- The range of Cardano since December has limited all price expansion

- The $ 0.78 support zone will probably see a strong price bouncing to $ 0.9 next week

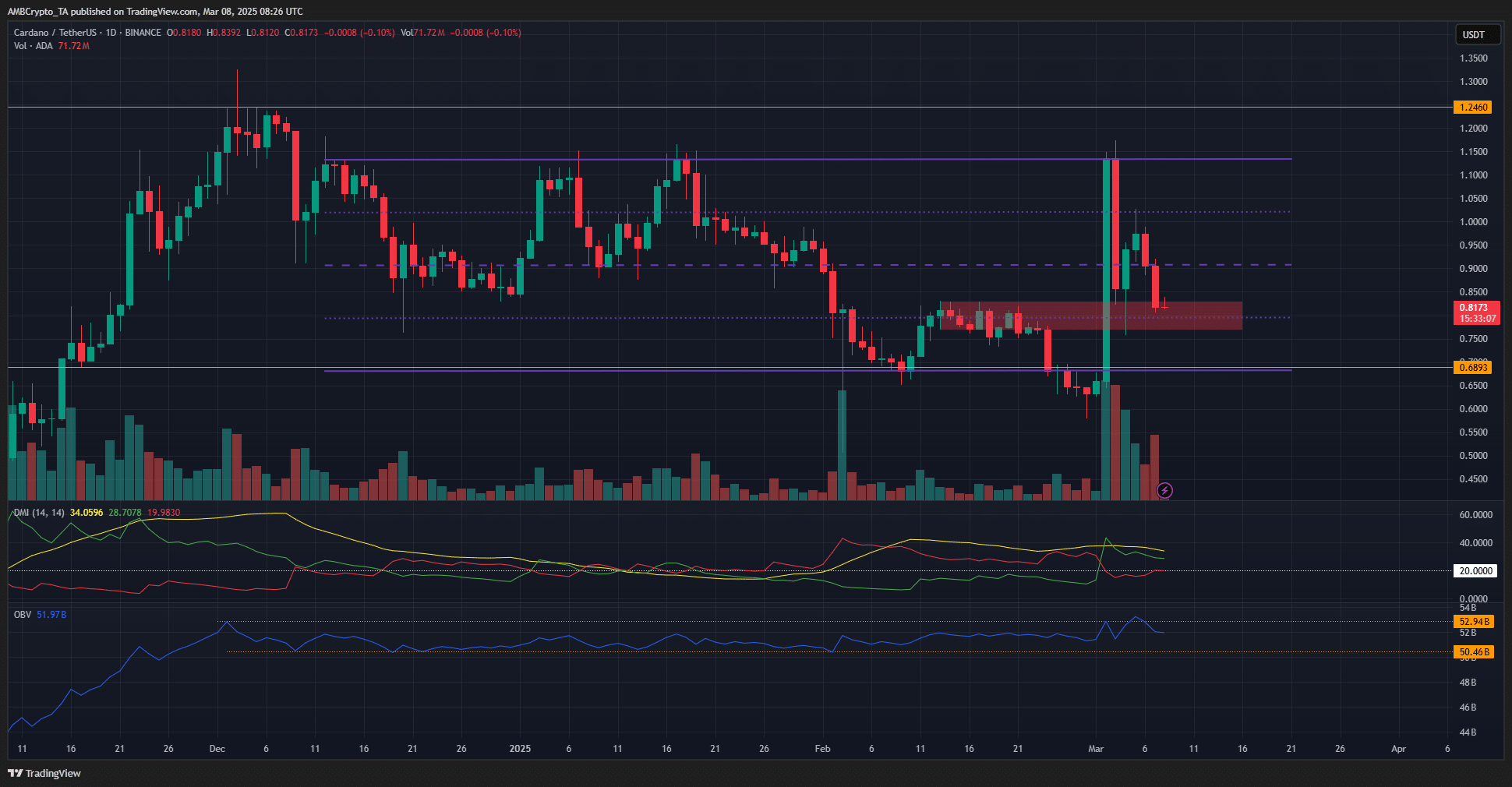

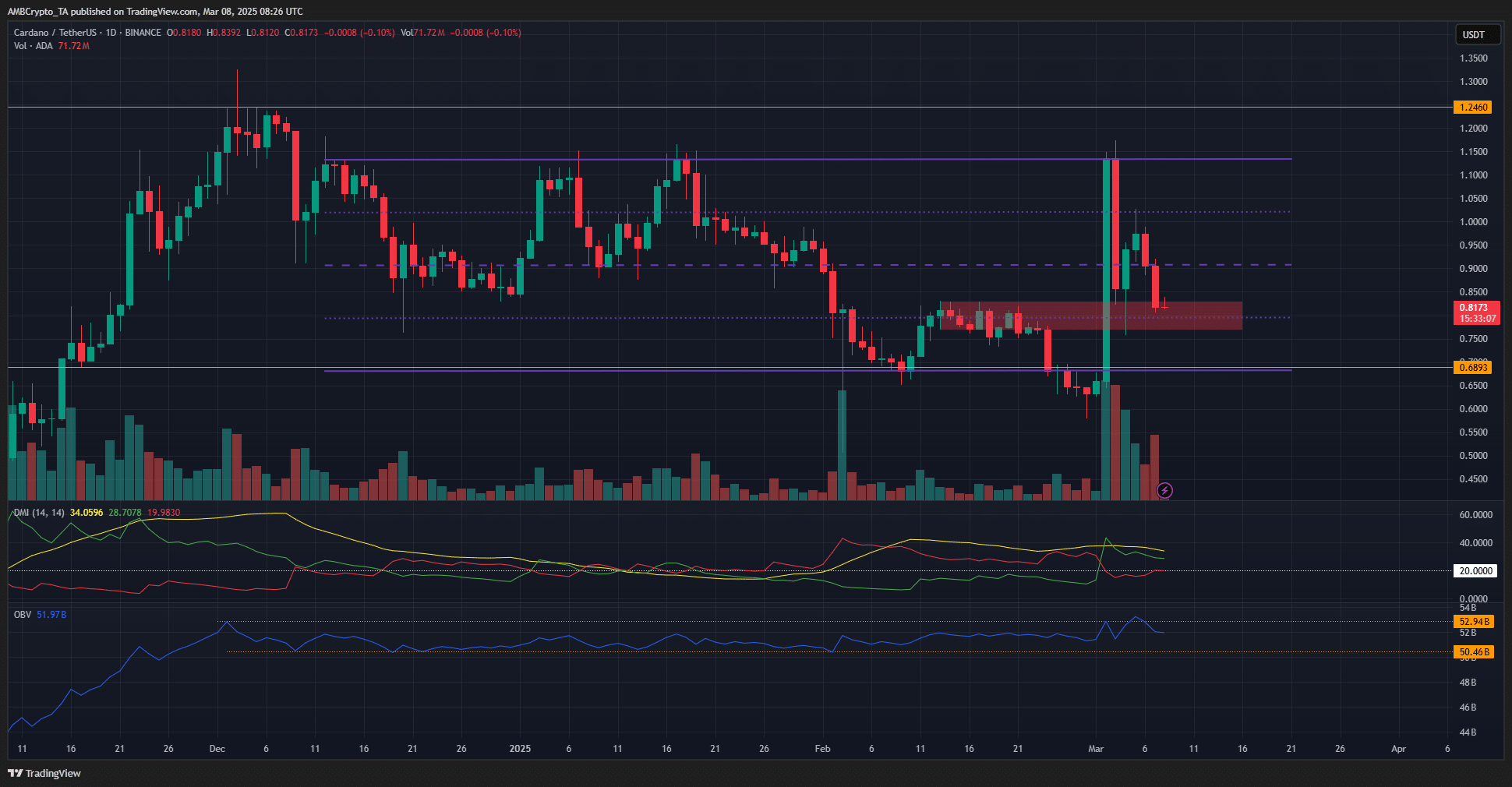

Cardano [ADA] Saw a price rally of 72% on the back of the news on Sunday 2 March that the US Crypto Strategic Reserve would also include Cardano. Since then, Ada has withdrawn most of its winnings on the charts.

At the time of writing, it acted in an important support zone that had been a resistance level in February. From a technical perspective, Cardano Swing traders seemed to present a buying option.

Cardano falls under the mid-range support, but must want to offer buyers

Source: Ada/USDT on TradingView

The strong pump last weekend meant that the market structure was Bullish. And yet the structure was not too important at the moment, since Ada has been traded within a reach (purple) since December. This was the fourth day in the past week that the price tested the demand zone of $ 0.8.

The Directional Movement Index emphasized a strong walk -in trend, with both the ADX (yellow) and +di (green) above 20. On the other hand, the BBV still had to break its range.

The lack of persistent purchasing pressure meant that Cardano can remain reach in the coming days or even weeks in the coming days. Here the meaning of the resistance of the past month that was found back as support was also remarkable. That is why Bulls would focus on moving to $ 1.15- $ 1.2, with the range high at $ 1.135.

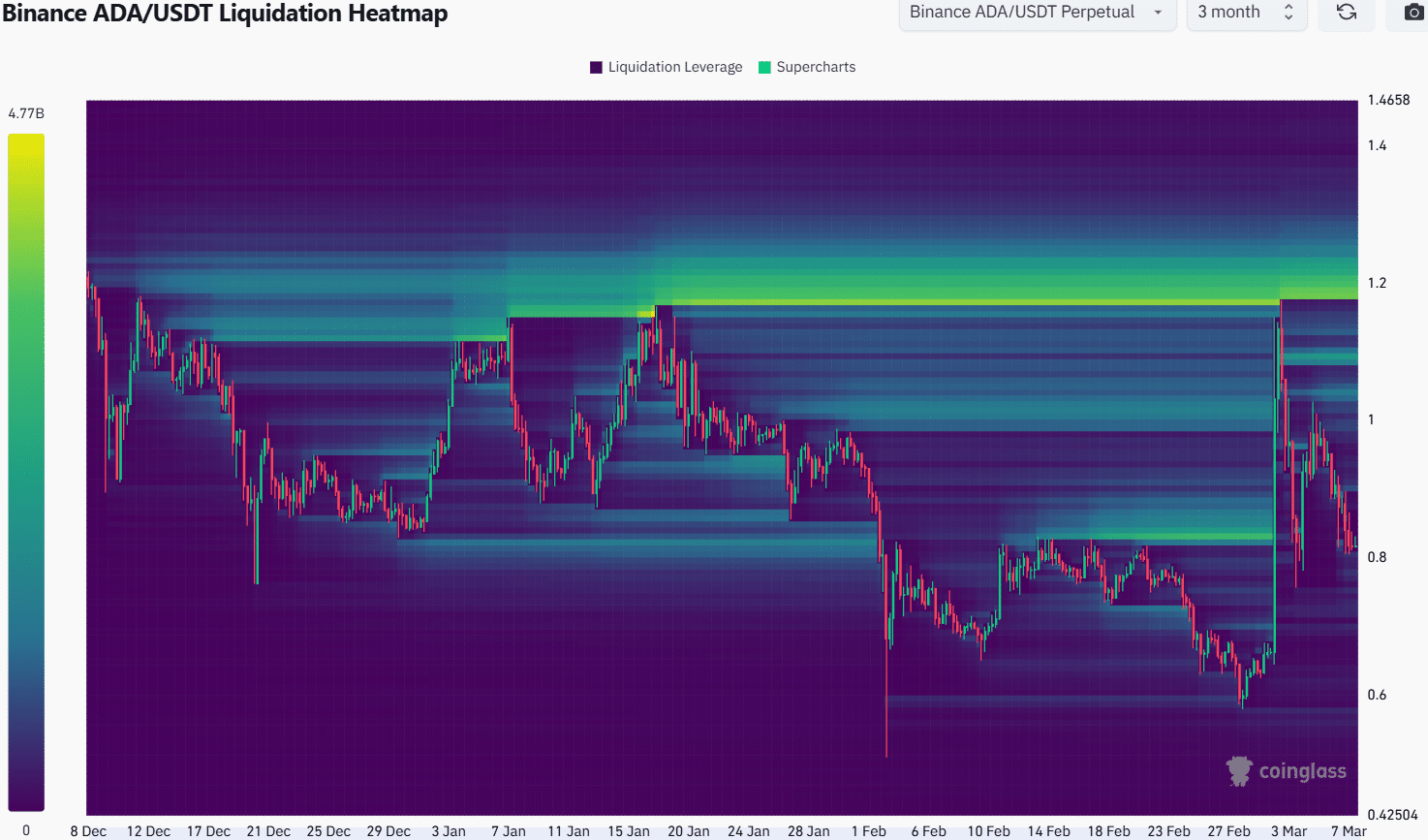

The 3-month liquidation heat emphasized the $ 1.2 level as the magnetic zone to pay attention to. The density of liquidation levels here means that bulls may have a hard time pushing the price further north.

The liquidity cluster would probably attract prices, but will be followed by a rapid rejection. This has been the pattern since January. Alternatively, a strong momentum movement can control a liquidation cascade, but the purchase volume has been absent so far.

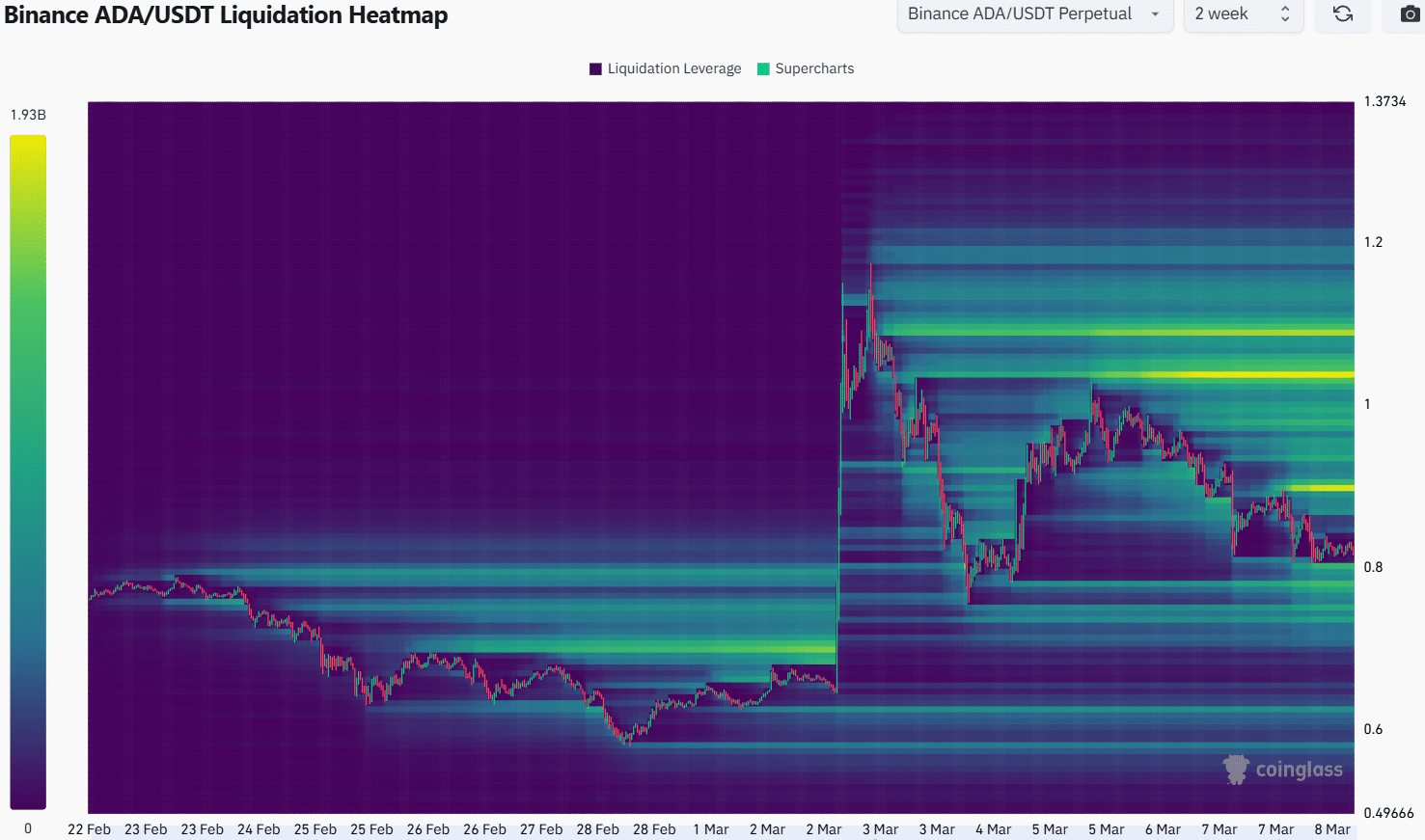

The 2 -week liquidation heat outlined other threats for Ada Bulls, apart from $ 1.2. The nearest, relatively dense liquidity bags were $ 0.78- $ 0.8 and at $ 9. That is why it can be expected that a move to $ 0.78 would probably be followed by a strong bounce of up to $ 0.9.

Further profit would depend on volume, sentiment and the state of the rest of the market, in particular Bitcoin [BTC].

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer