- The price fall in BTC will continue to exist, despite a strong dip purchase interest of retail traders, which expresses concern about further disadvantages.

- Liquidations have been blamed if Bitcoin is struggling to regain the momentum, which suggests that increased volatility in the upcoming sessions.

Bitcoin [BTC] Has confronted in recent days with a continuous fall in price, even if retail traders buy the dip aggressively.

The market has shown a strong contrary behavior, with the prices moving towards the expectations of the crowd.

Historically, Rebounds fade away for once the enthusiasm for dip-purchasing. However, the current trend suggests that optimism among retail investors remains high despite the continuous drawing.

Retail sentiment and purchase activity

According to Social sentiment dataEntries of ‘buying the dip’ have risen in recent days, coinciding with the continuous decline of Bitcoin.

Historically, price soils tend to form when the interest of the retail trade decreases, but the persistent optimism has not produced the expected bounce.

Source: Santiment

Instead, traders who expect an immediate reversal have seen the price of Bitcoin fall further, which means that the tendency of the market to strengthen the reclamation.

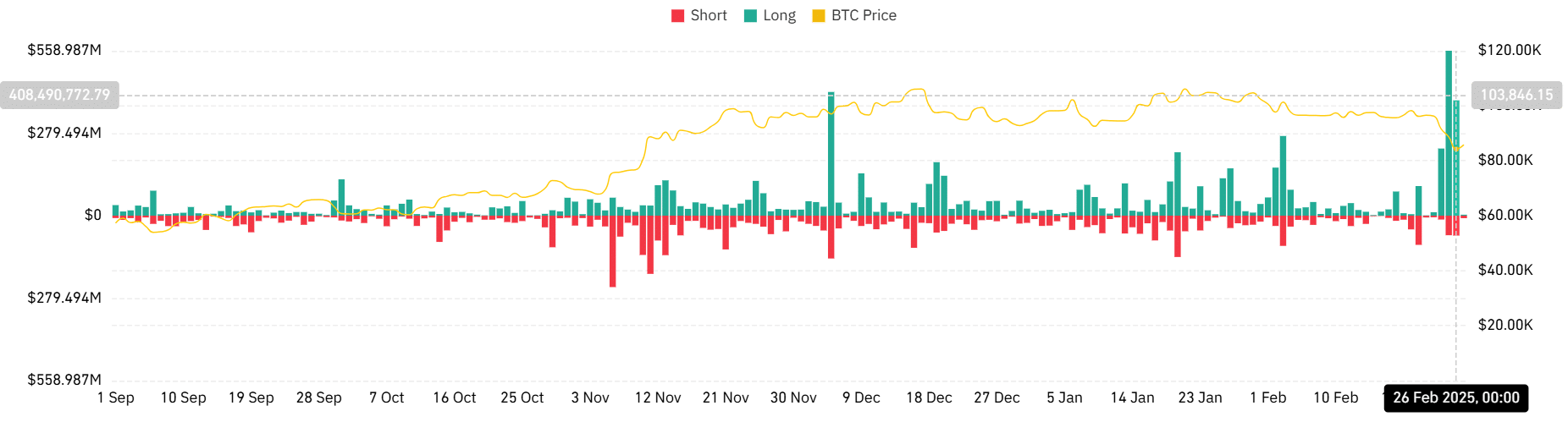

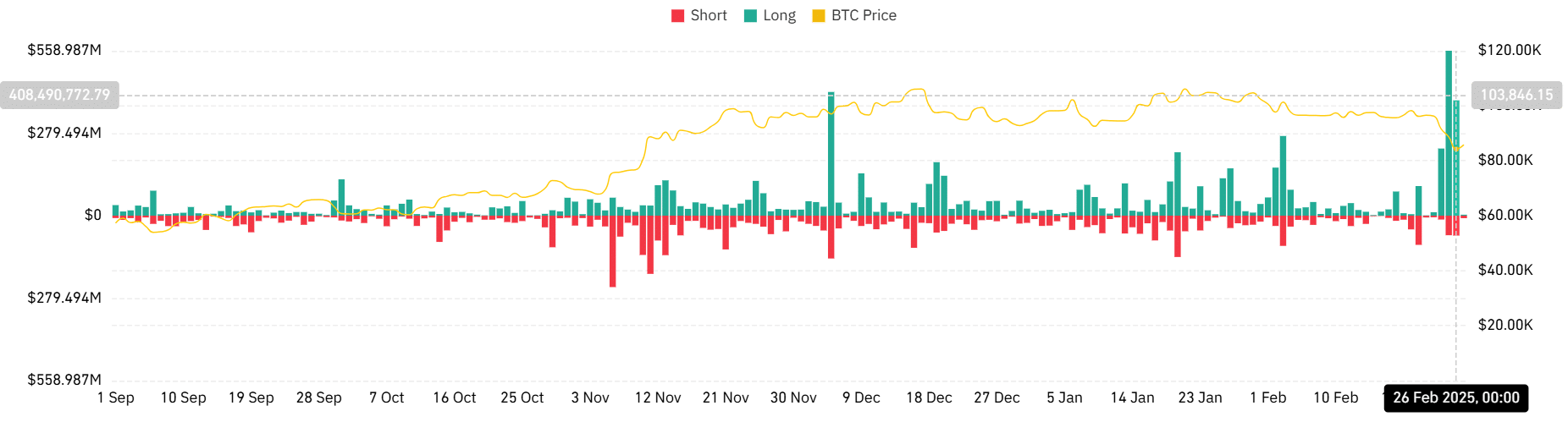

Bitcoin -Liquidations and Market impact

Liquidation data revealed that leverage traders took heavy losses, with considerable long liquidations that took place when Bitcoin did not succeed in recovering the most important support levels.

The liquidation heat jap indicated that the last price decrease was exacerbated by Cascade liquidations, making the prices further lower.

The analysis showed that Bitcoin saw the highest long liquidation in the past five months on 25 February. Long liquidation stood up to around $ 559 million, with a short liquidation volume of around $ 66 million.

The liquidation took place on 26 February with a long liquidation of $ 391 million, the third highest in the past five months.

Source: Coinglass

This pattern has been a recurring theme, with surviving traders who are confronted with forced outputs that worsen the bearish.

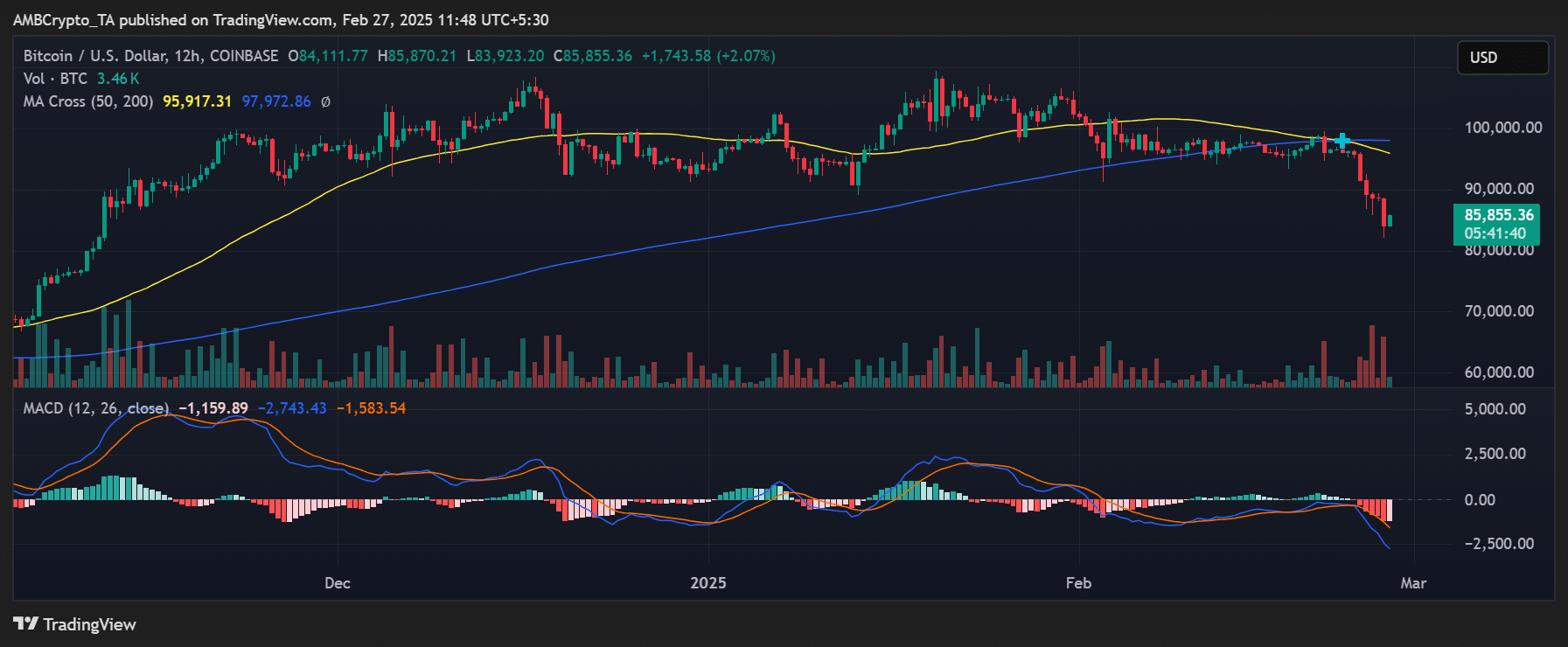

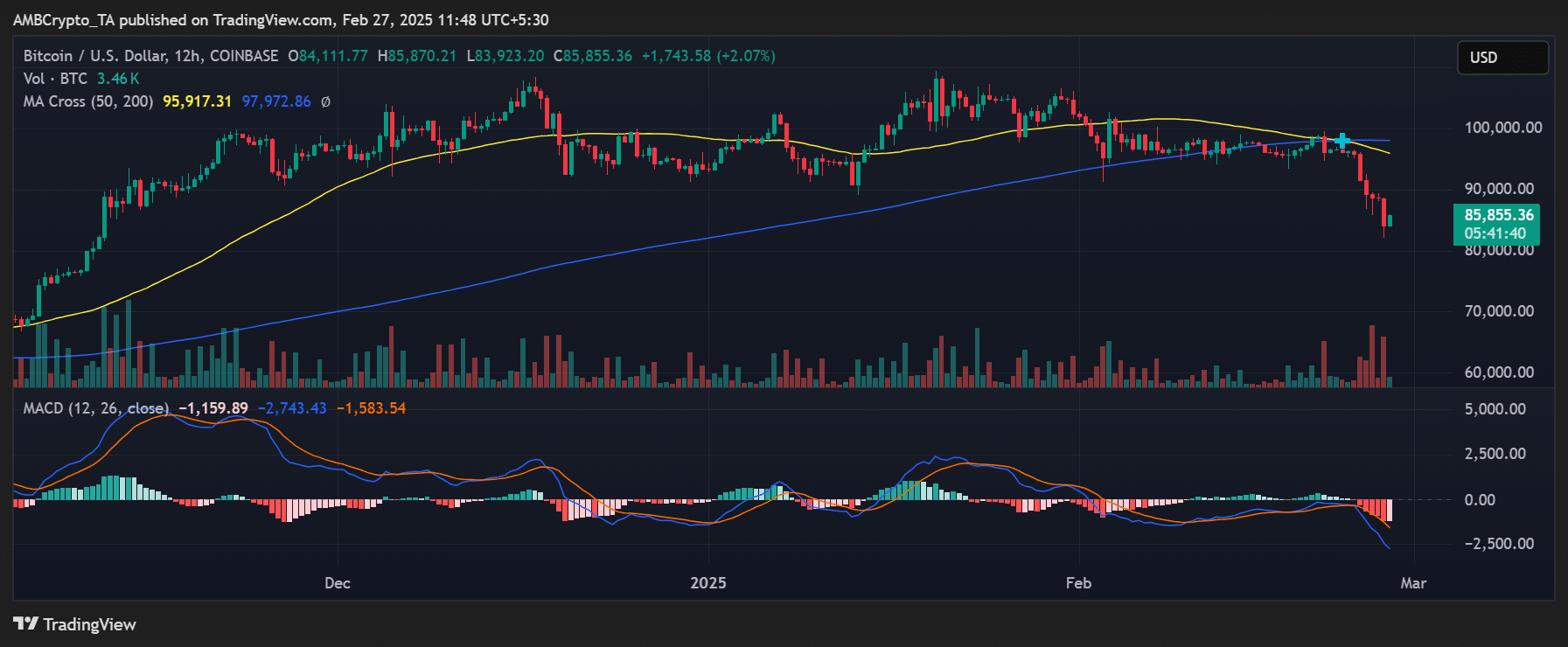

Bitcoin’s price trend and key levels

From this letter Bitcoin traded around $ 85,855 and marked a steep fall in recent highlights. The price is broken below the psychological level of $ 90,000 and further disadvantage could see a retest of $ 80,000.

Source: TradingView

Technical indicators, including the divergence of the advancing average convergence [MACD]showed a strong bearish Momentum, while the 50-day and 200 days moving averages suggest the constant weakness.

The next potential support is near $ 83,000, a level where previous question was observed.

What is the next step for BTC?

For a sustainable reversal, Retail enthusiasm must disappear, making a real market set possible. If buying pressure from retail traders, a short -term rally could arise.

In view of the current market structure, however, Bitcoin remains vulnerable for further down before a meaningful recovery takes place.

Traders must keep an eye on the liquidation levels and trends in the retail trade to gauge and stabilize and reverses its downward process.