Este Artículo También Está Disponible and Español.

Bitcoin (BTC) has fallen below $ 95,000 and risks a further decrease in the midst of the current market. As February ends, some analysts consider that the flagship Crypto must recover a number of crucial levels to continue his bullish long -term trend.

Related lecture

Bitcoin sees bleeding on Monday

In the past three days, Bitcoin has seen his price among a number of important levels and has fallen 5.7% of the highlights of Friday. In the midst of the news of the withdrawal of the US Securities and Exchange Commission of its crypto case against Coinbase, the largest crypto through market capitalization that was first traded above $ 99,000 in two weeks.

However, the positive sentiment disappeared soon after Bybit, one of the largest crypto exchanges in the world, a hack of $ 1.5 billion that cost around 401,347 ETH. As a result, most cryptocurrencies, including Bitcoin, lost their temporary profit.

Since then, the flagship Crypto is floating between the $ 95,000 and $ 96,000 zone, so that the resistance of $ 97,000 is approaching on Saturday. The correction went on on Monday, with BTC that dropped under $ 95,000 and hit his one -week low point at $ 93,800.

As noted by analyst Jelle, Bitcoin continued To dump on the opening of New York Markets. According to De Post, BTC has returned every week from his early recovery from Monday after the American market has been opened, so that the price to a red Monday is closed in recent months.

Despite these retrazes and the recent market corrections, Bitcoin has remained within the reach of the elections since November, which has minimal volatility. BTC floats between $ 96,000 $ 102,000 central zone of the range for the most part of this period.

In the midst of his recent achievements, Altcoin Sherpa pointed Of that, excluding February 18, Bitcoin is not closed under the daily support zone in more than a month, indicating that BTC has to close above $ 95,700 to maintain this crucial level.

BTC tests bullish flag -breakout again

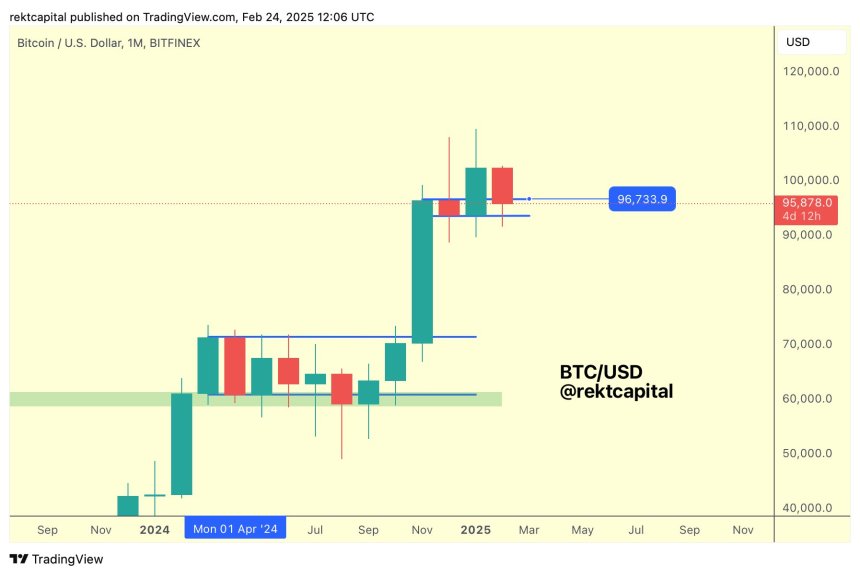

Meanwhile, Capital stretches marked That BTC needs a monthly close to $ 96,000 to continue its bullish long -term trend. In January, the largest crypto registered a historic candle for the first time after closing the month of the month.

This close confirmed Bitcoin outbreak from his monthly bull flag after the elections. However, due to the recent price promotion, BTC has re -tested its breakout level again, so that it temporarily lost.

The analyst claimed that the Cryptocurrency must reclong and close from February above $ 96,700 “to confirm the breakout and to adjust over time for the continuation of the trend.”

He added that BTC traded around this key level for most of February, and it is retained, would indicate a “successful retest after falling”.

Related lecture

Stretched Capital concluded that the daily close of BTC “is not as important as the higher period signal” if the bottom of the bull flag remains as support “and the three -month trend of a higher layer on the Neerwaartse Lanken still exists.”

At the time of writing, BTC acts at $ 94.165, a decrease of 2.1% in daily period.

Featured image of unsplash.com, graph of TradingView.com