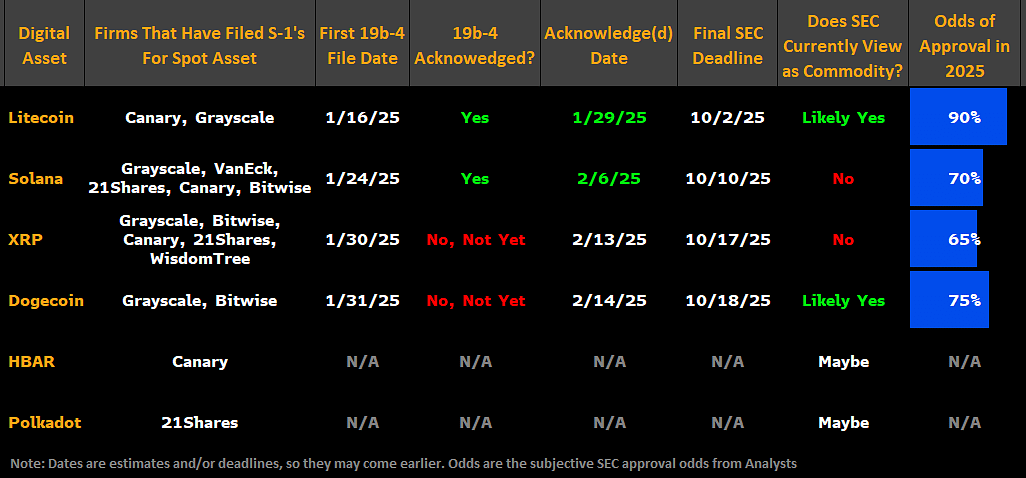

- LTC ETF has the highest approval opportunities in 2025 at 90% per Bloomberg analysts.

- LTC price has seen a remarkable recovery as ETF speculation intensifies.

Litecoin[LTC] Price rose +20% in the past two days and was $ 132 in the midst of renewed ETF speculation in the US.

According to Bloomberg ETF analysts, James Seyffart and Eric Balchunas, the chance of LTC ETF approval in 2025 were 90%.

Source: Bloomberg

Under the Altcoin ETFs, LTC had the highest opportunities for approval according to their analysis. However, the last sec deadline is October 2025.

So, will LTC continue to run the opportunities for approval in the front or loses the uptrend in the short term steam?

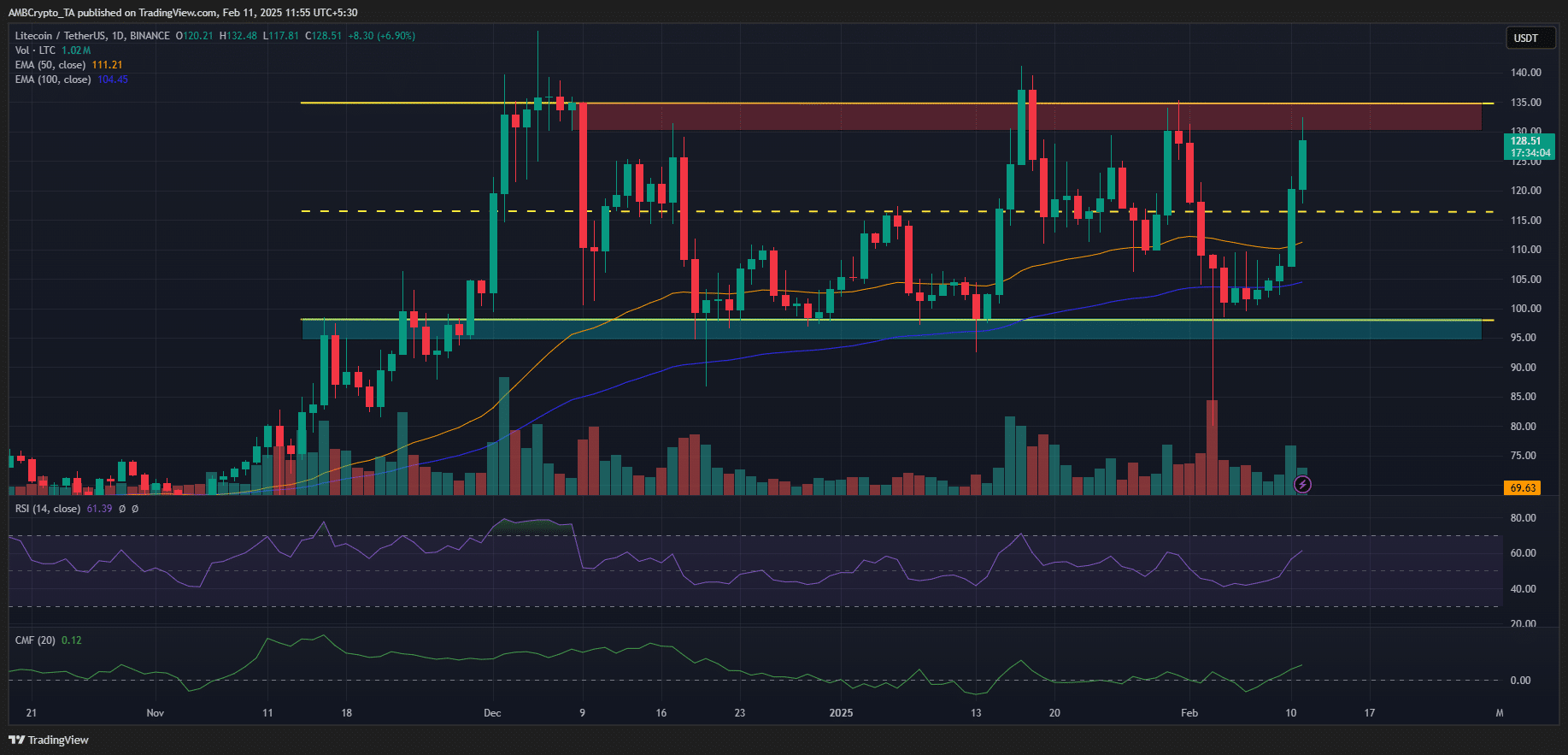

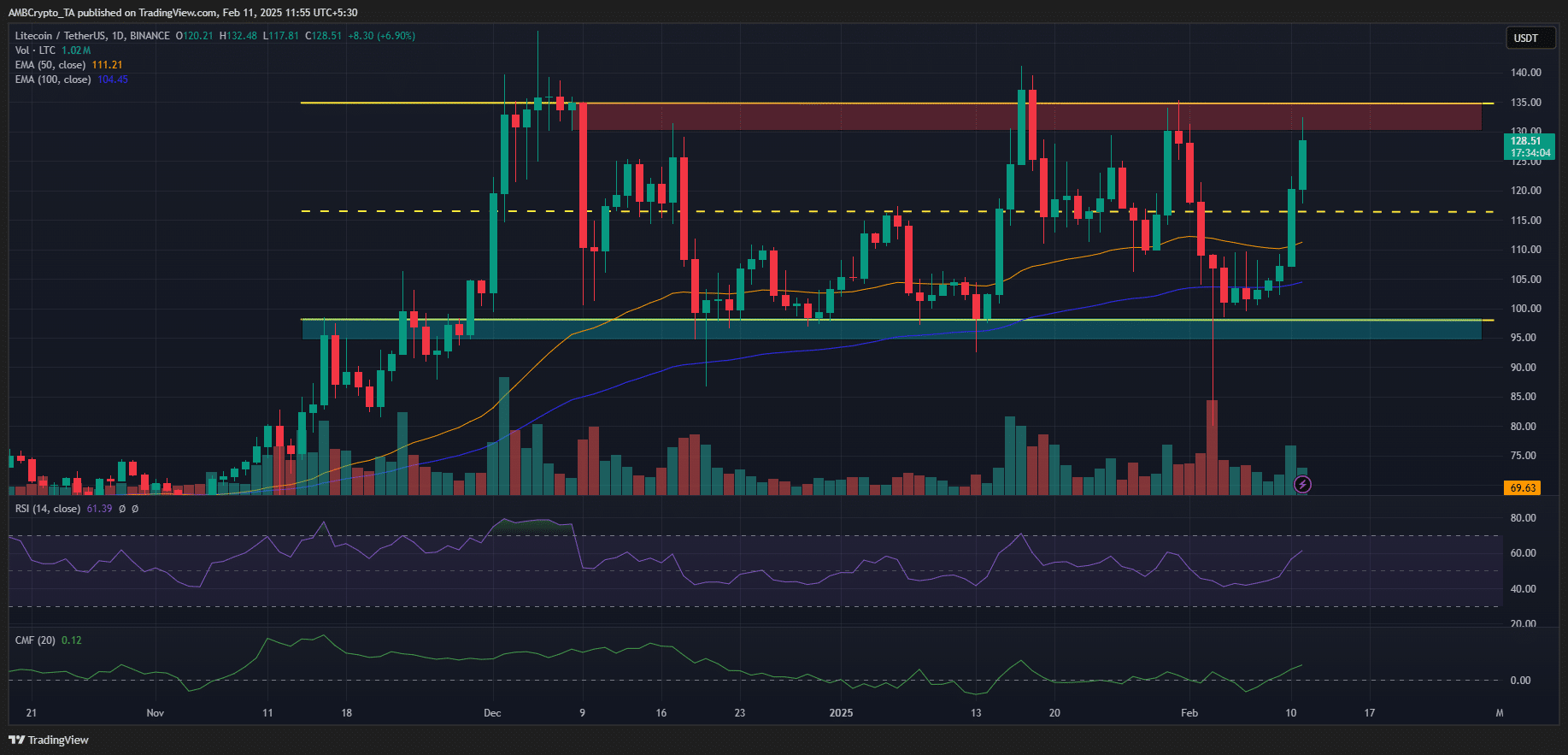

Litecoin again testing range-highs

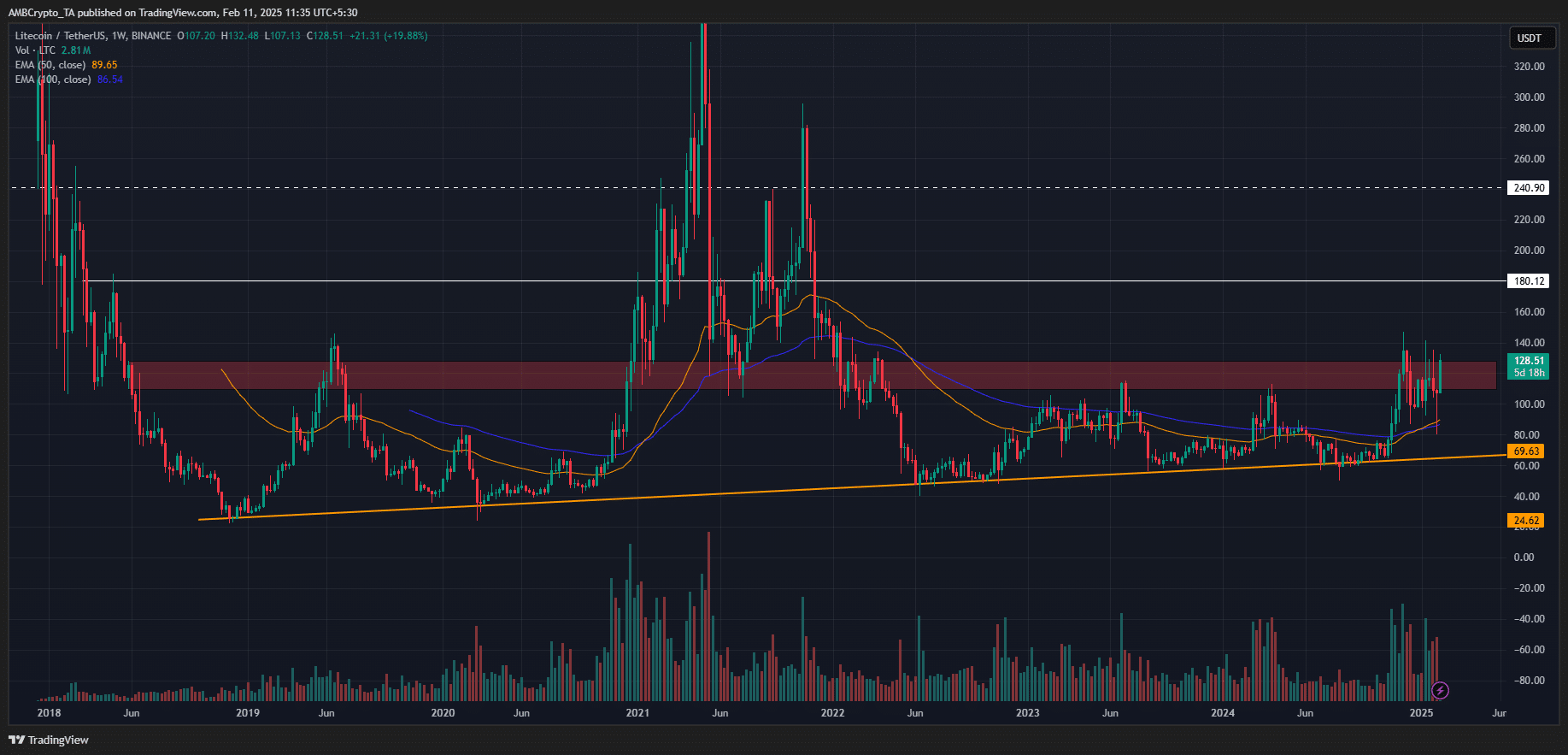

Source: LTC/USDT, TradingView

LTC Bullish was on the Daily Chart, but stayed within the price range of $ 95- $ 140 that has been seen since last November.

However, the daily RSI still had to hit the overboughtzone, which suggests that the ‘Bitcoin Beta’ still had room for growth.

That said, unless BTC is standing more than $ 100k, LTC’s range can become a different sales zone at $ 135 (red zone). The sale can come from swing traders who jumped at the buying option during last week’s De-Supply event. They would have risen 30% in the profit.

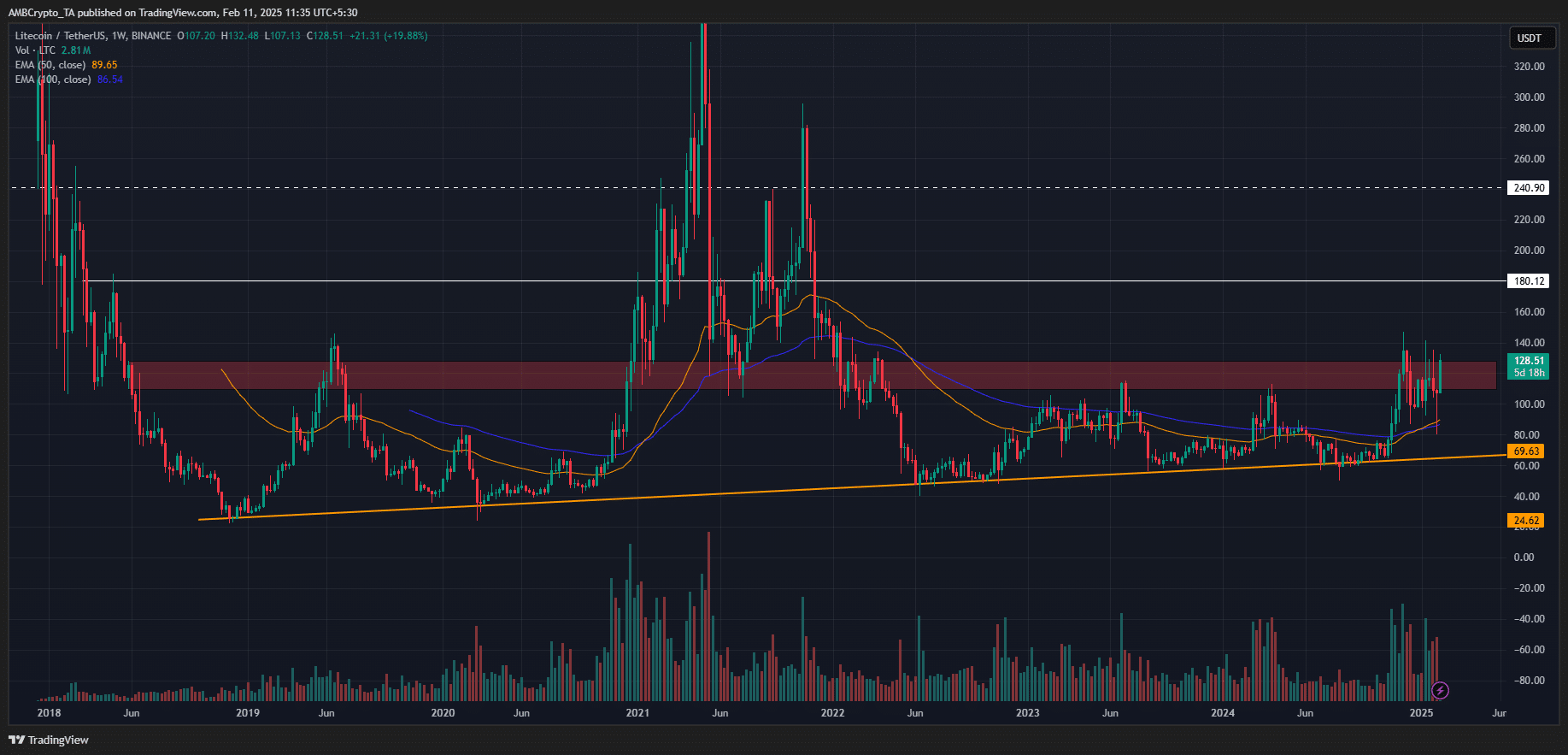

However, if it zoomed out at the higher period of time (weekly graph), the following key level for LTC would be $ 180.

The range of $ 100- $ 180 was an important range in 2021 before LTC expanded its winning series to +$ 280.

Source: LTC/USDT, TradingView

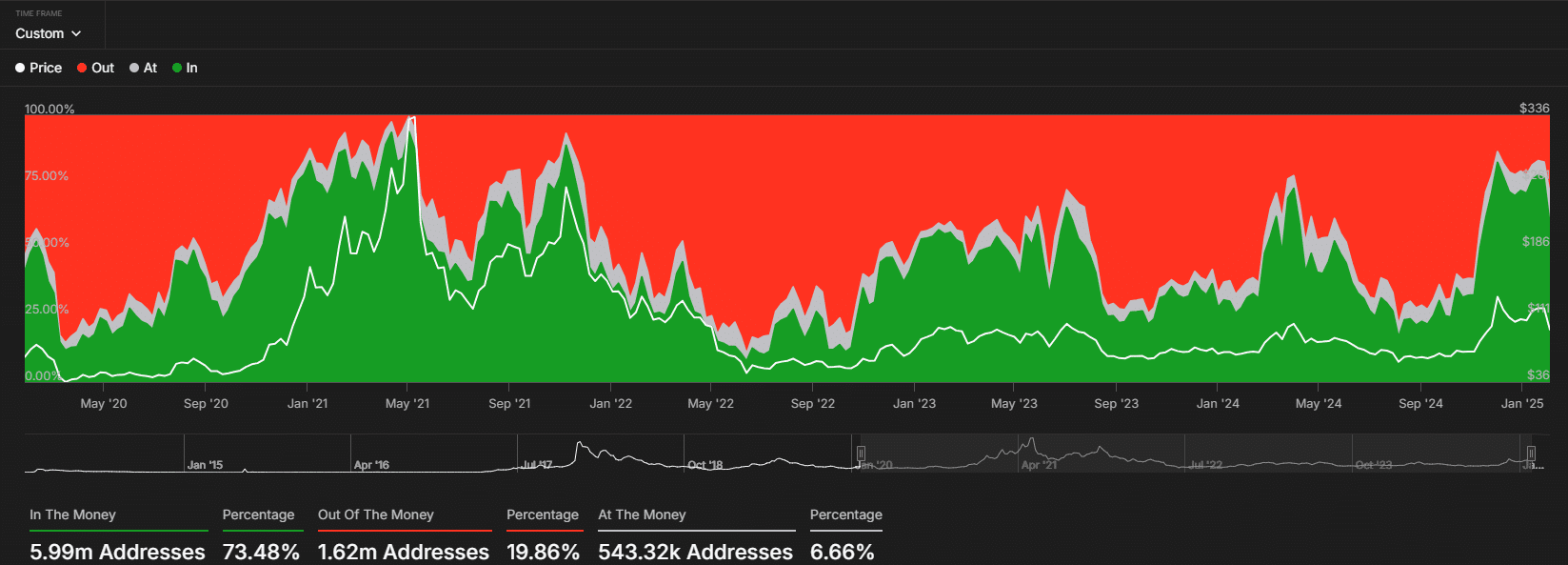

More than 73% of the LTC holders of profit

Another pitfall in the short term that is worth considering for late FOMO speculators was a high level of non-realized profit among LTC holders. At the time of writing, Intotheblock data revealed that 73% of the LTC holders had a profit.

For the perspective, LTC reached local tops in December and March when profitability reached 84% and 72% respectively.

This meant that the continuing meeting of LTC could be covered if holders started to book in large numbers of profit.

Source: Intotheblock

Litecoin [LTC] Priority 2025-2026

Simply put, the ETF speculation of LTC is a great opportunity for traders. Long-term holders, however, had enormous non-realized profits that can limit the recovery in the short term if they make a profit.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer