- Solana is perhaps lacking the steady purchasing pressure to restore the momentum that is seen in Q4 2024

- Liquidation White folder warned of a potential price decrease up to $ 160

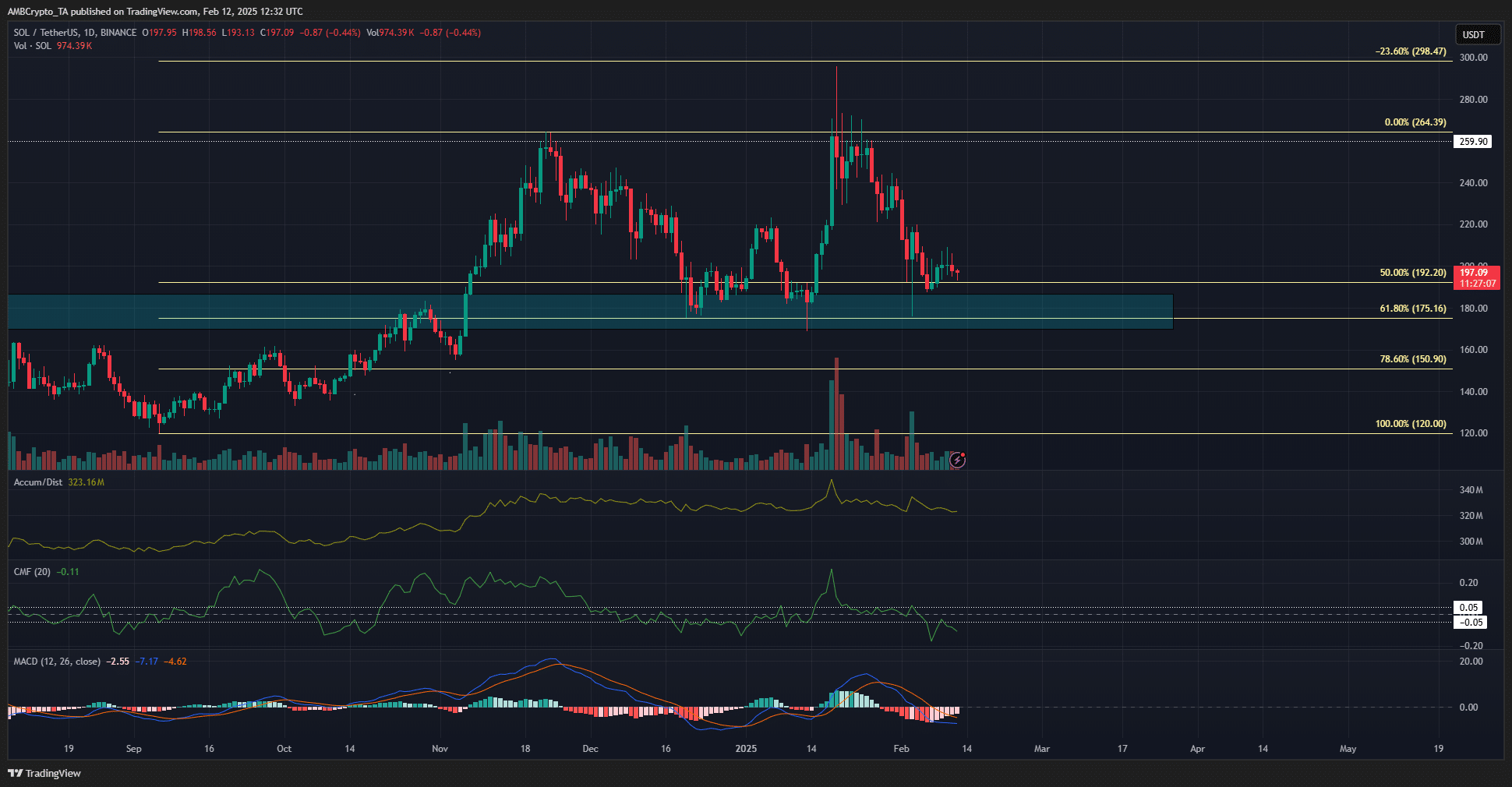

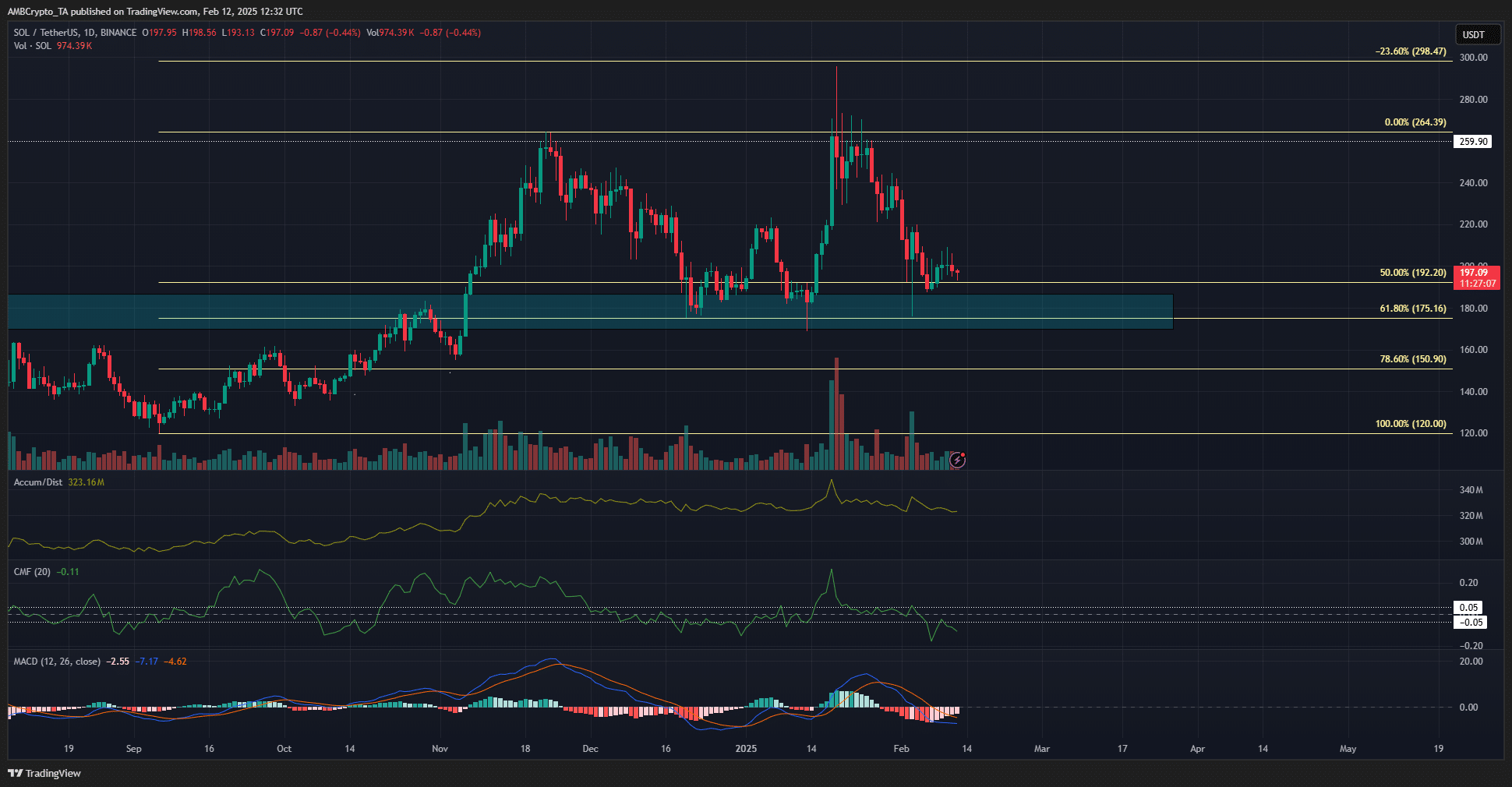

Solana [SOL]At the time of writing, resistance was again around the $ 205 zone, a short-term resistance zone that exists for a week. In fact, the daily graph unveiled a high volatility for Solana after strong winning against the end of 2024.

SOL has been oscillating between $ 180 and $ 260 since November and none of both price level has been overhauled by market participants. At the time of the press, the Bullish Order block remained a vital support zone on the Daily Chart for $ 180.

The high percentage of long positions among top traders can be an encouraging short -term signal. Whale activity also seemed to give some bullish signs.

Solana Bulls lack the power to scale $ 220

Source: SOL/USDT on TradingView

Despite the price of $ 188 a week ago, it was not enough to stimulate a recovery in the charts. The CMF was below -0.05 to indicate heavy capital flows from the market. The A/D indicator has missed a trend since November and reflects the oscillating price action.

At the time of the press, the MACD was below zero and emphasized that Beerarish Momentum was dominant on the daily graph. This went hand in hand with the market structure, which Beararish has been below $ 242 in the last week of January since the descent.

Despite the gloom around the higher period of time, however, Solana retained a bullish long -term bias. The Fibonacci retracement levels of $ 175 and $ 150 also remained intact. As long as this remains the case, another rally could come to $ 260 and then.

The 3-month liquidation heat showed that the $ 160- $ 165 region had a large number of liquidation levels. This magnetic zone can pull solana because the price is attracted by liquidity.

Swing traders and investors have to watch out for a drop below $ 190 zone. A renewed wave of acid sentiment around Bitcoin [BTC] Can also release the road for a SOL -free fall. On the other hand, a retest of $ 150- $ 160 would be a long-term chance for those who believe that this cycle has not yet been done.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer