Este Artículo También Está Disponible and Español.

The largest cryptocurrency in the world, Bitcoin has immersed A dramatic 11% of all time. Although some investors find this price devaluation alarming, historical data indicates that it is really small with regard to the other market cycles of the cryptocurrencies.

The earlier Bitcoin prize trends show various abrupt decreases and increases; Volatility is always present. One must take into account the context of this most recent decline to evaluate the future course.

Related lecture

Historical context of Bitcoin corrections

Bitcoin has seen many corrections since its foundation. For example, between January 2012 and December 2017, the value of the Alpha Coin fell more than 10% at least 13 times. Some corrections have caused market value losses of billions of dollars before they have made decent rebounds; Some have even reached 20% or more.

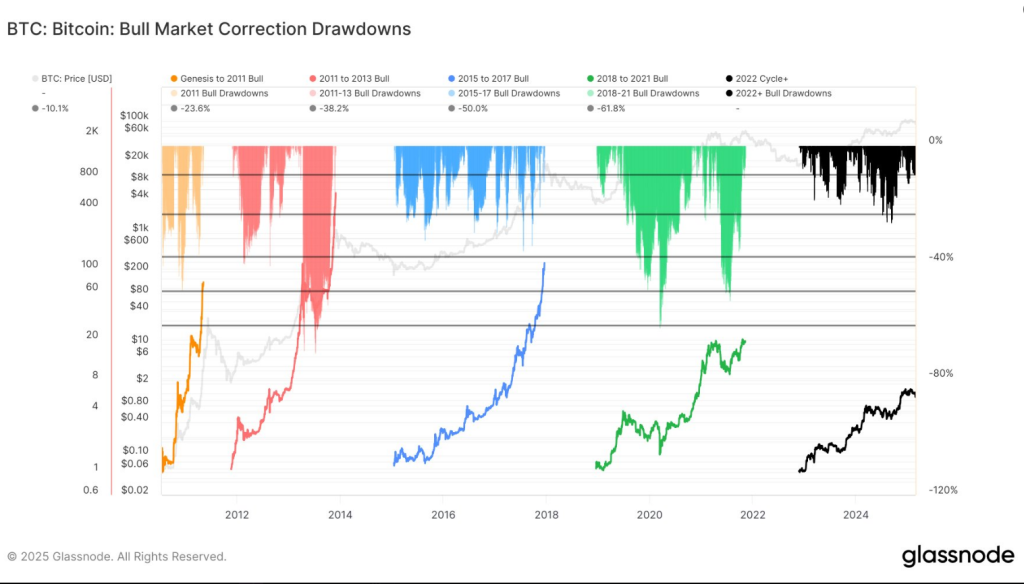

The fact that the current Bitcoin market cycle is less volatile than previous bull runs is one of the most remarkable functions. The following Drawdown patterns are seen in historical data from earlier cycles:

This cycle remains the least volatile of all:

🔹2011-2013: AVG. -19.19%, max. -49.45%

🔹2015-2017: AVG. -11.49%, max. -36.01%

🔹2018-2021: AVG. -20.41%, max. -62.62%https://t.co/iszhpa3cas pic.twitter.com/jfhma5j3kv– Glassnode (@glassnode) February 26, 2025

In the course of time, Bitcoin has shown his ability to recover and set new record heights; These fluctuations are inevitable in the nature of its market action. Even in bull markets, Bitcoin regularly undergoes short falls that help shake weak hands before it goes back to its increasing process.

Current market conditions

On February 27, 2025, Bitcoin traded at $ 85,800, which represents a 4% decrease compared to the close of the previous day. The Intraday High was $ 89,230 and the intraday layer was $ 82,460. The most recent decrease of 15% in the weekly frame exceeds the average draw of the cycle of 8.50%, but is considerably less than the decrease of 26% in earlier cycles.

Compared to other corrections, which have often lasted months, it is very modest. Many analysts claim that it is not a sign of a deeper market for market, but rather a natural part of the Bitcoin cycle.

In the meantime, according to analysis of the chain, unless Bitcoin Quickly bounces back over the level of $ 92,000, there is a chance that lower lows will continue to exist in the near future.

This barrier is crucial because it represents the moment at which most traders reach profitability in the short term. As an alternative, if they reduce their losses, Bitcoin can reduce to $ 70,000 or $ 71k.

Factors that influence the recent decline

The price of Bitcoin has fallen for a number of reasons. As always, sentiment is a major factor in the Bitcoin market, and even small changes in investor confidence can cause large price fluctuations.

Panic has also been sold because of concerns about security, especially after the Bybit HackThat cost the crypto exchange $ 1.5 billion in losses.

Inflation -fears, the policy of the central bank and the global economic uncertainty have also ensured that investors are more careful with risk assets. This external pressure often stimulates the volatility of Bitcoin, making the price very reactive to changing financial circumstances.

Related lecture

Based on how it has behaved in the past, the growing cycle of Bitcoin Dips seems to contain, although it is currently falling. It slowly improved after years of losses and reached the highest point after consolidations.

Featured image of Reuters, Graph of TradingView