- Surge in XRPs NVT ratio hinted during a walk in whale activity, which indicates potential volatility

- XRP’s consolidation within a symmetrical triangle pointed to an imminent outbreak or breakdown

A massive transfer of 150 million XRP, with a value of more than $ 380 million, recently took place between two unknown portfolios. As expected, this has caused a considerable curiosity in the cryptomarket.

This whale activity has also attracted the attention of many traders and analysts, many of whom are now wondering whether this will cause a great price shift or whether it is simply a routine transaction.

At the time of the press, XRP waS act at $ 2.36, after a decrease of 4.97% in the last 24 hours. This has contributed to the uncertainty surrounding the prospects in the short term.

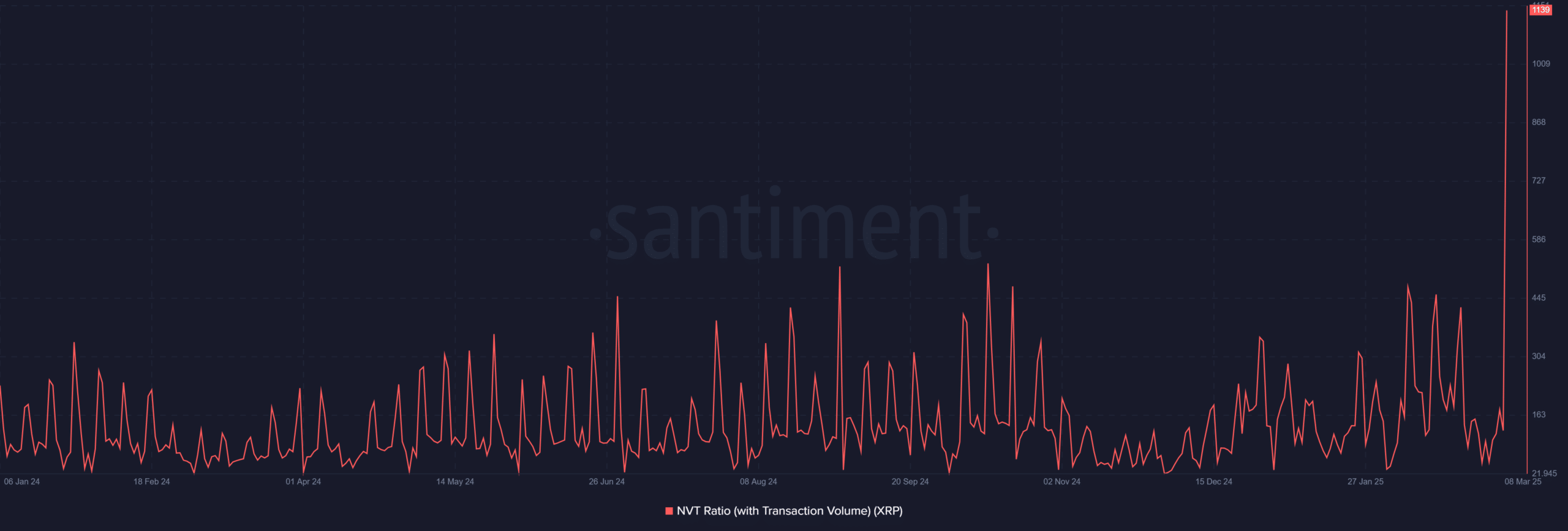

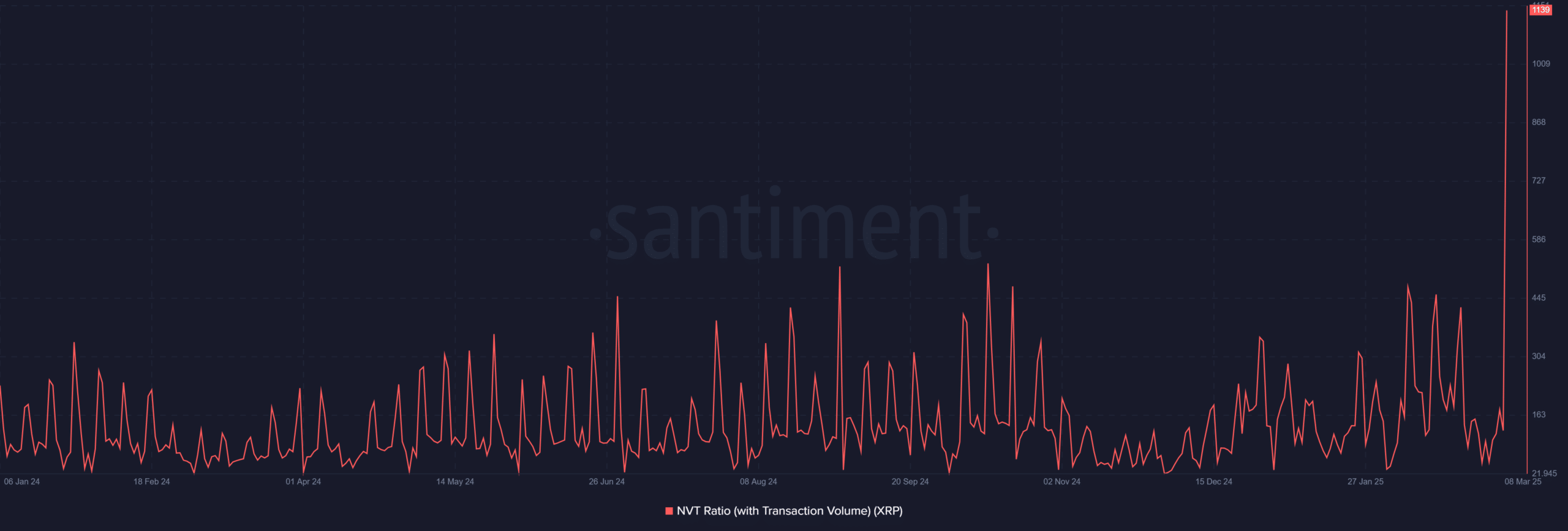

XRP Surge in NVT ratio – What does this mean for the market?

XRP’s network value to transaction (NVT) ratio registered a sharp walk, spiking to 1139.75 on 8 March of just 176 a day earlier.

This enormous increase seemed to point to an increase in transaction volumes compared to the market capitalization of XRP. Consequently, this was referred to increased activity and possibly larger movements.

That is why such an important jump can indicate that whale activity influences the price – a sign of possible upcoming volatility.

Source: Santiment

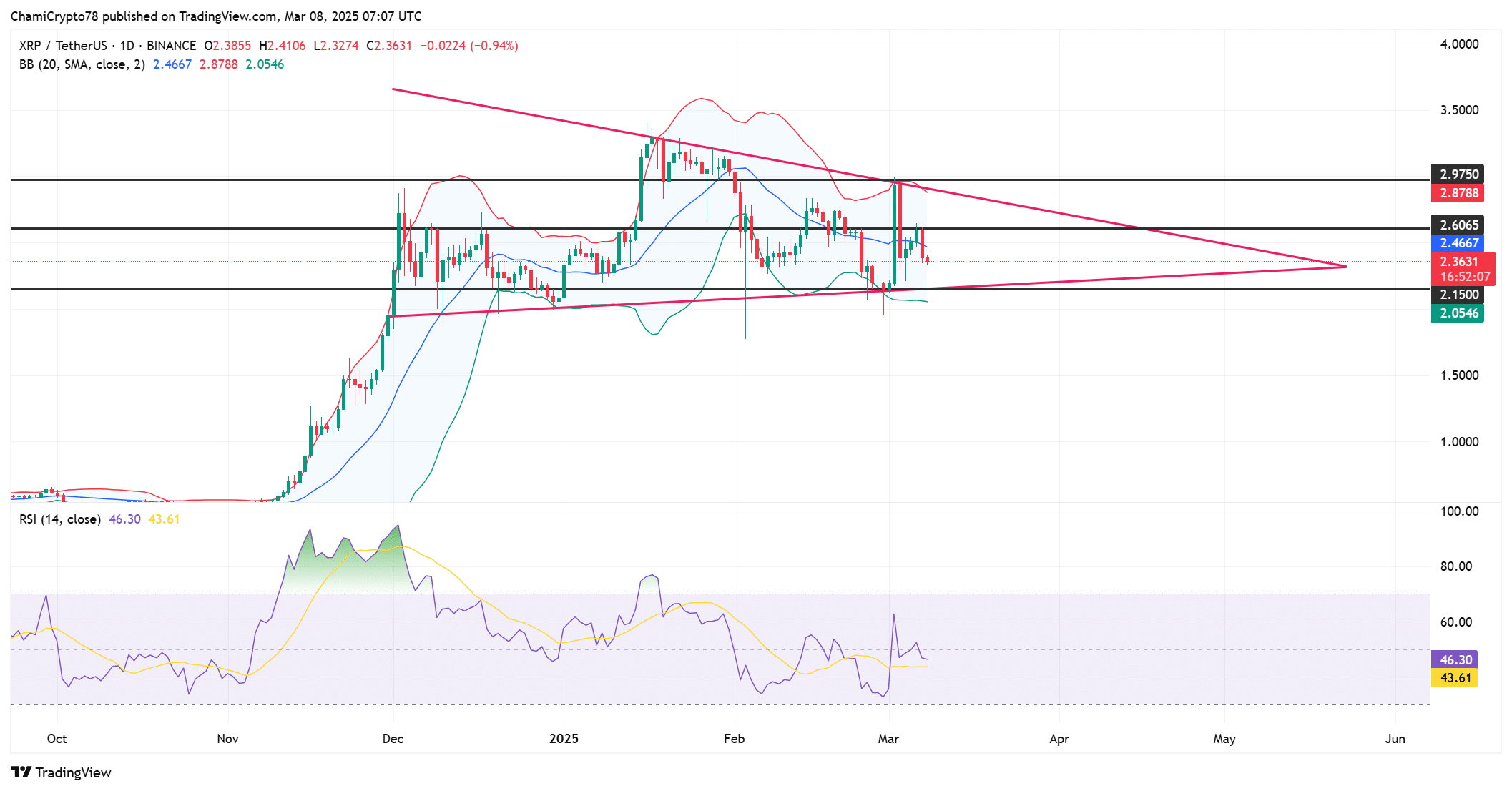

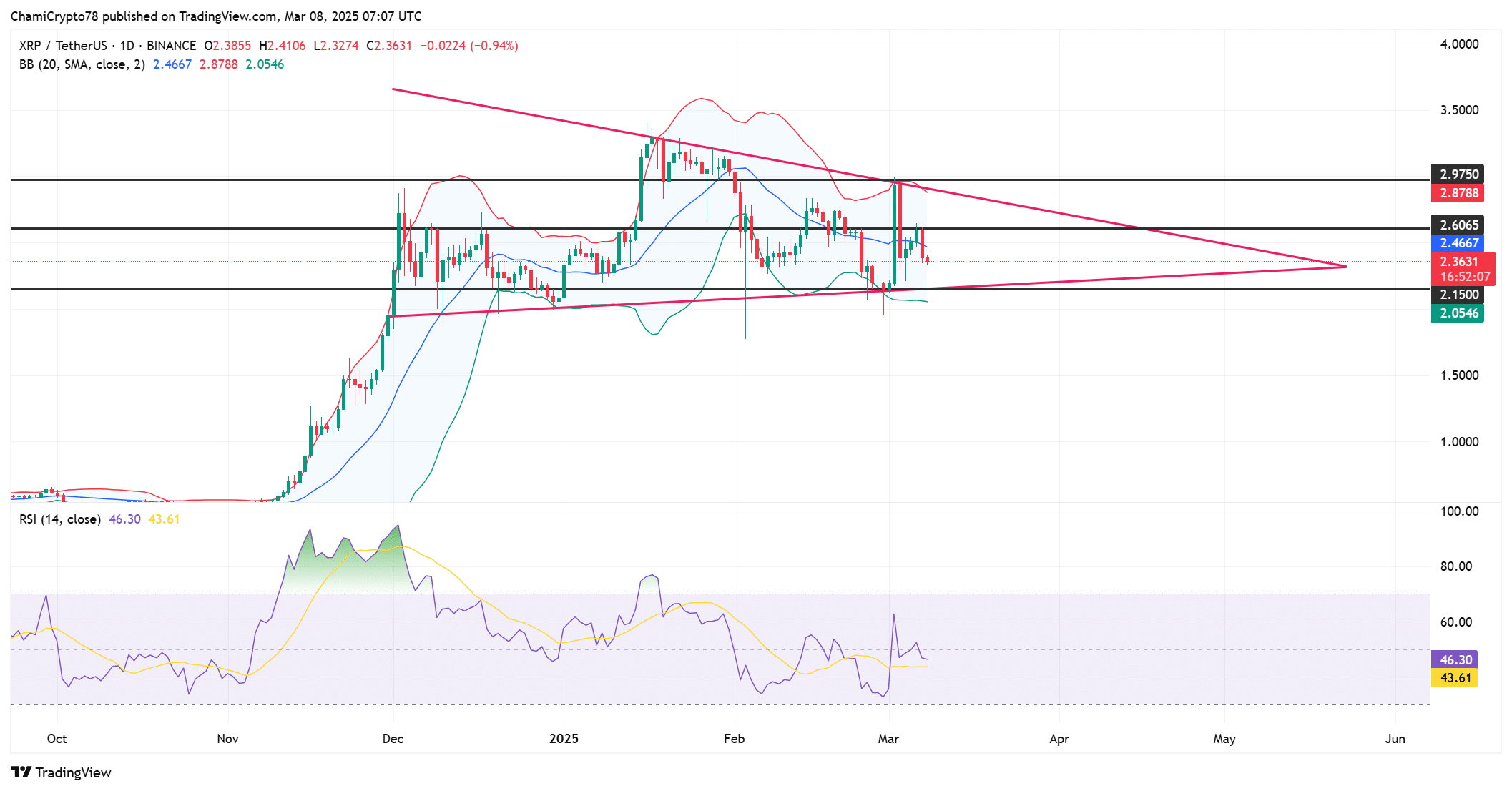

Symmetrical triangle consolidation – Is XRP ready for an outbreak?

The price diagram of XRP revealed that it is actively consolidated within a symmetrical triangular pattern. Such consolidation usually precedes an outbreak, making it crucial to observe the most important levels in the game.

The immediate support of XRP was $ 2.36, with resistance around $ 2.60. In addition, the Bollinger tires seemed to have been tightened, which reflected low volatility, while the stochastic RSI was at the neutral level of 46.30.

That is why XRP could see a considerable price movement as soon as the price breaks out of the triangle, either to the advantage or on the disadvantage.

Source: TradingView

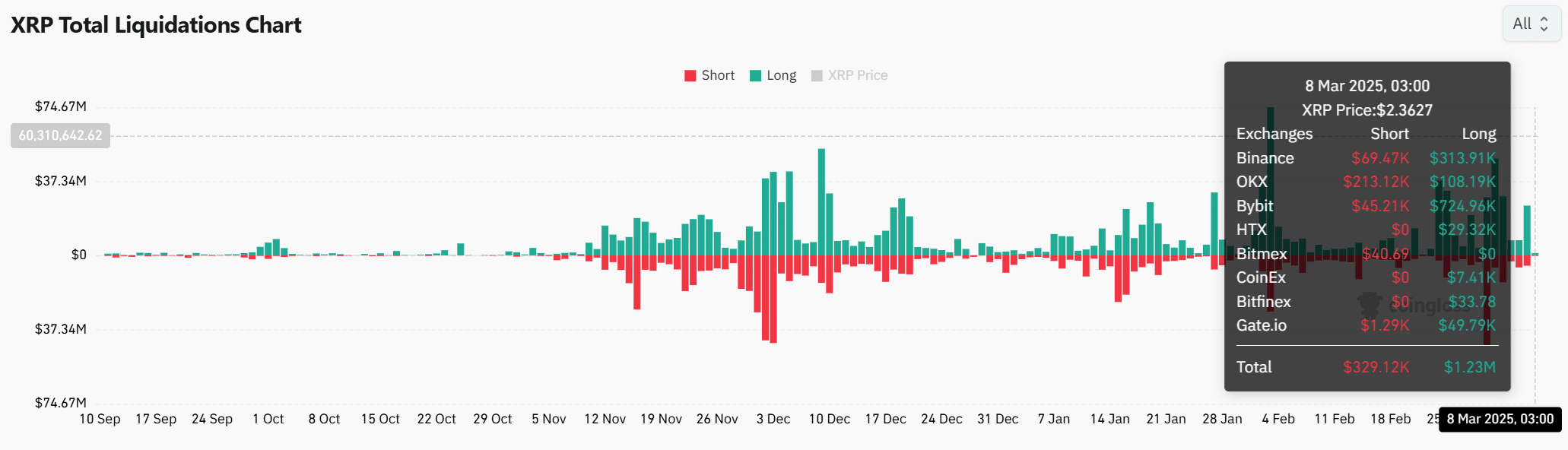

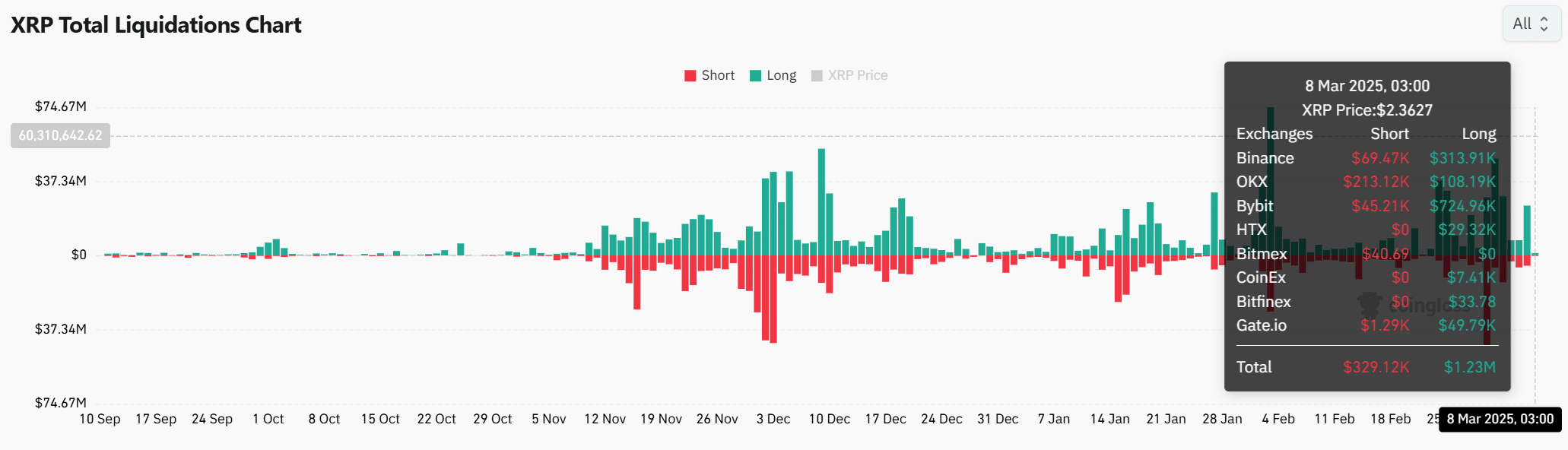

Long and short liquidation analysis – what do the liquidations reveal?

The long and short liquidation data emphasized remarkable fluctuations in market sentiment. In fact, the value of the total liquidations has recently risen to $ 329.12 million, with long positions good for $ 1.23 million of that total.

Binance led the liquidation volumes, with $ 313.91k liquidated in long positions. This indicated a market that is uncertain about the direction of XRP, where traders bet on both bullish and bearish movements.

Source: Coinglass

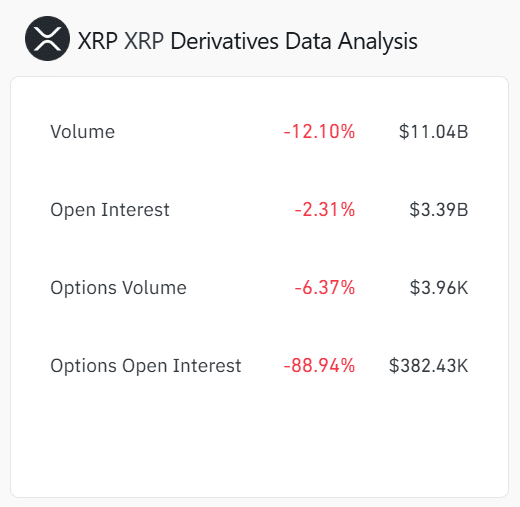

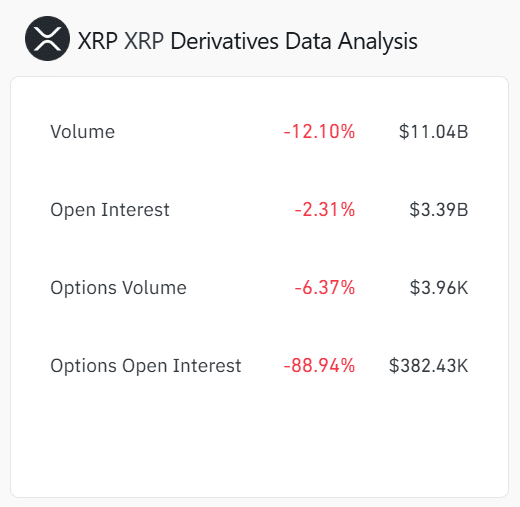

Derivative data analysis – cooling or preparing for a movement?

The newest derivative data referred to a cooling trend in the XRP market. In fact, the trade volume fell by 12.10%, with the same flashy figures of $ 11.04 billion at the time of press. Likewise, the open interest rate fell by 2.31% to $ 3.39 billion.

It is remarkable that options open interest decreased with a stunning 88.94%. This suggested that market participants are less confident about the price promotion in the short term. Although these figures shy through with a temporary silence, they therefore carefully emphasized sentiment among traders.

Source: Coinglass

Is XRP on its way to an outbreak or a malaise?

Given the persistent whale activity, an increase in NVT ratio and the continuous technical consolidation, XRP can be ready for a possible outbreak.

However, the cooling in derivative data and the neutral momentum on the graphs suggested that every major movement could take some time to materialize. That is why XRP can break out soon, but it will remain uncertain whether it will be bullish or will fall further.