- The MVRV abnormalities of Bitcoin indicated the potential profitable.

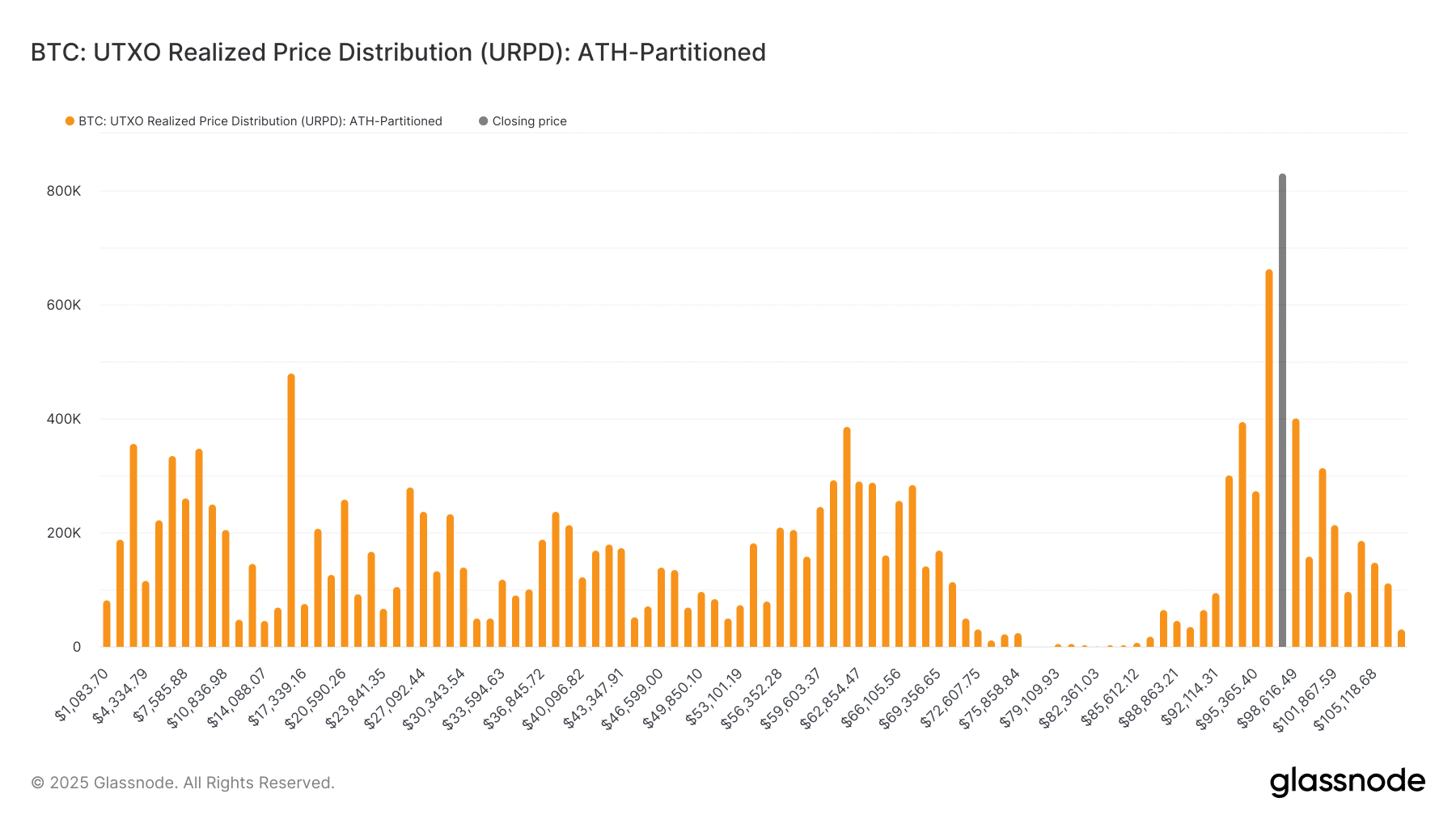

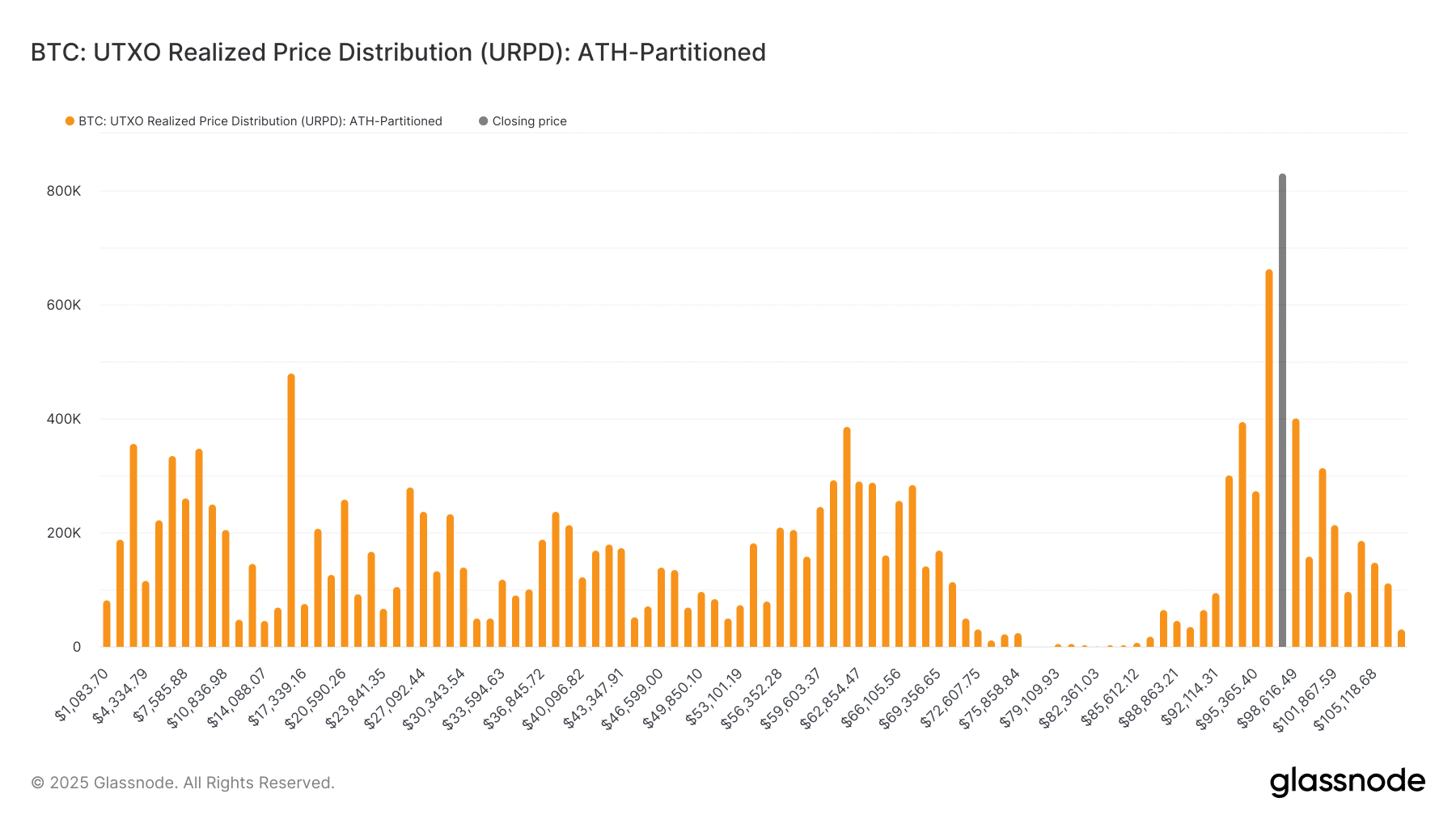

- UTXO -price distribution revealed strong support of around $ 90k, while resistor near $ 100k could determine the next step from BTC.

Bitcoin’s [BTC] The price is consolidating in the vicinity of the $ 97,000, shows resilience despite small fluctuations.

Recent data on the chains and technical indicators suggested that BTC remained in a strong position, although the most important resistance and support levels will determine the next step.

Bitcoin MVRV tires indicate potential top

The MVRV (Market value for realized value) Extreme deviation stress tires showed Bitcoin trade near the +1.0 band on Press Time, which historically indicates a strong price momentum.

Source: Glassnode

Although BTC briefly touched the upper deviation straps, a break above this zone can push the price to new highlights.

However, BTC can see a short -term correction in the direction of the average price level if rejection occurs.

The current level also means that the strongest support level of BTC is now about the price level of $ 93,000.

UTXO emphasizes important support zones

The UTXO realized price distribution (URPD) graph indicated that a considerable volume of BTC transactions took place between $ 90,000 and $ 101,000.

The concentration of transactions in these price zones suggests strong support, making BTC less chance of falling below $ 90,000 without a substantial sales pressure.

Source: Glassnode

Conversely, the distribution also shows resistance that is above $ 101,000, which means that Bitcoin needs a strong bullish momentum to break higher.

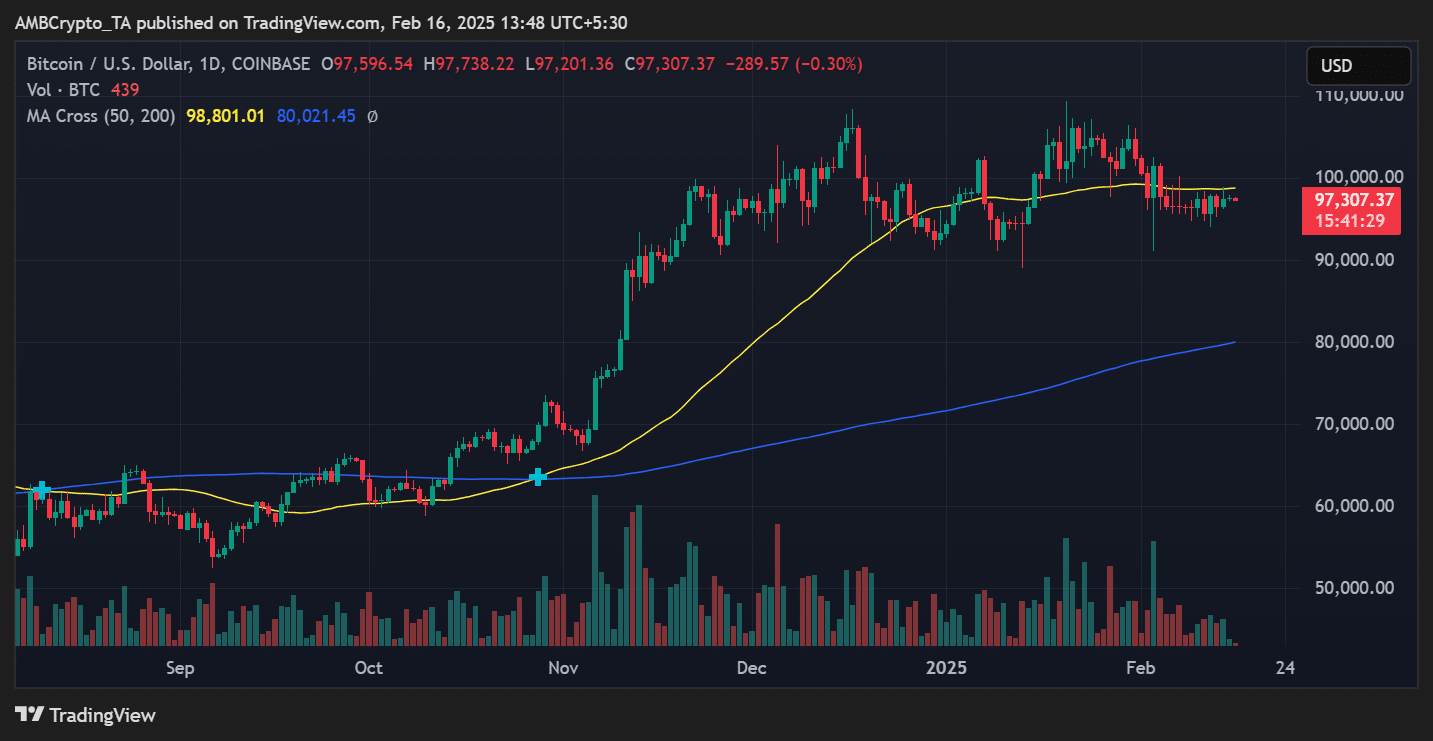

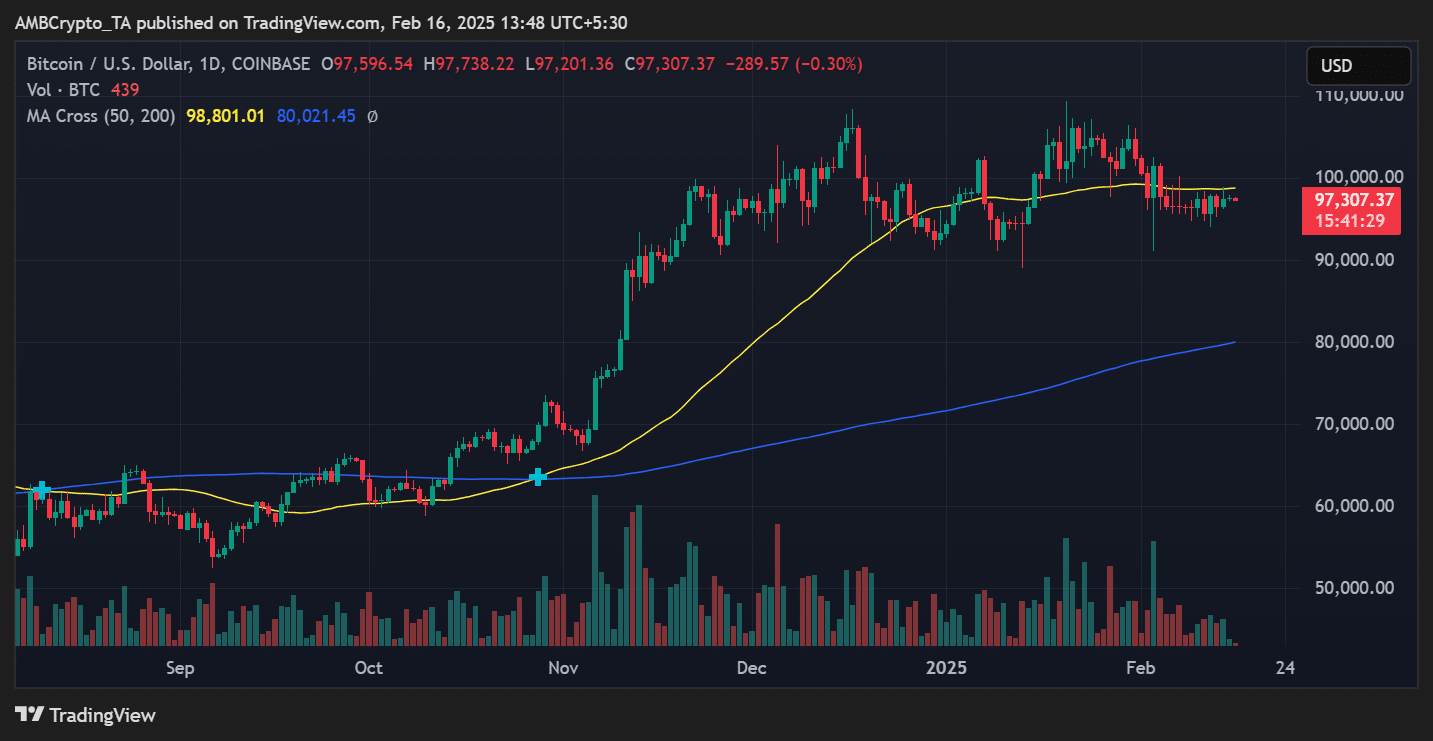

BTC Technical indicators Signals Caution Optimism

From a technical point of view, the price action of Bitcoin remains stable and acts slightly below the 50-day advancing average of $ 98,801 from this letter.

The 200-day advancing average was $ 80,021 and offered a strong long-term support basis.

Source: TradingView

Although the current price was confronted with resistance, the bullish structure remained intact, which suggests that Bitcoin could try another leg if buyers regain control.

A critical phase for the Bitcoin price action

Bitcoin’s current market positioning offers both opportunities and risks. The MVRV tires suggest a potential for further upwards, while the UTXO realized price distribution emphasized the most important support and resistance levels.

A break above $ 101,000 could open doors for higher valuations, while a non-support for $ 90,000 in the short term can cause arary sentiment.

Traders must keep a close eye on these levels when Bitcoin enters a decisive phase.