This is a segment of the Empire newsletter. To read full editions, subscribe.

Let’s face it: Ethereum is not having a good time. Part of it, as I wrote yesterday, is due to the general lack of momentum for Altcoins. There is also only a lack of positive sentiment – which is different from what we see for Bitcoin (even if it floats below $ 100,000).

In my conversation with Amberdata’s Greg Magadini, a part that had been omitted from yesterday’s edition, was his thoughts about Eth.

“The drag on Eth, in my opinion, is because the value proposition of EIP-1559 was creating a supply fire was made invalid, or was made invalid as soon as everyone started building their L2S and app chains and the fact that all transactions Van Ethereum are processed and withdraw to Ethereum. So then you run from a deflatoire to an inflatoire active. That is a fundamental reason to fall ETH, “he explained.

In other words, the inability of ETH to regain momentum, is currently not directly connected to the rest of the market – especially not the Memecoinrage.

Okay, so this wasn’t my most positive intro, but now I really wanted to look more on a positive look at Ethereum thanks to a Galaxy report from vice -president of research Christine Kim.

The report is aimed at what is being built on Ethereum and is a nice refresher course – or in the look – to see how projects use it.

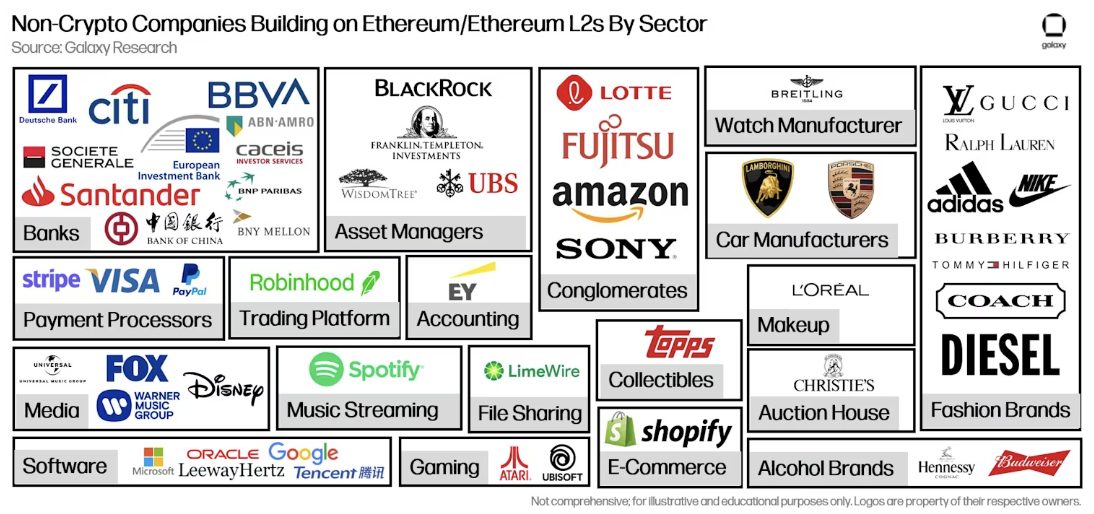

Kim noted that more than 50 non-crypto companies have built on Ethereum or an Ethereum L2. That is not a small number, especially when you get in and discover that around 20 of them are financial institutions with 10 of them are banks.

The largest use case, which should not be a surprise for loyal Empire Readers, is real-world assets. That is where you have the financial institutions to build and experiment with Tokenized assets – such as money market funds (think of BlackRock or Franklin Templeton) or government bonds.

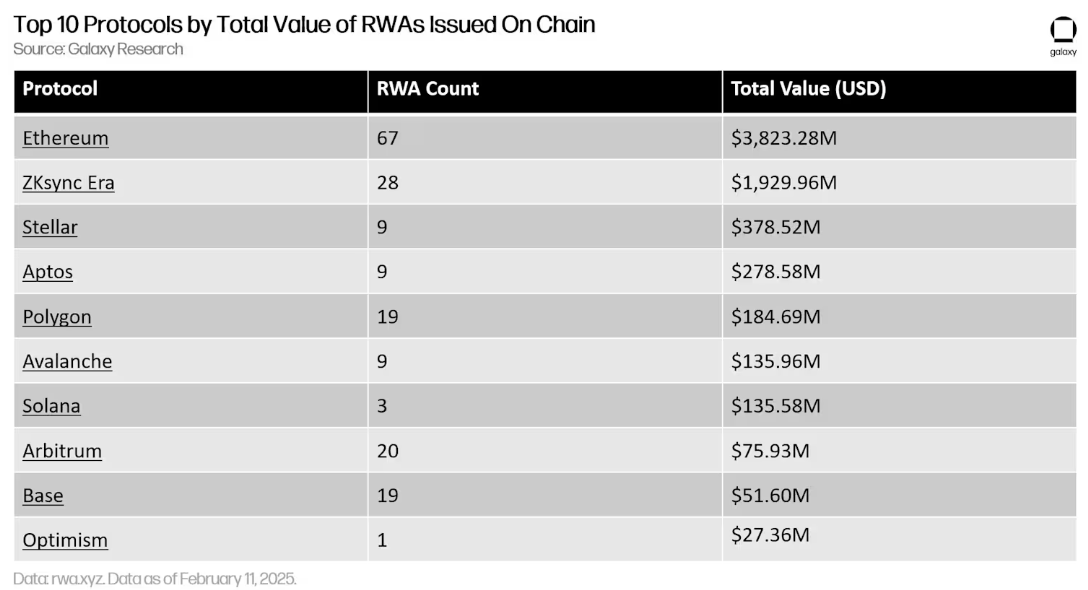

As you can see below, Ethereum doubles more than the number of RWAs published by Ethereum L2 Rollup ZKSync.

Now I know that RWAs are not the sexy Use case for crypto and I understand the but I think we can all agree that they show part of the promise of crypto for non-crypto-drilling (as long as we keep them away from the memecoins).

But okay, let’s continue with another Use Case Galaxy found: Gaming on Ethereum L2S.

NFTs have not made a comeback, which means that some companies that tried to get some crypto exposure by them, they stopped publishing them years ago. Reasonable. But Galaxy discovered that there nowadays is A use case for NFTS for some non-crypto-native companies and that is gaming.

“What is most striking about the continuous investment and development of NFTs by non-Crypto-Native companies such as Atari, Lamborghini and Lotte’s Caliverse is that they are being developed in the context of a larger gaming application on chains,” Kim wrote.

“This emphasizes how the scalability of L2S helps to support crypto-Native use cases that require frequent interactions in chains such as gaming between large retail brands and companies,” she continued.

There are still many questions and worries about Ethereum and where it goes from here, and that is something that I am sure we will cover again soon. But the Galaxy report shows that we still see many buildings happening, and it is attracted to people outside of crypto. And that, I think, is a little positive.