- Sol has fallen by 35.5%in recent months.

- The daily active addresses of Solana and the activity on the chains fell, which indicates downward pressure.

Since he reached a local highlight of $ 195 three weeks ago, Solana [SOL] has experienced a strong bearish. During this period, Solana refused to touch a low -point low.

With such a strong downward trend, the question is what ensures that Solana refuses? Analysis suggests that Solana is fundamentally struggling with low activity on the chain.

Solana’s decrease on chain activity

Solana’s chain activity has steadily decreased in recent months. As such, the number of daily active addresses of the network has fallen to achieve a low -month -old low -month -old.

Source: Artemis

When active users purchase, this reflects a strong decrease in market interests and lower acceptance. Lower active users often lead to reduced activity in chains, which can lead to price debit.

Historically, a lower number of users usually correlates with price fall as demand falls.

Source: Artemis

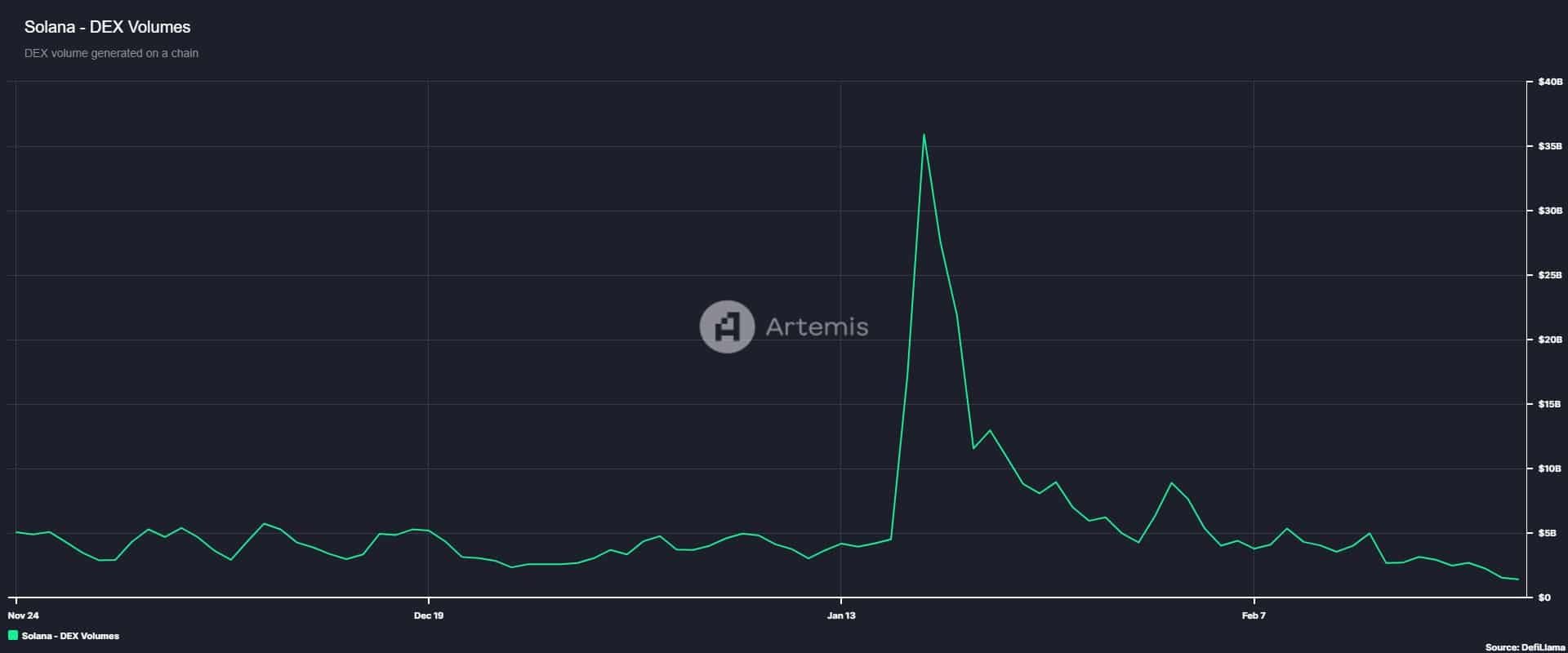

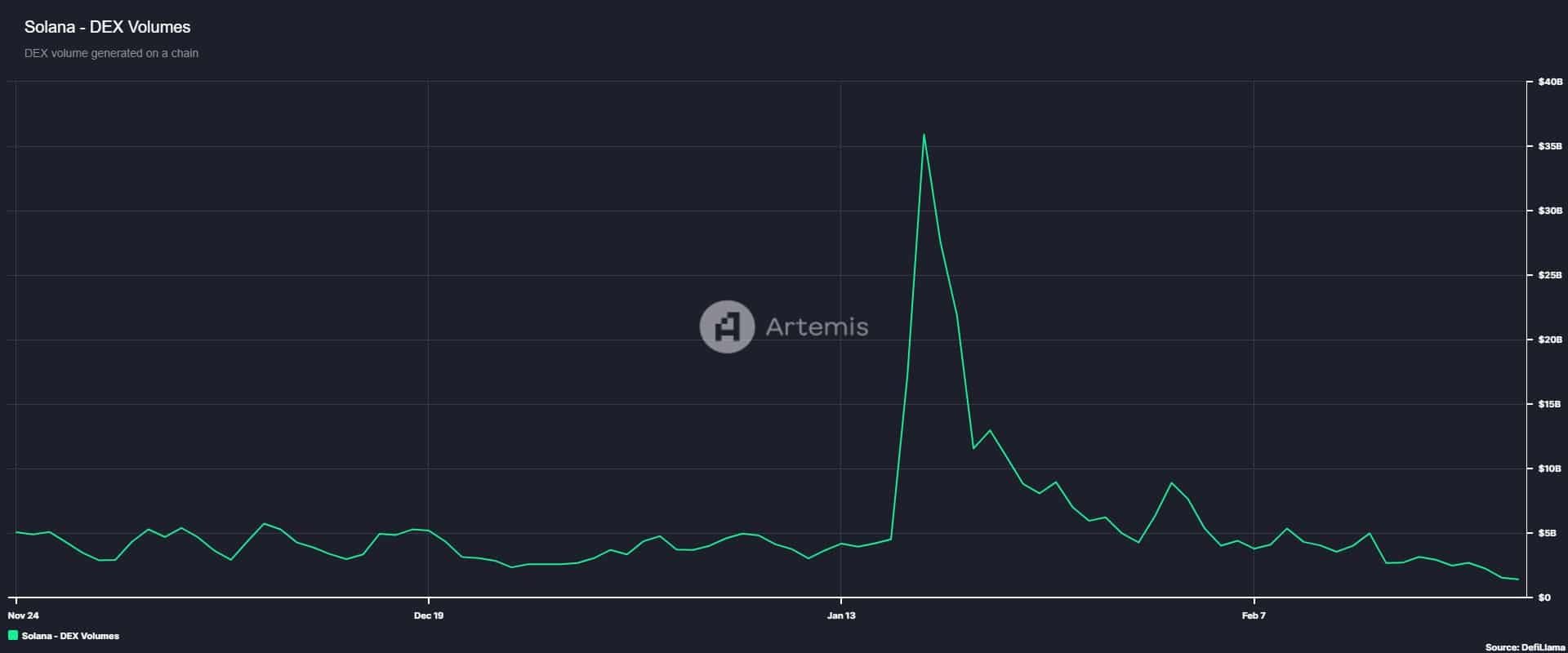

This reduced activity on the chain on Solana is further proven by the falling decentralized Exchange (DEX) Trade Volume. According to Artemis -DataThis has fallen to achieve a low four months of $ 1.5 billion.

Such a decline indicates a reduced trust in the network, because investors prefer centralized exchange (CEX) over security problems.

Source: Artemis

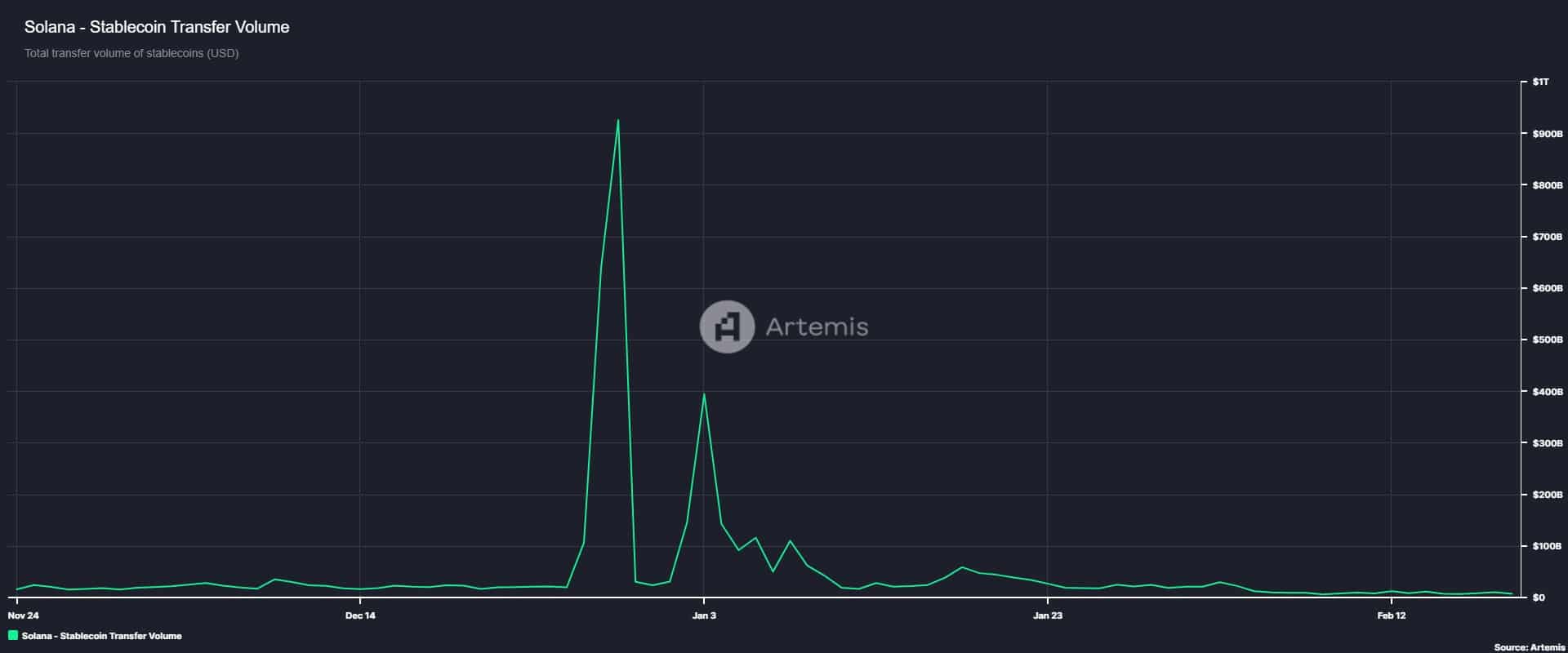

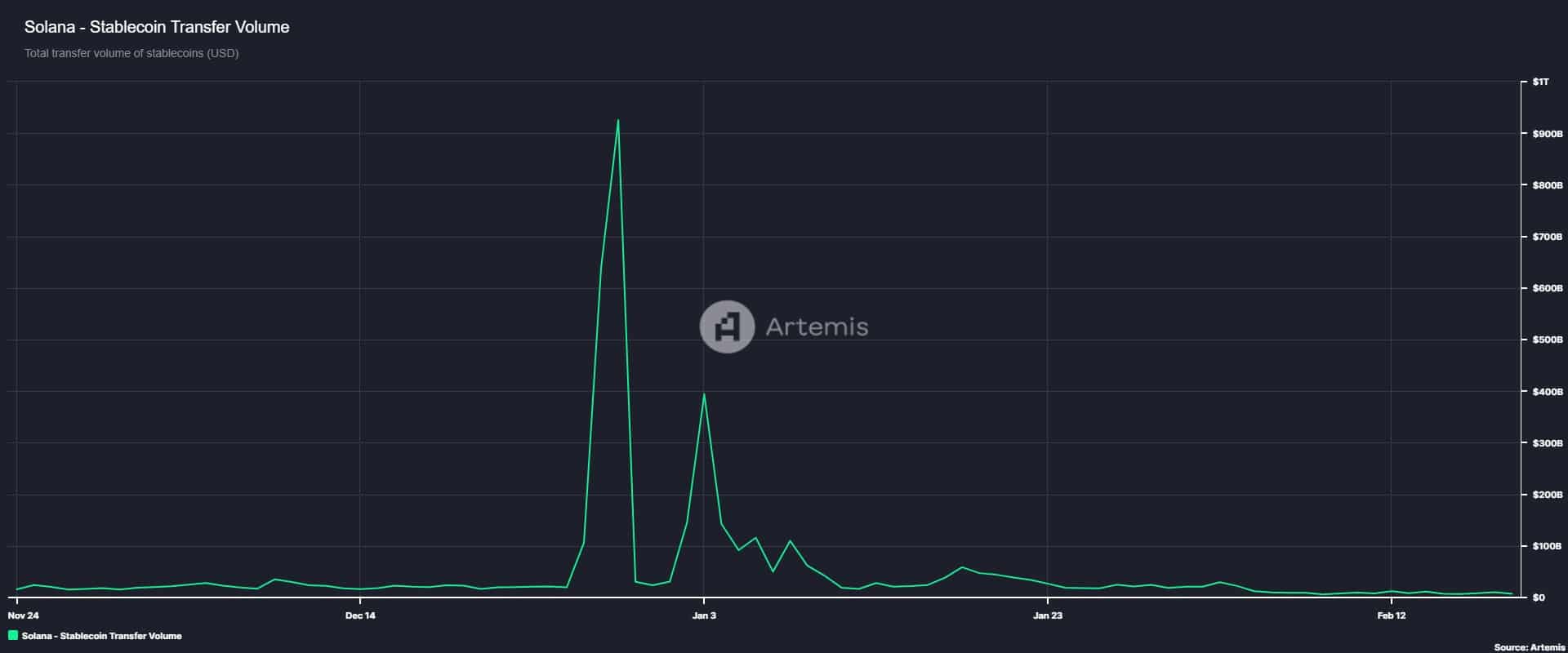

Moreover, the Stablecoin transmission volume has fallen from Solana to $ 7.1 billion. This marks a persistent decrease of $ 394 billion a month ago.

Such a significant decrease suggests that investors, especially large, consider other chains such as those of Ethereum [ETH].

This also reflects a risk-off sentiment with SOL investors.

Impact on SOL?

As expected, reduced activity on the chains has negatively influenced SOL’s price movements. This has influenced the demand side of SOL. Usually the low demand leads to less purchasing pressure, leaving the market to sellers and results in a downward price pressure.

At the time of writing, Solana traded at a low -three -month low. This meant a decrease of 7.09% on daily graphs. Solana has also fallen by 35.52% in the past month.

With a strong downward pressure and low demand, Sol could fall further.

If the current trend persists, Sol runs to $ 154, however, if buyers take this opportunity to buy the dip, Sol could recover to $ 175.