- February 2025 saw steep falls for Bitcoin and Ethereum, so that investors are worried about March.

- Historical trends suggest that March could bring more weakness for both BTC and ETH prices.

February 2025 has been a brutal month for the market, with both Bitcoin [BTC] and Ethereum [ETH] Seeing their steepest falls in more than ten years.

While the two dominant forces are struggling in space to regain the momentum, the uncertainty is great about the future of the market.

With historical data that point to March as a typical weak month before Crypto, investors wonder if this recent decline is just the start of a longer slump or whether a recovery on the horizon is.

BTC and ETH performance

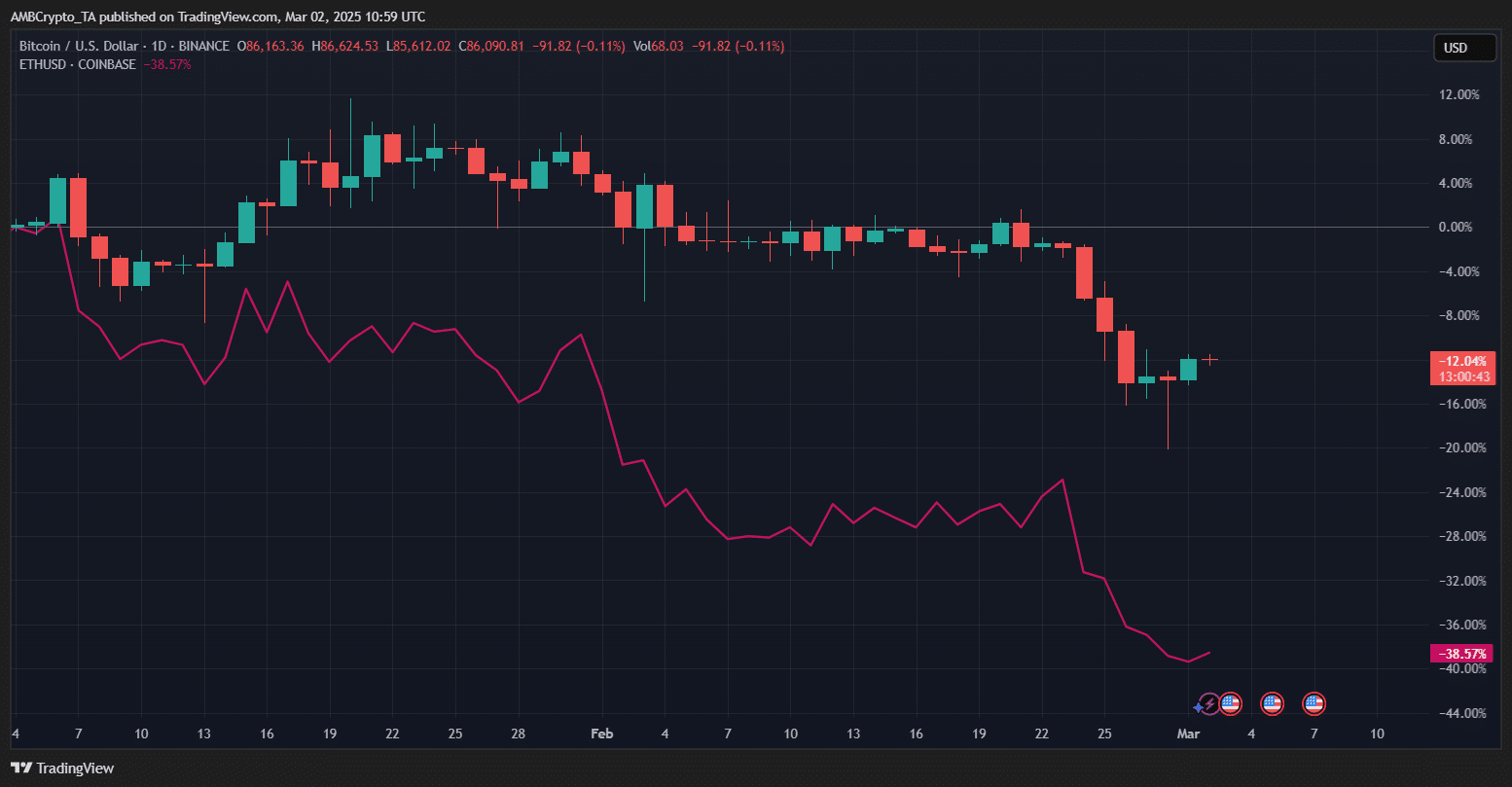

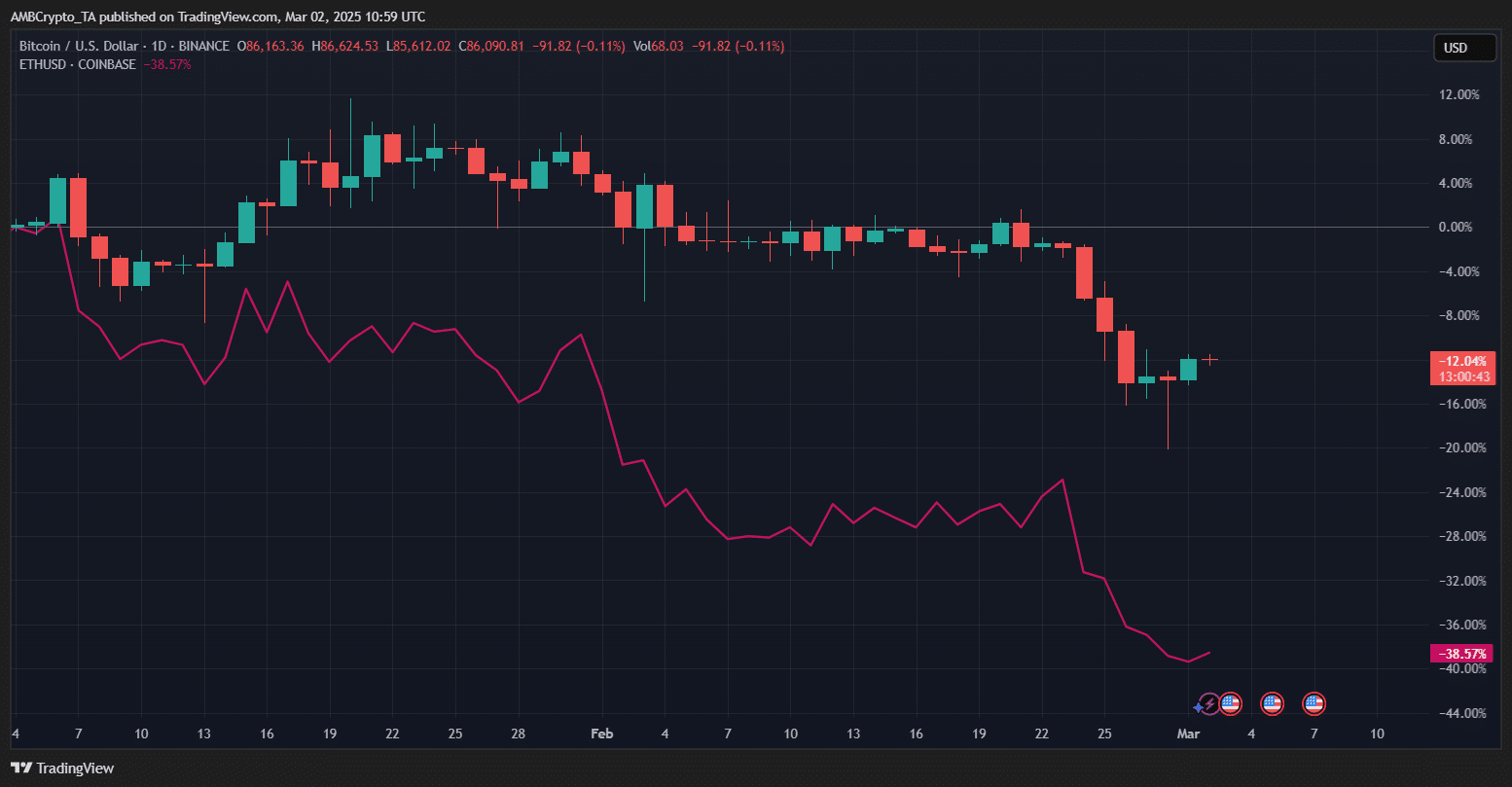

February 2025 was characterized by raised volatility for Bitcoin and Ethereum, with both assets that are confronted with significant corrections.

BTC started the month strongly, floating in the vicinity of local highlights, but Beerarish pressure gradually took over, which led to a steep fall of more than 12%.

Source: TradingView

In the meantime, ETH struggled even more and BTC performed with a stunning decrease of 38%.

The growing gap between the two suggests the change of investor sentiment, possibly powered by liquidity problems and sector -specific weaknesses.

While BTC found some support, Eth’s sharp decline raises questions about its resilience in the midst of broader market turbulence.

Weakness of March: a historic trend

Bitcoin and Ethereum have Historically little lighting offered In March. The average return of BTC was only 3.42%, with a median of 0.51%, which in many years indicates damped or negative performance.

ETH did a little better with an average return of 8.22%, but the median of 1.80% suggests inconsistency.

Source: X

BTC posted fads in 2014, 2015, 2018 and 2020 in particular in March, while ETH suffered in 2018 and 2022.

Given BTCs -17.39% and ETHs -31.95% Reden February in 2025, historical data continued caution for March, which strengthens a seasonal weak period for both assets.

Bitcoin and Ethereum: Can they return in March?

Bitcoin goes to Mars after a brutal February and left 17.39% – one of the worst monthly versions in recent years.

Historically, March has been a weak month, with an average return of -0.39% and a median of 0.51%, strengthening the concern about constant downward pressure.

Source: TradingView

From a technical point of view, BTC struggles under its 50-day SMA ($ 97,570.68) and floats near his 200-day SMA ($ 82,231,19).

The RSI at 36.85 suggested that it was still active in Bearish territory, but not yet deeply sold. A brief strout of the $ 80,000 support zone is visible, but the wider trend stays down.

Obv with -92.82k reflected weak accumulation, so that the chances of a strong recovery are further dimmed.

Unless Bitcoin is important levels above $ 90,000 with volume support, any short-term rally can be reached with sales pressure.

Source: TradingView

Ethereum did it even worse than Bitcoin in February and crashed 31.95% – the steepest fall for the month in its history.

Historically, March was faint for ETH, on average 2.82%, but the median return of 1.18% suggests mixed performance.

The technical means painted a similar bearish statue. ETH remained considerably under the 50-day SMA ($ 2,890.37) and 200-day SMA ($ 2,926.03), with the RSI at 37.82, which showed a mild recovery of over-sold circumstances.

The OBV at 10.61m suggested some accumulation that could help stabilize ETH, but the momentum remained weak.

To break Ethereum from his malaise, it must regain the $ 2,500- $ 2,600 zone and see a stronger purchase volume. Otherwise, all rebounds can be short -lived in March.

Investor sentiment and market psychology

During the decline of the market, investors psychology plays a crucial role in shaping a price action. Fear, uncertainty and doubt (FUD) often lead to panic sales, the worsening of falls outside of fundamental justifications.

As the prices fall, retail investors tend to capitulate, while institutional players are looking for submissions.

Current sentiment suggests caution, but no outright capitulation. However, if macro -economic worries continue to exist, sentiment can become overly bearish and create opportunities for Contrarian buyers.