- Solana’s new proposal could reduce inflation by 80%.

- Option traders looked at $ 120 in the middle of increased bearish.

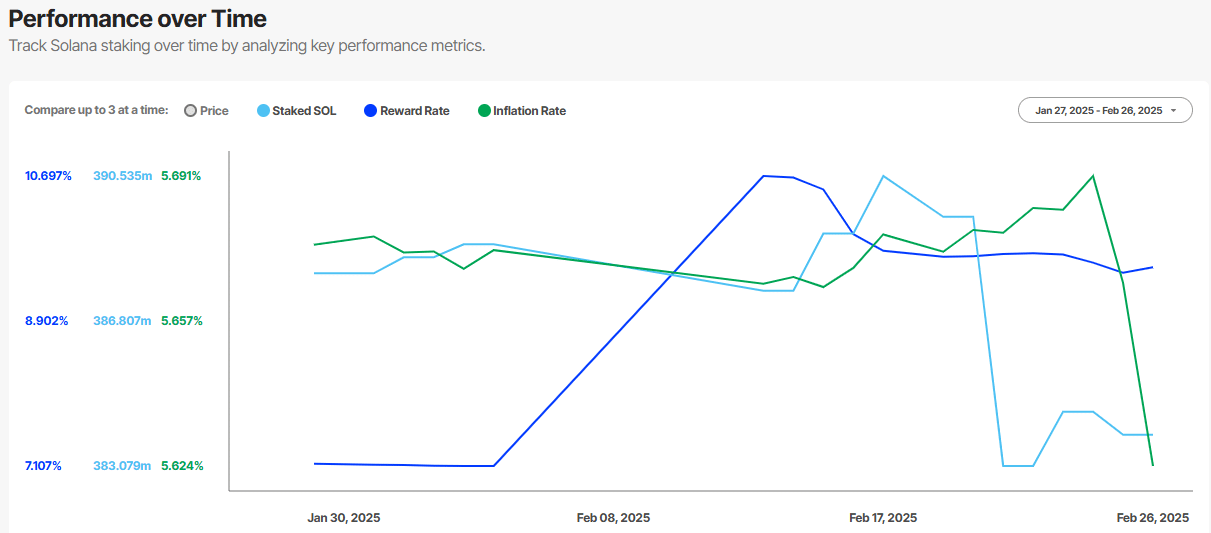

Part of Solana[SOL] Insiders has drumde support for the new proposal (SIMD-0228), which states that it would significantly reduce inflation.

According to Ryan Watkins Crypto VC partner at Syncracy Capital, the move will even be scoop Inflation with 80%.

“Potential 80% inflation reduction that will soon come to Sol.”

Has Solana been paid too much for security?

The SIMD (Solana Improvement Document) -0228 proposal strives to limit the Solana issue percentage to tackle participation.

According to Vishal Kankani, a partner at Multicoin Capital, Solana was ‘paid too much for network security’ with its fixed issue rate compared to Ethereum. He said”

“Currently, Solana releases around 4.5% new tokens annually and drops by 15% every year. For comparison, Ethereum radiates less than 1% with less than 30%. ”

Kankani added that the current model also limits Defi growth.

“High emissions from Solana not only push prices by increasing tax-induced sales, but also appears to be unnecessary returns and discouraging, which discourages participation in the growing Defi sector.”

However, the preparation of rewards would also be reduced by almost 80%, a movement with which some members of the community were not satisfied.

Strikers earn around 10% of rewards, but this would decrease considerably if the proposal was assumed.

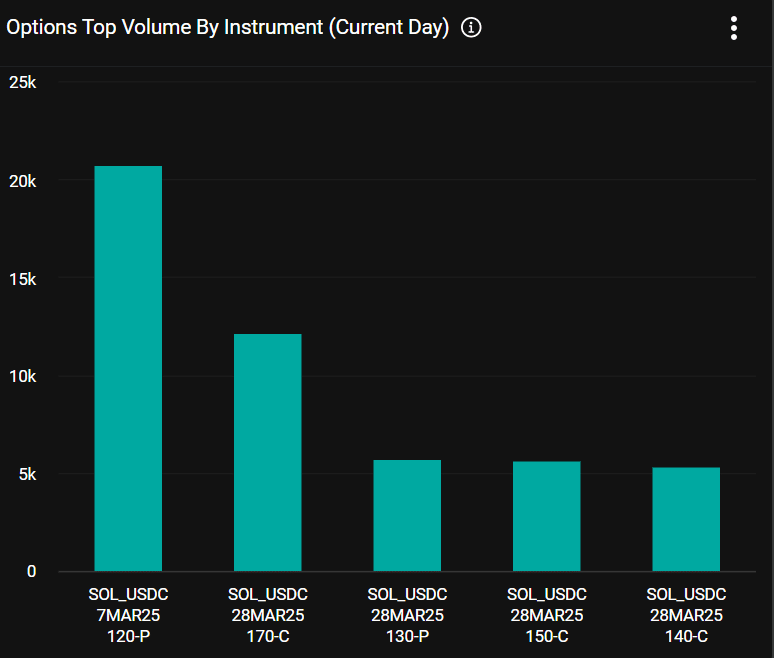

Will Sol fall to $ 120?

Interestingly, the voting time line comes from the FTX estate immediately after the march unlock of 11.2 million Sol.

The massive unlock is planned for 1 March and has added bearish pressure on the token after the fall-out of the Memecoin scales.

SOL has since dropped 53% from its record high of $ 295, under $ 140.

However, Amberdata’s Greg Magadini stated that the unlocking was already priced and that a broader marketbound Sol would stimulate.

In a recent newsletter, Magadini said”

“There is an argument that could yield assistance in SOL prices a positive place/full correlation, because the market is potentially excessive pressure.”

The extensive BTC DIP up to $ 86k Soured MarktVonveniment. The PUT options (Bearish Bets) for the purpose of $ 120 had been bought the most on Deribit in the last 24 hours.

This suggested that Sol -traders Furthermore, risks for this level were expected in the first week of March.