- Ethena had a bearish structure on the daily graph

- On the basis of local highlights, but it seemed unlikely that the prize could follow

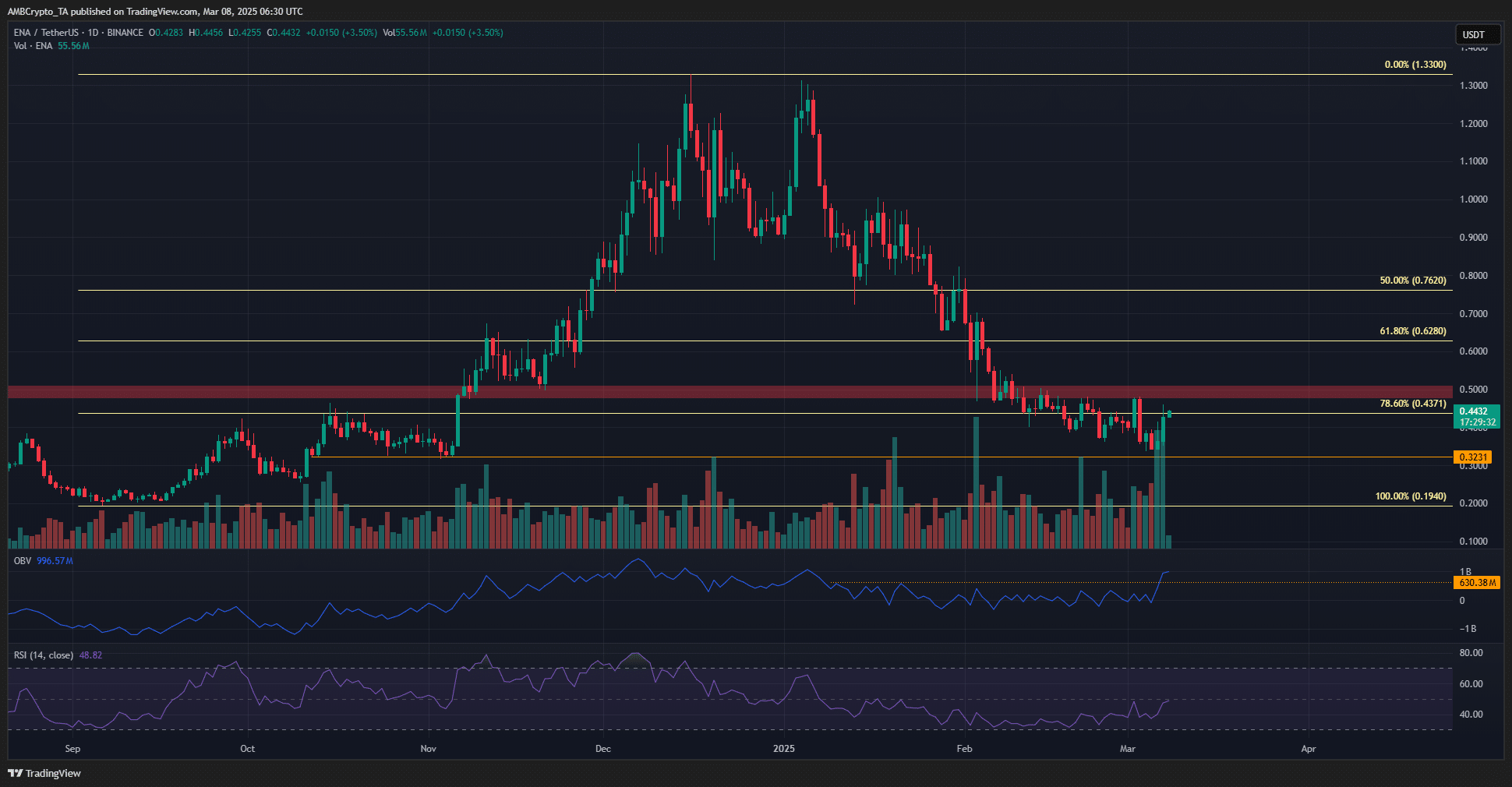

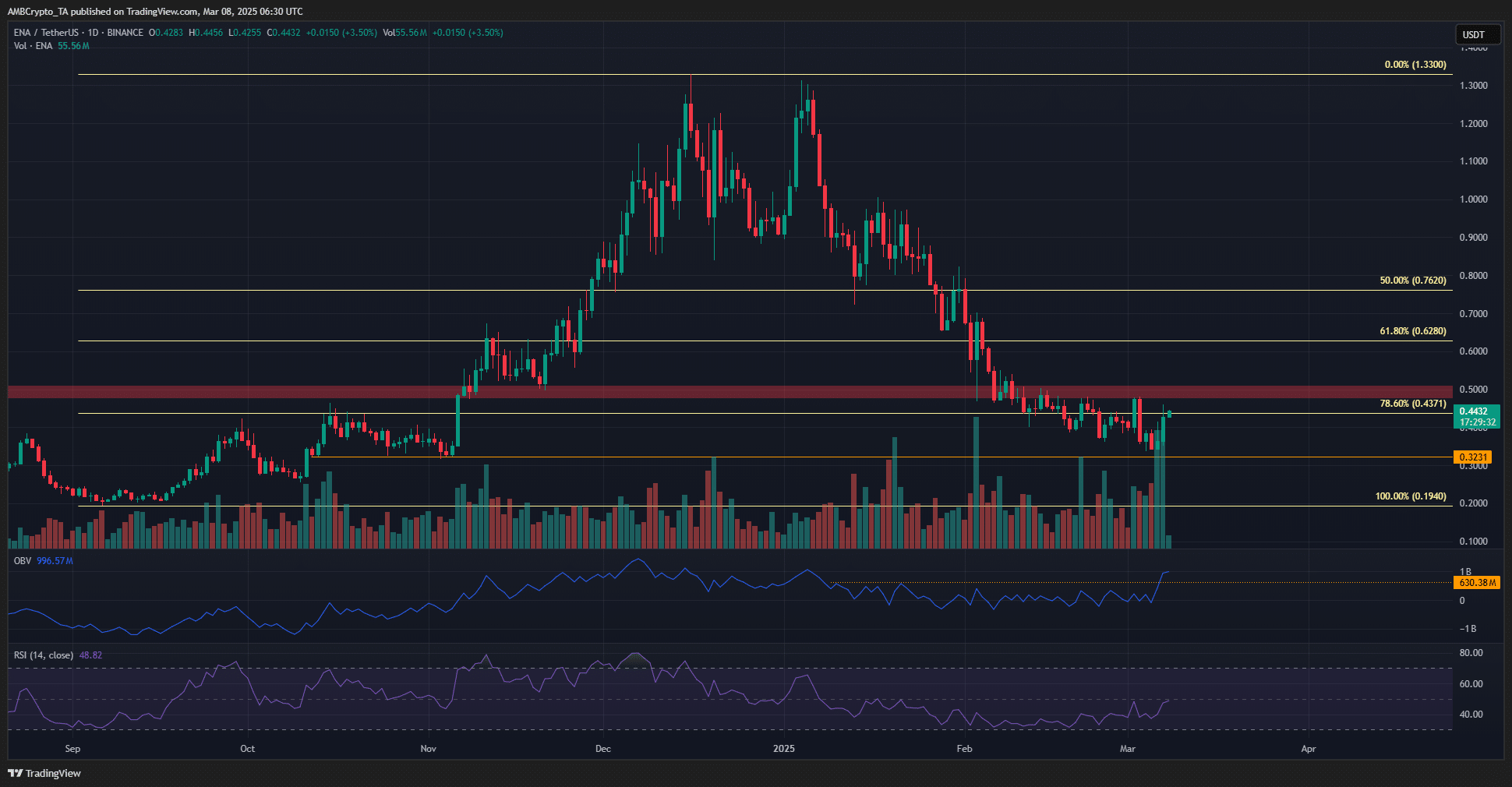

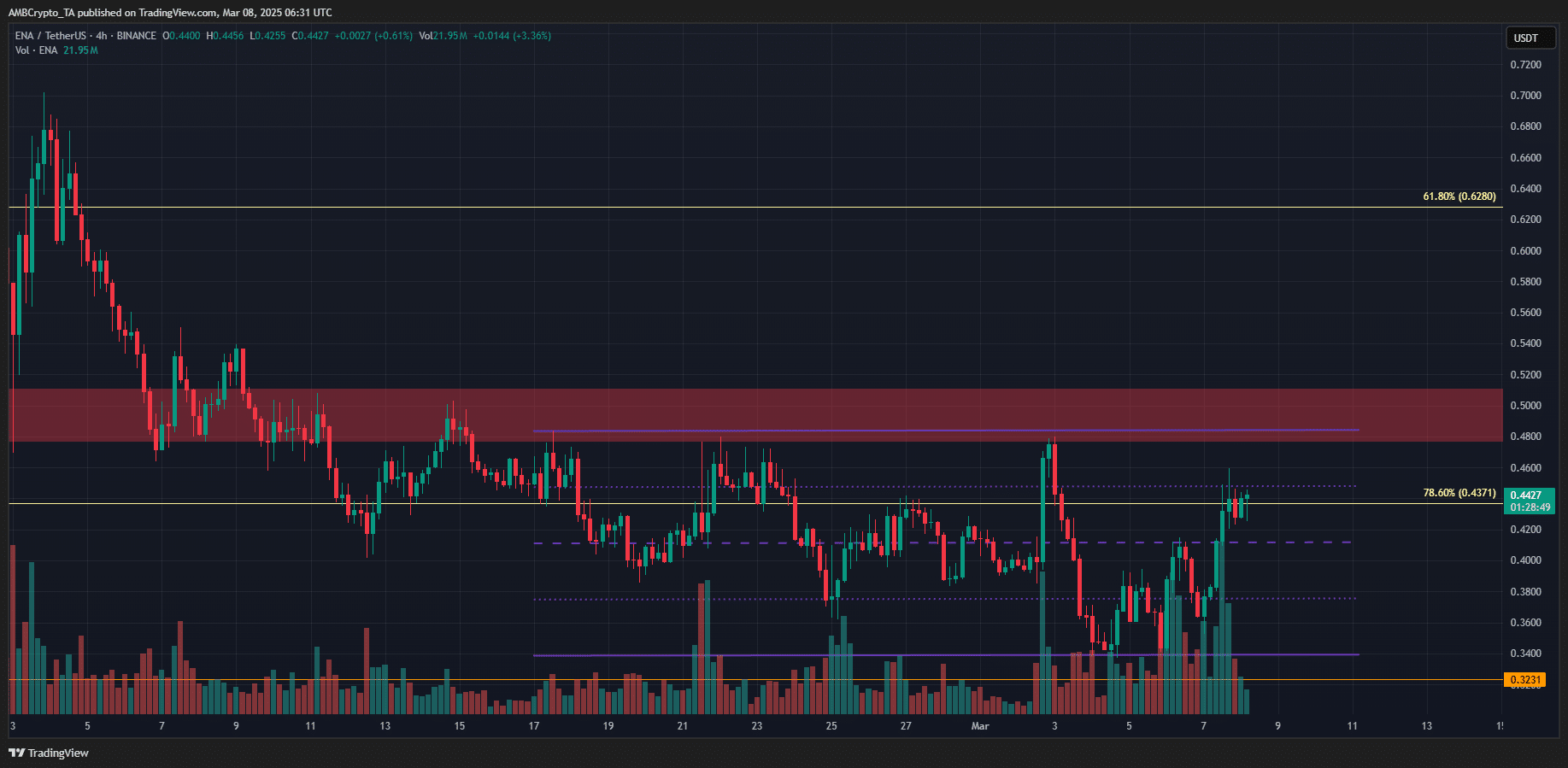

Ethena’s price [ENA] Fell under the $ 0.5 support zone in February, but the decline seemed to have stopped at the time of the press. In fact, a range of reach was spotted under the $ 0.5 resistance. This can offer traders profitable opportunities.

Bitcoin’s [BTC] Volatility can also play a role to play. The leading crypto in the world visited the resistance of $ 92.8K on Thursday 6 March and was again confronted with rejection. Will Ena also see a downward route during the weekend?

Ena -buyers now seem to have the upper hand

Source: Ena/USDT on TradingView

The market structure on the daily graph was Beerarish. In 2025, the prize only made lower highlights and lower lows. The most recent lower high was $ 0.48, and a daily session that would be close to it that would indicate a market structure shift.

The trade volume has been high in recent days, with the same reflected by the volume bars below the price. This intake of volume ensured that the BBV broke out after the local highlights of the past two months.

At the time of the press, the RSI also tested neutral 50 as a resistance, with a potential momentum shift around the corner. Together they lay on a bullish in the charts.

Source: Ena/USDT on TradingView

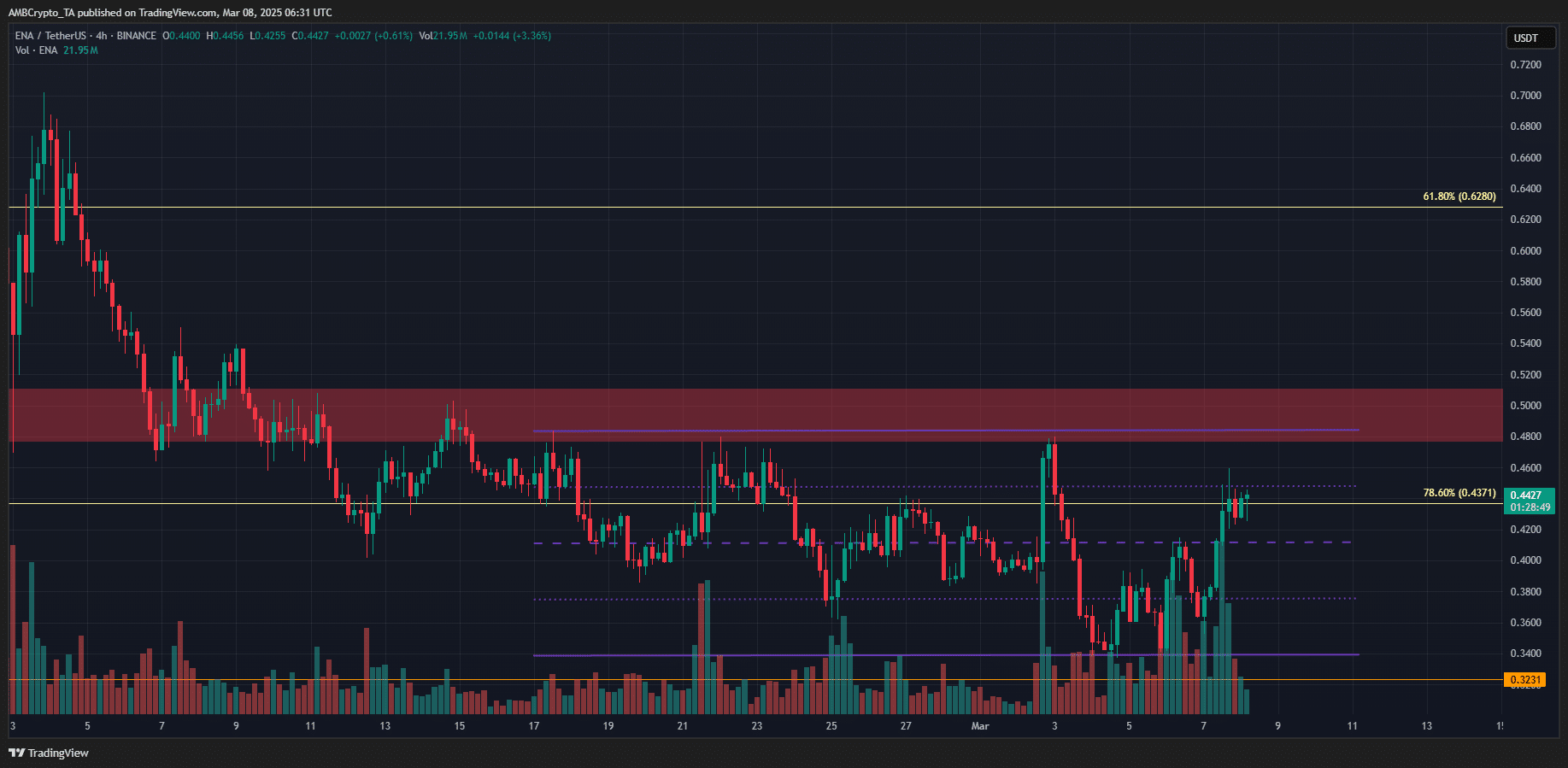

Zooming in on the 4-hour graph, we can see a range (purple) with the highlights within the $ 0.5 resistance zone. At the time of the press, ENA Bulls struggled with the 25% level of the range of $ 0.448.

Even if they succeed in overcoming it, a breakout may not be at hand. Despite the OBV-Breakout, traders must remain Beerarish and they want to sell the retest of $ 0.48- $ 0.5. This is because the higher bias remained for the Tijderish.

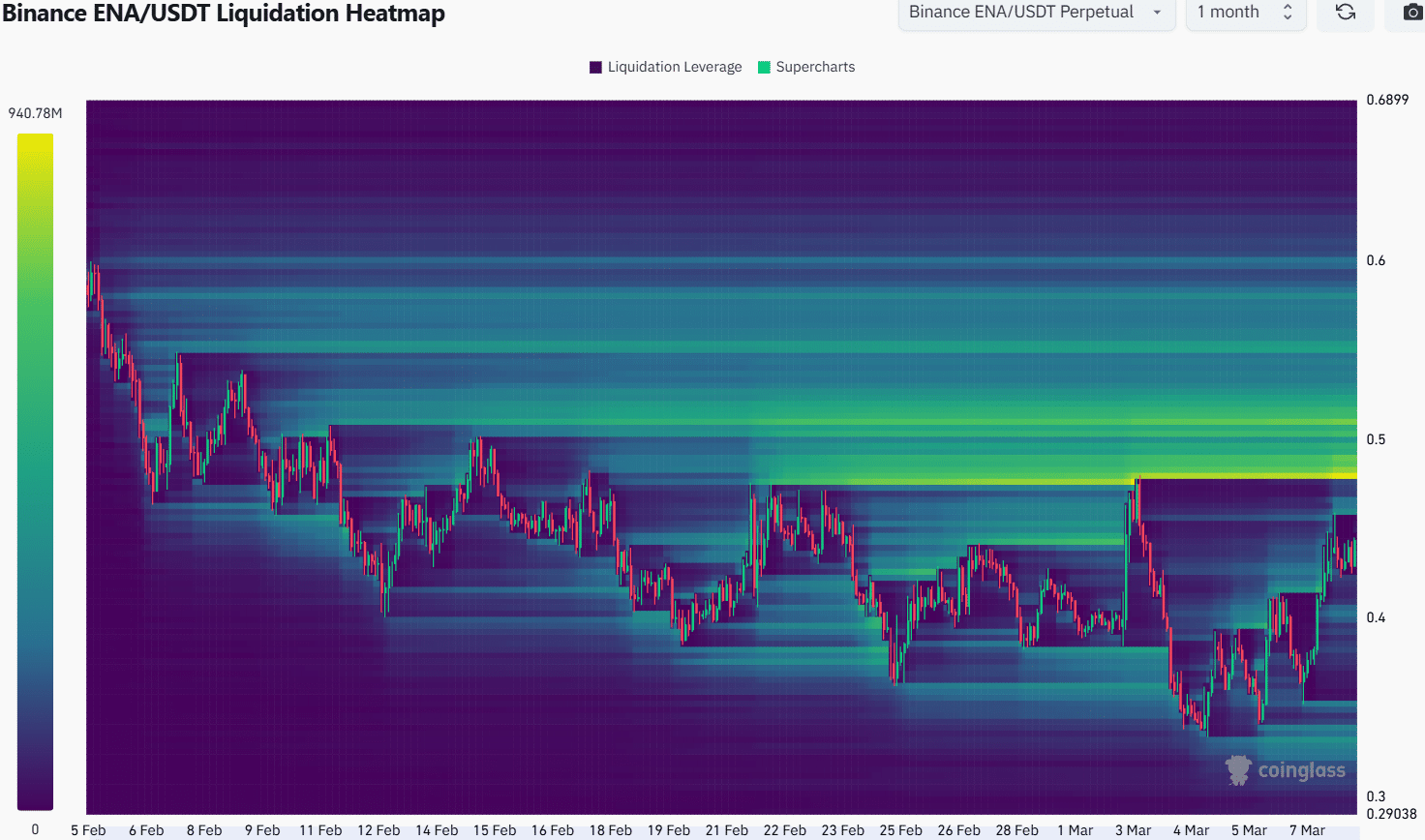

The liquidation of the past month emphasized the $ 0.48- $ 0.515 as a strong magnetic zone. That is why it is very likely that the price would test this region soon, because the price is attracted by liquidity. These liquidity clusters also formed prime converting areas.

Swing traders can use a movement than $ 0.515- $ 0.52 to set up a stop-loss if they wanted to sell. A step further than $ 0.52, the bearish idea would end up here. The middle reach level at $ 0.412 and the lows of $ 0.34 would be the bearish goals.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer