- The network activity of BTC has indicated a disturbing decline, which is a reflection of the weakened investor sentiment.

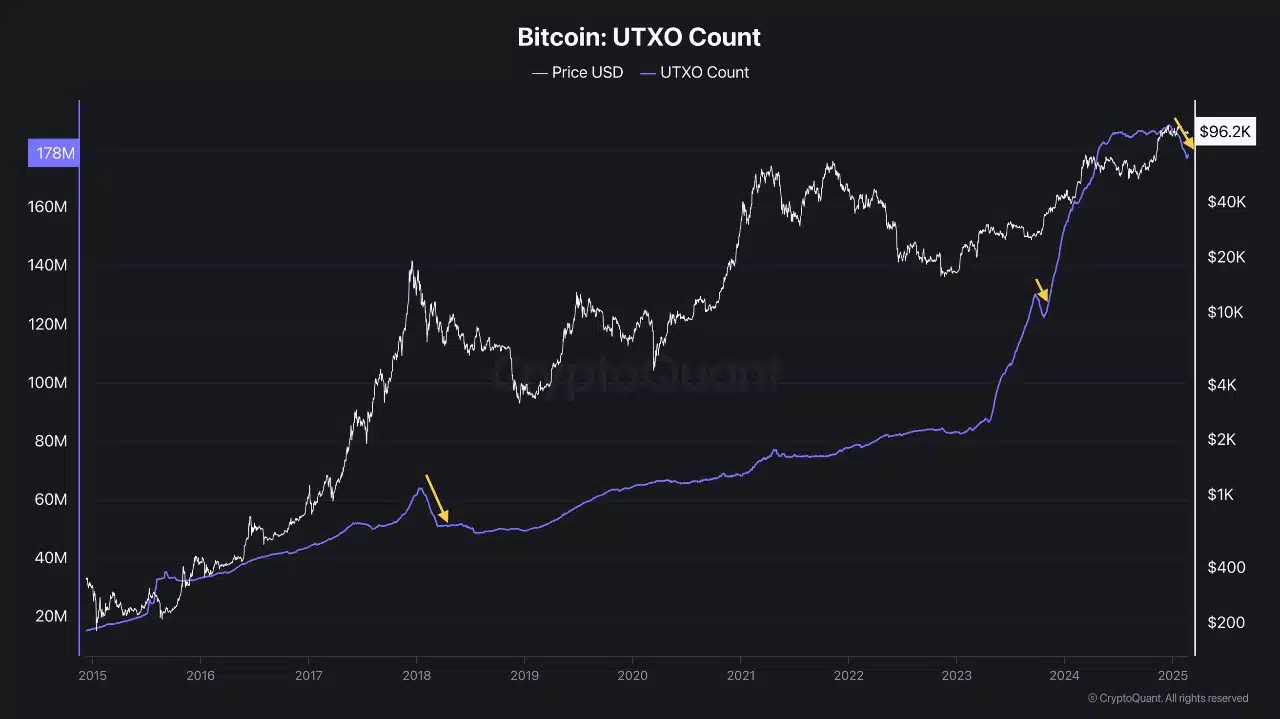

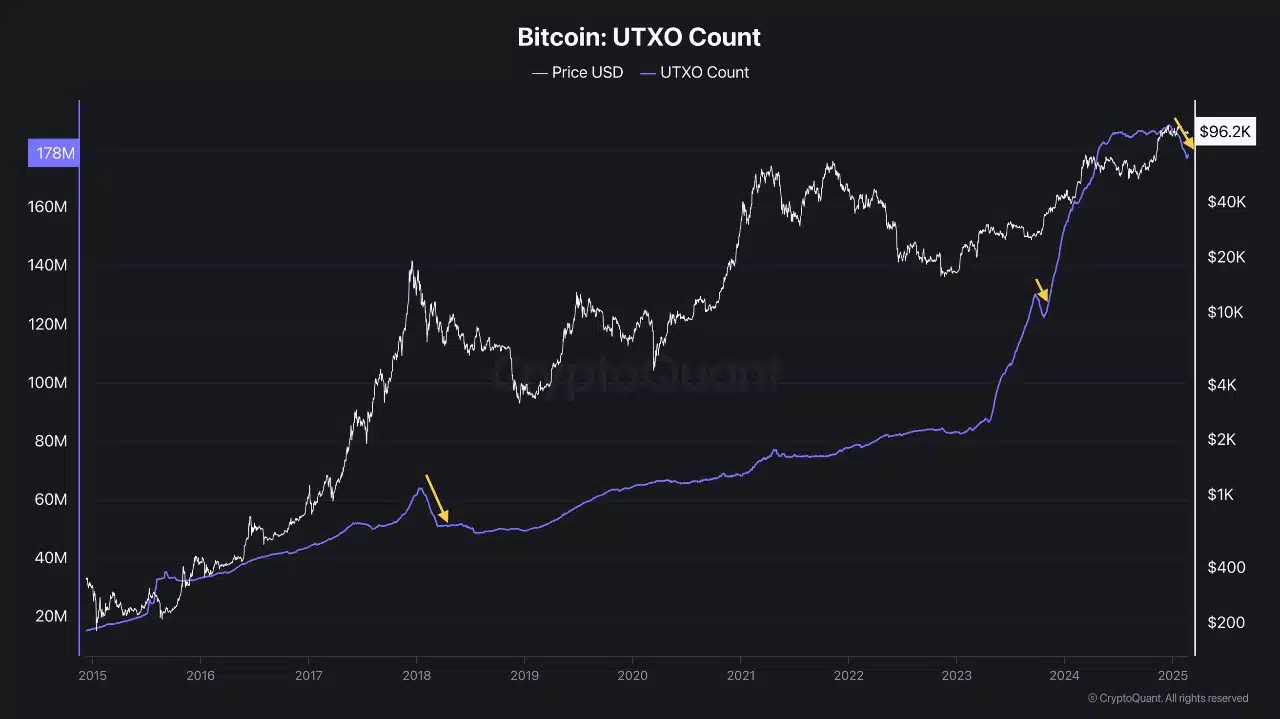

- The number of UTXO from Bitcoin, included from 2015 to 2025, fell in particular at the beginning of 2025 and fell to levels comparable to the correction of September 2023.

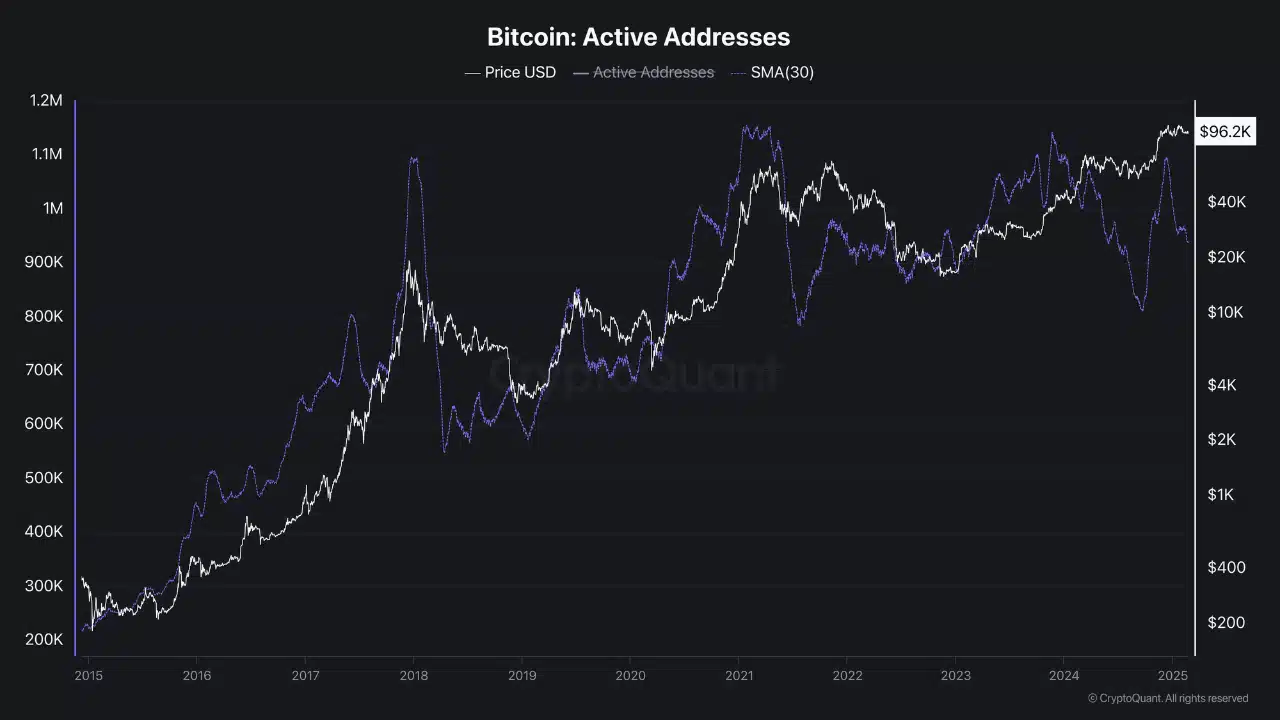

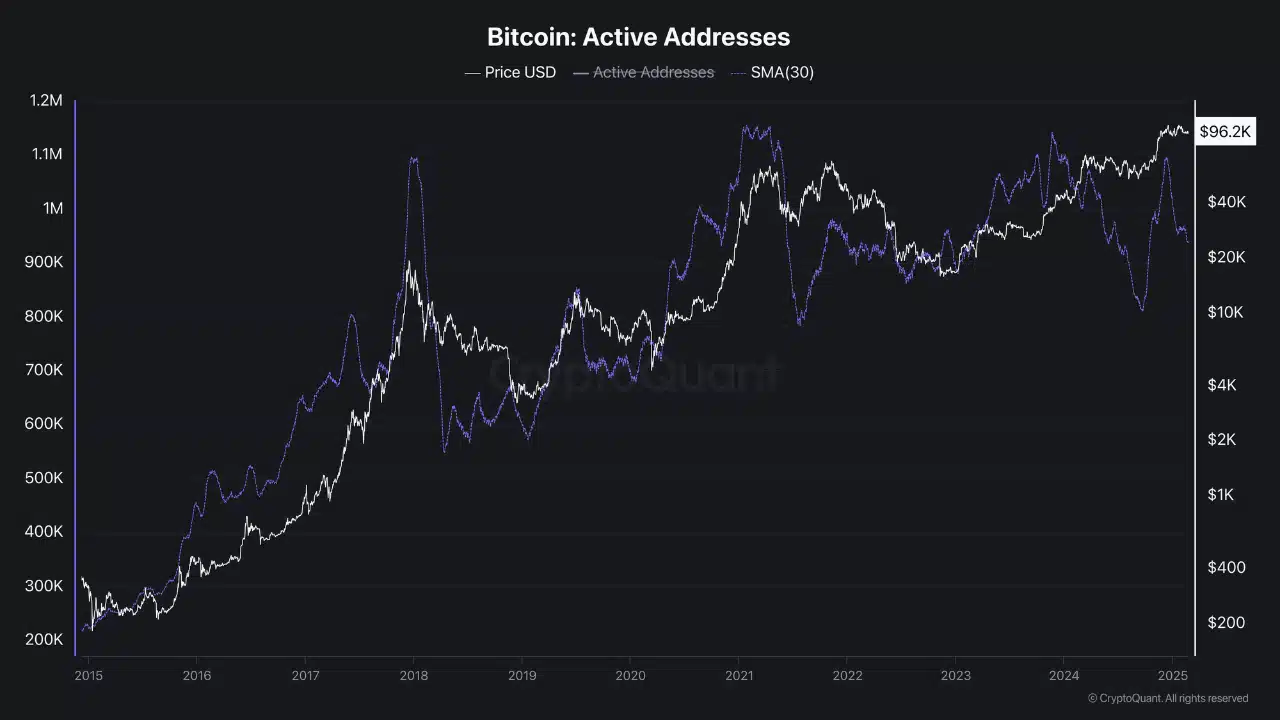

Bitcoin’s[BTC] Network activity has indicated a disturbing decline, which is a reflection of weakened investor sentiment. Active portfolios, transactions and Utxo counts were brought down, reflect by correction periods.

The accumulation percentage of Bitcoin Spot ETF’s also delayed, with recent capital outflows.

Less hands on the market

Consequently, the active addresses of Bitcoin fell sharply at the beginning of 2025, with the metric peak nearly 1.2 million in 2021 and fell to 900,000 by 2025.

Source: Cryptuquant

This decrease in trade volumes indicated reduced network participation, which expressed concern about a potential investor output, similar to the peak of the market cycle in 2017.

Moreover, the decline suggested decreasing trust, driven by geopolitical tensions and the lack of Bitcoin-friendly legislative action.

If this trend continues, the price of Bitcoin, currently for $ 96,200, could be confronted with long -term consolidation comparable to March 2024, unless new catalysts arise.

Bitcoin: a temporary dip or a market shift?

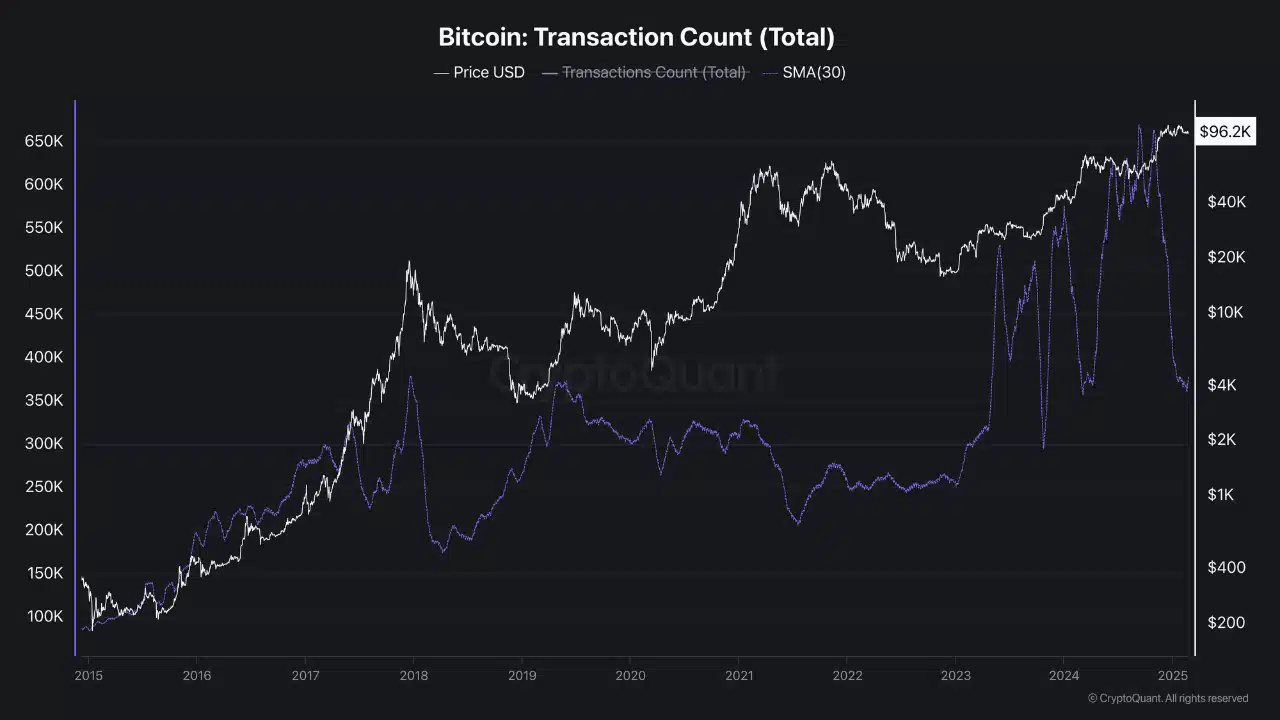

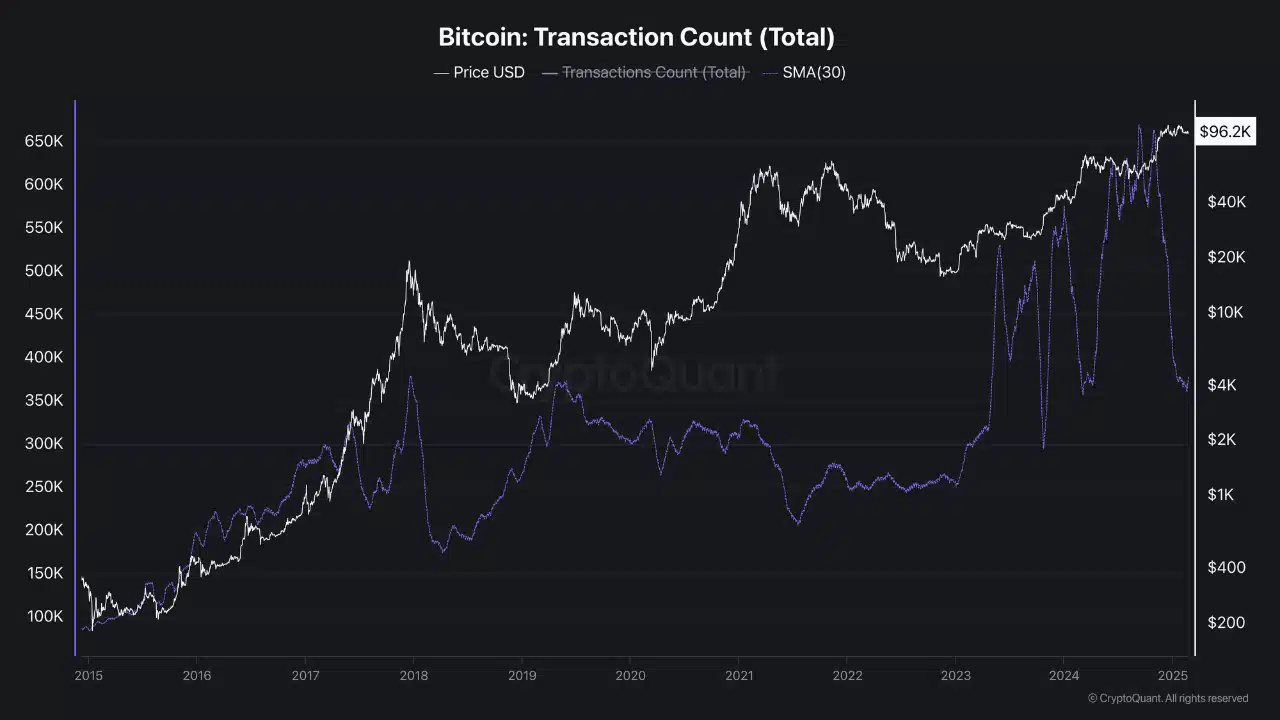

Furthermore, Bitcoin transaction also showed a significant decrease. Transactions, which once reached a peak at 650,000 daily in 2021, fell under 400,000 at the beginning of 2025.

Source: Cryptuquant

This reduction in commercial activity indicated weakened investor sentiment, which resembled the correction of September 2023 when the transaction fees fell during the decline of the market.

Persistent falls can put extra pressure on the price of Bitcoin, in particular in the midst of risk-off sentiment with regard to uncertainties in trade policy. A reversal would require renewed market optimism or stability in macro -economic factors.

Are not a BTC Krimpen?

The number of UTXO from Bitcoin, included from 2015 to 2025, fell in particular at the beginning of 2025 and fell to levels comparable to the correction of September 2023.

The metric, which steadily increased to 178 million at the beginning of 2025, had a sharp decrease, which reflects fewer -out -output expenditure.

Source: Cryptuquant

This trend aroused concern that the market can approach the end of a cycle, although this conclusion is not yet final. The pattern indicated reduced network activity and lower accumulation of investors, which led to worries about potential price stagnation.

However, some bullish indicators suggested a possible recovery, depending on new market catalysts.

Buyers or sellers: who really has control?

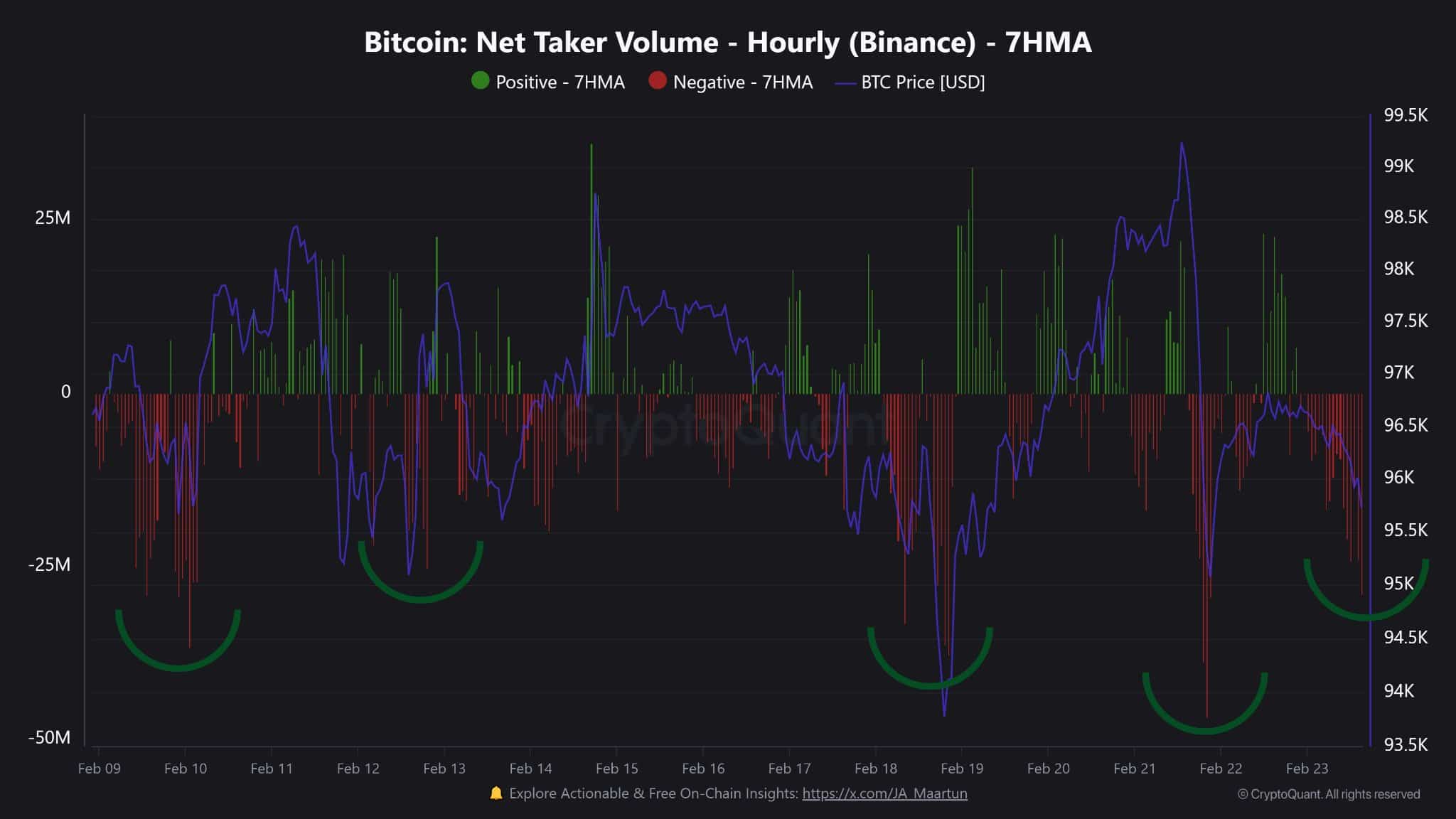

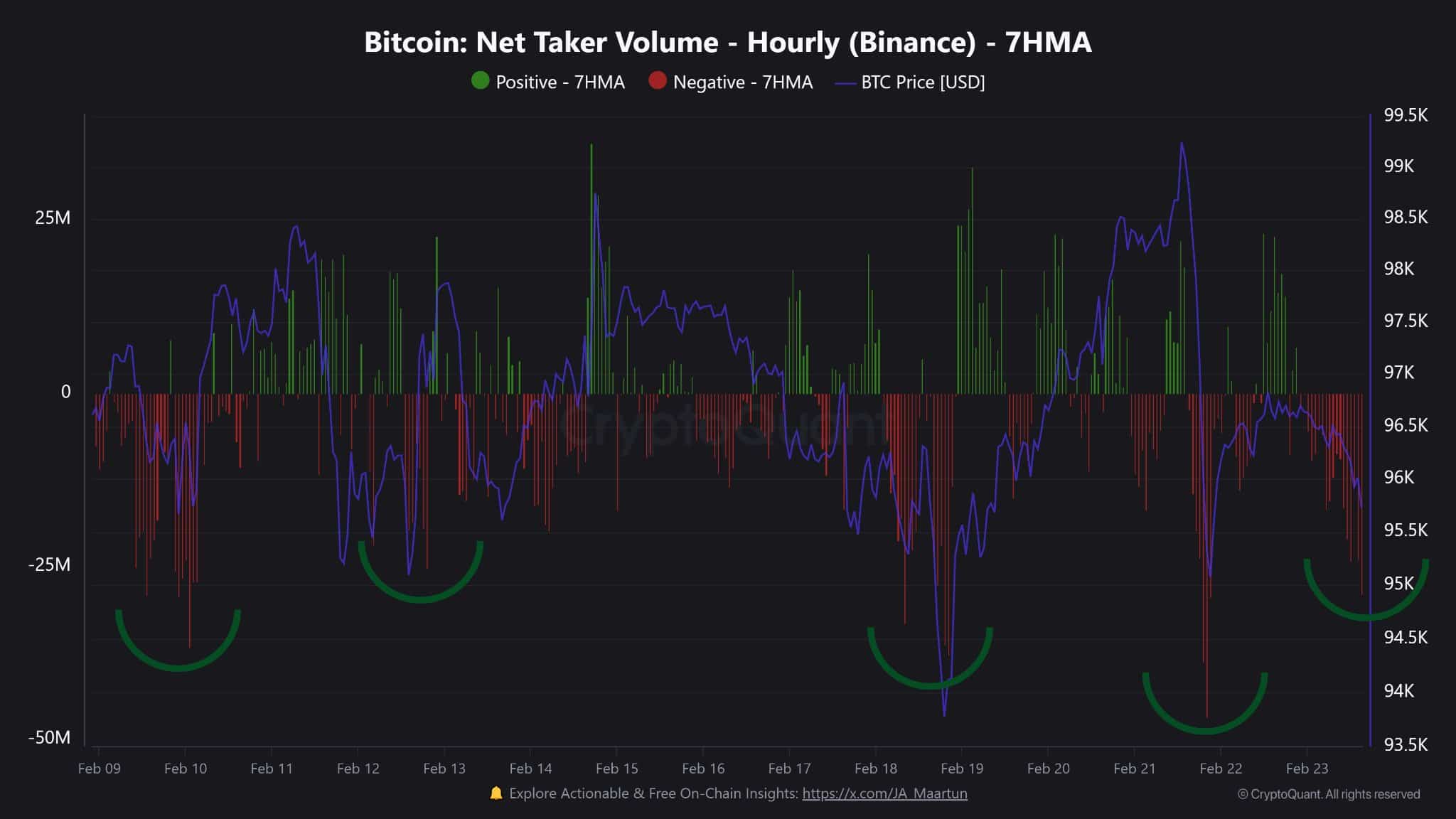

Bitcoin’s network volume on Binance, followed from 9 to 23 February 2025, unveiled low 7hma values, with negative peaks that dominated.

Source: Cryptuquant

This indicated Beerarish pressure, while Taker Sellers surpassed buyers, who strengthened a weak market sentiment. The pattern was similar to March 2024 when low net tow volumes preceded a consolidation phase.

A revival in long positions depended on recovering the control of Taker buyers. This was based on geopolitical stabilization or new bullish catalysts. If sentiment improved, the price of Bitcoin could recover from $ 96,200. Otherwise, a longer consolidation period probably seemed.

In conclusion, the falling network activity of BTC, shrinking transaction volumes and reduced UTXO count signaled weakened investor confidence and a possible extensive consolidation phase.

The delay in the accumulation of spot ETF and the net -branch volumes underlined current market uncertainty. Although historical patterns suggest that BTC could recover, any persistent upward movement would require a shift in macro -economic sentiment.

It would also need the solution of geopolitical tensions or renewed institutional requirements.