- The recent liquidation event of Bitcoin reflected earlier market crashes such as FTX and COVID-19.

- Institutional purchasing interest rate suggested a potential recovery, despite persistent market volatility.

Bitcoin’s [BTC] Recent price decrease has sent shock waves by the market and causes the greatest liquidation of long positions that are seen in months.

While BTC collapsed, traders who had held bullish positions were quickly forced, which resulted in massive losses.

This dramatic sale has made creepy comparisons with earlier market crashes, which makes many wonder whether a similar decline on the horizon could be.

A market reset in motion?

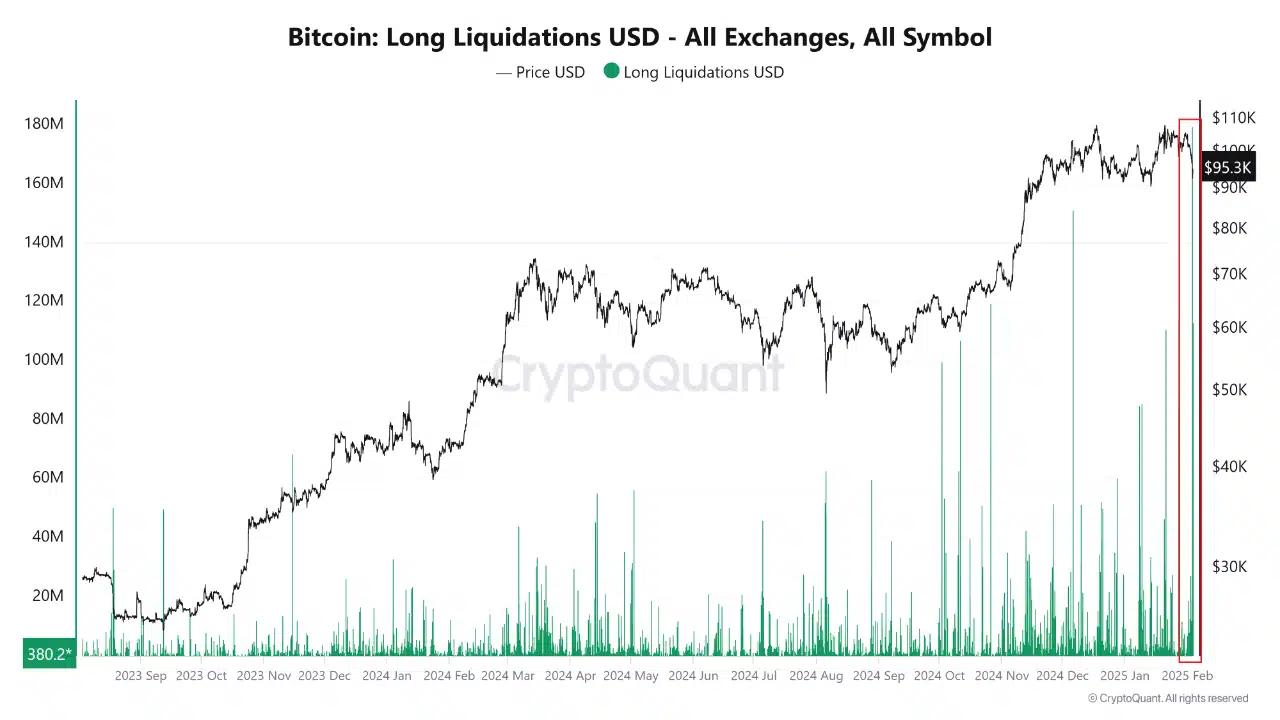

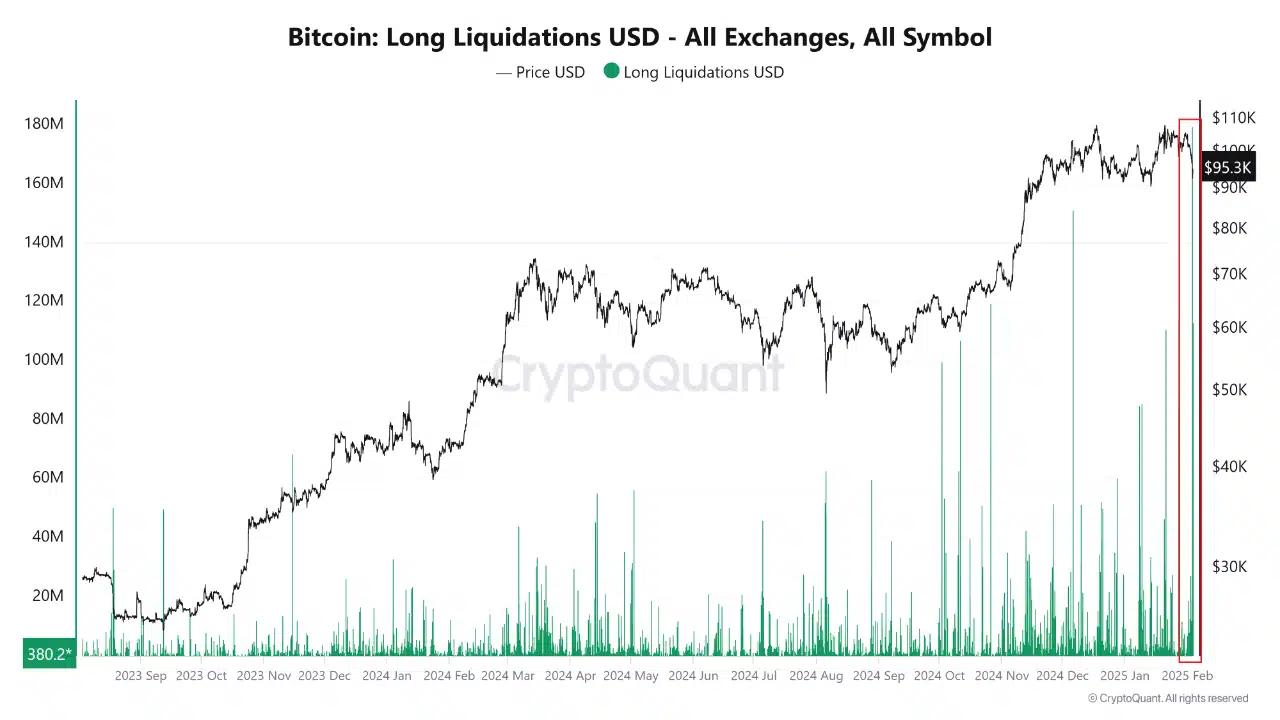

Recent data is displayed Those Bitcoin long liquidations have been achieved since September 2023 unseen levels.

The newest liquidation volume exceeded $ 180 million, a figure that underlines the extreme trust traders in bullish positions before the abrupt decrease.

The sudden price decrease to around $ 95.3k has activated a cascade of forced sale, so that the lifting tree positions are quickly cleared up.

Source: Cryptuquant

The high expectations of the upward movement market were quickly crushed, which activated a drastic liquidation event.

The steep liquidation peak at the end of January and early February points to excessive leverage. This caught leverage traders from the Guard, which led to one of the most important market cleaning in recent history.

Bitcoin: causes and effects of the price decrease

The sudden BTC price fall can be reduced to various important factors. Submitted positions were an important driver, in which traders used a high leverage that was forced to sell as BTC dropped, which activated a liquidation cascade.

Macroeconomic uncertainty, including concerns about monetary policy or new regulations, also brought investors and contributed to the sale.

The effects of this price decrease have been considerable. The liquidation event has wiped out many surviving traders and re -established the leverage of the market.

It also increased volatility, causing competitive price fluctuations. With a surplus leverage, however, the market can now be in a better position for a more stable, organic recovery.

Comparison with similar gigantic crashes

The recent liquidation event shows striking similarities with previous market crashes.

Source: Cryptuquant

Bitcoin: Resetting expectations

The Coinbase Premium Gap reveals considerable purchase interest after the dip from Bitcoin to the range of $ 92k- $ 95k.

The positive premium suggests that institutional investors intervene to absorb liquidity, using the price decrease to accumulate BTC at lower levels.

This shows a strong institutional demand despite the wider market weakness.

Source: Cryptuquant

However, the MVRV momentum indicator has remained negative Since the beginning of the year, so that many investors are still under water.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Historically, a negative MVRV suggests long -term consolidation or further down if confidence does not return quickly.

This liquidation event has reset market sentiment and although excessive leverage has been erased, the market remains volatile.