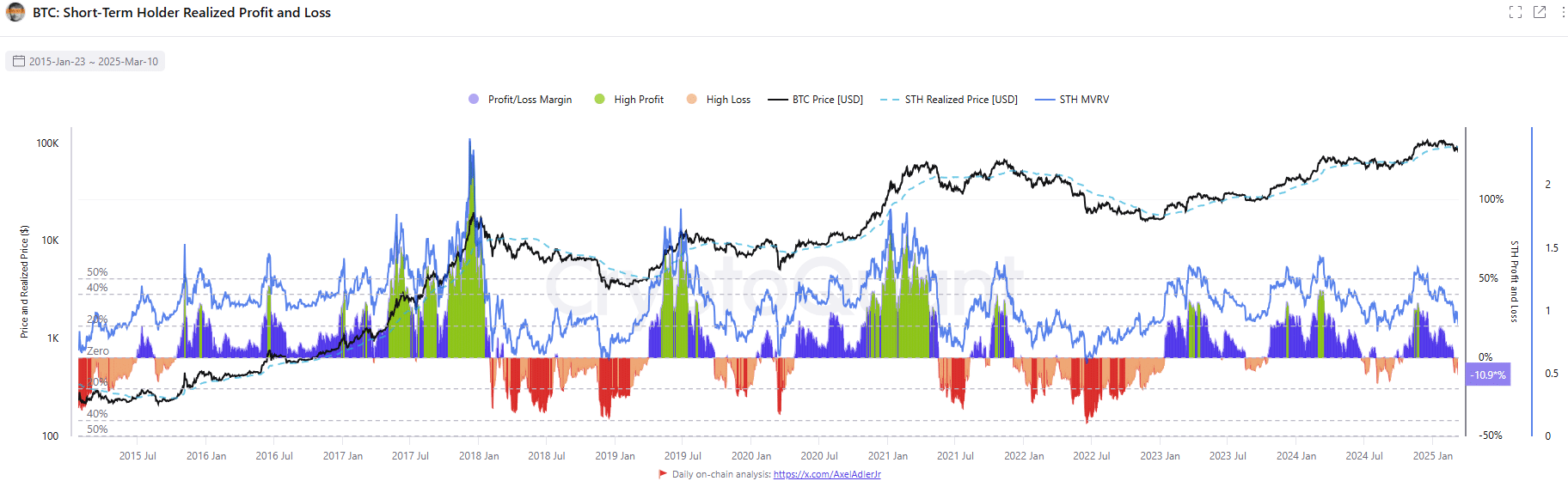

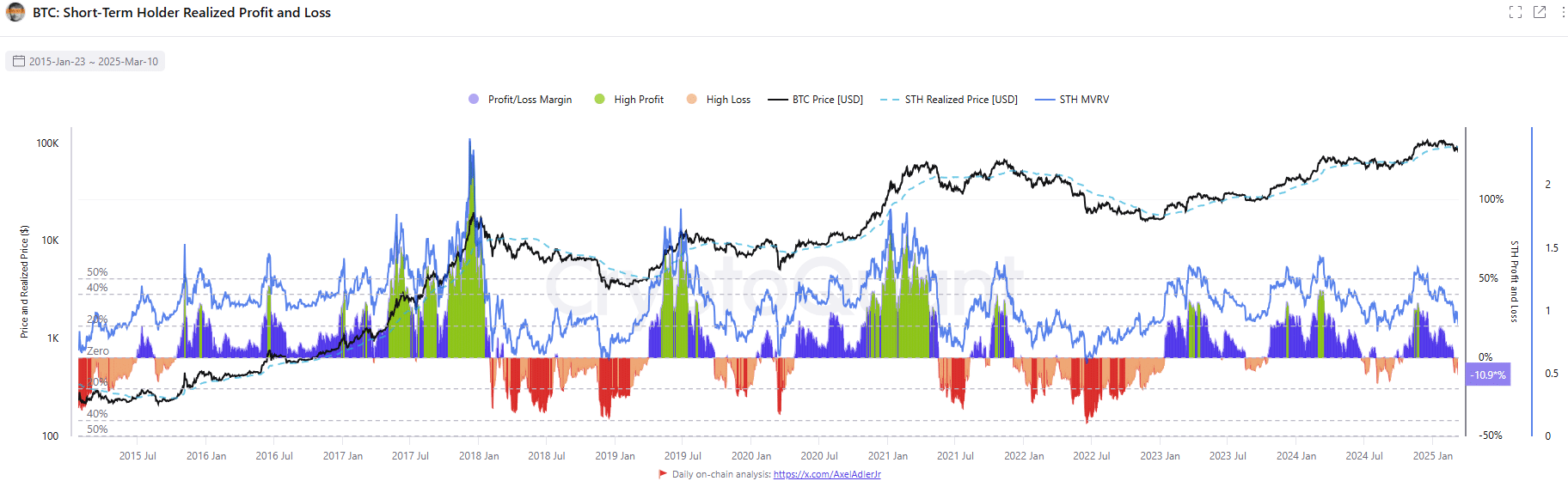

BTC loss in the short term comparable to the consolidation conditions

Source: Cryptuquant

The behavior of whales is a good insight into how BTC could then move, because these are the portfolios with the power to move the markets. In a post Cryptoquant insightsanalyst Darkfost It was noted that Binance, the largest crypto exchange per volume, saw a falling exchange -walfish ratio.

The exchange rate ratio follows the share of the top 10 inflow compared to the total intake on an exchange. A higher value indicates increased whale activity, which is usually indicated a greater sales pressure.

The metric had risen since November 2024. However, it has decreased in the past month and offers a glimmer of hope. Nevertheless, BTC remains 11% lower than the $ 92k series Less points that will be observed in January.

Source: Cryptuquant

The STH realized profit/loss ratio was at the time of -10.9%. This is in line with trends that are observed in June-August 2024 and August-October 2023, periods in which Bitcoin hit new two-month lows before he means a consolidation phase that lasts 2 to 3 months.

A similar pattern could unfold this time. Although further losses cannot be excluded, the worst may already be over. Consolidation on the support level of $ 72K In the next three months seems to be a realistic opportunity.

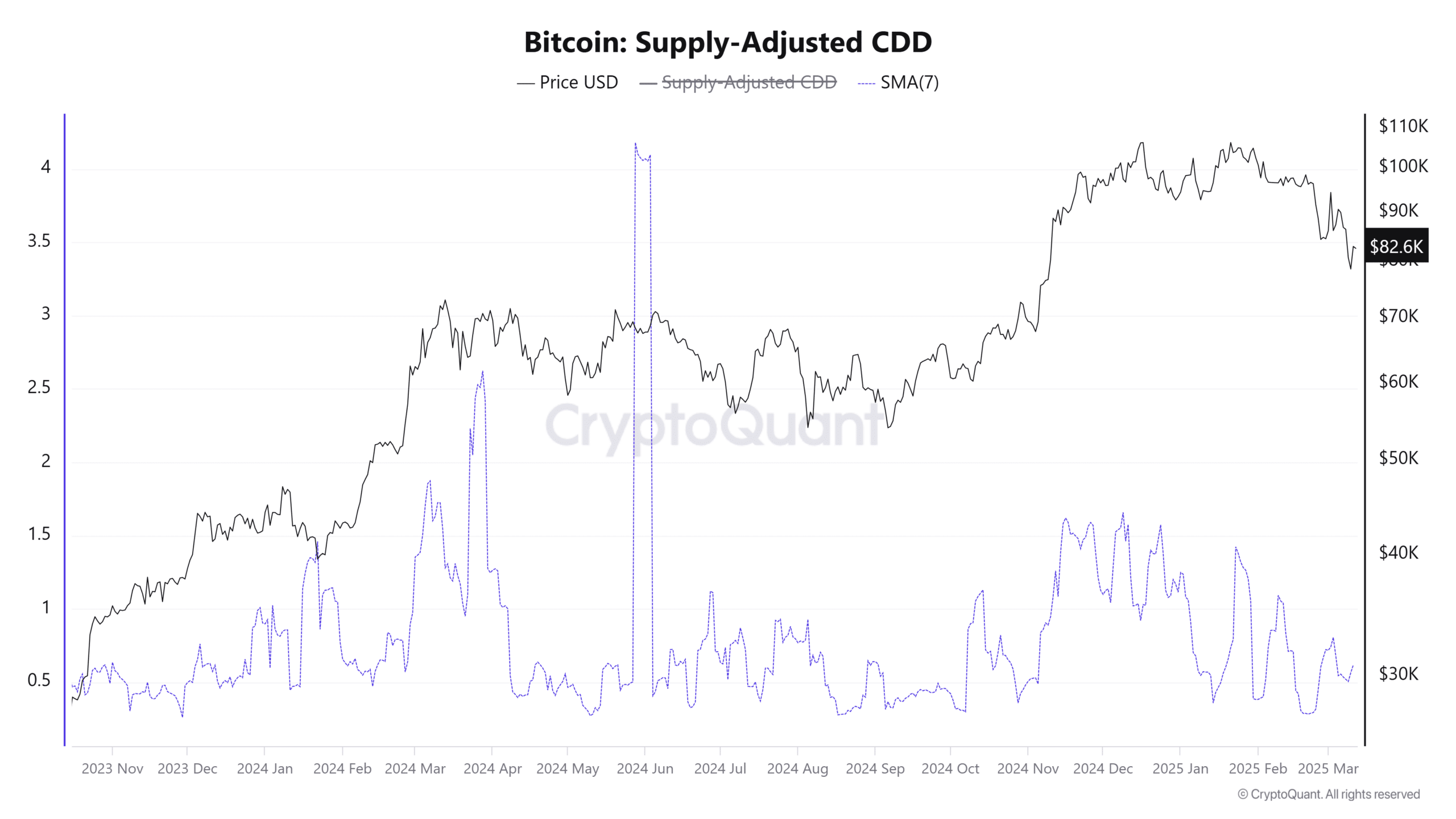

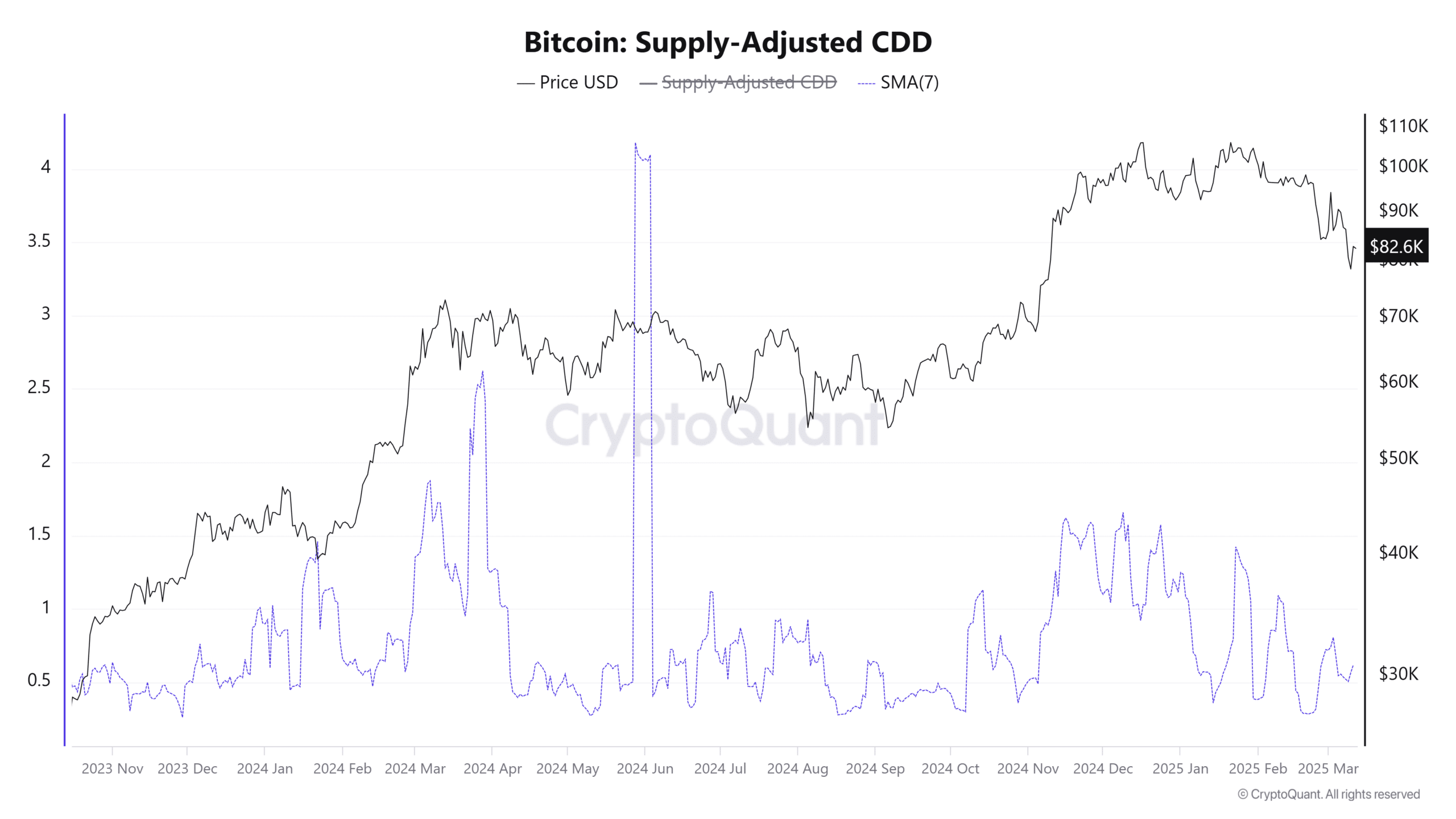

Source: Cryptuquant

The coin days corrected by offer (CDD) metriek is calculated by multiplying the number of coins by the days that they were last moved. Spikes in this metric mean that older coins are sold. To adjust the range, the original CDD is divided by Bitcoin’s circulating power supply.

Since December, the 7-day advancing average (7DMA) of this metric has consistently made lower highlights, indicating a decrease in sales activity and reduced movement between older tokens.

This is an encouraging sign, which suggests that accumulation can follow soon. Although sellers generally remain dominant, the most intense phases of sales seem to have elapsed.