- BTC has made a moderate recovery in the past day and rose by 1.55%.

- Sellers still dominate Bitcoin markets, and it seems that a short squeeze has led to a recovery in the short term.

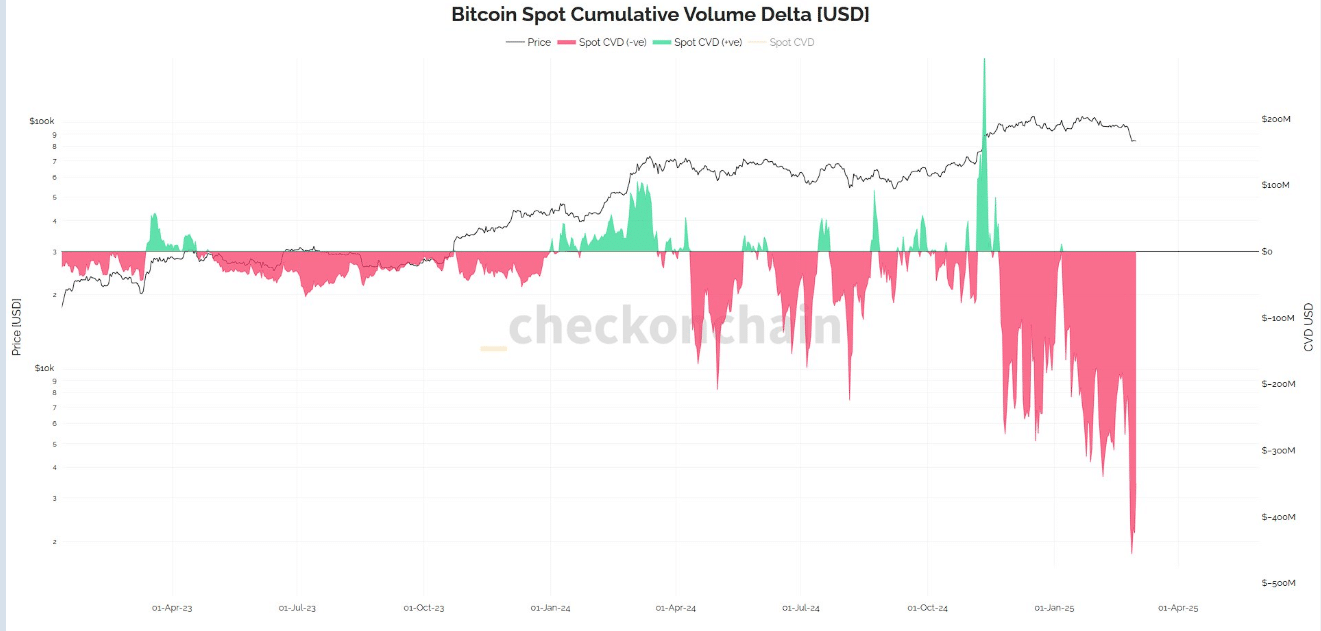

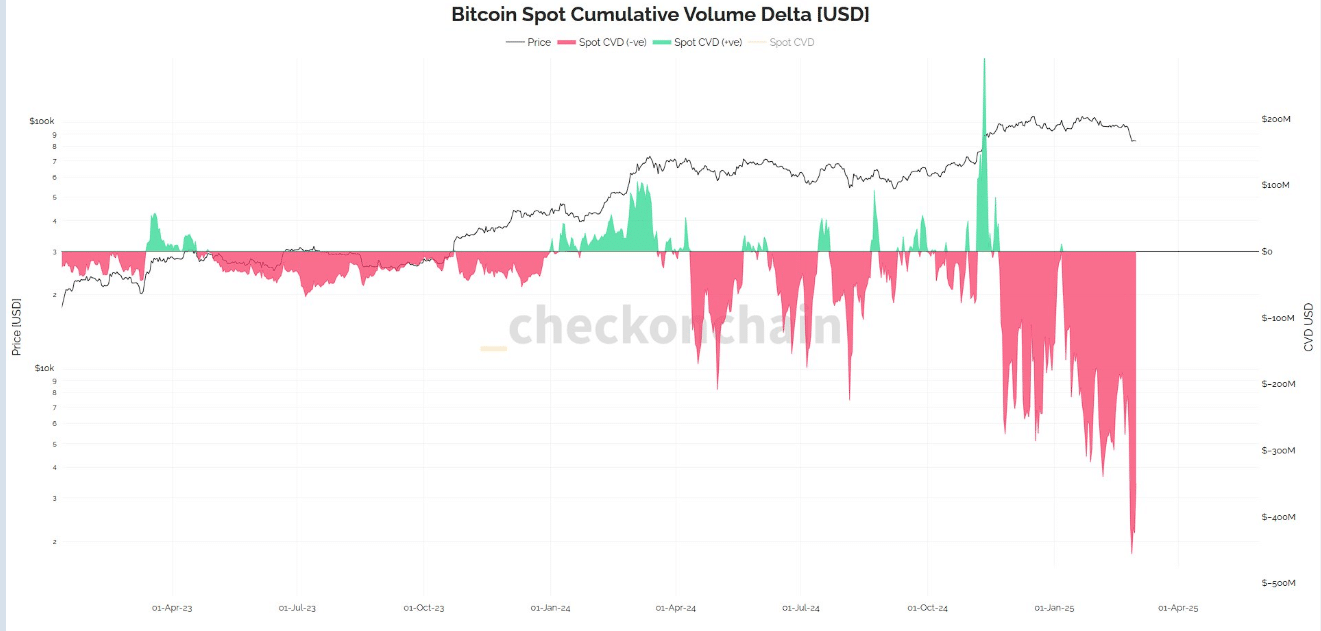

Bitcoin’s [BTC] Market dynamics has taken a dramatic turn, in which sellers dominate the scene as BTC’s cumulative volume delta [CVD] Dives to his most negative level.

This signals intense sales pressure, historically a precursor to decrease further. However, a short squeeze can shift the momentum, which activates a surprise repair that BTC pushed back to $ 86,259.

Bitcoin CVD hits the highest negative area

In the past month, Bitcoin has had one of the worst performance in recent years and fell by 17% in February.

BTC saw this drop of 4 months. However, this trend is reversed, with Bitcoin reclaiming $ 86259 from this writing.

Despite this recovery in the daily graphs, sellers are still heavily active in the market, as is the case of the falling CVD.

In fact, Bitcoin’s place has refused the cumulative volume delta to touch its most negative area.

Such a huge decrease means that the market is carrying out more sales orders than buying orders, suggesting that more investors are selling their BTC.

Source: Checkonchain

Since CVD usually follows cumulative sales V Purchase volume, an extremely negative level indicates that selling Momentum outweighs the buying, which usually reflects strong market preparation.

Historically, when sellers dominate the market, further price decreases preceded if Bitcoin is struggling to find strong support. This decline led more traders to take short positions because they expected prices to fall further.

However, the sudden demand for shorts seems to have resulted in the reverse effect, resulting in a short squeeze.

Has BTC experienced a short squeeze?

While Bitcoin experiences higher sales orders, the markets indicate a recovery in the short term. As such, the short -term conditions suggest that BTC could achieve a moderate profit on its price charts.

This means that although CVD has reached its highest negative value, it seems that Bitcoin has experienced a short pinch, because the demand for BTC among traders has risen and has risen.

This led to the price repair that was observed in the past day.

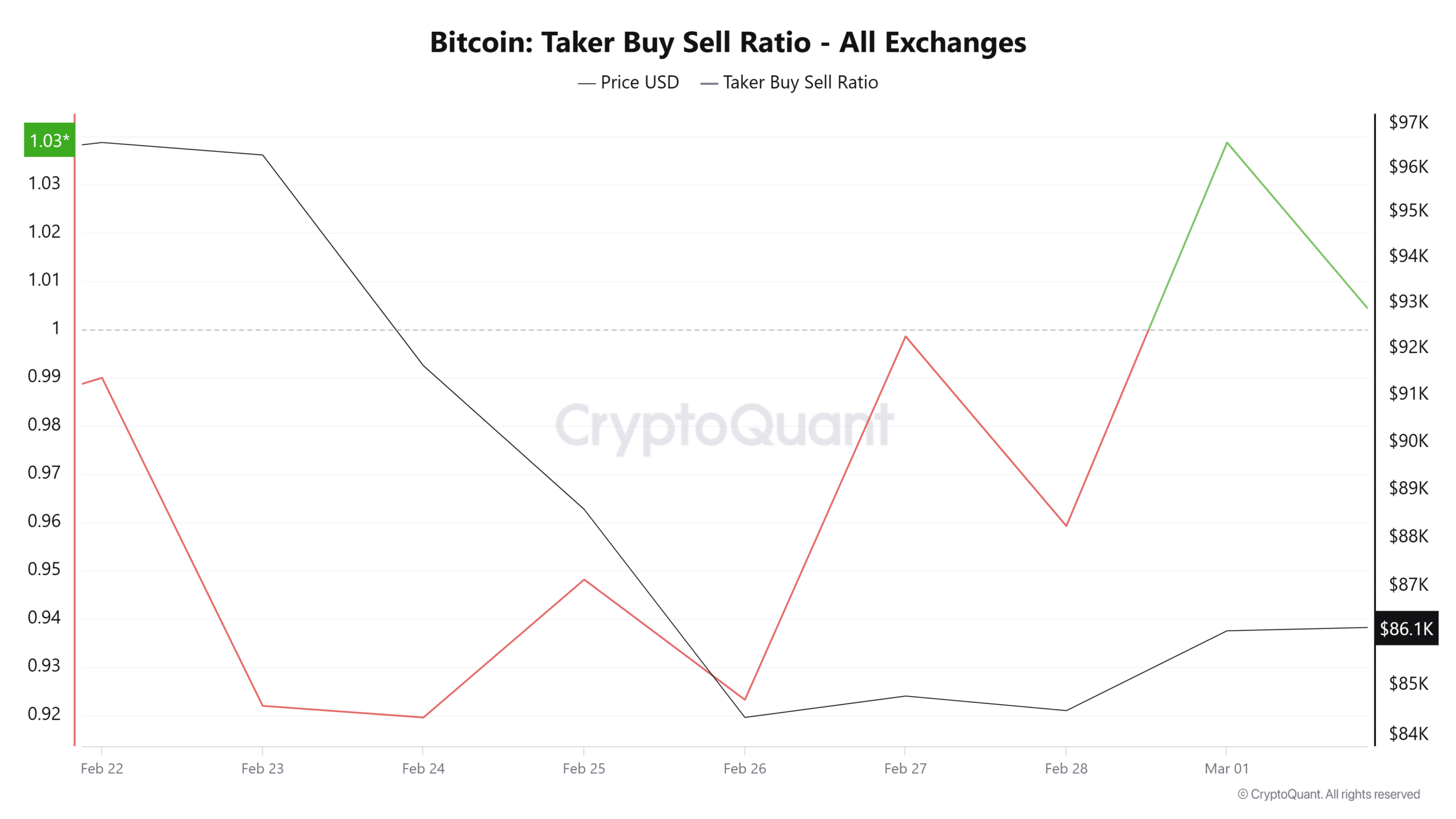

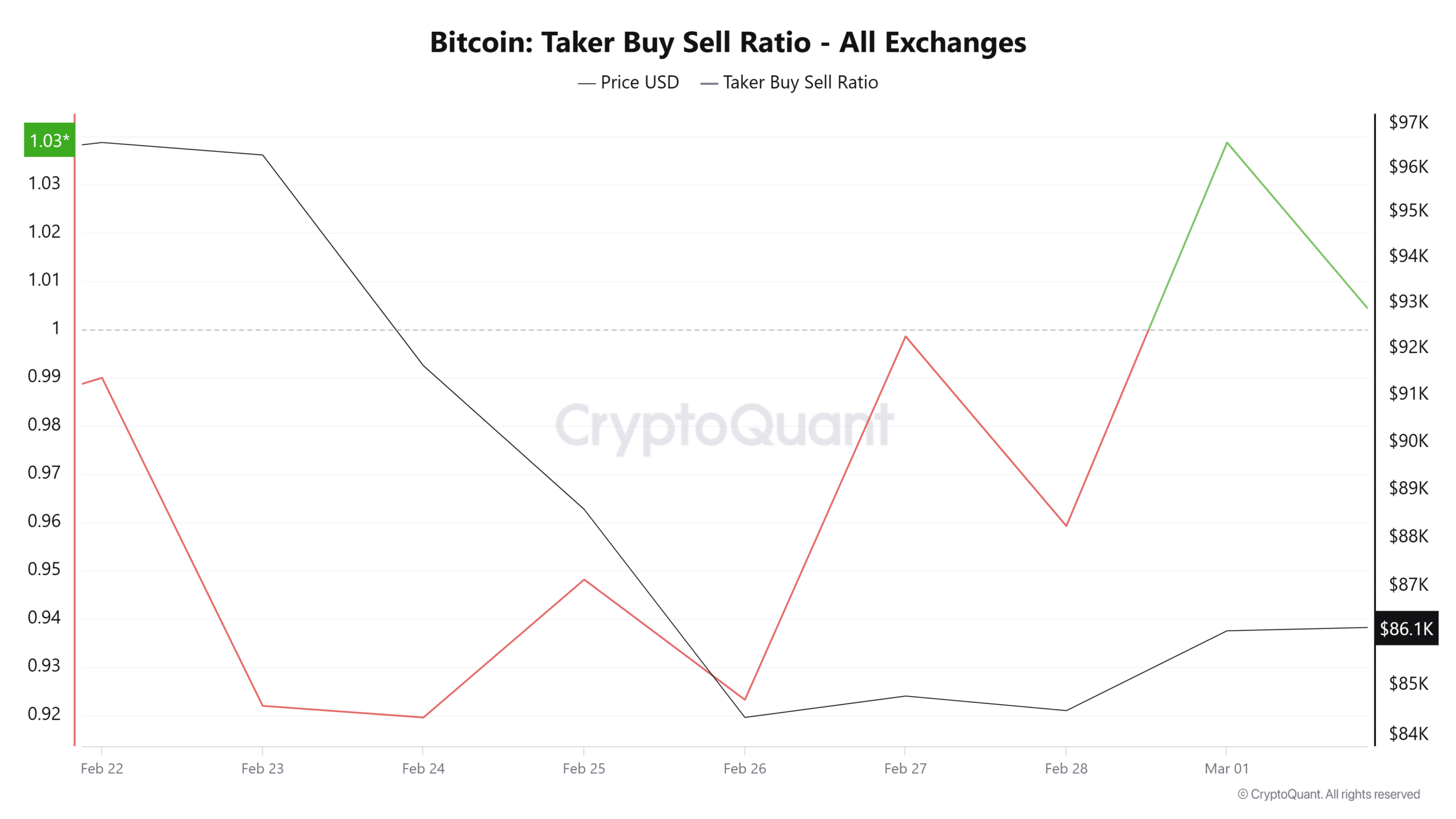

Source: Cryptuquant

This sudden shift in sentiment stems from an increasing demand for futures. The increase in buying orders is apparent from the high demand for futures as traders started.

These buyers entered the market and have absorbed the high sales pressure that results from the negative CVD. As such, the Buy-Sell Ratio of Taker has become positive for the first week.

Source: Cryptuquant

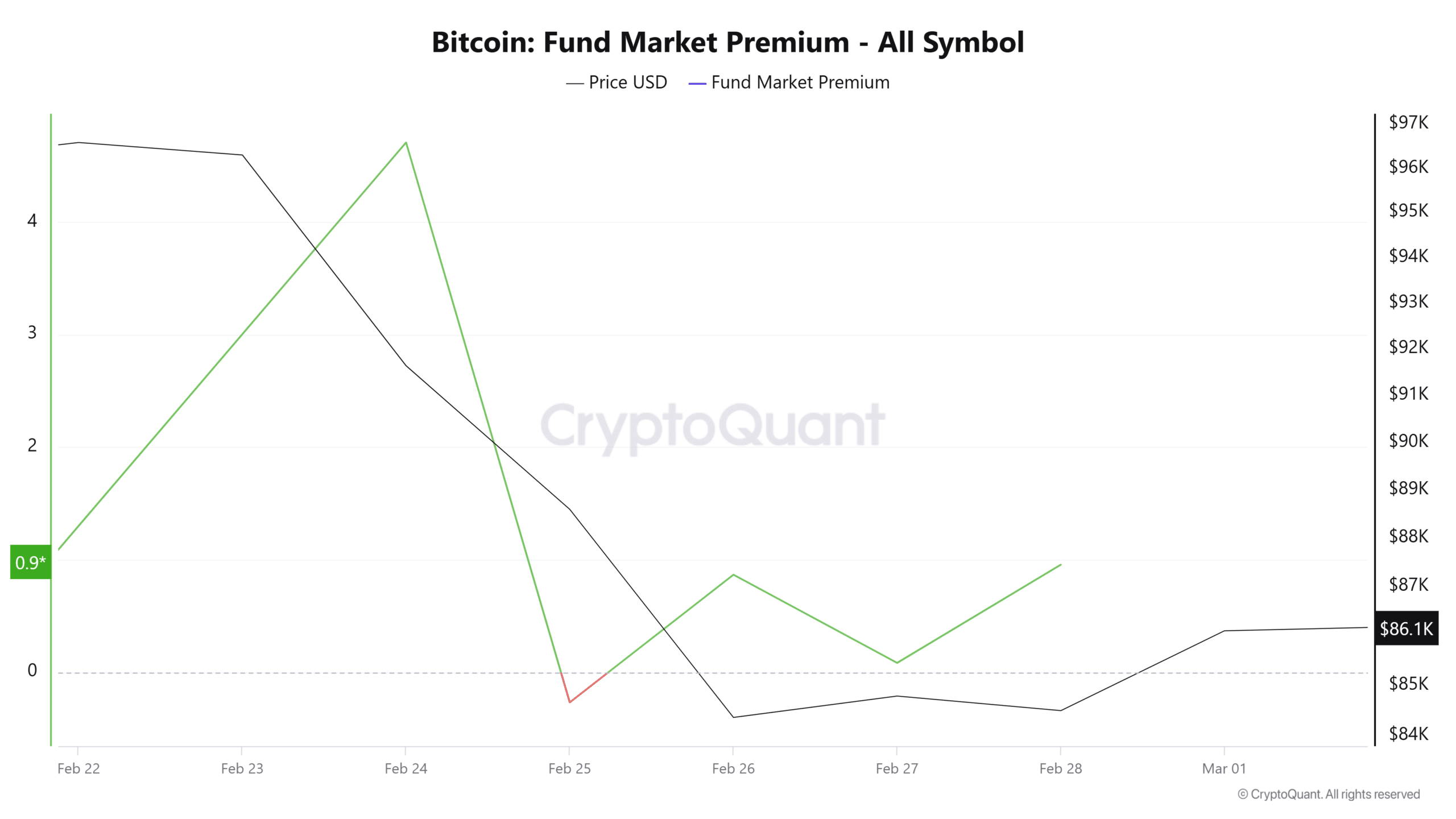

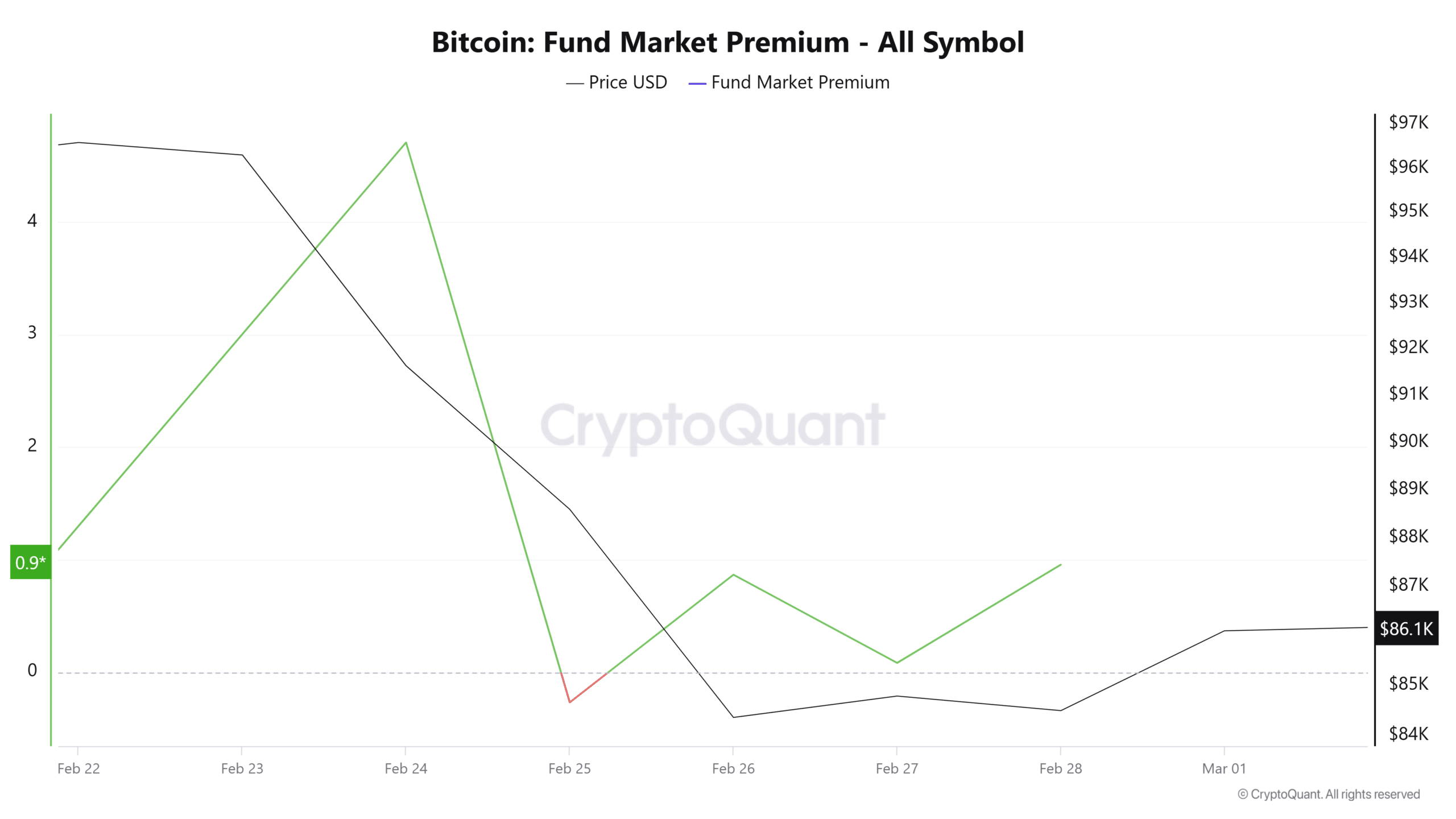

Moreover, Bitcoin’s fund market premium has become positive, which suggests that the Futuresmarkt Bullisher is than the spot market.

Bitcoin traders in Futures are therefore willing to pay a premium allowance to set their positions. This indicates that Bitcoin is currently experiencing a high demand for lifting tree positions.

Simply put, Bitcoin has seen sellers dominate the market, who has motivated traders to take short positions.

However, this resulted in a high demand for short positions, which resulted in a short squeeze and led to recovery, as witnessed last day.

With the demand for futures, BTC was able to see a short -term recovery to $ 89,300. With sellers who dominate the market, however, BTC can fall if the market shock is witnessed in the past day, to $ 83,400.