- The strongest resistance for Bitcoin is $ 97,828, where 360,470 BTC was collected

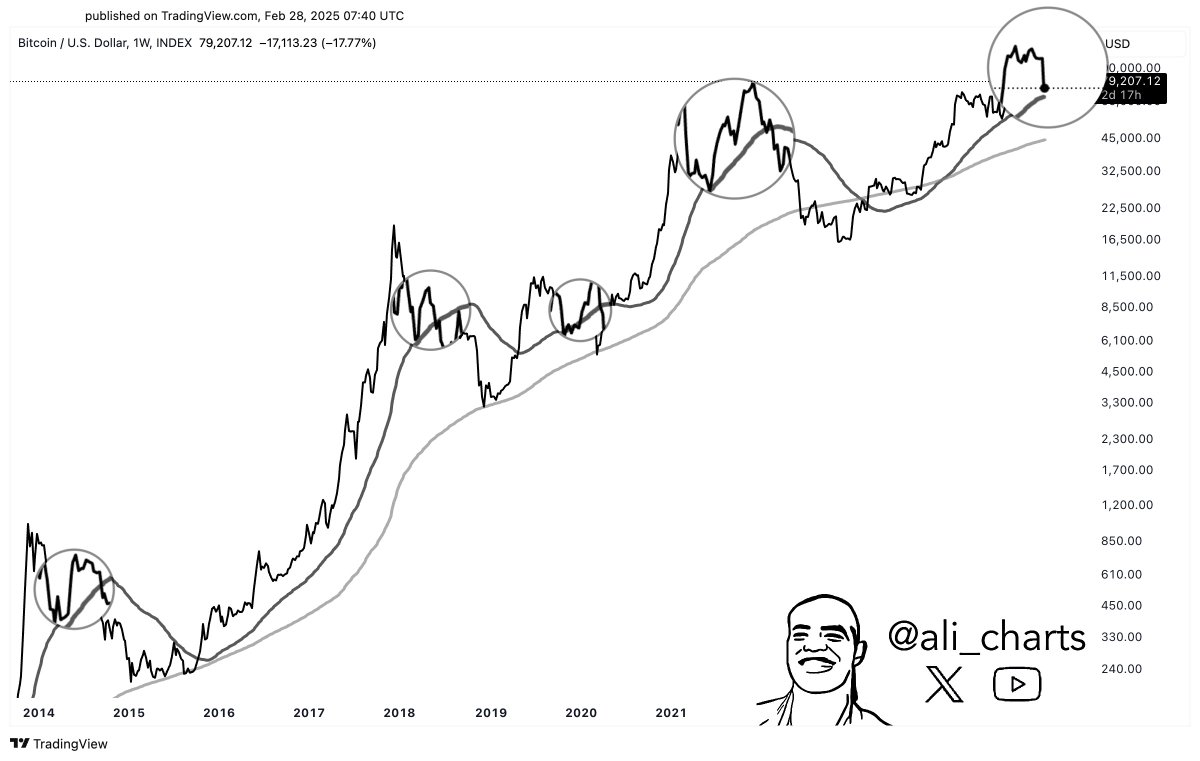

- Bitcoin often bounces from the progressive average of 50 weeks, which is now $ 74,700

Bitcoin’s [BTC] Cost -based distribution card emphasized two critical levels – strong resistance to $ 97,828 and considerable support at $ 64,078. About 360,470 BTC were collected at resistance level, making it an important psychological and technical barrier.

Historically, the price is struggling to break with high density beyond such battery zones, unless there is an increase in question whether a strong catalyst is. A bull’s cycle or an increase in ETF intake can also be huge catalysts for the aforementioned break.

Conversely, the support level of $ 64,078 194,530 BTC applies, which indicates a considerable area where buyers have been in historically to prevent further decreases.

According to the price structure, Bitcoin gathered in September 2024 from $ 55,000 to peak above $ 108,000 in the early 2025, with a strong momentum en route.

Source: X

The heavy purchasing pressure in the $ 60,000 to just less than $ 75,000 suggested that many investors have taken over BTC in this bracket. The latest Retracement of the Crypto of highlights near $ 100,000 brought BTC back to the upper tires of this high-support zone.

If Bitcoin fails to reclaim $ 97k, this risks further corrections to $ 75k before it re -testing the $ 64k zone. A break below this level would further confirm downward potential, so that BTC may be dragged to $ 55k.

On the contrary, a strong outbreak above $ 97k could activate a renewed upward trend, aimed at new highlights above $ 108k.

Where will BTC first strike?

A further analysis showed that Bitcoin’s historical trend often finds support with the advancing average of 50 weeks, which is currently $ 74.7k. In fact, BTC tested the MA in every cycle after a strong rally before he continues his upward process.

For example – Bitcoin approached this advancing average in 2015, 2019 and 2021, in which each copy led to a substantial price bumper. At the time of writing, BTC was withdrawn from his recent high near $ 97,000, all while he went to the $ 74,700 support zone. This, despite his recent efforts on recovery.

Source: X

If BTC holds around $ 85k above its current level, a rebound and possibly a retest of the $ 90k resistance could follow. However, if the crypto loses this support, a deeper retracement to $ 64k is probably a level where large quantities of BTC were collected.

A break under $ 64k would shift the Beerarish market sentiment, which may activate a larger correction. Conversely, the recovery from $ 97k and retaining would increase the chance of new all-time highlights more than $ 108k.

With Bitcoin who bounces historically on this key -to -be -tracing average, in the coming weeks will be crucial to determine whether it will continue his bullish cycle or enter a long -term correction phase.