- The executive order of Trump calls for an American Bitcoin reserve, with the help of existing cryptocurrency assets brought by the government.

- Dalende Exchange reserves Signal Bullish Sentiment, but expressed concern about the liquidity of the market.

In a groundbreaking step, US President Donald Trump has taken an important step to integrate cryptocurrencies into the financial strategy of the country.

Trump’s Bitcoin Reserve plan takes shape

On March 6, Trump signed an executive order to set up a strategic reserve of digital assets, with the help of tokens that are already in government possession instead of acquiring new ones – who are inadequate for market expectations for new purchases.

Trump organized an exclusive top of the White House with top cryptocurrency leaders, building on this initiative and his vision of a crypto stock supported by the government.

This unprecedented commitment signals a shifting regulation landscape, with possible implications for Bitcoin [BTC] And the wider market for digital assets.

In addition, the US has a Bitcoin reserve, in which market forecasts shifted from 24% to 32%, according to polymarket facts.

This growing speculation has already led conversations in various states, in which Utah, Arizona and Ohio actively discuss the possible implications of a Bitcoin reserve supported by the government.

However, not all states have been rejected on board – Zuid -Dakota, Montana and others.

As the perspectives continue to diverge, the expectation about an American Bitcoin reserve becomes intensive.

Why do the exchange reserves fall?

In the meantime, exchange reserves are falling, which indicates a potential supply squeeze, as marked by Moon whales.

“The US creates a strategic #bitcoin reserve. In the meantime, exchange reserves are in free fall. “

Source: Maanwalvissen/X

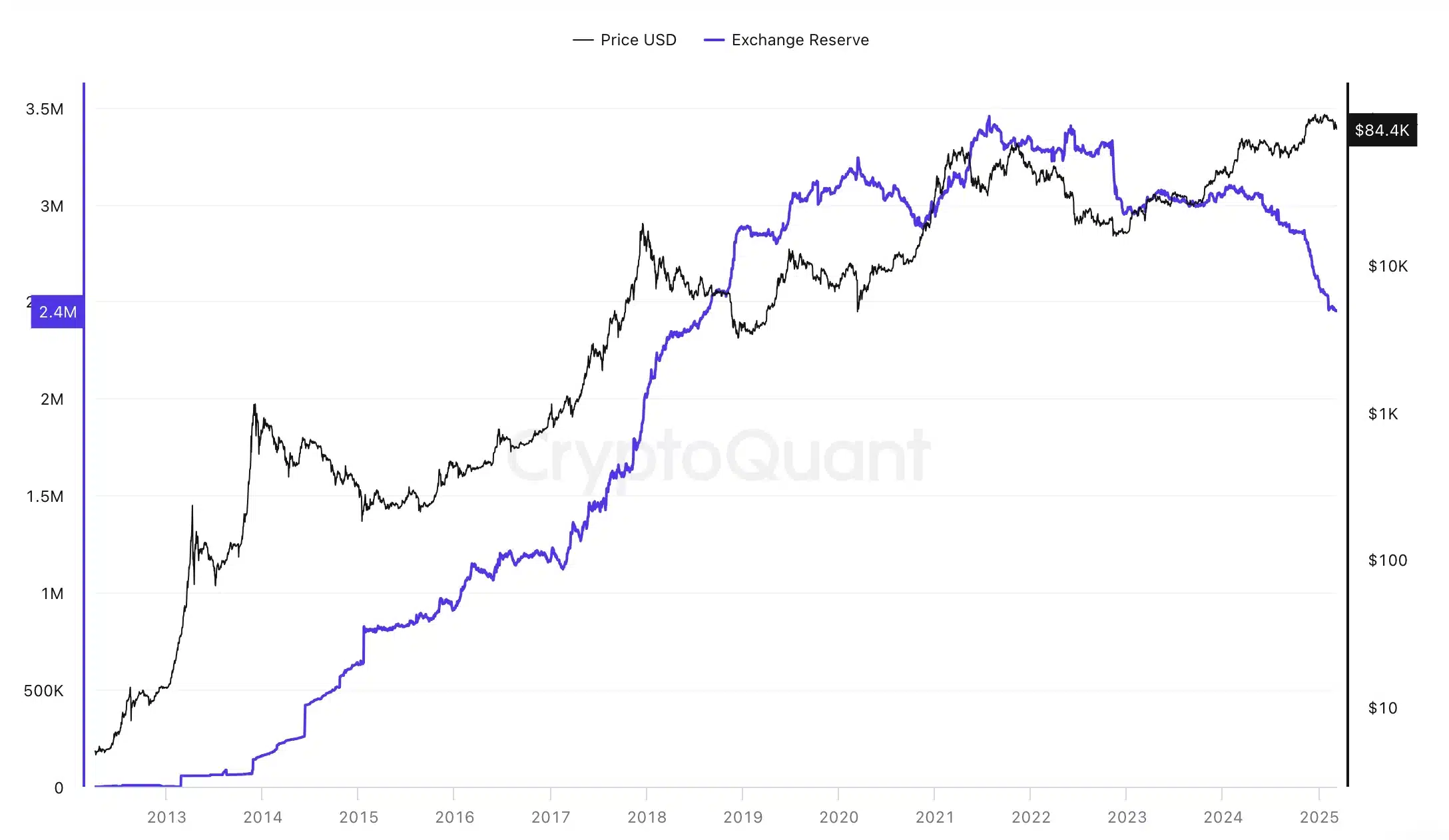

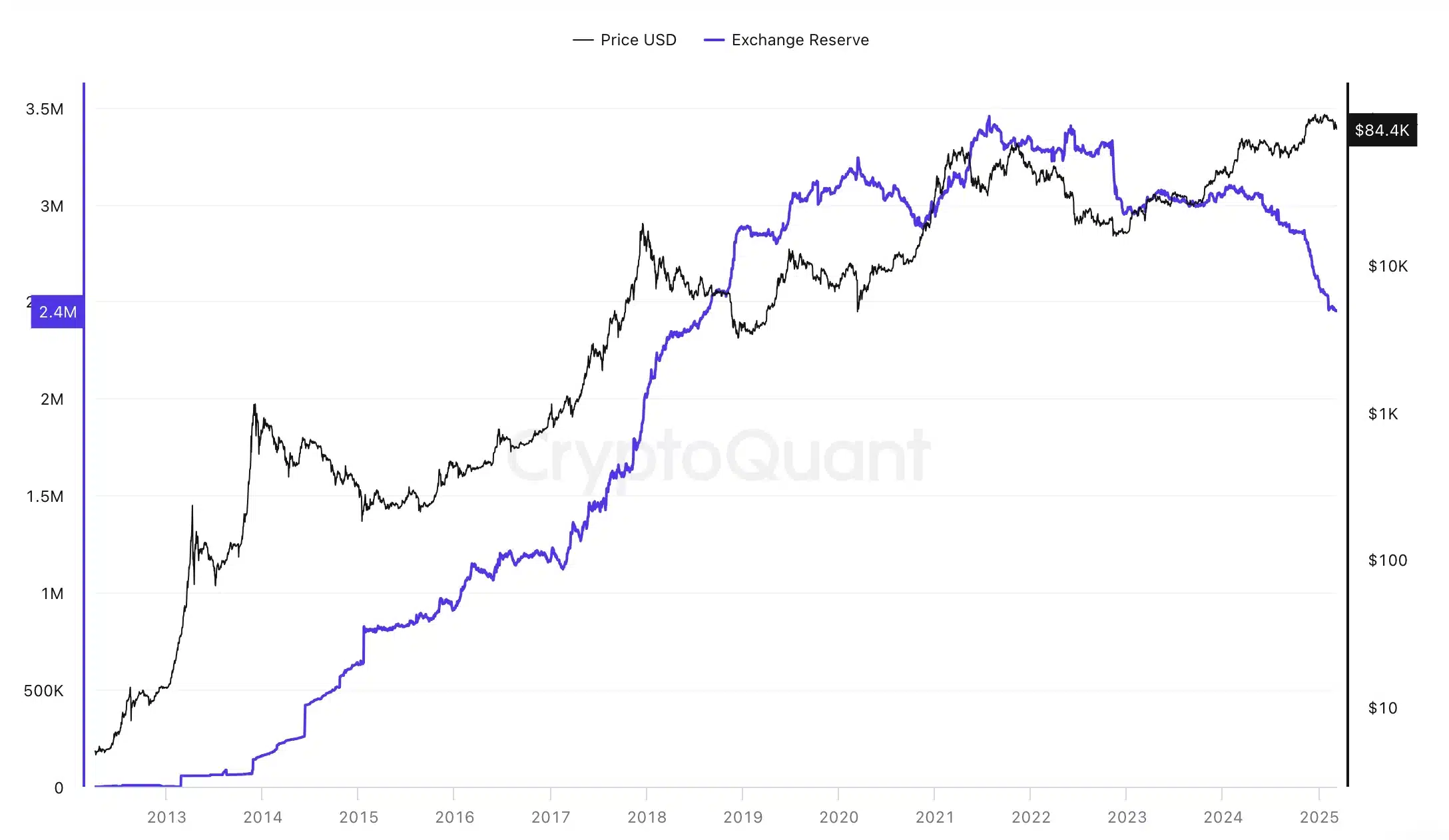

Cryptoquant data further strengthens this trend and reveals that the exchange reserves will continue to fall.

Source: Cryptuquant

Investors are increasingly moving their property to private portfolios and exhibit a preference for long -term storage over immediate sale.

A shrinking exchange reserve often indicates bullish sentiment, because a reduced offer can create a potential offer if demand increases.

This trend also reflects the growing interest in Defi, deployment and cold storage solutions for improved security and alternative yield options.

Although lower reserves can increase prices, they can also reduce the liquidity of the market, which increases volatility due to less tradable assets.

What is waiting for us?

In the meantime, the price of Bitcoin remains under pressure, trading at $ 84,57.57, at the time of the press, after a decrease of 1.89% in the last 24 hours, according to Mint market cap.

Moreover, some segments of the market continue to show bullish optimism, anticipating the long -term profit, but the general momentum seems vulnerable.

As expected, these shifts have kept traders on sharply, with the next step of Bitcoin probably dependent on broader adoption trends and institutional interest.