Bitcoin acts above $ 90k after experiencing extreme sales pressure last week, so that the price was as low as $ 78,100 and broke levels due to the most important demand. However, the market recovered soon after President Trump’s announcement that he is planning to set up an American strategic crypto reserve, including Bitcoin and Select Altcoins such as XRP, SOL, Ada and ETH. This statement injected trust back into the market and fed Bitcoin’s rebound.

Related lecture

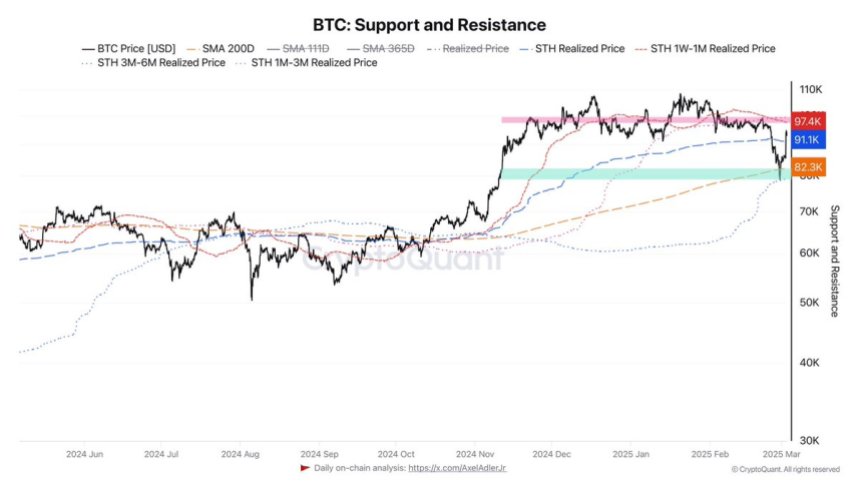

Despite this recovery, the road remains uncertain because Bitcoin is confronted with important technical levels that can define the next step. According to the data from top analyst Axel Adler over X, Bitcoin is currently traded at $ 92k, with support levels that rest around the 200-day simple advancing average (SMA) at $ 82,314 and the realized price for short-term holders in the reach of $ 79,290. At the resistance side, Bitcoin must break the realized price for short -term holders in the reach of 1 weeks to 1 months at $ 97,478 and the reach of 1 months to 3 months at $ 99,395.

Since Bitcoin continues to stabilize above $ 90k, analysts believe that an outbreak above $ 100k can cause a renewed bullish momentum, while not holding the above important support levels can lead to a different wave of sales pressure. In the coming days, it will be crucial in determining the next major movement of Bitcoin.

Bitcoin -Price promotion remains uncertain

Bitcoin is about to enter a critical phase while the market of fear to excitement shifts after the announcement of President Trump of an American crypto -strategic reserve. The announcement has brought Bullish sentiment to the market, with Bitcoin increasing more than 12% since the news broke out. Only three days ago Bitcoin broke under the most important levels of demand, and now speculation is growing about the potential for a huge bull run.

Market sentiment reversed from extreme bearish to bullish within a few hours, the argument reinforces that Bitcoin stays in a strong uprising. Analysts keep a close eye on to determine whether BTC can keep this momentum. Adler’s insights on X It appears that Bitcoin is currently trading at $ 92k, with critical support that is around the 200-day Simple Moving Average (SMA) at $ 82,314 and the price realized for short-term holders in reach of 3 to 6 months at $ 79,290.

At the resistance side, Bitcoin must break the realized price for short -term holders in the reach of 1 weeks to 1 months at $ 97,478 and the reach of 1 months to 3 months at $ 99,395. In addition, the short -term holder realized the price for $ 91,096K as a local support level.

Although the price promotion has improved considerably, some analysts warn that BTC has to retain above $ 90k to maintain bullish momentum. The Futures market also remains stable, without significant lever building, which reduces the chances of sudden liquidations. Investors keep a close eye on the range of $ 97k – $ 100k, because it can cause an explosive rally above.

Related lecture

The market is warmed up quickly, but the big demand remains: can BTC recover $ 100k this week? With renewed optimism and rising speculation, all eyes are focused on Bitcoin’s next move.

Price promotion Details: holding key levels

Bitcoin is traded at $ 91,800 and has above the most important $ 90k marking after a sharp recovery of last week’s extreme sales pressure. The price struggled below this level for several days and fell to $ 78k, which brought speculation that Bitcoin could enter a bear market. Bulls, however, have recovered some control and Bitcoin has succeeded in stabilizing above this crucial demand zone.

This recovery has shifted the market sentiment, where many analysts are now considering the possibility of a renewed bullish phase. If BTC continues to hold up to $ 90k in the coming days and pushes to $ 95k, this could be the scene for an attempt to reclaim the psychological $ 100k level. Breaking above this milestone would probably confirm a complete recovery and indicate the continuation of Bitcoin’s long -term uprising.

Related lecture

Restoring the $ 90k level again can cause bulls problems. A breakdown under this key support can restore the bearish -momentum, so that BTC may be sent back to the $ 85k or even $ 80k regions. The coming days will be crucial, because bulls try to solidify their position and push BTC to a stronger recovery phase. All eyes are now focused on whether Bitcoin can retain this level and build up Momentum for another rally.

Featured image of Dall-E, graph of TradingView