Este Artículo También Está Disponible and Español.

The recent price in the burden in Bitcoincaused by a turbulent cryptocurrency market, has sent many investors in panic mode, which means they have to discharge their BTC interests with losses.

Blockchain Analytics company Glassnode, however, noted that a group of Bitcoin investors remained resilient despite the volatility of the crypto market, and said that the long-term holders of the firstborn crypto are not scaled by the current market waste.

Related lecture

Long -term holders ‘largely unaffected’

Glassnode said that Bitcoin, like other cryptocurrencies, experienced a shaky week in which traders saw the world’s most dominant digital assets -crashing under the level of $ 100,000.

At one point the price of Bitcoin almost reached the level of $ 90,000, at $ 92,800, on 3 February, which was the lowest since BTC on January 13 $ 90,890.

On the better side, the blockchain analyzed company noted that the long-term holders of BTC seem isolated of all Chaos around the cryptocurrency Community, who says: “#BTCs long -term holders (LTHS) remain largely unaffected.”

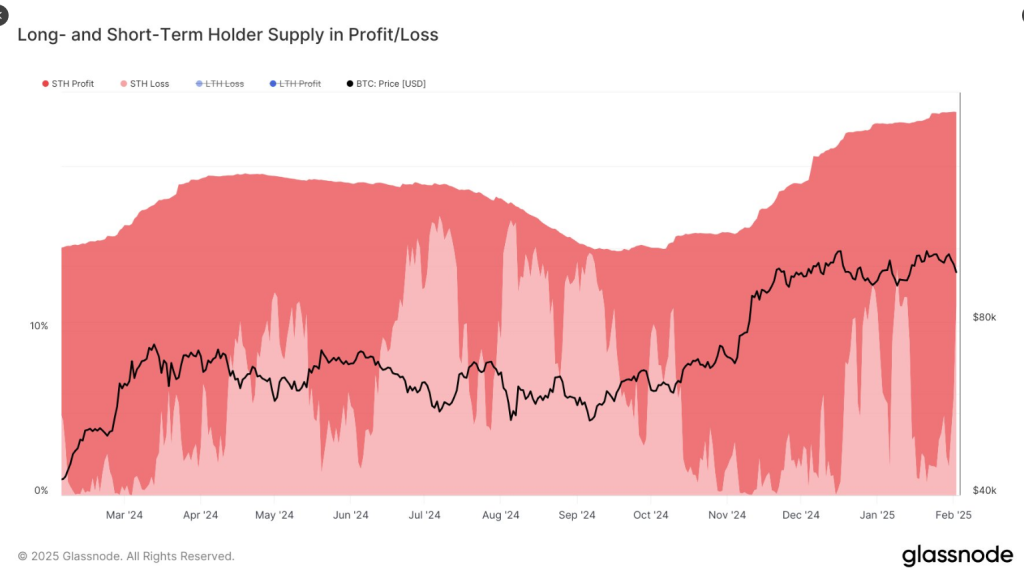

Glassnode revealed that data showed that almost 0.01% of the range of these BTC holders was in loss, which emphasized the resilience of long-term investors in times of market turbulence. However, the crypto company noted that these Bitcoin investors experienced a decreasing non -realized profit.

“Their non -realized profit share has fallen steadily since November, now at the lowest since September – which suggests that there is no renewed accumulation,” Glassnode said in a post.

The analyst noted that BTC holders do not buy aggressively at the current prices, possibly wait for better market signals before the accumulation is resumed.

Bitcoin short -term holders bleed

In the meantime, data showed that another Bitcoin investors segment suffered the most from the market crash borte termholders.

According to Glassnode, short-term BTC holders experienced a considerable loss after the price of the crypto below the level of $ 100,000, causing panic among these traders.

#Bitcoin Persons under $ 100k in the weekend and a remarkable amount to the short -term holder (STH) in loss. At $ 97K, the range of loss and profit from STHS was equal to ~ 11% – the largest loss exposure for STHS since the beginning of January: https://t.co/drjy6ahqmm pic.twitter.com/Gypnij0bqx

– Glassnode (@glassnode) February 3, 2025

Glassnode said that when Bitcoin dropped to $ 100,000 in the weekend, this “a remarkable number of short -term holder (STH) pushed delivery in loss.”

“At $ 97K, the range of loss and profit from STHS was equally distributed to ~ 11% – the Largest loss forest for STHS Since the beginning of January, the Blockchain Analytics company said in an X post.

Beerarish Market sentiment

An analyst noted that Bitcoin briefly dropped so low that it hit almost $ 90,000 per coin, because the dominant crypto suffered after the market crash.

“Bitcoin plummeted to $ 91.2k when all crypto is immersed with world share markets that start the week with heavy bleeding. Media -Sales points seem to attribute falling sectors ‘Trump’s trade war’“Said Market Intelligence Platform Santiment in a message.

😰 Bitcoin plummeted to $ 91.2k when all crypto is immersed with world share markets that start the week with heavy bleeding. Media seem to attribute the kelm meters to ‘Trump’s trade war’.

Whether this is the main reason or whether there is others … pic.twitter.com/ij1bq6xfuu

– Santiment (@santimentfeed) February 3, 2025

Related lecture

Santiment added that there have been overwhelming negative reactions of investors in the cryptocurrency community as a result of the price fall, and for a moment it seems that BTC is about to enter Bearish territory.

The Market Intelligence Platform noted that Bitcoin could currently withdraw to $ 96,000.

“Has this flush been orchestrated to have Trigger-Happy retail traders sell on a local soil? Historically, markets almost always move the opposite direction of the expectations of the crowd, “Santiment asked.

Featured image of Pexels, Graph of TradingView