- Bitcoin’s recent decrease of 22% can be made comparisons with previous cycle corrections in the past.

- This analysis investigates historical trends, market conditions and the potential next move of BTC.

Less than three months after Trump’s second term, market volatility has risen to unprecedented levels. Bitcoin [BTC] has fallen 22% of the $ 109k of all time high, comparable to corrections that are seen in the Bull Run 2016-17.

During that cycle, BTC delivered a return at 122.8%, but ended the Q1 with 4% compared to the opening price of $ 434.46. However, this year’s deeper decline increases to ask.

Is BTC the Q1 crash from 2018 (- 48%) reflected to $ 6,929, instead? Ambcrypto has investigated this possibility.

Macro parallels from 2018: Trade war and Bitcoin’s 72% crash

In 2018, Bitcoin closed the cycle with an annual decrease of 72%, with $ 3,740.50.

In particular, macro circumstances are very similar at the time to the landscape of today – Trump’s trade war with China and escalating rates. Against the center of the Q2 2018, inflation Strength to a highlight of two years of 2.9%.

In response, Bitcoin, who had risen to $ 9,826 in April, suffered a quarterly decrease of 40%.

Source: Bitbo

While Q2 unfolds, the crypto market is confronted with renewed macro pressure.

With $ 7 trillion on debts refinancing Investors change capital to safe port activa such as bonds-a trend confirmed by the 10-year-old Treasury proceeds (interest on bonds), which has fallen to a low point of two months.

Simply put, the bond market absorbs the liquidity and travels capital away from risk assets while the US government insures cheaper lend rates.

If this trend continues, Bitcoin and wider crypto markets can be confronted with an increased risk, which increases the chance of a crash in 2018.

Indicators on the BTC Capitulation Risk chain signal

According to the latest report from Glassnode, the market structure of Bitcoin has shifted from accumulation to distribution. In the meantime, the trend score of the accumulation remained almost 0.1, which has reflected a consistent sales pressure since January.

In addition, the Cost Basic Distribution (CBD) HeatMap shows a decrease in the “Buy-the-Dip” activity under $ 92k, which indicates a reduced demand for accumulation.

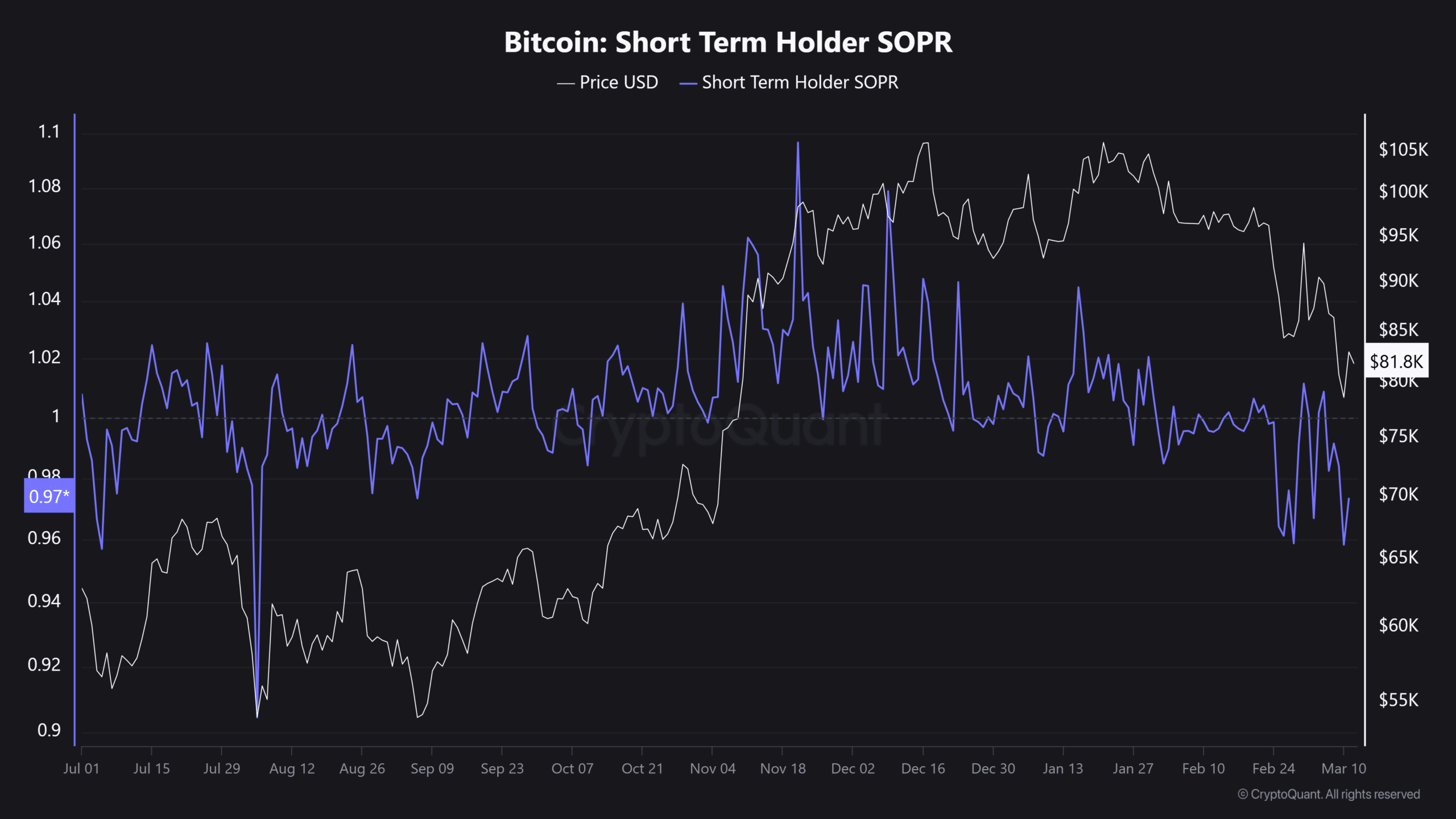

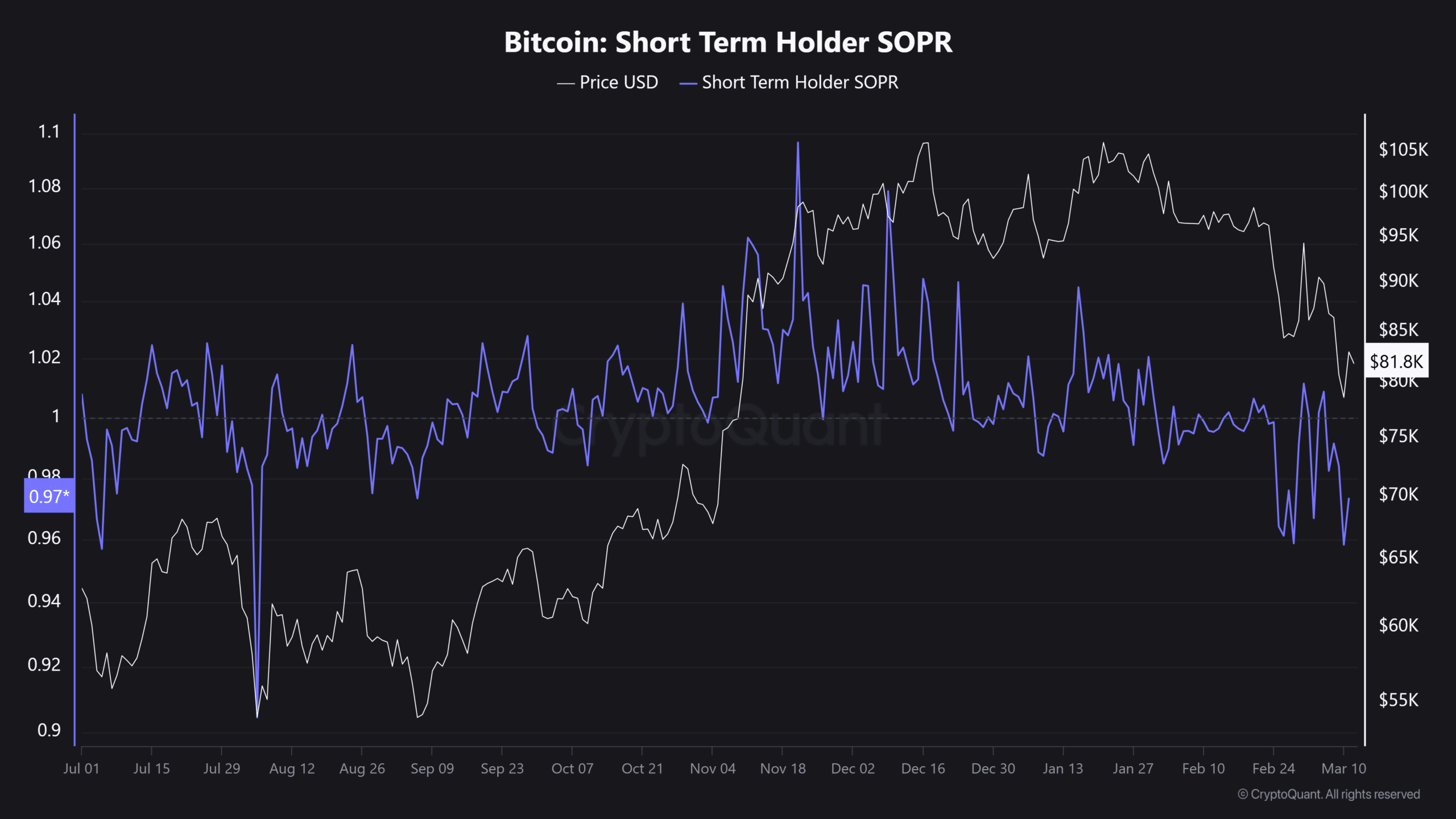

Short -term holders (STHs) show signs of capitulation. The STH spent output profit ratio (STH-Sopr) has remained under 1, suggesting that many investors sell with a loss.

It reached 0.97 when Bitcoin dropped to $ 78k, which emphasized a considerable capitulation.

Source: Cryptuquant

This pattern is very similar to August 2024, when Bitcoin fell to $ 49k under intense sales pressure.

At the moment the accumulation remains weak in critical demand zones, despite the fact that Bitcoin acts 22% under his record high of $ 109k. This reflects a clear risk-off sentiment, in which buyers show the reluctance to enter the market.

In combination with prevailing macro -economic challenges, the current scenario increasingly reflects the crash of 2018, where an extensive distribution led to long -term downward movements.

As a result, Bitcoin is confronted with an increased risk of further corrections before a strong level of support is determined.