- BTC has fallen by 6.54% for the past 24 hours.

- The Bitcoin market can be overheated, although other indicators suggest a possible rebound.

In the last 48 hours, while Trump Trade Wars Escalen in North America, the Cryptomarkt is the most difficult. One of the most affected crypto assets is Bitcoin [BTC].

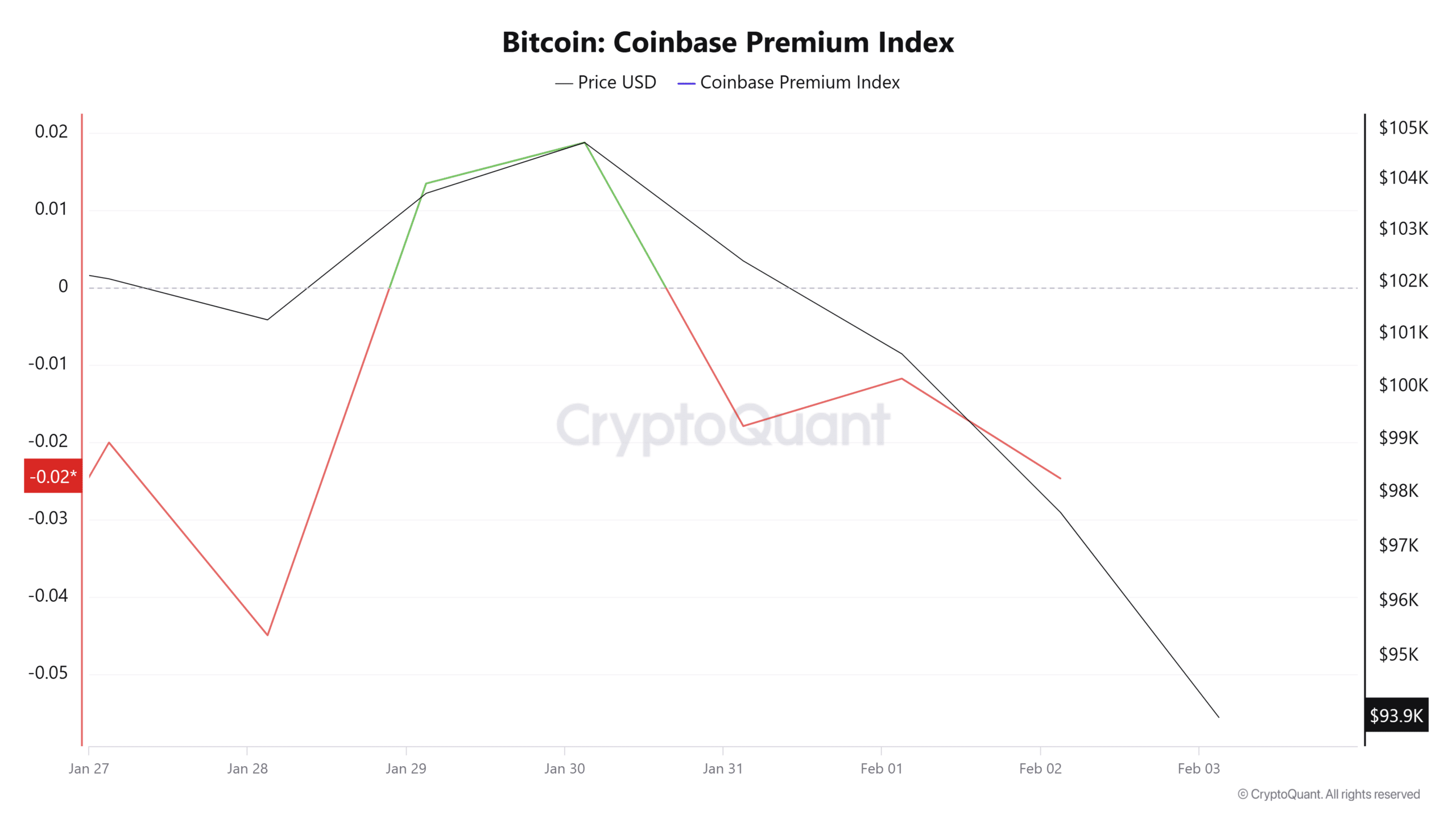

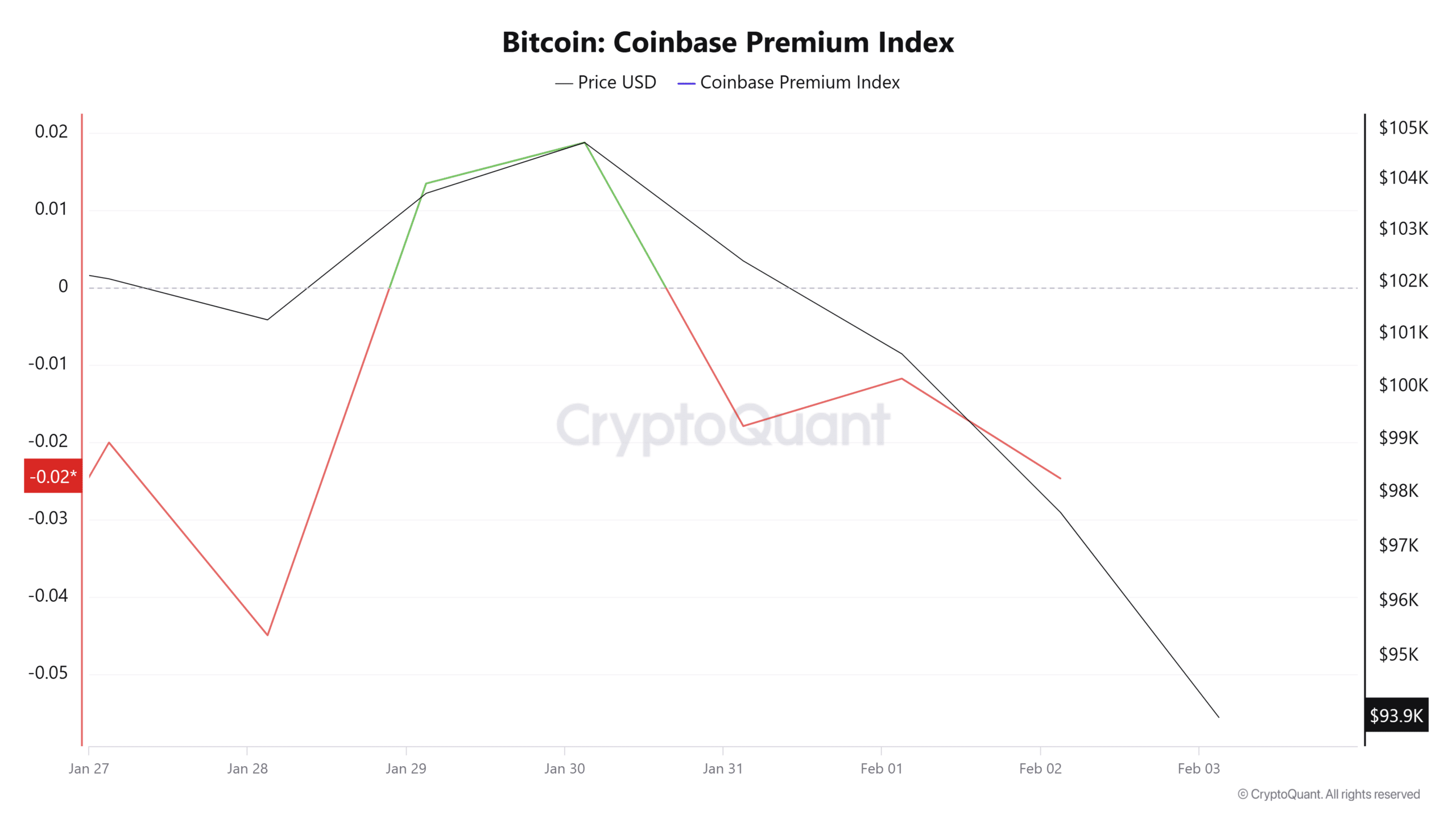

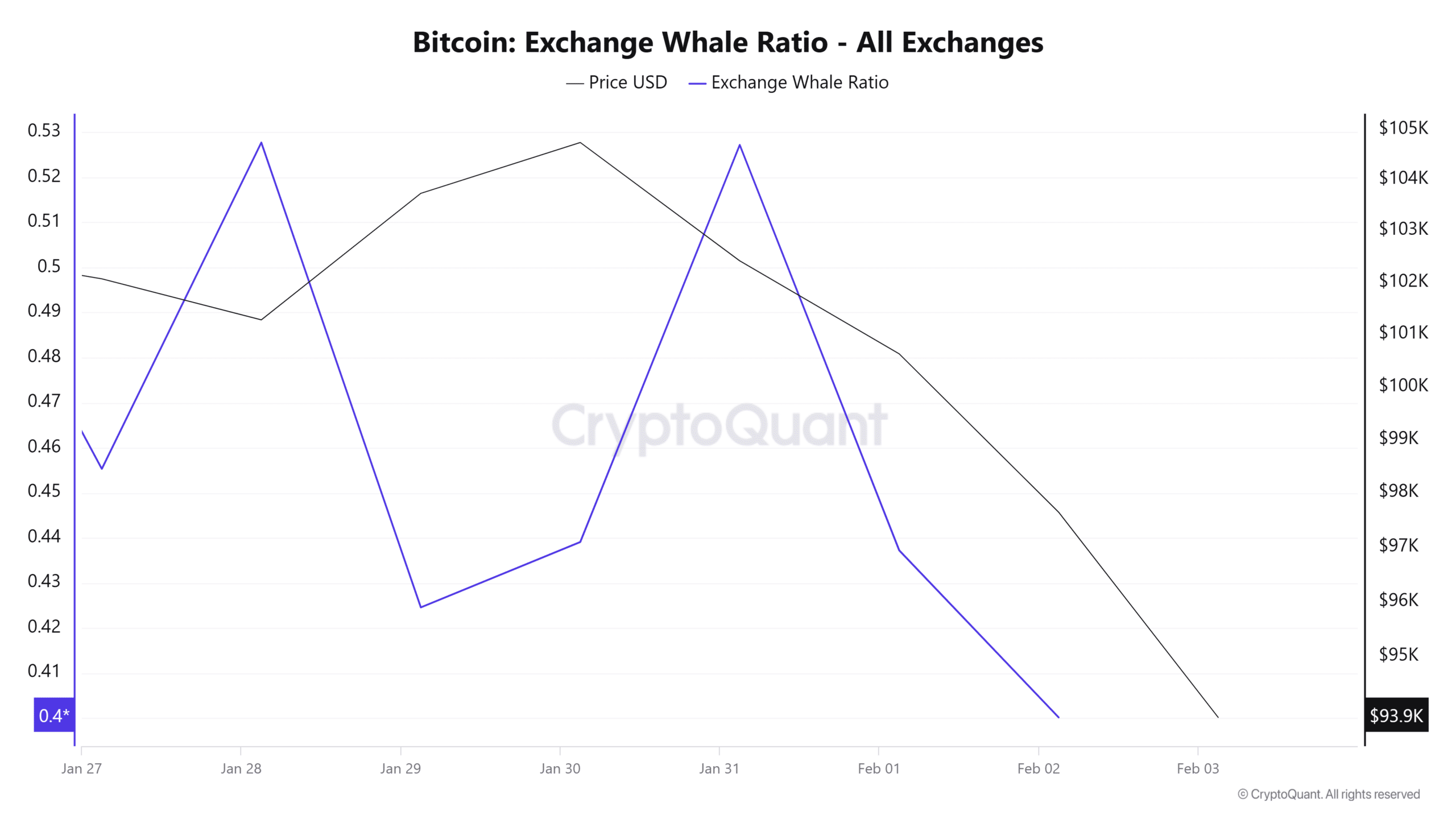

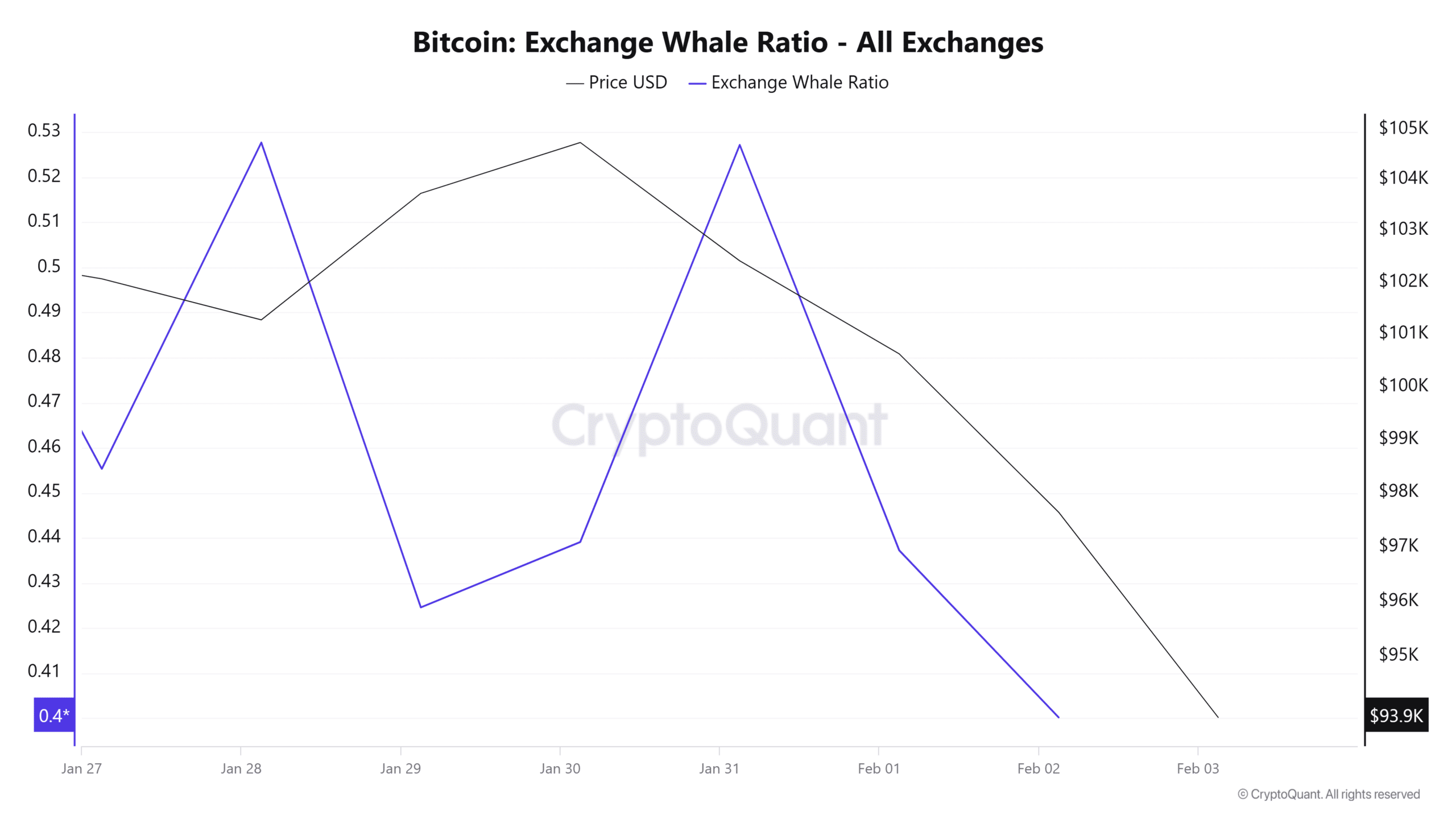

Source: Cryptuquant

During this period Bitcoin fell for the first time in 2025 to a low point of $ 91K. The recent market crash had important stakeholders talked about Bitcoin’s future process.

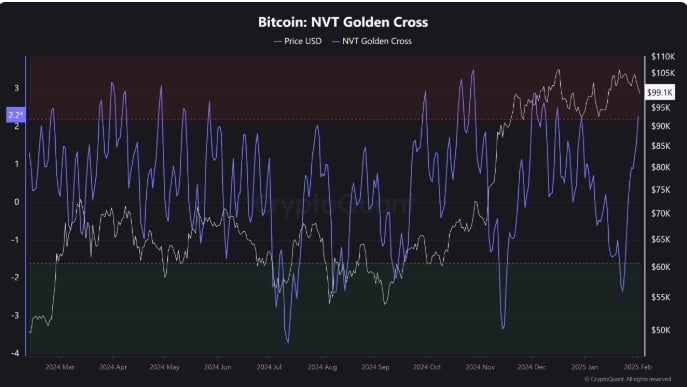

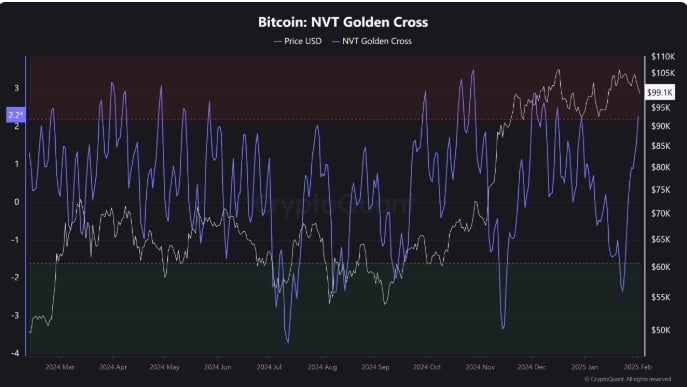

Bitcoin’s N / A Golden reaches a critical level

According to CryptoquantNVT Golden Cross shows that the Bitcoin market is currently overheated and risks a market bubble.

With the Golden Cross Spiking to the current level to settle on 2, this means that Bears try to take over the market.

Source: Cryptuquant

When the Golden Cross reaches this level, it gives a potentially on persistent downward pressure. This phenomenon has been seen over the past two days when American investors become Bearish.

Exciting the critical threshold means that a downward momentum is building and that bears are now on the rise.

What suggest other indicators?

Although the recent price promotion is a reason for the alarm, important indicators suggest that other regions excluding the US remain optimistic.

As such, the recent correction can be a decrease in the short term before the market finds a way out of the current situation.

Source: Cryptuquant

Bitcoinwalfissen, for example, are still bullish and keep their assets off trade fairs. As such, the exchange rate ratio has fallen to reach a low point of 10 days.

This decline means that whales expect that prices will return and not sell their BTC.

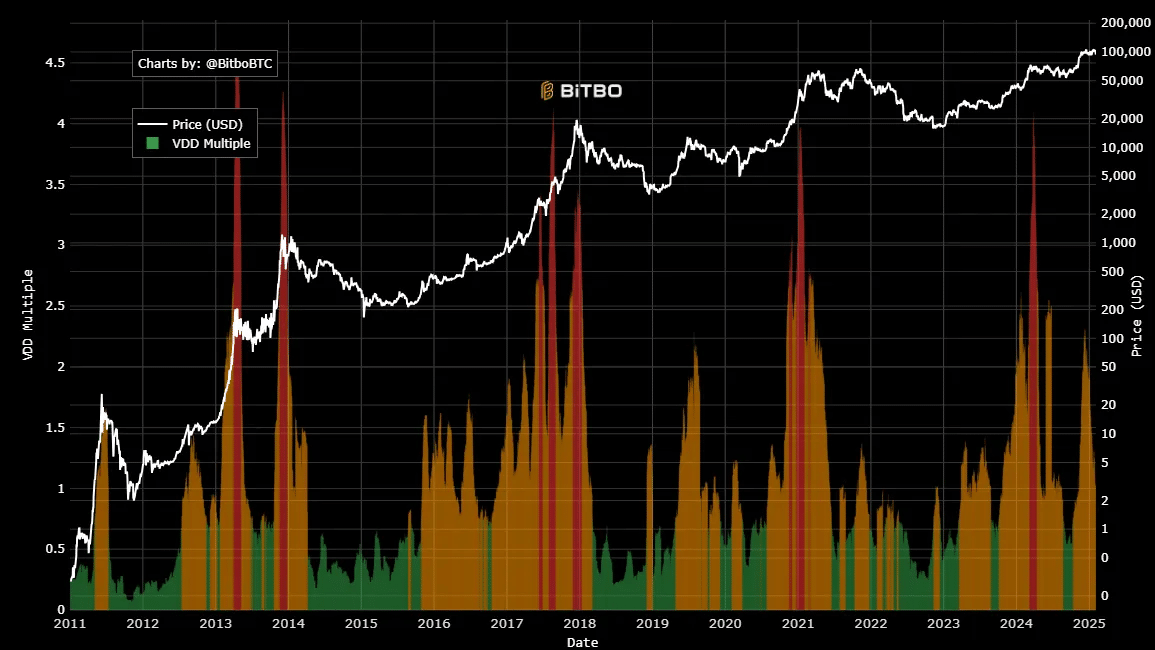

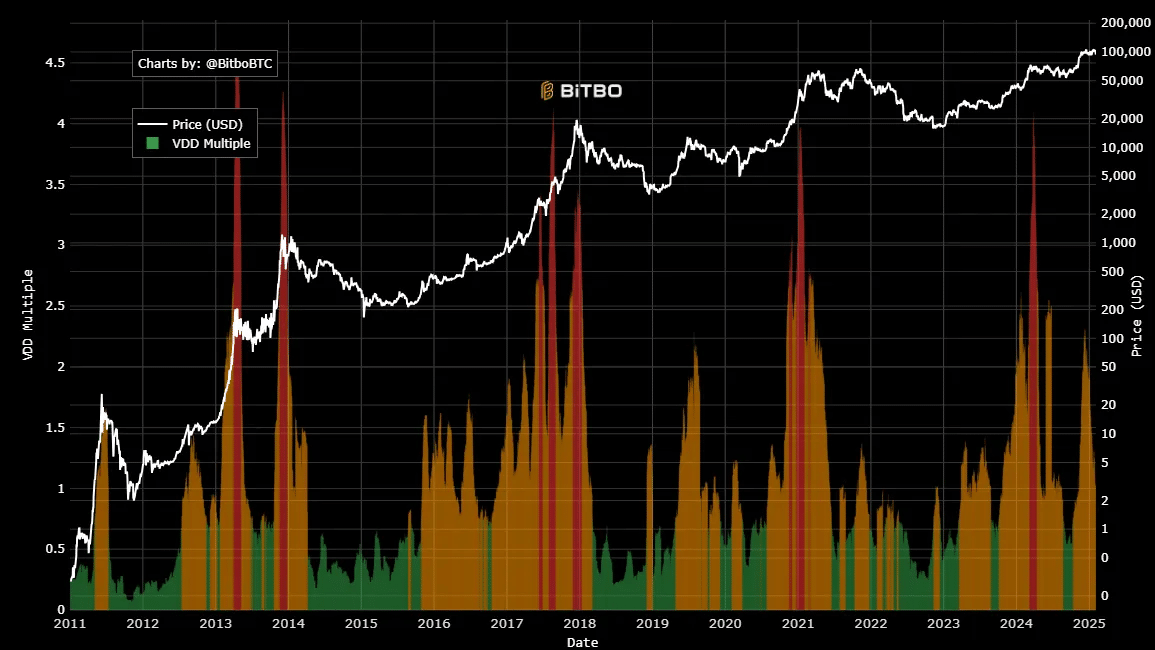

Source: Bitbo

Moreover, the VDD -more than Bitcoin remained above 1 and settled at 1.05 at the time of writing. If this remains above 1, this means that holders do not sell a panic in the long term, which indicates market stability.

There is a low sales pressure of long -term holders and the current decrease is largely led by short -term holders. With long -term holders still bullish, the market could recover quickly and it is unlikely that the drop will take place.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Simply put, although Bitcoin has fallen in recent days because the North American market becomes BEARISH, other indicators suggest that the decrease is led by holders in the short term.

The market will probably return because holders will remain bullish in the long term and whales.

A rebound here will reclaim BTC $ 96,370 and try to reach $ 98,000. Further correction could, however, see a dip up to $ 92,103.