- BTC fell by 2.55%in the past day.

- Bitcoin saw an increase in the demand for institution as the Coinbase Premium Index runs to positive.

In the past week, Bitcoin [BTC] continued to act between $ 95k and $ 98k. At the moment, Bitcoin even traded at $ 95936. This meant a decrease of 2.55% on daily graphs with an extension of these bearish fronts on weekly cards with 1.56%.

Because Bitcoin is struggling to maintain an upward trend and to recover higher resistance, investors in particular have taken this opportunity to buy BTC.

As far as popular crypto analyst Ali Martinez has suggested increasing institutional demand, referring to the Coinbase Premium index.

Bitcoin Institutional demand increases

Institutional demand has risen with the continuous consolidation of Bitcoin. The Coinbase Premium Index has remained positive in the past week.

When it is positive, it suggests a stronger purchasing pressure on Coinbase than on Binance, which implies that American investors dominate the market.

Source: X

As such, settings have used the current pricagnation to accumulate Bitcoin at lower rates.

This rising purchasing pressure of institutions reflects Bullish Sentiments because they anticipate prices in the short term.

What suggest BTC graphs

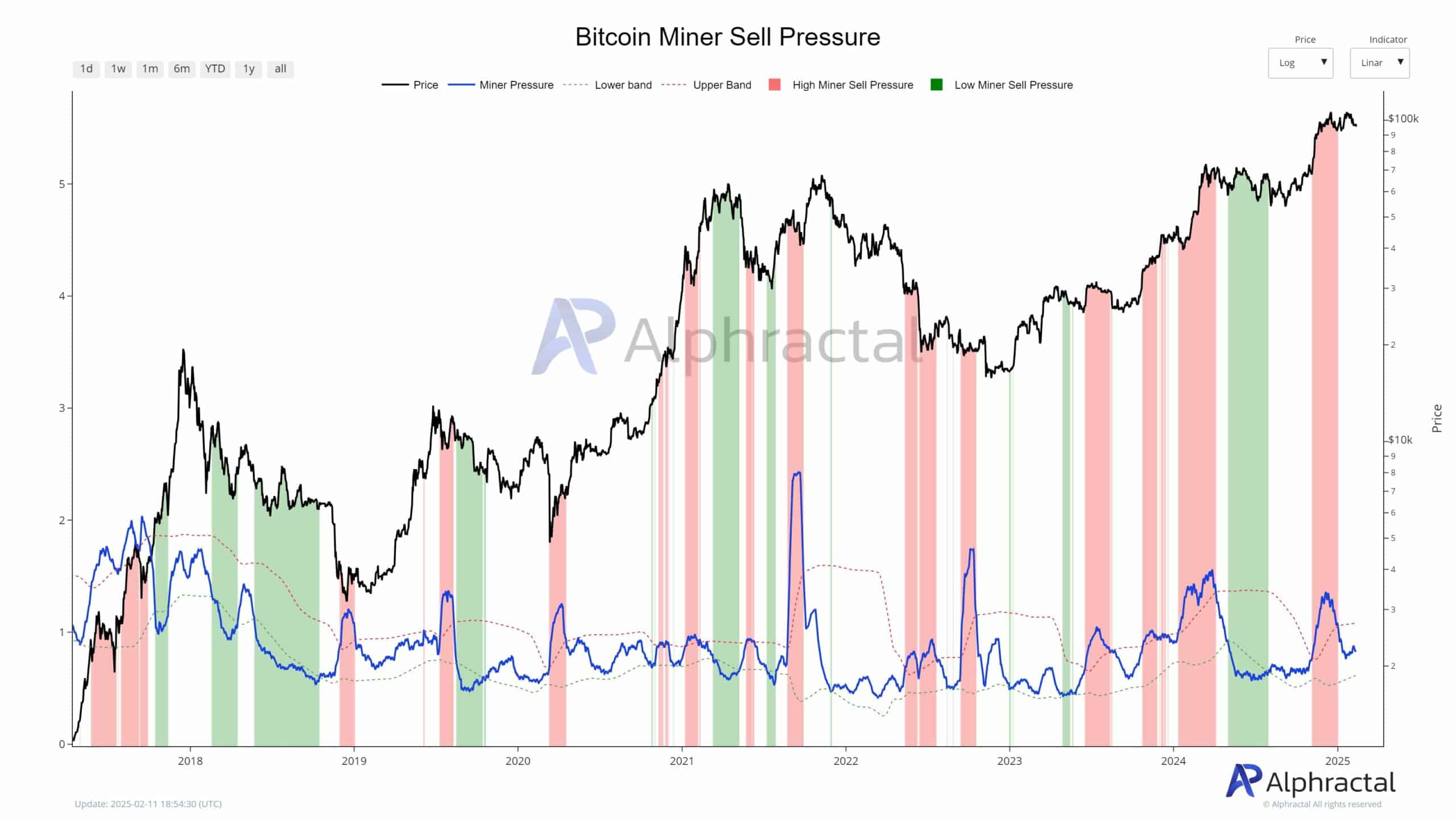

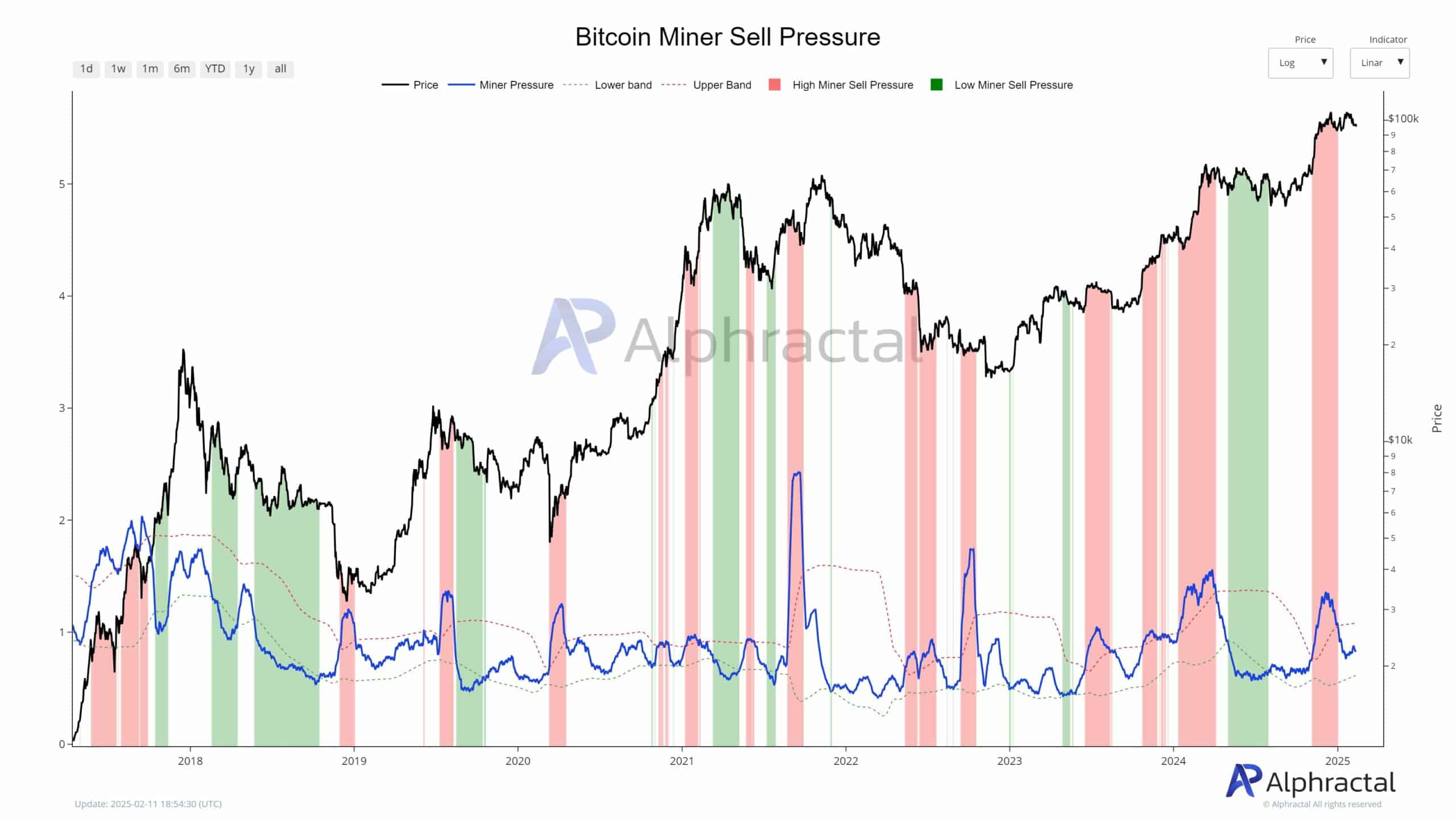

Source: Alfractaal

With the institutional demand for BTC, this reflects bullish sentiments from this group. To begin with, we see this bullishness under institutions as a sales pressure of miners. According to Alphractal, the sales pressure of miners has fallen, which reduces the BTC offer from miners.

That is why the values after a period of high sale of miners are now below average, which suggests a break in miner -reading.

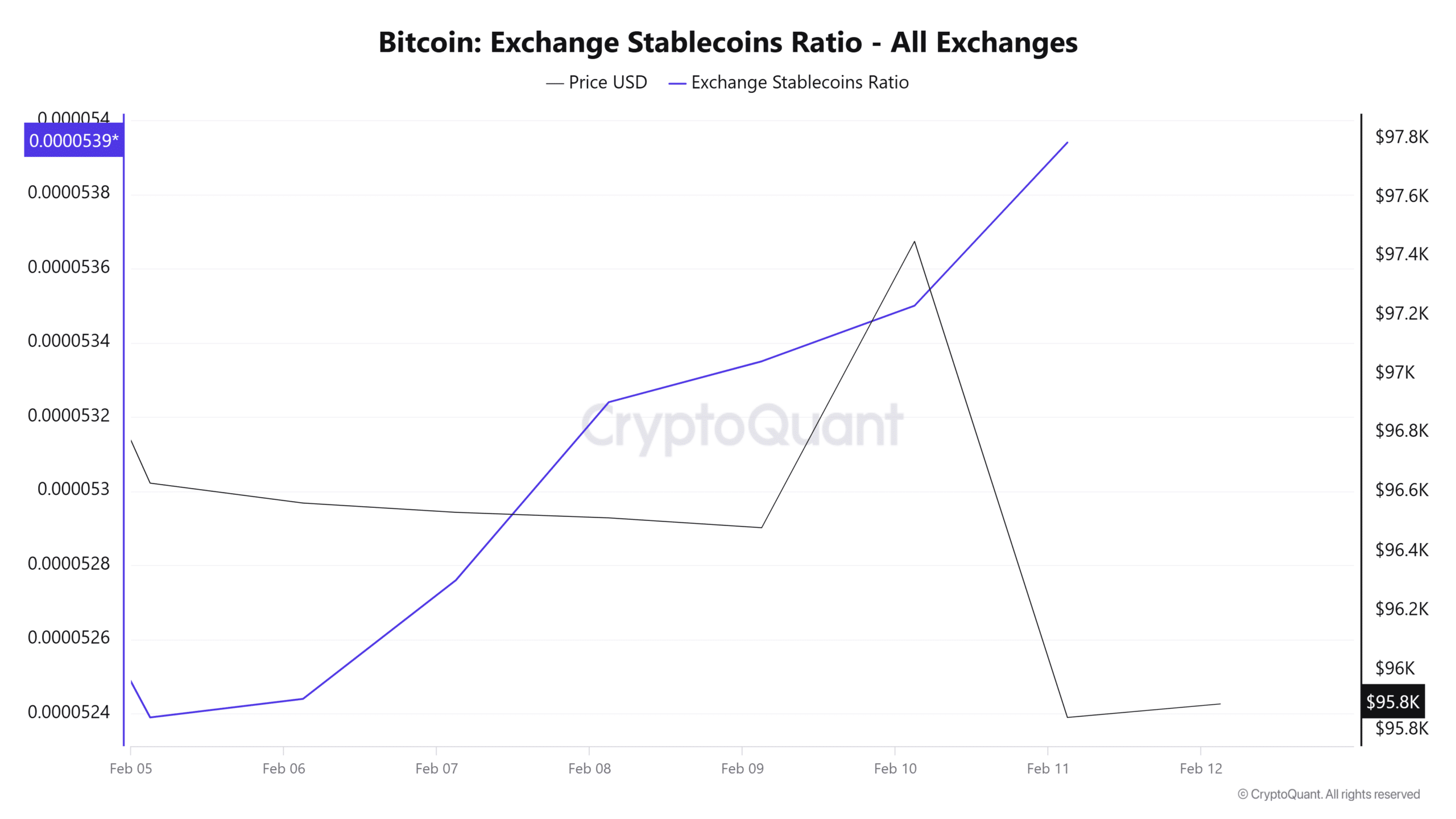

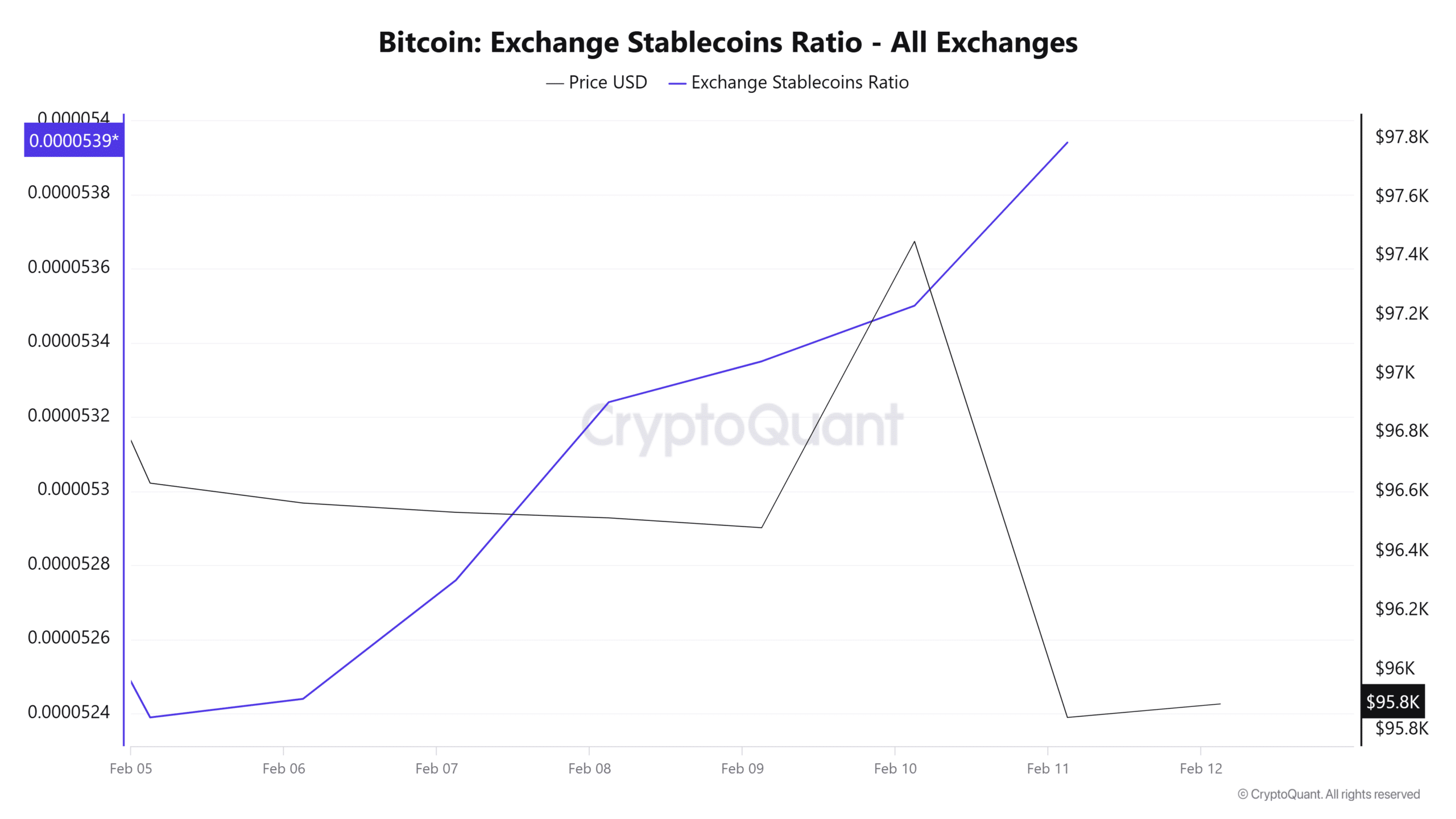

Source: Cryptuquant

Moreover, the ratio of Bitcoin’s Exchange Stablecoins has risen last week. Settings often use stablecoins such as USDT or USDC to buy BTC, so a rising Stablecoin supply indicates a potential purchasing power on the market.

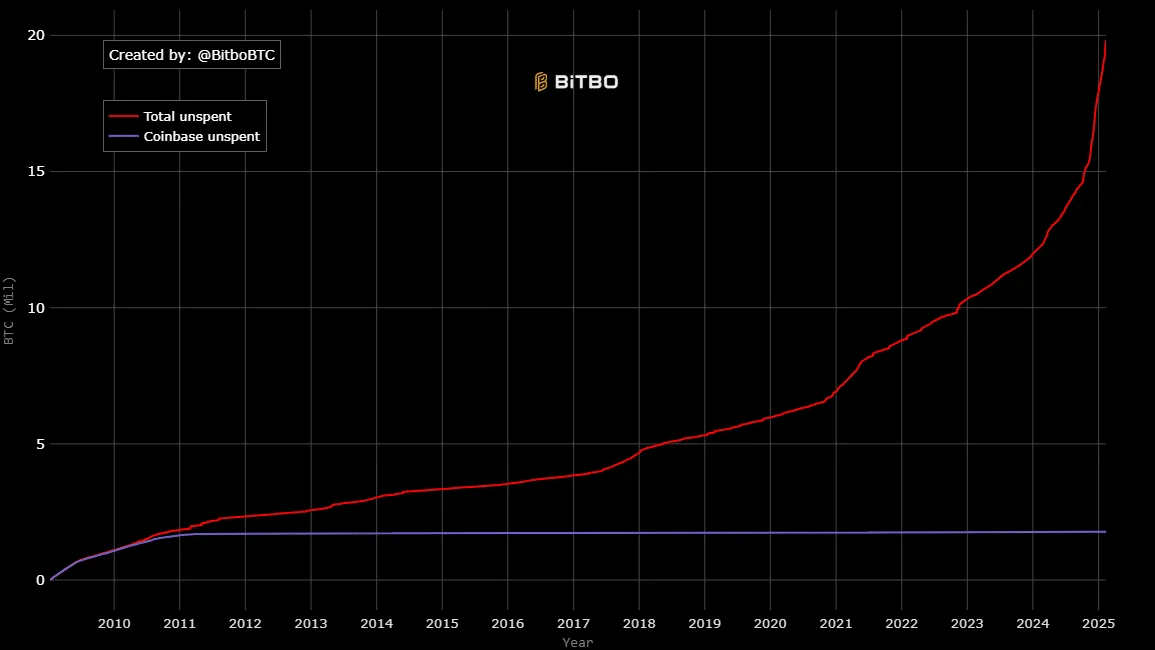

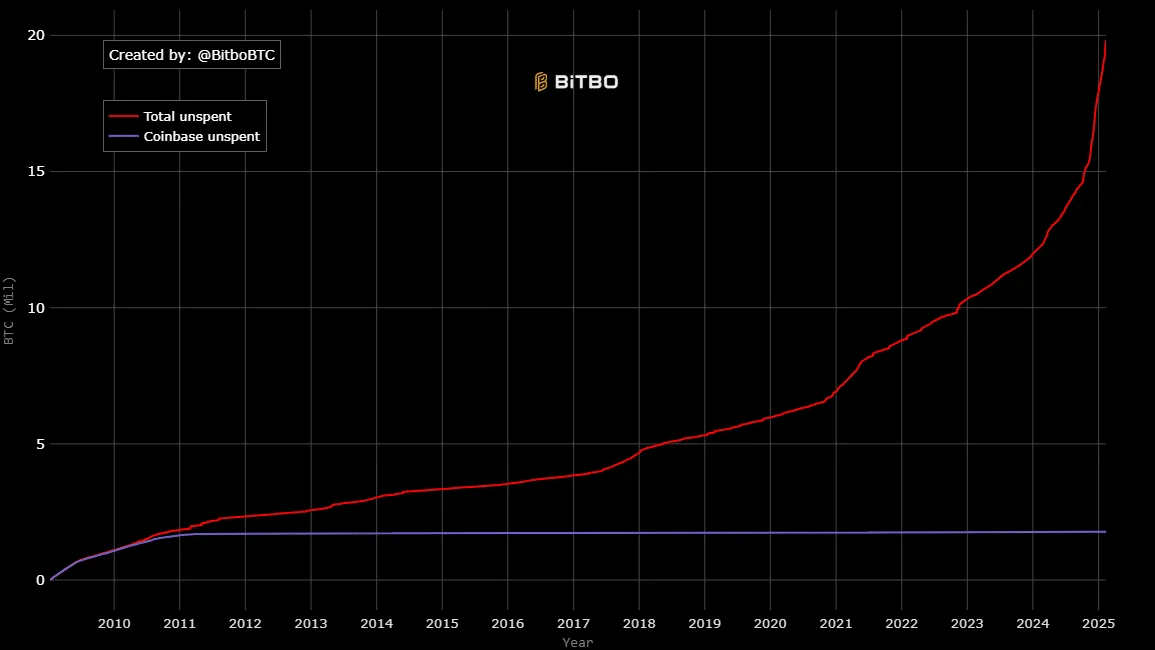

Likewise, dormant coins, in particular total non -pronounced non -rise, have a steady increase, while the non -spoken coins of Coinbase have remained the same.

This means that large and long -term holders do not sell BTC, nor through Coinbase or other fairs.

Source: Bitbo

Concluding, Bitcoin experienced a high demand from institutions, according to reduced sales pressure and higher purchase activity.

With settings that buy without selling, it reflects strong bullish sentiments that turn to accumulate.

That is why the current market conditions position BTC for more profit on its price diagrams. If this trend applies, BTC can break from $ 98,405 and try $ 100k.

However, with STH sellers who are still on the market, a withdrawal could come back to $ 95,031.