- The Aave battery phase received a grip after a competitive decrease.

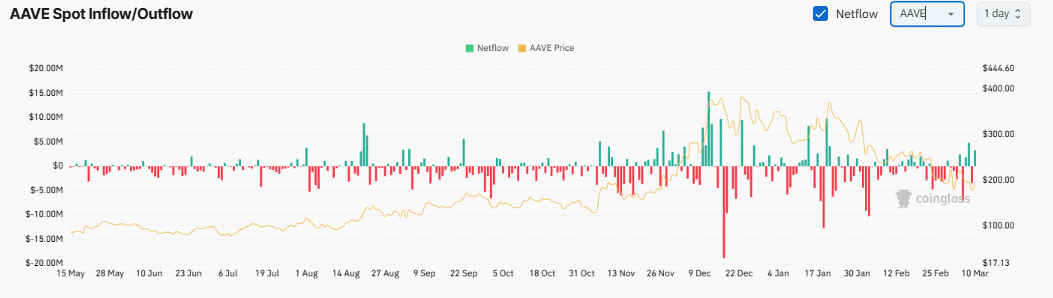

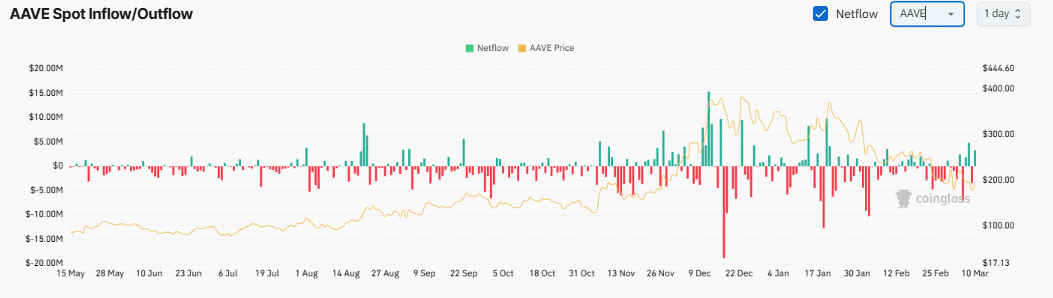

- The Netflow trends from Aave, as illustrated by CoingLass data, further gave insight into market sentiment.

Aave [AAVE] has experienced considerable price fluctuations, powered by market sentiment and accumulation trends. After reaching $ 400 in December 2024, it actively fell sharply and in the early 2025 he dropped below $ 200.

As the accumulation reinforces and technical indicators signal momentum shifts, the Aave price process remains at a critical moment. This analysis investigates the latest trends that shape Aave’s prospects.

Source: Coinglass

The graphs of Smart Dex Traders show that a battery phase is introducing a competitive price decrease. On the Aave/USDT 1-hour candlestick card, it is actively traded at $ 193.31, which reflects a decrease of 0.75%.

The price range includes a highlight of $ 194.19 to a low point of $ 191.16, which indicates sales pressure. The EMA with 10 periods at $ 185.73 remains under the EMA of 50 periods at $ 188.32, which confirms a bearish trend.

The trade volume has risen to 6,026 m, which indicates increased activity. In the meantime, the cumulative volume -delta (CVD) has fallen to -98,367k, which strengthens the sale of dominance.

However, the speed of change (ROC) at 9.10 and the MACD at 1.72 point to potential momentum shifts. If buying volume increases, Aave can be back to $ 200.

On the other hand, continuous sales pressure can yield the price below $ 180, making the support level of $ 171.50 possible. Trends for monitoring volume are crucial for confirmation.

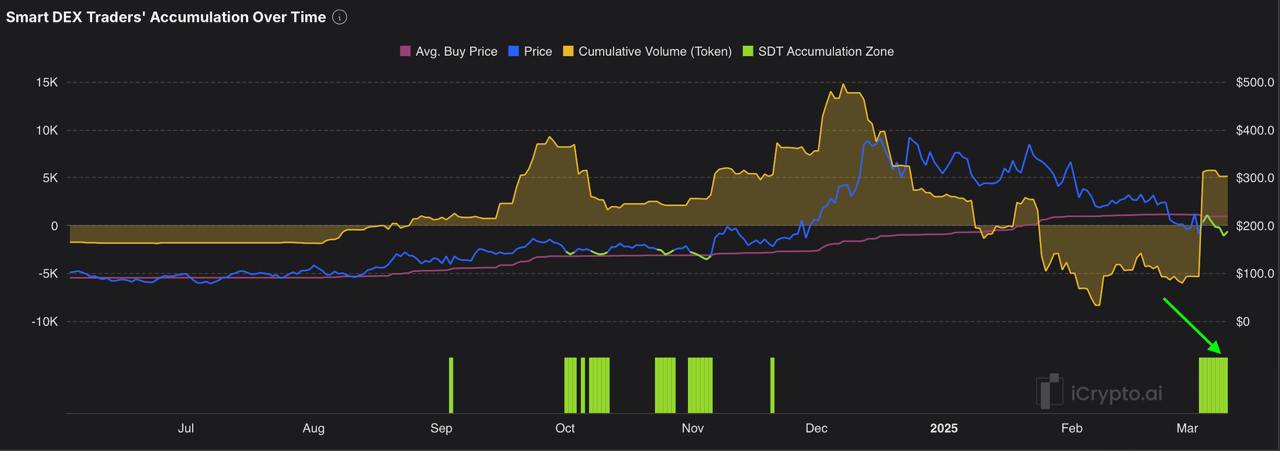

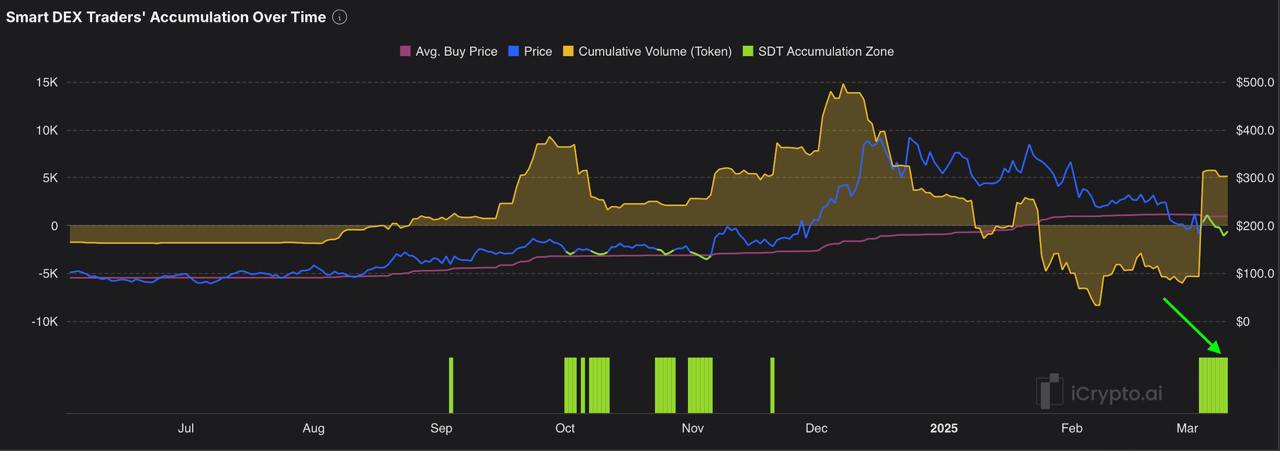

Cumulative volume trends and price correlation

Furthermore, the graph analyzed cumulative volume trends that influence Aave’s price movement. Data from Smart Dex traders showed cumulative volume that in September 2024 peaked at 15k -tokens, coinciding with a price increase up to $ 400.

While the volume fell to -10k in January 2025, the price of Aave fell to $ 171.50. By March 2025 the cumulative volume recovered to 5K, which suggests that renewed accumulation.

Source: ICRYPTO

The average purchase price remained stable at $ 200 despite volatility. Accumulation zones, especially at $ 150 in August 2024, correlated with subsequent price repair.

Persistent volume at 5K indicated potential upward pressure to $ 250. However, a drop below zero can indicate a decrease of up to $ 150, which reflects a representation of the Bearish sentiment.

Market sentiment suggests …

In addition, Aave’s Netflow trends, as illustrated by CoingLass data, further insight into market sentiment. Netflow peaked at $ 15 million in July 2024, geared to a price increase up to $ 300.

An important outflow of -$ 20 million in January 2025 coincided with the decline of Aave to $ 171.13. By March 2025, Netflow became positive at $ 5 million, which suggests that renewed purchase interest.

Source: Coinglass

In December 2024, consistent outskirts of $ 5 million led to a considerable fall in price. A positive Netflow of $ 5 million indicated potential accumulation, which suggests that prices could rise to $ 200. However, a reversal to -$ 10 million can send prices below $ 150.

This pattern appears to be on September 2024, when an inflow of $ 10 million preceded a price rally. Monitoring the Netflown levels is essential, because the inflow often indicates the start of an upward and early indications of price outlets.

Rebound or go backwards?

The technical indicators of Aave and data on the chain point to a potential rebound as positive trends. On the graph of 1 hour, Aave acts at $ 193.31, with a volume of 6.026 m and a MacD of 1.72, which indicates an increasing momentum.

The cumulative volume of 5K in March 2025 is in line with earlier rallies, such as the $ 400 increase when the volume reached 15k.

In addition, a $ 5 million Netflow offers a bullish signal after January -$ 20 million outflow. If the volume remains above 6m and Netflow surpasses $ 10 million, Aave can climb to $ 250.

Conversely, a volume decrease under 3m or a negative Netflow of -$ 5 million can push prices to $ 150, testing important support at that level. Historical trends, including the volume peak of September 2024, strengthen the Bullish prospects.