Este Artículo También Está Disponible and Español.

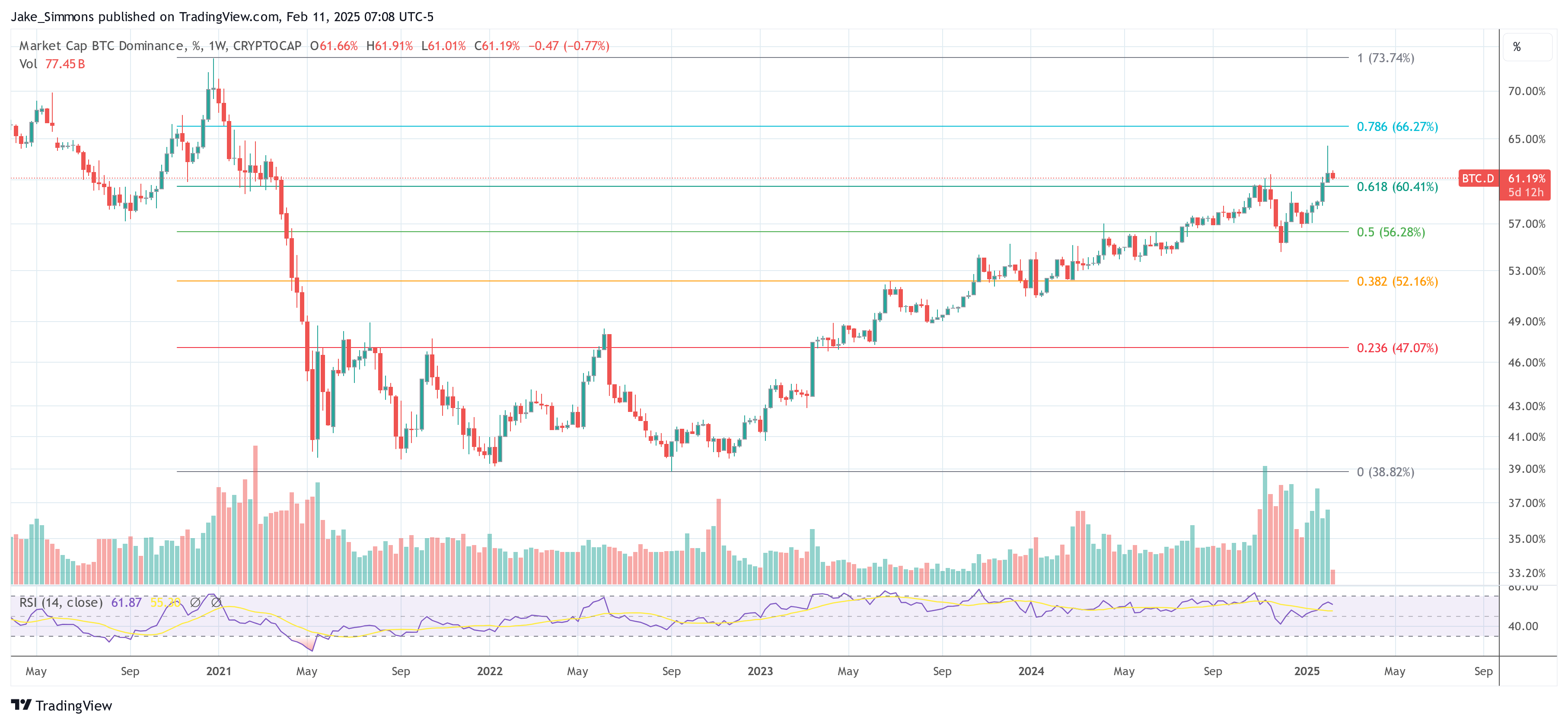

The Bitcoin Dominance (BTC.D) rose above 64%this week, the highest level since March 2021, so that the debate led over an approaching short squeeze that could send its price to heaven. The Stark -warning comes from Joe Consorti, head of growth at Hesa, who went to X on Monday to outline what he regards as a decisive turning point for Bitcoin versus the rest of the digital assets market.

A historic break in the correlation patterns of Bitcoin

In afterConsorti argues that the recent Bitcoin price action marks the first time in his 16-year history that both the price and market dominance have risen in combination. Historically, Bitcoin’s dominance would initially rise, only to take the way speculation was spilled in Altcoins. However, Consorti explains: “This is the first time in history that the share of Bitcoin in the total market for digital assets is increasing while the price is climbs. In earlier cycles, the retail-driven speculation pushed the price of Bitcoin up and later went money to Altcoins, causing Bitcoin dominance to fall. That dynamic has disappeared. “

According to Consorti, the days that a wide Altcoin -Rally would follow the first wave of Bitcoin. Bitcoin Dominance has recently reached 64%highest level since February 2021. Consorti attributes the phenomenon to a significant change in market participation: “These cycle, institutions, sovereigns and long-term holders lead the management, which increasingly granted capital, capital, Exclusive to Bitcoin while they largely ignore the rest of the market. ‘

Related lecture

Last week’s market turbulence resulted in what Consorti calls ‘the single liquidation event in’ crypto ‘history’, with reference to data that more than $ 2.16 billion in positions were wiped out within 24 hours. Ethereum led the liquidation figures by $ 573 million, and the largest single liquidation – an ETH/BTC order of $ 25.6 million – took place on Binance. “As you may have guessed, ETH/BTC does not have a great time,” Consorti notes, pointing out that the ETH/BTC pair acts in more than three years at 0.026 – the lowest level.

He argues that these liquidations emphasize the precarious nature of heavily used Altcoin markets: “All swept in an instant when the price moved against them. This was not your standard technical correction, it marks the start of an extinction-level event for Altcoins. “

The “Altcoin Casino” in Crisis

The analysis of Consorti suggests that what he calls “the Altcoin Casino” is now collapsing. He points to failed stories about popular projects – in addition, Solana and Defi among them – who have had difficulty retaining the trust of investors: “Altcoins have purely survived about stories. Every cycle, a new series of stories arose, promised world -change innovation. None of them lasted. “

He contrasts this with Bitcoin’s core value proposition, which he believes does not require marketing: “Bitcoin, on the other hand, does not need any story. It does not need marketing or hype. It exists, and it thrives because it is built to do one thing – move wealth in a world of eternal monetary expansion. “

Consorti also refers to the “merging” of Ethereum and the supposed deflatory design, pointing that the total range of ETH has increased since its upgrade has increased with 13,516 ETH-under Making the claim “Ultra-sound Money”.

Related lecture

Consorti adds a policy dimension to the transformation of the market and emphasizes a statement from Senator John Boozman during the first press conference of the White House Crypto Working Group: “Some digital assets are raw materials, some are effects.”

This, he suggests, is a tacit recognition that distinguishes Bitcoin from other digital assets. In a further development, Consorti quotes a remark from the White House Ai & Crypto Czar David Sacks, who mentioned that the group is evaluating the viability of a strategic bitcoin reserve- a shift of the previous terminology of the “National Digital Asset Stockpile” Used under a Trump ERA Executive Order.

Consorti frame this as a “great development” that indicates the growing recognition of the unique characteristics of Bitcoin: “This language shift is monumental. A few years ago the US government was openly hostile to Bitcoin. Today they are discussing it in stock.”

In the midst of this revolution, Consorti suggests that the next dramatic movement in Bitcoin could be an explosive short squeeze. Financing percentages on perpetual futures, he notes, have become ‘deep negative’, reminiscent of when Bitcoin acted near $ 23,000 in August 2023. This implies a tilt in leverage opposite traders who are gambling against Bitcoin – a position that could quickly relax: ‘While last week of last week leverage, most long positions wiped out, the next major movement could be the opposite – an explosive rally fed Due to forced short liquidations. “

If the market turns against these short-sellers, the forced backs can increase the price higher with an unusual speed and volume, especially if the total liquidity remains thin. He concluded: “Traders who surpassed their leverage about Bitcoin will eventually have to buy it back when the price goes against them, just as survivored Longs was wiped out last week. Bitcoin is rolled up. The stage is set for a potential short squeeze. The longer this dynamic of short dominance persists, the greater the risk of a forced shirt -reading cascade that sends the price of Bitcoin higher with violence. “

At the time of the press, BTC.D was 61.19%.

Featured image made with dall.e, graph of tradingview.com