- BTC has fallen by 2.43% for the past 24 hours, at the time of press.

- The lifting tree positions of Bitcoin declined in the midst of the economic uncertainty in the US

In the last day, when the cryptomarkt crashed in the midst of American economic uncertainty, Bitcoin [BTC] Immersed to November 2024 levels.

Since he has reached a low of $ 76k, Bitcoin has made a moderate recovery. At the moment Bitcoin even acted at $ 80,338. This meant a decrease of 2.43% in the last 24 hours.

These struggles in the prices of Bitcoin in the midst of American macro -economic problems have added pessimistic investors to fear of risk markets.

Bitcoin’s lifting tree positions fall

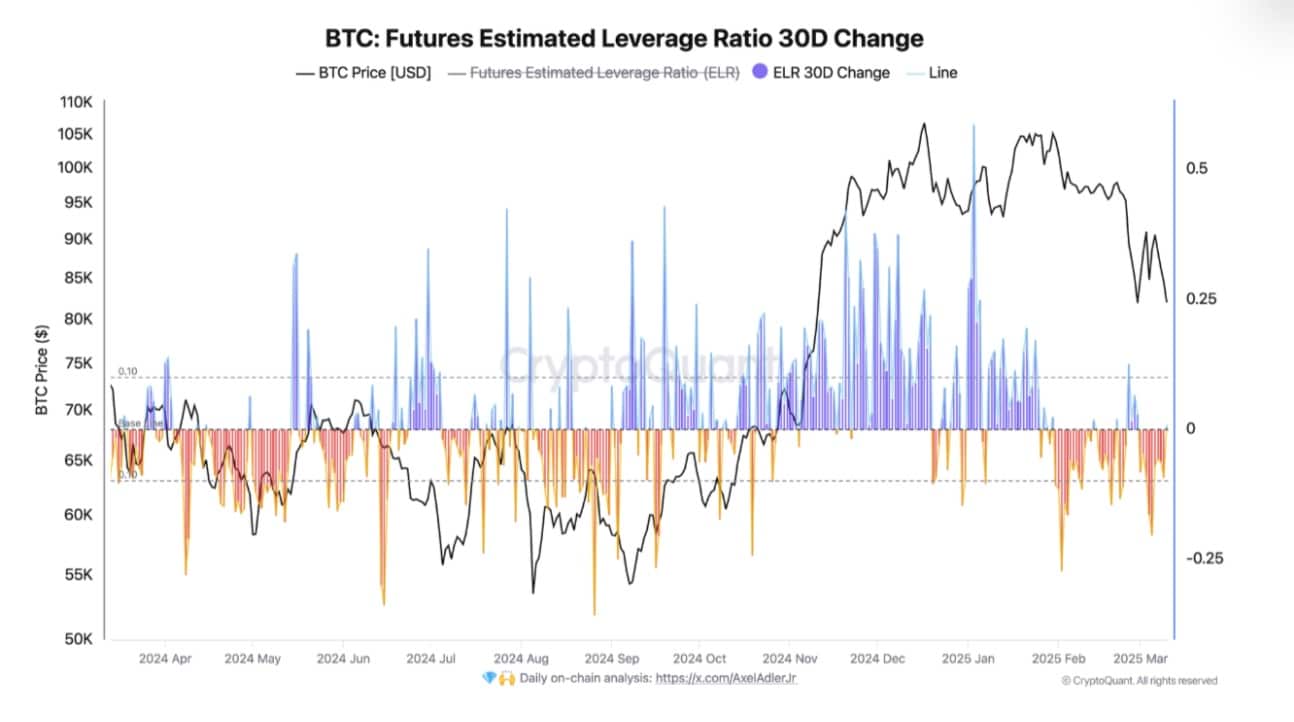

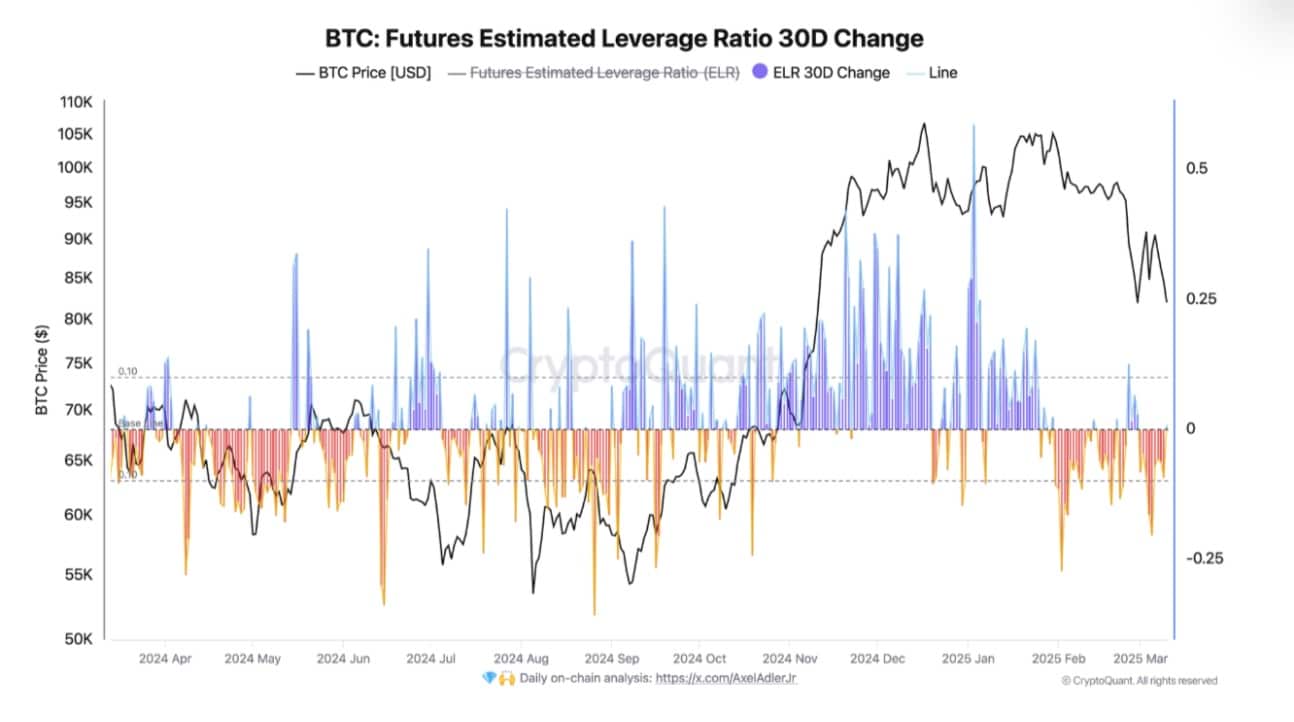

According to Cryptuquant, Since January 29, the estimate of futures in the negative area has evolved.

Source: Cryptuquant

At the time of the press, the estimated lever ratio (ELR) was around -0.13, suggesting that traders reduce leverage as their risky appetite decreases.

This means that traders are less optimistic and avoid speculative market activities that reflect strong bearish sentiments.

The current market trend stems from political and economic uncertainty about Trump’s policy. The US government’s agenda adds anxiety to risk markets so that traders can protect their positions and reduce risk exposure.

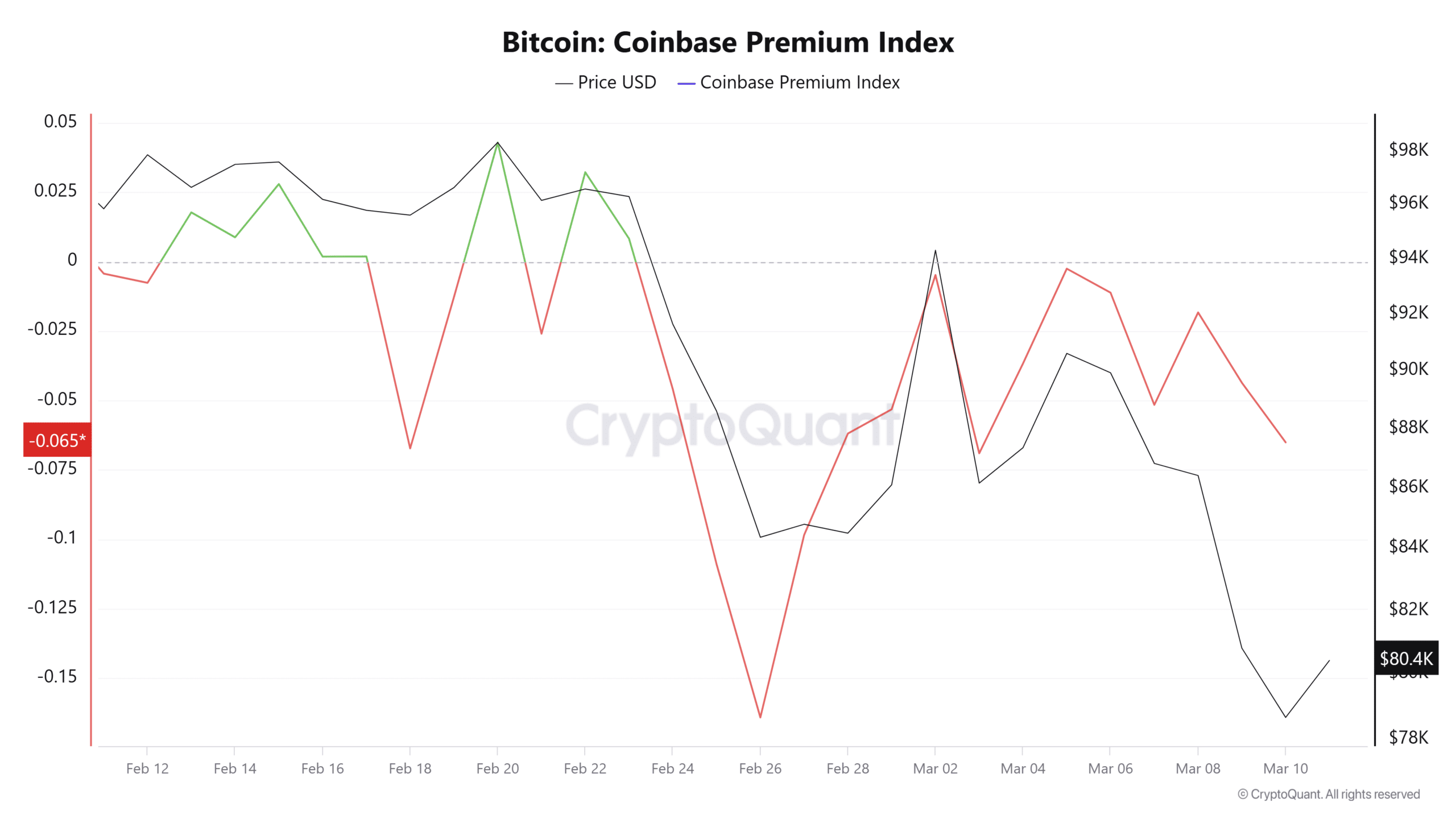

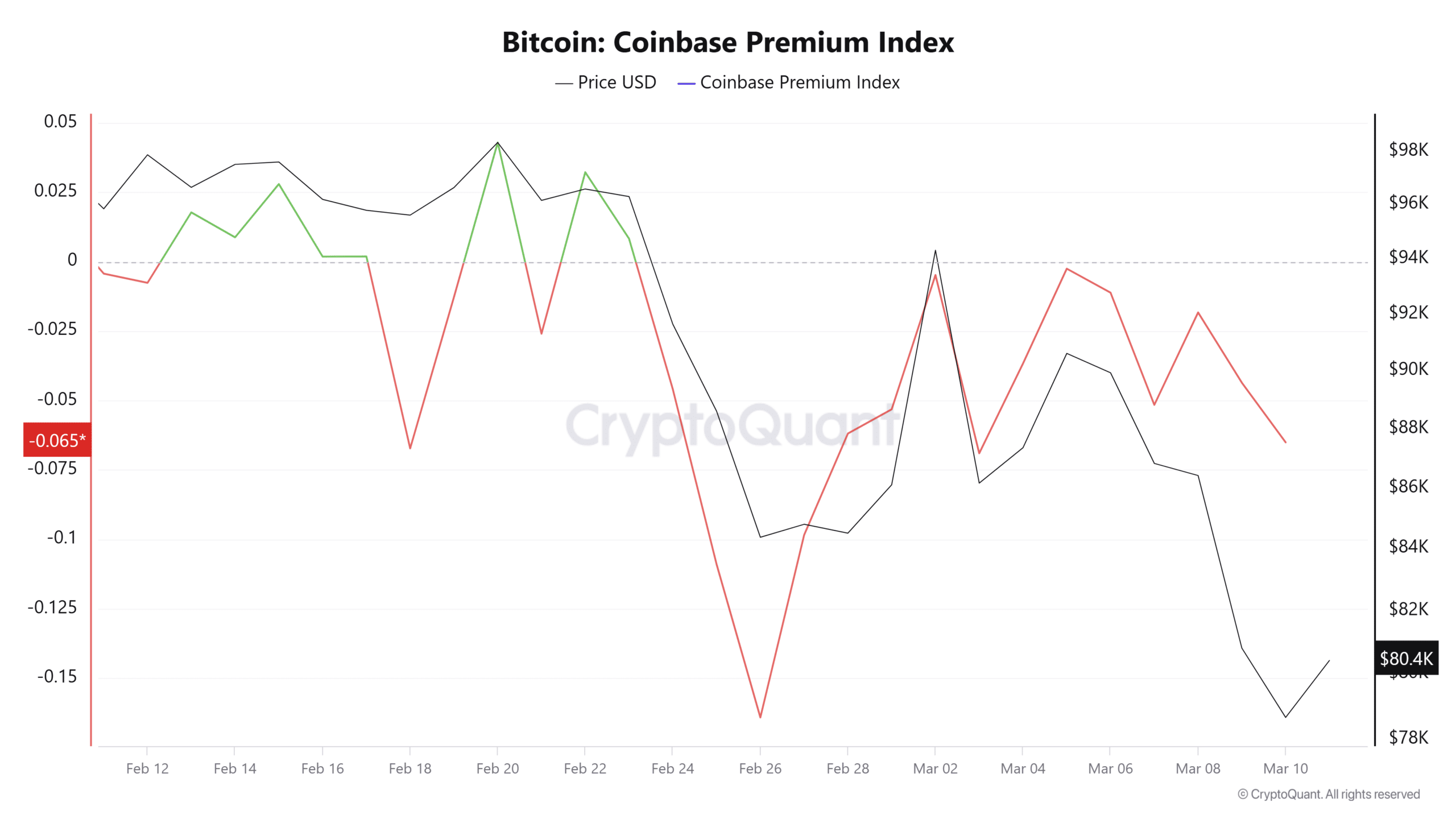

Source: Cryptuquant

Ambcrypto has observed the impact of this policy on crypto markets and Bitcoin, because the Coinbase Premium index has remained negative in the past two weeks.

If this runs for a long period and remains negative, this suggests that American investors sell without institutional accumulation. As such, the wider market sentiments among traders Kearish remain and expect the bear trend to continue.

Source: X

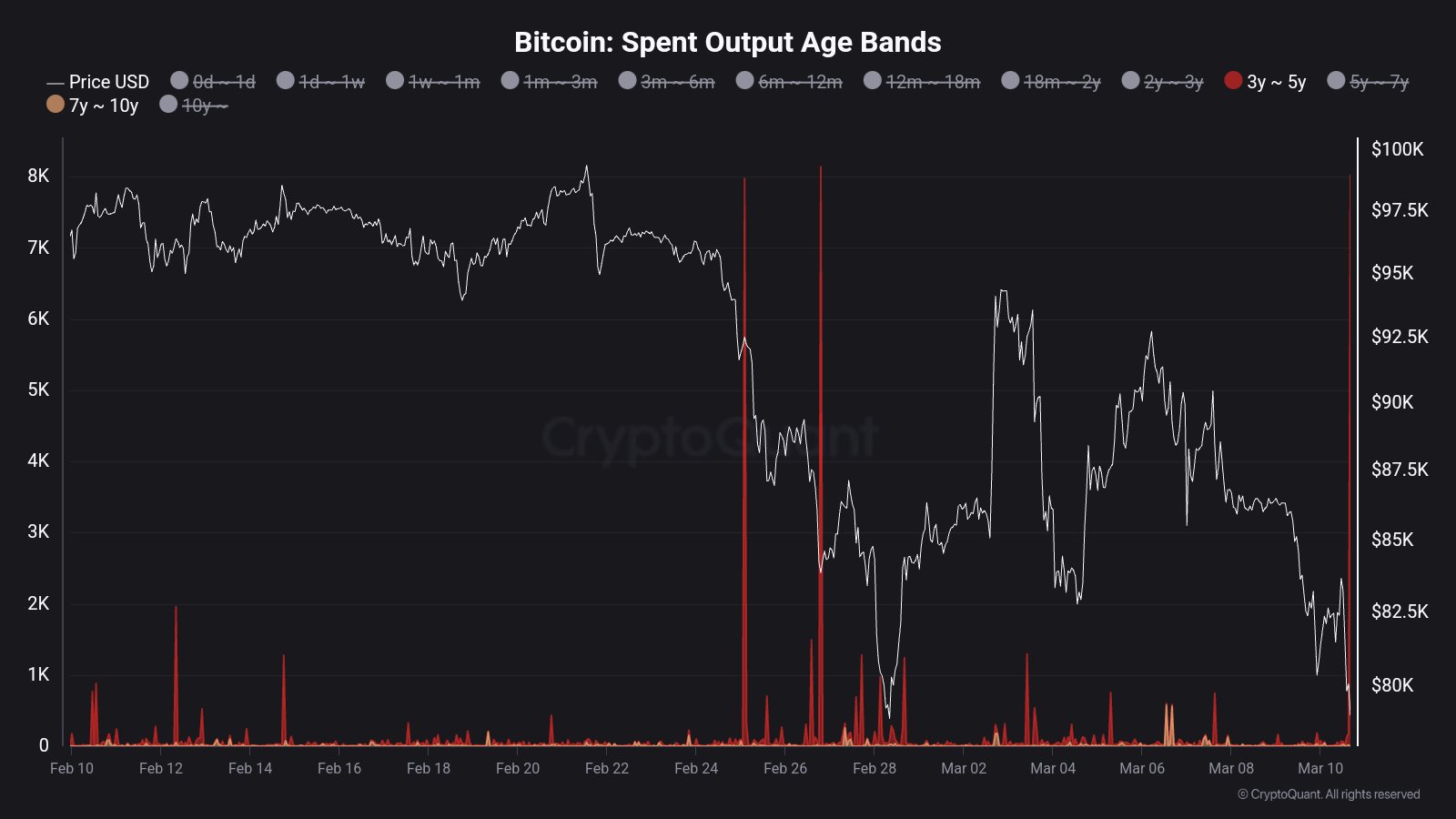

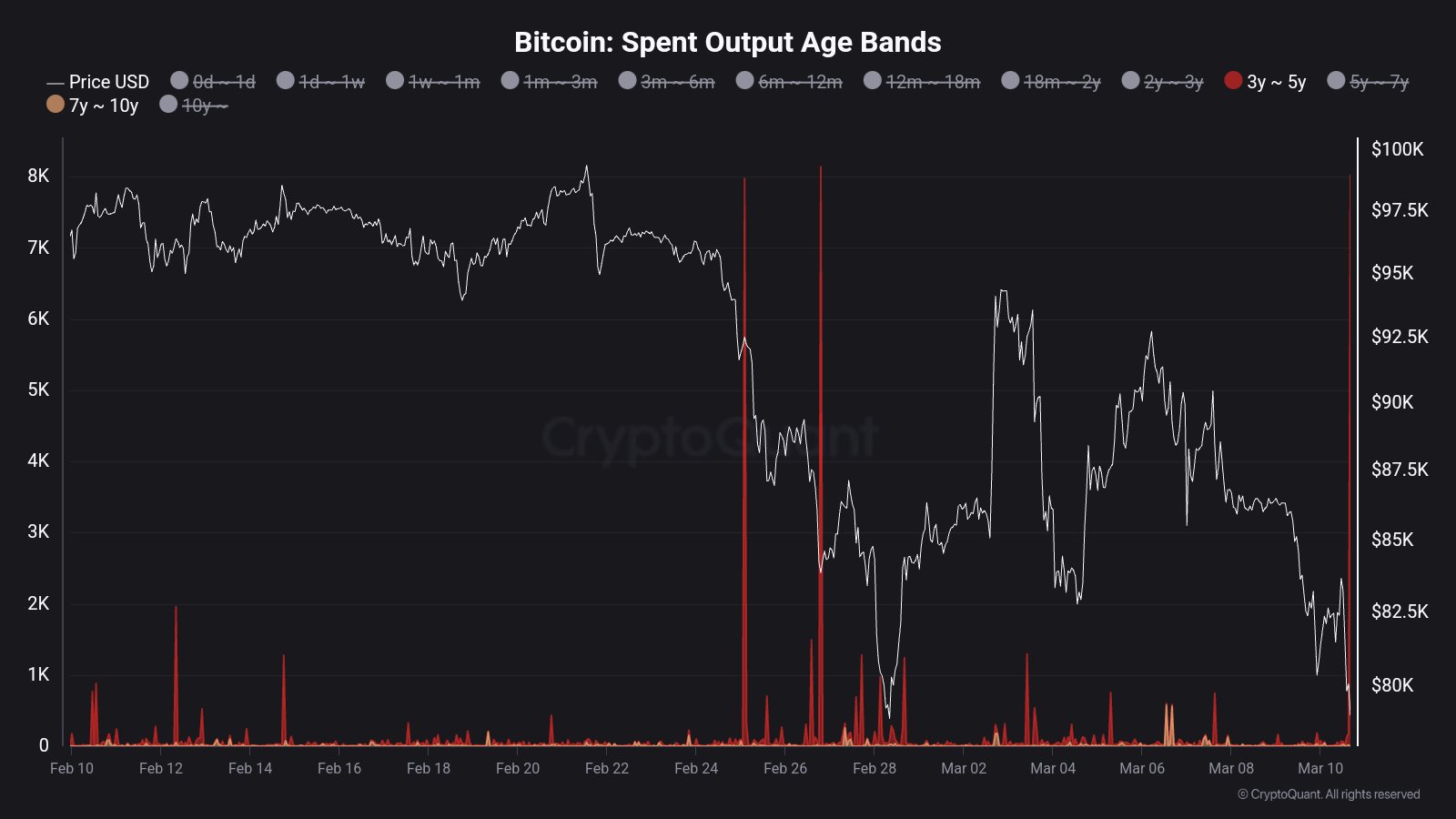

The bearish sentiment of the market is intensified because sleeping coins are starting to move. In particular, 8,000 BTC that have remained inactive for three to five years have recently become active.

If these coins are transferred to exchanges, the chance of a sale increases. Historically, the movement of older coins often creates a considerable sales pressure.

Source: Cryptuquant

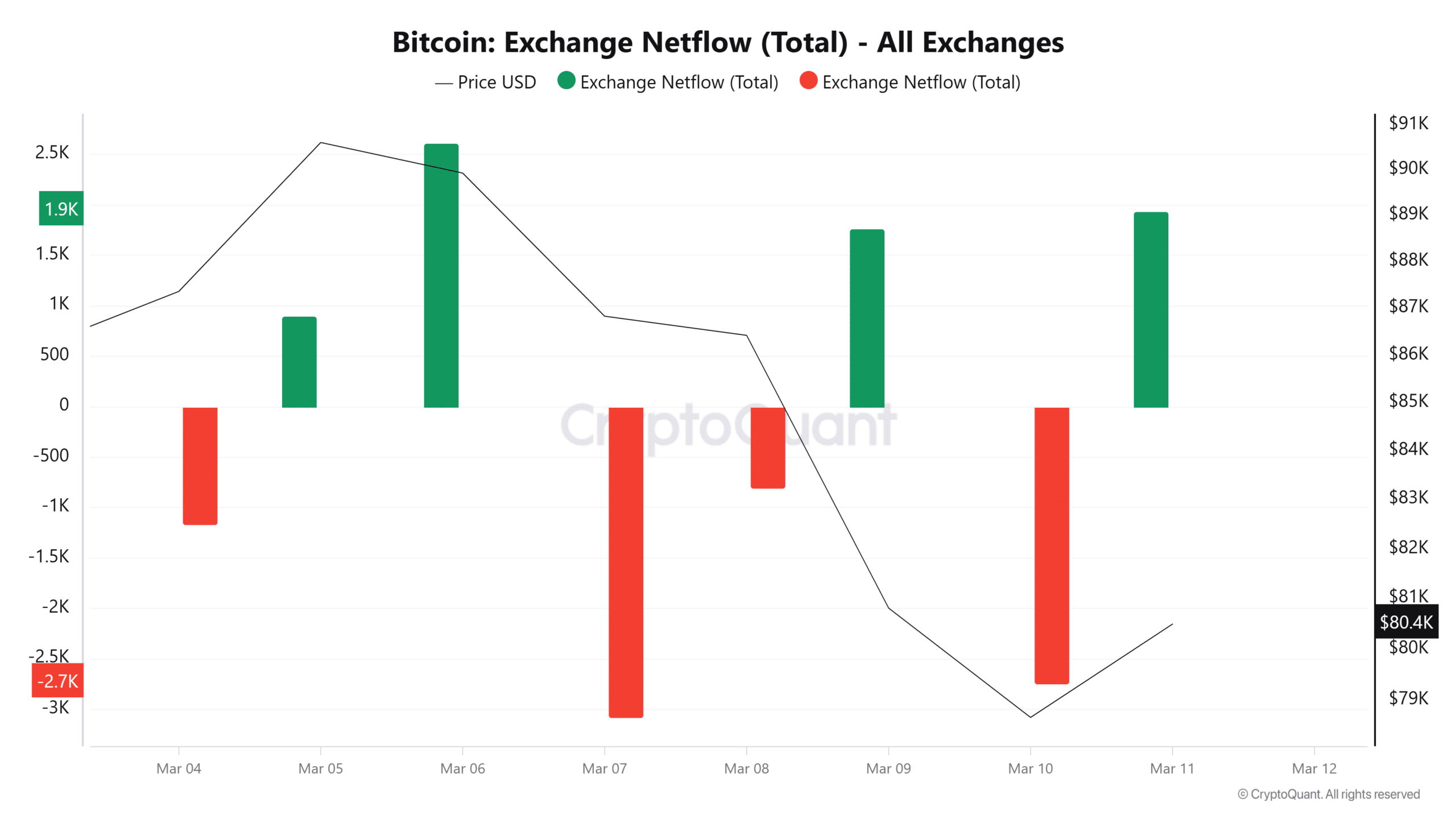

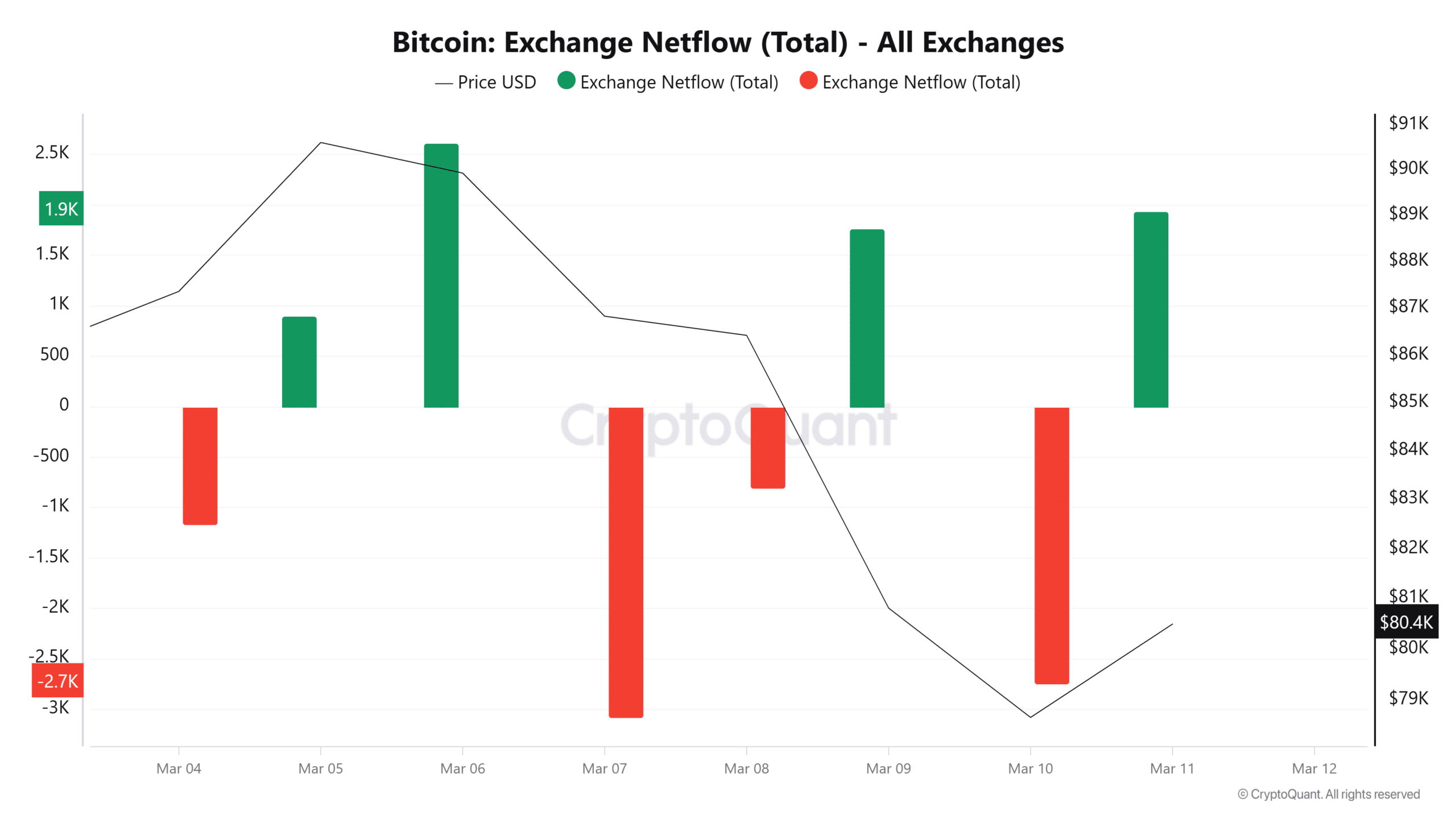

We can see that these coins have moved to exchanges; Looking at the Exchange Netflow suggests that there is a considerable inflow, because it has become positive with more than 1.6k BTC.

As such, more than 50k saw BTC flowing in trade fairs in the past day. This suggests that the markets have experienced strong bearish sentiments in the past day.

What for BTC now

With investors who reduce lifting tree positions, this strongly areas that are currently on the market. Insofar as Bitcoin’s future process is strongly linked to the US economy and the macro -economic policy. Therefore, until the US economy stabilizes, BTC volatility will continue.

Therefore, if the trend continues in the past day, BTC could again fall to $ 77592. A shift in market sentiments, as the American economy cools, will restore a switch to $ 84k, increasing market confidence, increasing a higher level to move higher levels.