- The number of BNB addresses has now reached a new of all time.

- Spoting and derivative traders were tailored to the potential meeting of BNB in the upcoming trade sessions.

Despite a decrease of 4.53% in the last 24 hours, Binance Coin [BNB] Probably seemed to resume his bullish momentum. Sentiment among top traders and spot investors in particular began to become bullish.

Recent market activity on the chains suggested a likely BNB price tree in the coming sessions because of the decided bullish Kijk.

BNB -Adoption could soon be spinning

There has been a remarkable increase in the number of unique addresses on the BNB chain in the last 24 hours, with a new highest point of 500 million addresses.

This milestone indicates the growing acceptance that BNB, his native token, could positively influence, because increased transactions and use probably coincide with a market trally.

Source: Bscscan.com

Although a rally is possible, a price dump may not come true if the wider market sentiment Beerarish remains, as it is currently.

Market sentiment and on-chain analysis

Ambcrypto analyzed the market sentiment to determine possible price movements for BNB in the upcoming trade sessions.

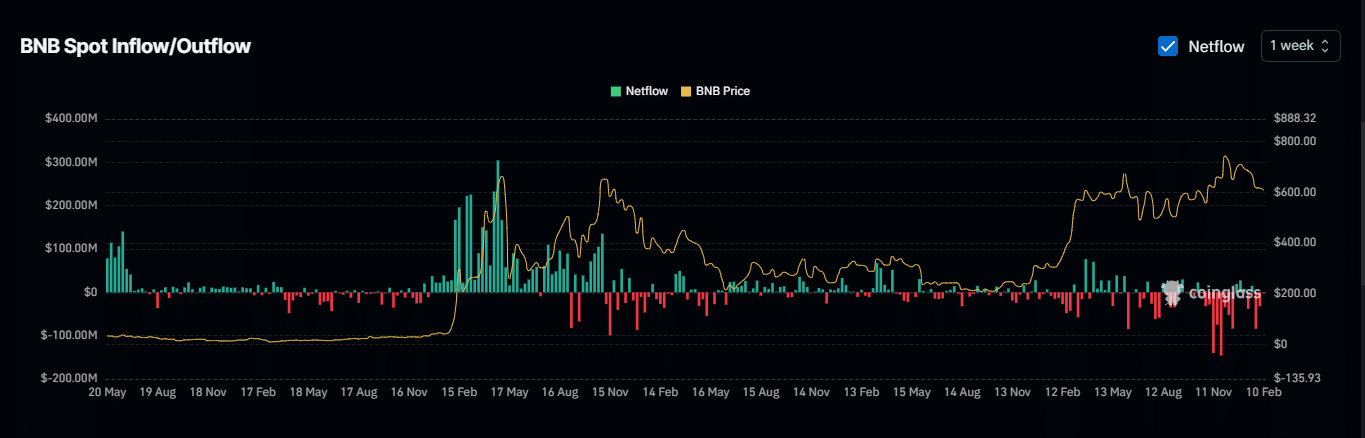

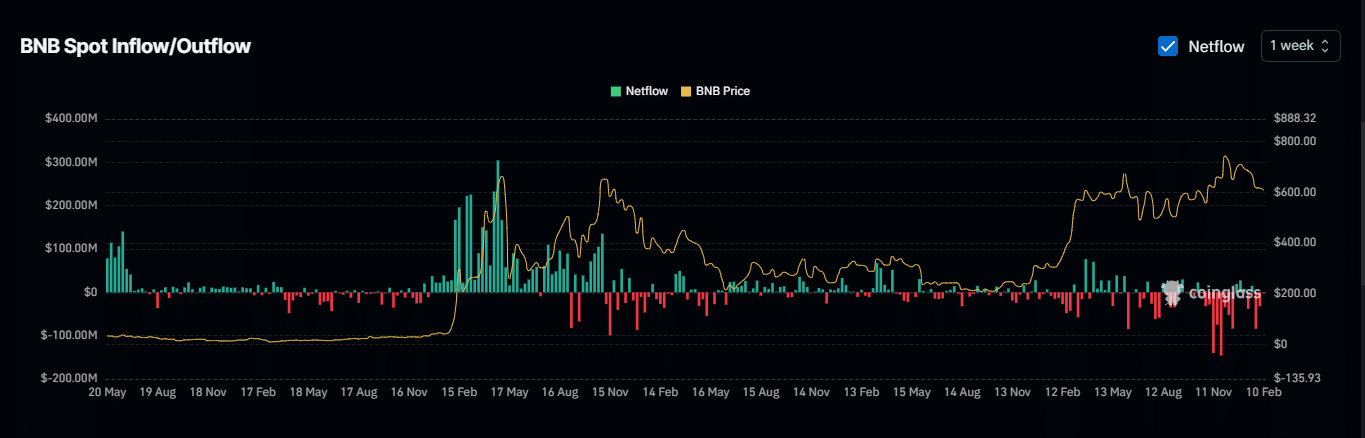

Spot traders have been on a bargain for BNB in recent weeks. $ 117.84 million was purchased from BNB between January 27 until PEPLIEG.

Source: Coinglass

This was determined by Coinglass Exchange Netflow data, which have become negative.

A negative Netflow suggests an increased purchase activity, while traders move their participations from fairs to private portfolios instead of keeping exchanges for sale.

The derivative market shared a similar bullish sentiment. Binance Top Derivative Traders are currently the most optimistic, with the long-to-korter ratio-the number of buyers versus sellers assembling 2,369.

This indicates more buyers than sellers, because higher values above 1 signal increased the buying activity.

BNB price movement on the graph

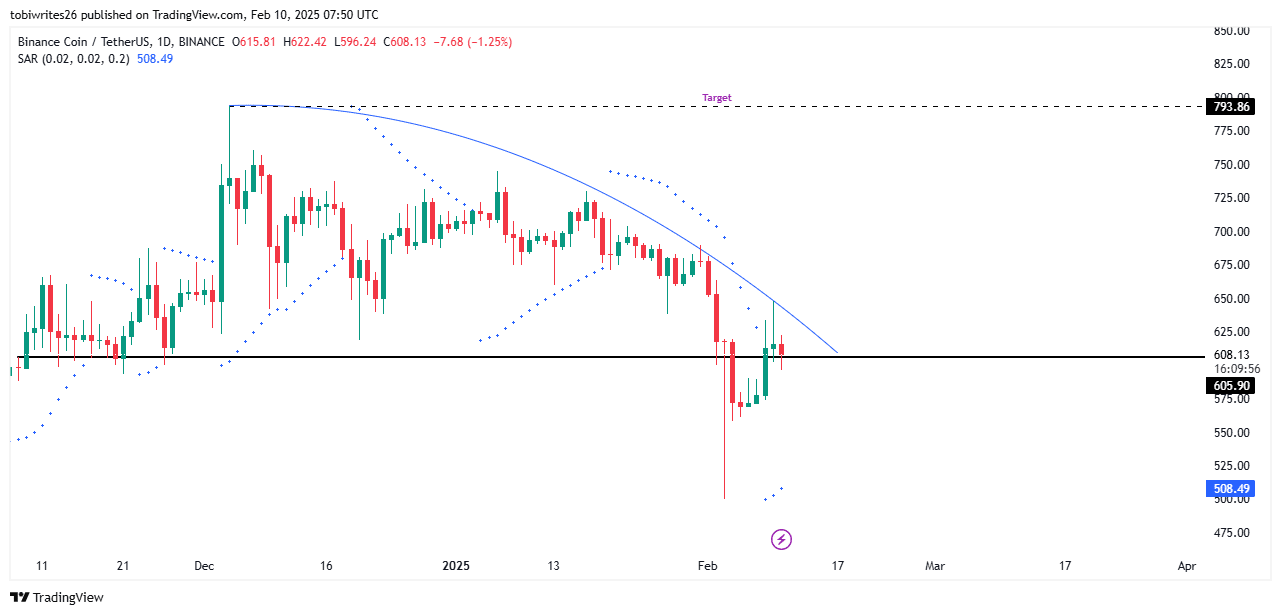

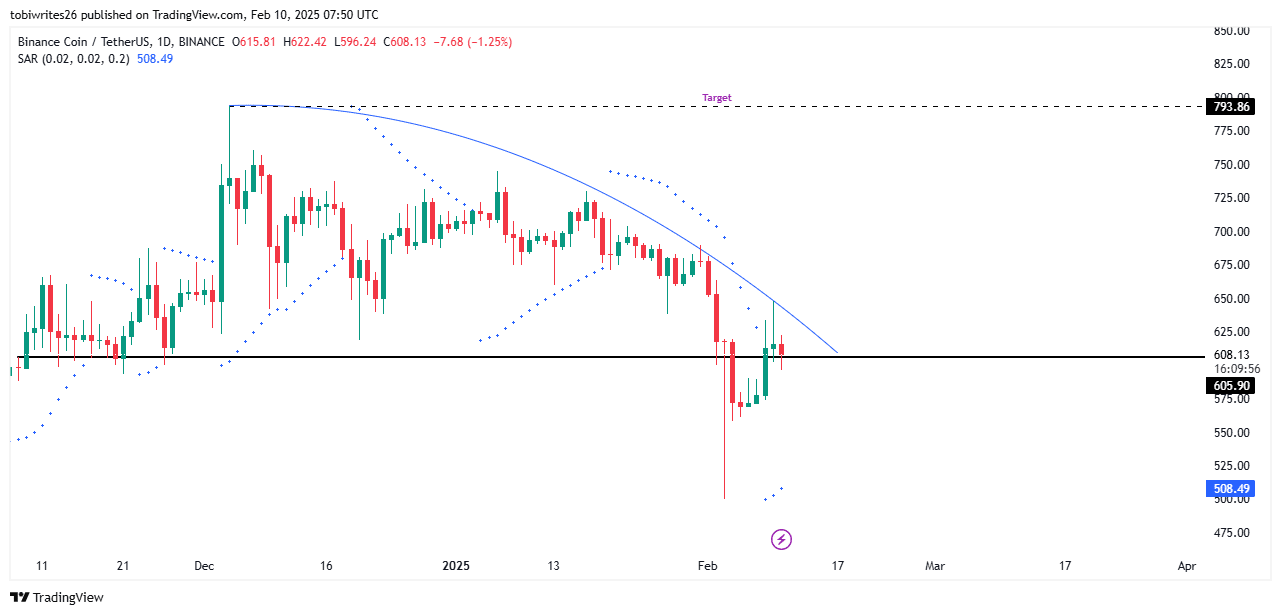

The price of BNB started coordinating on the bullish sentiment in the charts and started Reclaiming a support level that has recently been violated.

During the press, it was trade in the vicinity of the support of $ 605.90, which could serve as a catalyst for a considerable upward movement, so that the upward liquidity was marked in blue and focused on $ 793.86.

Source: TradingView

Read Binance Coin’s [BNB] Price forecast 2025–2026

Adding to the bullish outlook is the parabolic sar -indicator (stop and reverse), which uses dots to identify potential price trends and reversations. When the dots form below the price, this indicates an upward trend.

The parabolic SAR has formed under the press price of BNB, which indicates Bullish Momentum and a potential price destination in the upcoming trade sessions, which increases the chance of a rally.